Intuit Finds a Buyer for Quicken

March 04 2016 - 10:40AM

Dow Jones News

Intuit Inc. said Friday it would sell is Quicken segment to

private-equity firm HIG Capital for an undisclosed amount, about

six months after the maker of TurboTax said it was looking to pare

down.

In a blog post, Eric Dunn, head of Quicken, said "Quicken will

thrive with increased investment" and that he will remain on board

after the transaction is completed. Miami-based HIG has $19 billion

in capital under management, according to its website.

Intuit didn't offer a deal price for the personal-finance

business or indicate when the transaction would close. A spokesman

for the company didn't immediately return a request for

comment.

The divestiture comes after Intuit last summer flagged several

business units for sale, including collaboration platform QuickBase

and communications software business Demandforce in addition to

Quicken, in a move to focus on its core small-business and tax

preparation businesses.

In its most recent fiscal year, Intuit brought in $51 million in

revenue from Quicken and swung to a loss in the segment. The

company reported $4.2 billion in overall revenue in fiscal 2015 and

earned $365 million.

Shares in the company slipped 0.4% in early trading. So far this

year, the stock is up 0.8%.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

March 04, 2016 10:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

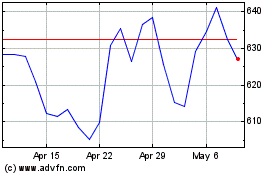

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024