File Today With TurboTax and Get Your Maximum Refund

January 19 2016 - 8:00AM

Business Wire

IRS now Accepting E-filed Returns

TurboTax®, the nation’s leading online tax preparation service

from Intuit Inc. (Nasdaq:INTU), reminds taxpayers that the Internal

Revenue Service begins accepting e-filed tax returns today,

officially kicking off the tax season. Taxpayers can file now with

TurboTax and get every dollar they deserve.

“Last year, more than 30 million people prepared their taxes

with TurboTax, benefiting from a simple and highly personalized

experience that helps them find and keep more of their hard-earned

money,” said Greg Johnson, senior vice president of marketing for

Intuit’s Consumer Tax Group. “With about 75 percent of all

taxpayers getting a federal tax refund, which averaged close to

$2,800 last year, there’s no reason to wait. With TurboTax you can

prepare your tax return and e-file with direct deposit for your

fastest possible refund.”

Do-it-yourself tax preparation is the fastest-growing tax

preparation method, up 5 percent year-over-year, according to the

IRS. The rise of DIY tax preparation is especially relevant to the

60 million Americans who have simple tax returns and can file them

at absolutely no cost with TurboTax Absolute Zero.

Last year, TurboTax saw nearly 5 million taxpayers take

advantage of the no-strings-attached offer, with the ability to

easily and accurately file their federal 1040A or 1040EZ returns,

as well as their state returns, for absolutely $0. TurboTax

customers also do not pay extra to comply with health care laws or

to claim their Earned Income Tax Credit.

TurboTax also continues to partner with IRS and state free file

programs. TurboTax All FreeSM is now available to give millions of

low to moderate-income families with adjusted gross income of

$31,000 or less – and up to $62,000 for active duty military – or

those eligible for Earned Income Tax Credit the opportunity to file

for free.

According to the IRS, the fastest way for taxpayers to get their

tax refund is through e-file and direct deposit. The IRS expects to

issue more than nine out of 10 federal tax refunds in less than 21

days after acceptance. The deadline to file individual tax returns

this year is April 18, except in Maine and Massachusetts, where the

deadline is April 19.

About Intuit

Intuit Inc. creates business and financial management solutions

that simplify the business of life for small businesses, consumers

and accounting professionals.

Its flagship products and services include QuickBooks® and

TurboTax®, which make it easier to manage small businesses

and tax preparation and filing. Mint.com provides a fresh,

easy and intelligent way for people to manage their money, while

Intuit Tax Online, ProSeries® and Lacerte® are Intuit's

leading tax preparation offerings for professional accountants.

Founded in 1983, Intuit had revenue of $4.2 billion in its

fiscal year 2015. The company has approximately 7,700 employees

with major offices in the United States, Canada, the United

Kingdom, India and other locations. More information can be found

at www.intuit.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160119005688/en/

Intuit Inc.Ashley McMahon,

858-215-9069Ashley_mcmahon@intuit.com

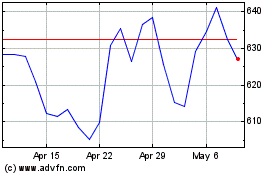

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024