Current Report Filing (8-k)

May 08 2015 - 7:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

May 6, 2015

|

Innospec Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

1-13879

|

98-0181725

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

8310 South Valley Highway, Suite 350, Englewood, Colorado

|

|

CO 80112

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(303) 792 5554

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(c) Appointment of new Executive Vice President of Innospec Inc. (the "Company")

On and effective as of May 6, 2015, Patrick J. McDuff, 51, has been appointed as the Company's Executive Vice President in addition to his role as President, Fuel Specialties, Americas for the Company's subsidiary, Innospec Fuel Specialties, LLC.

Mr McDuff will be responsible for Innospec's Fuel Specialties business in the Americas and Asia Pacific regions and will serve a key role in the strategic development of that business globally. Mr McDuff has been President, Fuel Specialties Americas since 2010. Prior to this he held the positions of Regional Sales Manager, Director of Sales, and Vice President, since joining the Company in September 1994 . He has over 25 years’ experience in the chemicals industry, having previously held positions with Texaco Research & Development and Betz process Chemicals.

On May 7, 2015, Mr McDuff entered into an Executive Service Agreement with Innospec Fuel Specialties, LLC (effective May 6, 2015) (the "Agreement") to serve as Executive Vice President of the Company as well as President, Fuel Specialties, Americas. The Agreement provides for an indefinite term of employment and may be terminated by the company on twelve months’ written notice or by Mr McDuff on 6 months’ written notice.

The Agreement generally provides that Mr McDuff will receive an annual base salary of $345,000 initially, which will increase to $390,000 per annum, with effect from January 1, 2016 subject to his satisfactory performance during 2015 as determined by the President and CEO of the Company and approved by the Compensation Committee of the Board. Mr McDuff’s salary will then be reviewed annually by the Compensation Committee of the Board starting January 1, 2017.

At the discretion of the Compensation Committee of the board, Mr McDuff will be eligible to participate in the Management Incentive Compensation plan (MICP) and his target bonus shall be 40% of his base salary for 2015, with a maximum bonus payable under this plan of 92%. In addition to the above and for 2015 only, Mr McDuff shall be eligible, at the absolute discretion of the Compensation Committee of the Board, for an additional bonus under the Innospec Fuel Specialties, LLC bonus plan of up to 30% of his annual base salary.

Mr McDuff’s participation in the Innospec 2014 Long Term Incentive Plan will continue.

Mr McDuff will be required to hold a minimum of the equivalent of 200% of his annual base salary in Innospec Inc. Stock. He is expected to achieve this by December 31, 2019.

In the event of a change of control (as described in the Agreement), if Mr McDuff terminates his employment for "Good Reason" (as contemplated in the Agreement) or is terminated other than for "Cause" (as defined in the Agreement), he will be entitled to twenty four months’ compensation (i.e. base salary, bonus at target) from the date of change of control.

The foregoing description of the Agreement is only a summary and is entirely qualified by reference to the actual Agreement, a copy of which is included as Exhibit 10.1 to this report on Form 8-K and is incorporated herein by reference. Any capitalized terms used but not defined herein have the meanings given to such terms in the Agreement.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Innospec Inc.

|

|

|

|

|

|

|

|

May 8, 2015

|

|

By:

|

|

David E. Williams

|

|

|

|

|

|

|

|

|

|

|

|

Name: David E. Williams

|

|

|

|

|

|

Title: VP, General Counsel, CCO and Corporate Secretary

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

10.1

|

|

Executive Service Agreement of Patrick J. McDuff

|

CONFORMED COPY

EXECUTIVE SERVICE AGREEMENT

Between

INNOSPEC FUEL SPECIALTIES LLC

AND

MR. PATRICK McDUFF

EXECUTIVE SERVICE AGREEMENT

Dated : May 7, 2015

| |

|

|

| PARTIES |

|

|

EMPLOYER:

|

|

Innospec Fuel Specialties LLC (“the Company”). |

EMPLOYEE: Mr. Patrick McDuff of [residential address removed for confidentiality] (“you”)

| |

|

|

| “the Board”

|

|

means the board of directors of the Parent Company

as the case may be and includes any committee of

the Board duly appointed by it; |

| “Chairman”

|

|

means any person or persons jointly holding such

office of the Parent Company from time to time and

includes any person(s) exercising substantially

the functions of a Chairman of the Board of the

Parent Company; |

| “Confidential Information”

|

|

includes but is not limited to any trade secrets,

names and contact details of customers and

prospective customers, purchasing and sales

agents, suppliers, prices charged to or charged by

the Company and any Group Company, financial and

budget information, and any other information of a

confidential nature relating to the Company or any

Group Company or information which has been given

to the Company or any Group Company by a third

party under a duty of confidence where such a duty

has been made known to you and which is not in the

public domain otherwise than by breach of your

duties of confidentiality to the Company and any

Group Company. |

| “Group Company”

