Intuit Sheds QuickBase

March 08 2016 - 3:10PM

Dow Jones News

TurboTax maker Intuit Inc. agreed to sell its QuickBase business

to private equity firm Welsh, Carson, Anderson & Stowe for an

undisclosed amount, wrapping up a trifecta of divestitures intended

to shed non-core assets.

A QuickBase spokesman said the company will remain in Cambridge

and will continue to be led by Allison Mnookin. Intuit will become

one of QuickBase's largest paying customers, according to the

spokesman.

The deal concludes a string of planned segment sales that Intuit

announced about six months ago. Intuit, based in Mountain View,

Calif., had said it intended to pare down and focus on its core

small-business and tax-preparation software businesses. Last week,

the company said sold its personal-finance business Quicken to

private-equity firm HIG Capital, a month after it sold its

communications software unit Demandforce to Internet Brands.

The company hasn't disclosed deal values for the individual

segments, but a spokeswoman said Friday that sale of the three

units would together result in proceeds of about $500 million.

In its most recent fiscal year, ended in July, QuickBase brought

in $11 million in profit, up from $7 million a year earlier. The

segment represented 3% of Intuit's bottom line. The three

businesses the company has recently shed together brought in $236

million in revenue in fiscal 2015, or 5.6% of total sales, but they

resulted in a loss of $118 million.

Shares in the company, up 3.6% this year, added 0.6% in

afternoon trading Tuesday

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

March 08, 2016 14:55 ET (19:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

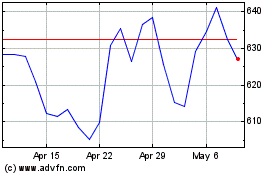

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024