U.S. Hot Stocks: Hot Stocks to Watch

November 18 2016 - 9:38AM

Dow Jones News

Among the companies with shares expected to trade actively in

Friday's session are Abercrombie & Fitch Co. (ANF), Foot Locker

Inc. (FL) and Gap Inc. (GPS).

Abercrombie & Fitch posted its third straight quarter of

declining same-store sales, as the once-popular retailer's

rebranding efforts are showing little signs of winning back

shoppers. Shares fell 10% to $15.24 in premarket trading.

Foot Locker's profit and revenue increased in the third quarter

and same-store sales climbed, though at a slower pace than last

year. Shares fell 1.54% to $70.25 premarket.

Gap Inc.'s quarterly profit dropped 18% as the apparel maker,

which has reported seven straight quarters of lower sales, absorbed

costs tied to store closures. Shares fell 7.49% to $28.41

premarket.

Chip maker Marvell Technology Group Ltd. (MRVL) reported

third-quarter revenue and earnings above its guidance amid strong

growth in data storage and network infrastructure business. Shares

rose 8.91% to $14.55 premarket.

Intuit Inc.(INTU), the maker of TurboTax and QuickBooks, posted

a 9.1% increase in revenue for its fiscal first quarter, while

issuing guidance for the current period that was more optimistic

about sales than Wall Street estimates.

Molson Coors Brewing Co. (TAP) said Chief Financial Officer

Mauricio Restrepo has resigned, effective immediately, because of

"personal conduct" unrelated to the company's operations or

financial statements. Tracey Joubert, who was financial chief of

Molson Coors Brewing's U.S. business, has been named CFO.

Nike Inc. (NKE) boosted its quarterly dividend to 18 cents from

16 cents, marking its 15th consecutive year of higher payouts.

Ross Stores Inc.'s (ROST) profit rose 13% in the three months

ended October as the off-price retailer benefited from

higher-than-expected revenue and stronger margins.

First NBC Bank Holding Co. (FNBC), whose mounting financial

problems brought it under scrutiny, has struck an accord with

regulators to improve its capital position.

Salesforce.com Inc. (CRM) said Thursday revenue rose 25% on

rising sales in its subscription and support segment as the company

boosted its full-year sales target.

Williams-Sonoma Inc. (WSM) on Thursday reported lackluster sales

for its fiscal third quarter and gave a downbeat current-quarter

forecast, as the retailer faced retreating sales at its Pottery

Barn brand.

Yum Brands Inc.(YUM)--the owner of the KFC, Pizza Hut and Taco

Bell fast-food brands--is adding another $2 billion to its stock

buyback authorization. The $2 billion, to be used by the end of

2017, would be on top of what is left of its $4.2 billion

authorization announced in May. As of last month, the company had

about $1.6 billion left from that authorization.

Write to Chris Wack at chris.wack@wsj.com or Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

November 18, 2016 09:23 ET (14:23 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

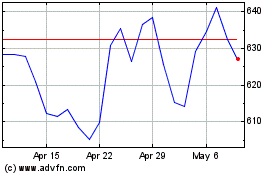

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024