|

|

includes the Parent Company and any holding

company from time to time of the Company or any

subsidiary or associated company from time to time

of the Company or of any such holding company (for

which purpose “holding company” and “subsidiary”

have the meanings ascribed to them by section 736

of the UK Companies Act 1985 as amended by the UK

Companies Act 1989 and “associated company” means

any company which any such holding company or

subsidiary holds or controls more than 20 per

cent. of the equity share capital). |

| “Marketing Information”

|

|

means all and any information (whether or not

recorded in documentary form or on computer disc

or tape) relating to the marketing or sales of any

product or service of the Company or any Group

Company including without limitation sales targets

and statistics, market share and pricing

statistics, marketing surveys and plans, market

research reports, sales techniques, price lists,

discount structures, advertising and promotional

material, the names, addresses, telephone numbers,

contact names and identities of customers and

potential customers of and suppliers and potential

suppliers to the Company or any Group Company and

the nature of their business operations, their

requirements for any product or service sold to or

purchased by the Company or any Group Company and

all confidential aspects of their business

relationship with the Company and Group Company. |

| “Parent Company”

|

|

means Innospec Inc. which is a Delaware

corporation, listed on the Nasdaq stock exchange. |

| “Termination Date”

|

|

means the date on which your employment under this

Agreement terminates. |

| 2.1 |

|

The Company appoints you to serve the Company as President, Fuel Specialties, Americas or in

such other appointment as may be agreed from time to time, to serve the Parent as Executive

Vice President or in such other appointment as may be agreed from time to time, and to serve

other Group Companies in such other capacity as may be agreed from time to time. |

| 2.2 |

|

The appointment pursuant to this Agreement shall be deemed to have commenced on 6 May 2015

and shall continue until terminated by the Company or Parent Company in accordance with

clauses 10.1, 11 or 17.1. Your period of continuous employment with the Company began on 30

September 1994. |

| 2.3 |

|

With your prior consent, the Company or Parent Company may from time to time appoint any

other person or persons to act jointly with you in your appointment. |

| 2.4 |

|

You represent that by virtue of entering into this Agreement you will not be in breach of any

express or implied terms or any contract with or any other obligation to any third party

binding upon you. |

| 3.1 |

|

You shall at all times during the period of this Agreement; |

| |

3.1.1 |

|

devote your working time, attention and ability to the duties of your

appointment. |

| |

3.1.2 |

|

faithfully and diligently perform those duties and exercise such powers

consistent with them which are from time to time assigned to or vested in you; |

| |

3.1.3 |

|

obey all lawful and reasonable directions of the Board and the President

and CEO of the Parent Company; |

| |

3.1.4 |

|

use your best endeavours to promote the interests of the Company and

Group Companies; |

| |

3.1.5 |

|

keep the Board and the President and CEO of the Parent Company promptly

and fully informed on a regular basis or as circumstances warrant (in writing if so

requested) of your conduct of the business or affairs of the Company and any other

Group Company and provide such explanations in connection therewith as the Board or

President and CEO of the Parent Company may require; |

| |

3.1.6 |

|

not at any time knowingly make any untrue or misleading statement

relating to the Company or any Group Company; |

| |

3.1.7 |

|

inform the Chairman, or President and CEO of the Parent Company,

promptly if you receive a solicitation from a competitor or potential competitor

either on a personal or business basis which could be prejudicial to the best

interests of the Company or its Group Companies. |

| 4.1 |

|

You will be employed at our Englewood site, but as a term of your employment you may also be

required to work at or from any other of the Group Company’s establishments whether inside or

outside of the USA. You may also be transferred or seconded between establishments when

necessary as required by business needs. Whilst this Agreement provides for such transfer or

secondment the Company and Parent Company will give careful and sympathetic consideration to

your personal circumstances and career interests. |

| 5.1 |

|

Your basic salary will be $345,000 per annum and this will be backdated to January 1, 2015.

Subject to your satisfactory performance during 2015, as determined by the President and CEO

of the Parent Company and approved by the Compensation Committee of the Board, your basic

salary will be increased to $390,000 per annum with effect from January 1, 2016. Your salary

will then be reviewed by the Compensation Committee of the Board effective January 1, 2017 and

every January thereafter. The fact that your salary may be increased in any year or years

during your employment does not confer any right on you to receive any increase in any

subsequent year. |

| 5.2 |

|

The salary referred to in this clause will be inclusive of any director’s fees to which you

may be entitled. |

| 5.3 |

|

At the absolute discretion of the Compensation Committee of the Board, you may participate in

the Management Incentive Compensation Plan. Your participation in the Management Incentive

Compensation Plan (MICP) will be subject always to such terms and targets as the Compensation

Committee of the Board may determine from time to time. Your target bonus in this plan will

be set at 40% of your base salary for 2015 and the maximum bonus payable to you in 2015 under

this plan will be 92% of your base salary. With effect from January 1, 2016, your target

bonus in this plan will be set at 50% of your base salary and the maximum bonus payable to you

under this plan will be 115% of your base salary. The Compensation Committee of the Board

reserve the right to change both the target and maximum percentages at any time. |

| 5.4 |

|

In addition to the above and at the absolute discretion of the Compensation Committee of the

Board, for 2015 only, you will be eligible for an additional bonus under the Innospec Fuel

Specialties LLC bonus plan of up to 30% of your annual base salary. This will be paid

quarterly in line with the Innospec Fuel Specialties LLC bonus payment schedule. From January

1 2016, you will no longer be eligible to receive any bonus or incentive payments under the

Innospec Fuel Specialties LLC bonus plan. The Compensation Committee of the Board reserves the

right to withdraw your participation in this plan and change any or all of the terms of this

bonus at any time. |

| 5.5 |

|

Your participation in the Innospec 2014 Long Term Incentive Plan (2014 LTIP) will continue

and there will be no change to this Plan or your participation level as a result of this

appointment. |

| 5.6 |

|

You will no longer be eligible to participate in any other bonus plans run by the Company or

Group Company other than those specified in 5.3, 5.4 and 5.5 |

| 6. |

|

LONG TERM INCENTIVE PLAN |

| 6.1 |

|

You will be eligible to be considered for grants under the Parent Company’s long term

incentive share option plans. Participation in the scheme in any one year and the number of

options awarded is discretionary and is determined by the Compensation Committee of the Board

in line with their stated grant policy. The Compensation Committee of the Board reserves the

right to review and modify this grant policy at any time. You will not be entitled to any

compensation in lieu of any options granted if as a result of such revision, there is a

decrease in the value or number of options granted to you. |

| 6.2 |

|

You will be required to hold a minimum of 200% of your annual base salary in Innospec Inc.

stock. You will be expected to achieve this holding by December 31, 2019. The Compensation

Committee of the Board reserves the right to review and modify this requirement at any time. |

| 6.3 |

|

In the event of termination of your employment with the Company, any outstanding options will

be subject to the Rules of the relevant Share Option Plan. |

| 7.1 |

|

It is recognised that the nature of your role will involve working extended hours, either

during the working week or at weekends. This is accepted as a normal part of the working life

of a global business executive and does not warrant either extra payment or time off in lieu. |

| 8.1 |

|

The Company shall reimburse you for all expenses reasonably incurred by you in the proper

performance of your duties subject to you complying with such guidelines or regulations issued

by the Company and Parent Company from time to time in this respect and to the production by

you to the relevant company of such receipts or other evidence of actual payment of the

expenses as it may reasonably require. |

| 9.1 |

|

You will continue to be eligible to participate in the Company’s group health insurance plan

and other group benefit plans, subject to all of the terms and conditions of the respective

plans. |

| 9.2 |

|

You will continue to be eligible to participate in the Company 401(k) plan and pension plan

at your current levels. |

| 9.3 |

|

You will continue to be eligible to receive a car allowance of $950 a month, paid through

payroll. This will be treated as taxable income and will be subject to the normal payroll and

social security taxes and payments. This amount is non-pensionable and will not be included

in salary for bonus purposes. The Compensation Committee of the Board reserves the right to

review and change this amount at any time. |

| 9.4 |

|

You will continue to be eligible for all other benefits for which you are currently eligible

to receive as an employee of the Company. |

| 9.5 |

|

The Company reserves the right to review and modify any or all of the benefit programs at any

time |

| 10.1 |

|

Subject to clause 11.1 below, the Company has the right to terminate your employment by

giving you 12 months’ notice in writing. This will not apply in the event of the Company’s

termination of your employment pursuant to clause 17 below. You are required to give the

Company and Parent Company not less than 6 months’ notice in writing of termination of

employment, to be served in accordance with clause 25 below. In line with our normal

practice, your continued employment will be contingent upon your ability to perform in the

role as well as performance targets which will be mutually agreed. |

| 10.2 |

|

Your role as Executive Vice President of the Parent Company and President Fuel Specialties,

Americas is salaried and exempt from the overtime provisions of the Fair Labor Standards Act. |

| 10.3 |

|

After notice of termination has been given by either party pursuant to clause 10.1 or if you

seek to or indicate an intention to resign from the Company or any Group Company or terminate

your employment without notice, provided that you continue to be paid and enjoy your full

contractual benefits until your employment terminates in accordance with the terms of this

Agreement, the Board and/or President and CEO of the Parent Company may in their absolute

discretion without breaking the terms of this Agreement or giving rise to any claim against

the Company or any Group Company for all or part of the notice period required under clause

10.1: |

| |

(i) |

|

exclude you from the premises of the Company and any Group Company; |

| |

(ii) |

|

require you to carry out specified duties (consistent with your status,

role and experience) for the Company and any Group Company or to carry out no

duties; |

| |

(iii) |

|

announce to employees, suppliers and customers that you have been given

notice of termination or have resigned (as the case may be); |

| |

(iv) |

|

appoint one or more persons to assume some or all of your duties as

Executive Vice President of the Parent Company and President Fuel Specialties,

Americas; |

| |

(v) |

|

instruct you not to communicate orally or in writing with suppliers,

customers, employees, agents or representatives of the Company or any Group Company

until your employment hereunder has terminated; |

| |

(vi) |

|

instruct you not to act or communicate orally or in writing on behalf of

the Company or any Group Company. |

For the avoidance of doubt, your obligations under this Agreement continue to apply

during any period of exclusion pursuant to this clause.

| 10.4 |

|

On commencement of any period of exclusion pursuant to clause 10.3 you will: |

| |

(i) |

|

deliver to the Company in accordance with clause 21 all property

belonging to the Company or any Group Company; and |

| |

(ii) |

|

resign in accordance with clause 22 from all offices and appointments you

hold in the Company, the Parent Company and any Group Company. |

| |

10.5 |

|

During any period of exclusion pursuant to clause 10.3 you will not be

entitled to accrue any bonus/ profit share/ performance-related pay under this

Agreement. |

| 10.6 |

|

Before and after termination of your employment, without additional compensation, you will

provide the Company and/or any Group Company with assistance regarding matters of which you

have knowledge and/or experience in any legal proceedings or possible proceedings in which the

Company and/or Group Company is or may be a party. |

| 10.7 |

|

You agree to comply with all Company rules and policies as may be amended from time to time

regarding the holding and dealing (whether directly or indirectly) of shares in the Company,

subject to the Board’s discretion. |

| 11.1 |

|

In the event that there is a Change of Control of the Parent Company, as defined in Appendix

1, then, for the 12 months following the date of the Change of Control, |

| |

11.1.1 |

|

If you terminate for “Good Reason”, as defined in Appendix 2, your employment with

the Company, you will be entitled to 24 months’ compensation

from the date of the Change of Control defined as base

salary, bonus at target and any car allowance but excluding compensation for pension

contributions other benefits and any other salary supplements. |

| |

11.1.2 |

|

If the Company terminates your employment under this agreement, other than

pursuant to clause 17 below, you will be entitled to 24 months’ compensation, as

defined above in 11.1.1, from the date of such notice. |

| 12.1 |

|

If you are absent because of your own physical or mental illness or injury you shall report

this fact forthwith to the President and CEO of the Parent Company and complete any

self-certification forms or medical practitioner’s certificates which are required by the

Company and Parent Company or as may be required by law. |

| 12.2 |

|

If you are absent because of your own physical or mental illness or injury duly certified in

accordance with the provisions of Clause 12.1 you shall be paid such remuneration, if any, as

the Chairman or President and CEO shall determine from time to time or as may be required by

law. You will in all cases be paid in compliance with the salary basis requirements of

applicable wage and hour laws. |

| 12.3 |

|

The provisions of this clause will not prejudice or limit in any way the Company’s or Parent

Company’s right to terminate this Agreement pursuant to its terms. In particular but without

limitation the Company and Parent Company may terminate your employment pursuant to clause

10.1 for any reason and to clause 17.1 on the grounds set out in that clause. The Company and

Parent Company may terminate this Agreement pursuant to such clauses even if at the time of

such termination, any Company benefits payable pursuant to this clause have not been

exhausted. |

| 13.1 |

|

At any time during the period of your appointment you shall at the request and expense of the

Company permit yourself to be examined by a registered medical practitioner to be selected by

the Company or Parent Company and shall authorise such medical practitioner to disclose and

discuss with the Company and Parent Company the result of such examination and any matters

which arise from it, provided however that the Company or Parent Company may request such

examination only to the extent the request is based on a reasonable concern that a medical

condition may materially affect your ability to perform your duties. |

| 14.1 |

|

You will promptly disclose to the Company and Parent Company and keep confidential all

inventions copyright works, designs or technical know how conceived or made by you alone or

with others in the course of your employment. You will hold all such intellectual property in

trust for the Company and/or Parent Company and will do everything necessary or desirable at

its expense to vest the intellectual property fully in the Company and/or Parent Company

and/or to secure patent or other appropriate forms of protection for the intellectual

property. Decisions as to the protection or exploitation of any intellectual property shall

be in the absolute discretion of the Company and Parent Company. |

| 14.2 |

|

You hereby assign to the Company and Parent Company by way of future assignment all

copyright, design rights and other intellectual property rights for the full terms thereof

throughout the world in respect of all copyright works and designs originated, conceived,

written or made by you (except only those works or designs originated, conceived, written or

made by you wholly outside your normal working hours which are wholly unconnected with your

employment or the business of the Company and Parent Company) during the period of your

employment by the Company. |

| 14.3 |

|

You hereby irrevocably and unconditionally waive in favour of the Company and Parent Company

any and all moral rights conferred on you for any work in which copyright or design right is

vested in the Company and Parent Company whether by Clause 14.2 or otherwise. |

| 14.4 |

|

You shall, at the request and cost of the Company do all things necessary or desirable to

substantiate the rights of the Company or Parent Company under Clauses 14.2 and/or 14.3. |

| 15.1 |

|

You acknowledge that the Company and its Group Companies possess or will possess a valuable

body of Confidential Information and Marketing Information and that you have access to

Confidential Information and Marketing Information in order that you may carry out the duties

of your employment. |

| 15.2 |

|

You acknowledge that you owe a duty of trust and confidence and a duty to act at all times in

the best interests of the Company and any Group Company. You also acknowledge that the

disclosure of any Confidential Information and/or Marketing Information to any competitor of

the Company or any Group Company or to other third parties would place the Company or any

Group Company at a serious competitive disadvantage and would cause serious financial and

other damage to their businesses. |

| 15.3 |

|

You agree not to make use of or disclose (either during the period of your employment by the

Company or at any time after the Termination Date) any Confidential Information or Marketing

Information. |

| 15.4 |

|

You agree not to obtain or seek to obtain any financial advantage from the use or disclosure

of any Confidential Information or Marketing Information acquired by you in the course of your

employment with the Company. |

| 16. |

|

RESTRICTIVE COVENANTS |

| 16.1 |

|

Within this Clause 16 the following words shall have the following meanings: |

| |

|

|

| “Relevant Period”

|

|

shall mean the twelve month period prior to and ending

on the earlier of the Termination Date or the date

you have been excluded from the premises of the

Company and any Group Company and instructed to cease

the performance of your duties pursuant to Clause

10.3. |

| “Restricted Customer”

|

|

shall mean any person, firm, company or other entity

who was at any time in the Relevant Period a customer

of any Group Company with which you had dealings,

including without limitation the Company. |

| “Prospective Customer”

|

|

shall mean any person, firm, company or other entity

who was at the Termination Date negotiating with the

Company or any Group Company with a view to dealing

with the Company or any Group Company with which you

had dealings. |

| “Prohibited Business”

|

|

shall mean any business or activity carried on by the

Company or any Group Company at the Termination Date

or at any time in the Relevant Period in which you

shall have been directly concerned in the course of

your employment at any time in the Relevant Period. |

| “Protected Supplier”

|

|

shall mean any supplier or prospective supplier of

the Company or any Group Company with whom you shall

have had dealings in the course of your employment

during the Relevant Period. |

| 16.2 |

|

During the term of your employment (including any garden leave period) and continuing for a

period of twelve months after the Termination Date, you shall not in competition with the

Company or any Group Company directly or indirectly on your own account or on behalf of or in

conjunction with any person, firm or company or other organization canvas or solicit or by any

other means seek to conduct, or conduct Prohibited Business with any Restricted Customer. |

| 16.3 |

|

During the term of your employment (including any garden leave period) and continuing for a

period of twelve months after the Termination Date, you shall not in competition with the

Company or any Group Company directly or indirectly on your own account or on behalf of or in

conjunction with any person, firm or company or other organization canvas or solicit or by any

other means seek to conduct or conduct Prohibited Business with any Prospective Customer. |

| 16.4 |

|

During the term of your employment (including any garden leave period) and continuing for a

period of twelve months after the Termination Date, you shall not directly or indirectly

induce or seek to induce any employee of the Company or any Group Company to leave the

employment of the Company or any Group Company whether or not this would be a breach of

contract on the part of that employee. |

| 16.5 |

|

During the term of your employment (including any garden leave period) and continuing for a

period of twelve months after the Termination Date, you shall not directly or indirectly seek

to entice away from the Company or any Group Company or otherwise solicit, interfere with or

diminish the relationship between the Company or any Group Company and any Protected Supplier. |

| 16.6 |

|

Each of the restrictions contained in this Clause 16 is intended to be separate and

severable. In the event that any of the restrictions shall be held void but would be valid if

part of the wording thereof were deleted or modified, such restriction shall apply with such

deletion or modification as may be necessary to make it valid and effective. |

| 16.7 |

|

Each of the restrictions in each of Clauses 16.2 to 16.6 is considered by the parties to be

reasonable in all the circumstances but if any such restriction shall be held by any Court to

be void as going beyond what is reasonable in all the circumstances for the protection of the

interests of the Company and Group Companies, the said restriction shall apply with such

deletions or modifications as may be necessary to render it valid and effective.. |

| 17.1 |

|

The Company may by notifying you in writing terminate your employment with immediate effect

with Cause without compensation or benefits. For the purposes of this Agreement, the Company

will have “Cause” to terminate your employment: |

| |

17.1.1 |

|

if you commit any act of gross misconduct or negligence or repeat or continue any

other serious breach of your obligations under this Agreement; or |

| |

17.1.2 |

|

if you report to work under the influence of alcohol or illegal drugs, or if you

use any illegal drugs (whether or not at the workplace) or if you are guilty of any

conduct which in the reasonable opinion of the Board brings you or the Company or

its Group Companies into disrepute or causes them substantial economic harm; or |

| |

17.1.3 |

|

if you breach the provisions of the Company’s Code of Ethics; or |

| |

17.1.4 |

|

if you are convicted of any criminal offence involving moral turpitude or the

commission of any other act or omission involving disloyalty or fraud with respect

to the Company or any Group Company or any customer or suppliers of the Company or

any Group Company, which in the reasonable opinion of the Board affects your

position under this Agreement; or |

| |

17.1.5 |

|

if you commit any act of dishonesty or any breach of your fiduciary duty whether

relating to the Company, any Group Company, any of its or their employees or

otherwise; or |

| |

17.1.6 |

|

if you have in the reasonable opinion of the Board become incompetent to perform

your duties or substantially or repeatedly fail to perform duties consistent with

your position and related to the business of the Company or any Group Company; or |

| |

17.1.7 |

|

if you become prohibited by law from being a director of a company or if you cease

to be a director of the Company or any Group Company without the consent or

concurrence of the Board. |

| 18. |

|

COMPLIANCE WITH LAWS, POLICIES AND PROCEDURES |

| 18.1 |

|

While you are employed by the Company you shall: |

| |

18.1.1 |

|

comply with the Parent Company and Company’s Code of Ethics Policy,

Anti-Corruption Policy and all other policies and procedures (“Relevant Policies”)

which are available on the intranet or upon request, directly from the Legal &

Compliance Department or your local HR contact, in each case as the Parent Company

and Company may update them from time to time |

| |

18.1.2 |

|

comply with all applicable laws and regulations including those relating to

anti-bribery which including but not limited to the U.S. Foreign Corrupt Practices

Act (“FCPA”), the U.K. Bribery Act 2010 and other laws applicable in the country in

which you are employed; or |

| |

18.1.3 |

|

promptly report to the Company or Parent Company any request or demand for any

bribe, kickback, gift, or undue financial or other advantage of any kind received by

you in connection with the performance of your duties |

| |

18.1.4 |

|

not engage in any activity, practice or conduct which would constitute an offence

under any relevant anti-bribery laws or breach the Relevant Policies |

| |

18.1.5 |

|

report any violations of anti-corruption laws of which you become aware. Any such

issues must be reported to the President and CEO of the Parent Company, the Legal

and Compliance Department or reported to the confidential telephone hotline,

Expolink |

| |

18.1.6 |

|

if required by the Parent Company or the Company, annually certify your compliance

with this clause |

| 18.2 |

|

In addition to any penalties that government authorities might impose for violations of laws,

including anti-corruption laws, any breach of this clause will be taken very seriously by the

Company. This may be deemed a material breach of your employment agreement, which may lead to

disciplinary measures, including but not limited to termination of your employment with the

Company for Cause. |

| 19.1 |

|

The Company and any Group Company need to keep information about you for purposes connected

with your employment. The sort of information it will hold includes information for payroll

purposes, references, contact names and addresses and other personal details relating to your

employment. Some of this information may also be processed by other organisations on our

behalf. |

| 19.2 |

|

The information the Company and any Group Company hold will be for its management and

administrative use only but it may, from time to time, need to disclose some information it

holds about you to relevant third parties as required in the necessary course of the Company

or any Group Company’s business. The Company and any Group Company may also transfer

information about you to another Group Company solely for purposes connected with your

employment or the management of the business. You agree to the Company keeping the

information for these purposes throughout your employment and following its termination. |

| 19.3 |

|

You also agree to the Company and any Group Company keeping information about your health to

the extent relevant to your ability to do your job or, if you are or become disabled, whether

you require any reasonable accommodations to be made to assist you at work; and to the extent

needed in relation to the administration of any benefit plans in force from time to time. |

| 20.1 |

|

You hereby authorize the Company to deduct from your remuneration (which for this purpose

includes salary, bonus, vacation pay and sick pay) all any amount required by law to be

withheld for taxes or for any other purpose, any contribution required of you under any

employee benefit arrangement and all debts owed by you to the Company or any Group Company,

including but without limitation the balance outstanding of any loans (and interest where

appropriate) advanced by the Company or Group Companies to you. |

| 21. |

|

DELIVERY OF DOCUMENTS AND PROPERTY |

| 21.1 |

|

On termination of your employment for any reason (or earlier if requested) you will

immediately deliver to the Company or relevant Group Company all property (including but not

limited to documents and software, credit cards, cell phone, computer equipment, facsimile

machine, keys and security passes) belonging to the Company or any Group Company or containing

or constituting Marketing Information or Confidential Information in your possession or under

your control. Documents and software include (but are not limited to) correspondence,

diaries, address books, databases, files, reports, minutes, plans, records, documentation or

any other medium for storing information. Your obligations under this clause include the

return of all copies, drafts, reproductions, notes, extracts or summaries (however stored or

made and whether electronic or hard-copy) of all documents and software. |

| 22. |

|

RESIGNATION AS DIRECTOR |

| 22.1 |

|

Upon the earlier of the termination of your employment for any reason, or the date you are

excluded from the premises of the Company and any Group Company and are instructed to cease

the performance of your duties pursuant to Clause 10.3, you will, at the request of the Board

give notice resigning immediately without claim for compensation (but without prejudice to any

claim you may have for damages for breach of this Agreement): |

| |

22.1.1 |

|

as a director of the Company and all such Group Companies of which you are a

director; and |

| |

22.1.2 |

|

all trusteeships held by you of any employee benefit plan or other trusts

established by the Company or any Group Company or any other company with which you

have had dealings as a consequence of your employment with the Company. |

| 22.2 |

|

If notice pursuant to clause 22.1 is not received by the relevant company within seven days

of a request by the Company, or Group Company the Company and Group Company or either of them

are irrevocably authorized to appoint a person to execute any documents and to do everything

necessary to effect such resignation or resignations on your behalf. |

| 22.3 |

|

Except with the prior written agreement of the Board, you will not during your employment

under this Agreement resign from your office as a director or officer of the Company or any

Group Company. |

| 23. |

|

DISCIPLINARY AND GRIEVANCE PROCEDURES |

| 23.1 |

|

The Company has a number of policies and procedures including anti harassment policy and

disciplinary and grievance procedures and these are available from the HR Department. The

spirit and principles of these procedures apply to you suitably adapted to reflect your

seniority and status. Except and to the extent of any procedure implied by statute the

Company’s disciplinary and grievance procedures are not incorporated by reference in this

Agreement and therefore do not form any part of your contract of employment. |

| 23.2 |

|

Disciplinary issues will be handled by the Chief Executive Officer with appeals to the

Chairman or Board Committee appointed by the Chairman to deal with this. |

| 23.3 |

|

If you have a grievance in relation to your employment or are dissatisfied with a

disciplinary decision against you, you may apply in writing to the Chief Executive Officer who

will decide the matter in question (unless the grievance or dissatisfaction relates to the

Chief Executive Officer or any decision taken by the Chief Executive Officer, in which case

you should apply to the Chairman). If you are dissatisfied with such decision you may refer

the matter to the Chief Executive Officer or Board Committee appointed by the Chairman to deal

with this whose decision will be final.. |

The Group Companies shall be third-party beneficiaries of clauses 14, 15, 16 and 21 of

this Agreement. Otherwise, apart from any other provisions of this Agreement which are

expressly or impliedly entered into by the Company for itself and as agent of and trustee

for any Group Company the parties do not intend that this Agreement should confer any

right or benefit on any third party.

Notices under this Agreement by you to the Company or the Parent Company should be

addressed to the Company or Parent Company and left at its registered office or European

Headquarters respectively or sent by post or by facsimile transmission or other form of

electronic delivery to its registered office or European Headquarters respectively and

notices given by the Company or Parent Company to you should be served personally or sent

by post or sent by facsimile transmission or other form of electronic delivery to your

usual or last known place of residence in the USA. In case of service by post, the day

of service will be 48 hours after posting and in the case of facsimile transmission or

other electronic delivery the day of service will be the day of transmission by the

sender.

| 26.1 |

|

This Agreement will be governed by and interpreted in accordance with the laws of the State

of Delaware without giving effect to its conflicts of laws principles. |

| 26.2 |

|

The parties to this Agreement submit to the exclusive jurisdiction of the state and federal

courts located in the State of Delaware in relation to any claim, dispute or matter arising

out of or relating to this Agreement. |

| 26.3 |

|

Any delay by the Company in exercising any of its rights under this Agreement will not

constitute a waiver of such rights. |

| 26.4 |

|

The parties agree that any breach of clause 14, 15, 16 or 21 of this Agreement is likely to

cause the Company serious irreparable harm. In the event of such a breach, the parties agree

that the Company shall have, in addition to its other remedies, the right to an injunction.

Without any requirement to post a bond or other security, to prevent the violation of and to

enforce your obligations under this Agreement. |

| 26.5 |

|

This Agreement, including without limitation clauses 14, 15, 16 and 21 hereof, shall inure to

the benefit of the Company’s successors and assigns. |

| 26.6 |

|

This Agreement contains the entire agreement between the parties with respect to its subject

matter, and supersedes any and all prior communications, agreements and understandings,

written and oral, between the parties with respect to such subject matter. |

| 26.7 |

|

This Agreement may not be amended, nor shall any change, waiver, modification, consent or

discharge be effected, except by a written instrument signed by both you and the Company. |

| 26.8 |

|

The provisions of clauses 14 through 26 of this Agreement shall survive the termination of

your employment in all events. |

THIS AGREEMENT has been executed on behalf of the Company by a director and executed by you on the

date set out at the beginning.

SIGNED by

PATRICK WILLIAMS

.....................................

PATRICK WILLIAMS,

President and CEO

for and on behalf of THE COMPANY

SIGNED by

PATRICK McDUFF

....................................

PATRICK McDUFF

APPENDIX 1

Change of Control

“Change of Control” means a change in control of a nature that would be required to be reported in

response to item 5 (f) of Schedule 14A of Regulation 14A promulgated under the Securities Exchange

Act of 1934 of the United States of America, as in effect on the date hereof (“Exchange Act”)

whether or not the Company or the Parent Company is then subject to such reporting requirement;

provided that, without limitation, such a change in control shall be deemed to have occurred if

| (a) |

|

any “person” or “group” (as such terms are used in Section 13 (d) and 14 (d) of the Exchange

Act) is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act),

directly or indirectly, of securities of the Parent Company or the Company representing 30% or

more of the combined voting power of the Parent Company or the Company respectively, then

outstanding securities (other than the Parent Company or the Company, any employee benefit

plan of the Company or the Parent Company); and, for purposes of this Agreement, no change in

control shall be deemed to have occurred as a result of the “beneficial ownership”, or changes

therein, of the Parent Company or the Company’s securities, respectively, by any of the

foregoing, |

| (b) |

|

there shall be consummated (i) any consolidation or merger the Parent Company or the Company

in which the Parent Company or the Company is not the surviving or continuing corporation or

pursuant to which shares of the Parent Company or the Company’s Common Stock, respectively,

would be converted into cash, securities or other property, other than a merger of the Parent

Company or the Company in which the holders of the Parent Company’s or the Company’s Common

Stock immediately prior to the merger have (directly or indirectly) at least a 70% ownership

interest in the outstanding Common Stock of the surviving corporation immediately after the

merger, or (ii) any sale, lease, exchange or other transfer (in one transaction or a series of

related transactions) of all, or substantially all, of the assets of the Parent Company or the

Company, |

| (c) |

|

the shareholders of the Parent Company or the Company approve any plan or proposal for the

liquidation or dissolution of the Parent Company or the Company, or |

| (d) |

|

as the result of, or in connection with, any cash tender offer, exchange offer, merger or

other business combination, sale of assets, proxy or consent solicitation (other than by the

Board), contested election or substantial share accumulation (a “Control Transaction”), the

members of the Board immediately prior to the first public announcement relating to such

Control Transaction shall thereafter cease to constitute a majority of the Board. |

1

APPENDIX 2

Good Reason

“Good Reason” exists if, without your express written consent,

| (a) |

|

you are assigned duties materially inconsistent from your position, duties, responsibilities

and status with the Company and the Parent Company immediately prior to the date of the Change

of Control, |

| (b) |

|

the Company or Parent Company reduces your base salary as in effect immediately prior to the

date of the Change of Control, |

| (c) |

|

the Company or Parent Company reduces your aggregate compensation and incentive and benefit

package from that provided immediately prior to the date of the Change of Control, |

| (d) |

|

the Company or Parent Company requires you regularly to perform your duties of employment

beyond a forty miles radius from the location of your place of employment at the date of the

Change of Control, |

| (e) |

|

the Company or Parent Company takes any other action which materially and adversely changes

the conditions of your employment in effect at the time of the Change of Control, |

| (f) |

|

the Company or Parent Company fails to obtain agreement from any successor to comply fully

with the terms of this Agreement, or |

| (g) |

|

the Company or the Parent Company purports to terminate your employment other than pursuant

to a notice of termination which satisfies the requirements of this Agreement. |

2

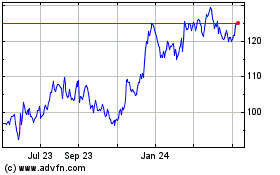

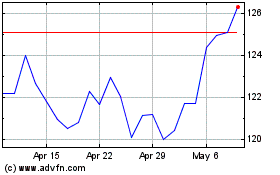

Innospec (NASDAQ:IOSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Innospec (NASDAQ:IOSP)

Historical Stock Chart

From Apr 2023 to Apr 2024