UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

November 19, 2015

Date of Report (Date of earliest event reported):

INTUIT INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | | | |

| | | | |

Delaware | | 000-21180 | | 77-0034661 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

| | 2700 Coast Avenue Mountain View, CA 94043 | | |

| | (Address of Principal Executive Offices) (Zip Code) | | |

Registrant’s telephone number, including area code: (650) 944-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On November 19, 2015, Intuit Inc. announced its financial results for the fiscal quarter ended October 31, 2015 and provided forward-looking guidance. A copy of the press release is attached to this Report as Exhibit 99.01.

The information in this Report and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly stated by specific reference in such filing.

ITEM 8.01 OTHER EVENTS.

On November 19, 2015, Intuit also announced that its Board of Directors approved a cash dividend of $0.30 per share. The cash dividend will be paid on January 19, 2016 to shareholders of record as of the close of business on January 11, 2016. Future declarations of dividends and the establishment of future record dates and payment dates are subject to the final determination of the Intuit Board of Directors. A copy of the press release announcing the cash dividend is furnished as Exhibit 99.01 to this Report.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

|

| | |

| | |

99.01 | | Press release issued on November 19, 2015, reporting financial results for the quarter ended October 31, 2015 and announcing the cash dividend.* |

|

| |

* | This exhibit is intended to be furnished and shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | |

| | | | | |

Date: | November 19, 2015 | | INTUIT INC. |

| | | |

| | | By: | | /s/ R. Neil Williams |

| | | | | R. Neil Williams |

| | | | | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

| | |

Exhibit Number | | Description |

| |

99.01 | | Press release issued on November 19, 2015, reporting financial results for the quarter ended October 31, 2015 and announcing the cash dividend.* |

|

| |

* | This exhibit is intended to be furnished and shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended. |

Exhibit 99.01

|

| | | | |

| | | | |

Contacts: | | Investors | | Media |

| | Matt Rhodes | | Diane Carlini |

| | Intuit Inc. | | Intuit Inc. |

| | 650-944-2536 | | 650-944-6251 |

| | matthew_rhodes@intuit.com | | diane_carlini@intuit.com |

Intuit Reports Strong First-quarter Results; QuickBooks Online

Subscribers Grew 57 Percent

Raises Earnings per Share Guidance for Fiscal 2016

MOUNTAIN VIEW, Calif. - Nov. 19, 2015 - Intuit Inc. (Nasdaq: INTU) announced financial results for the first quarter of fiscal 2016. The company’s fiscal first quarter ended Oct. 31.

“We started the fiscal year the same way we ended the last, with strong momentum across our businesses as our intense focus on our global cloud strategy takes shape,” said Brad Smith, Intuit’s president and chief executive officer.

“We exceeded our subscriber and financial targets in the first quarter and have raised our earnings per share guidance for the fiscal year based on these initial strong results and our acceleration of share repurchases in the quarter.”

Financial Highlights

In the first quarter Intuit:

| |

• | Reported 17 percent revenue growth, which includes the impact of ratable revenue recognition for certain desktop software offerings. |

| |

• | Increased total QuickBooks Online subscribers by 57 percent. |

| |

• | More than doubled QuickBooks Online subscribers outside the U.S. to 215,000. |

| |

• | Repurchased $1.3 billion of its common shares. |

| |

• | Raised GAAP and non-GAAP earnings per share guidance for fiscal 2016. |

Intuit Reports First Quarter Fiscal 2016 Earnings

Page 2

Unless otherwise noted, all growth rates refer to the current period versus the comparable prior-year period, and the business metrics and associated growth rates refer to worldwide business metrics.

Business Segment Results

The segment results below reflect the treatment of assets held for sale as discontinued operations.

Small Business

| |

• | Total Small Business segment revenue increased 5 percent. |

| |

• | The small business online ecosystem continues to build momentum, with revenue growth of approximately 28 percent, driven by strong customer acquisition. |

| |

◦ | Over 80 percent of QuickBooks Online customers were new to the Intuit franchise, raising total subscribers to 1,159,000. |

| |

◦ | More than doubled QuickBooks Online subscribers outside the U.S., reaching 215,000 customers. |

| |

◦ | Reached 35,000 QuickBooks Self-Employed subscribers, up from 25,000 in the last quarter. |

| |

• | Online payroll customers grew 17 percent. |

| |

• | Online payments customers grew 4 percent, and online payments charge volume grew 14 percent. |

Consumer and Professional Tax

| |

• | Consumer Tax revenue was flat in a seasonally light first quarter. |

| |

• | ProTax revenue grew more than 200 percent to $110 million, driven by changes to desktop offerings that affected the timing of revenue recognition. |

Intuit will provide a tax unit update in late February, concurrent with its second-quarter earnings release, and a final update in late April after the tax season ends.

Intuit Reports First Quarter Fiscal 2016 Earnings

Page 3

Snapshot of First-quarter Results |

| | | | | | |

GAAP | Non-GAAP |

| Q1 FY 16 | Q1 FY 15 | Change | Q1 FY 16 | Q1 FY 15 | Change |

Revenue | $713 | $612 | 17% | $713 | $612 | 17% |

Operating Income (Loss) | ($29) | ($109) | NM | $46 | ($42) | NM |

EPS | ($0.11) | ($0.29) | NM | $0.09 | ($0.11) | NM |

Dollars are in millions, except earnings per share (EPS). See “About Non-GAAP Financial Measures” below for more information regarding financial measures not prepared in accordance with Generally Accepted Accounting Principles (GAAP). Q1 FY16 results reflect the impact of changes to certain desktop software offerings; revenue for those offerings is recognized as services are delivered, rather than up front. Q1 FY16 results also reflect the treatment of assets held for sale as discontinued operations.

Capital Allocation Summary

“Our first priority is investing for customer growth,” said Neil Williams, chief financial officer. “This quarter we also increased our dividend by 20 percent and repurchased $1.3 billion in shares.”

In the first quarter the company:

| |

• | Ended with $474 million in cash and investments. |

| |

• | Repurchased shares at an average price of $88.50 per share; about $1.4 billion remains on the authorization. |

| |

• | Received board approval for a $0.30 per share dividend for the fiscal second quarter, payable on Jan. 19. This represents a 20 percent increase versus last year. |

Forward-looking Guidance

“Looking ahead, we remain focused on executing against a compelling long-term growth opportunity in both tax and small business,” Smith said. “We are expanding our categories and our geographies. The proof points are evident in the momentum we are building, as the QuickBooks Online ecosystem continues to grow at a very healthy rate.”

Intuit Reports First Quarter Fiscal 2016 Earnings

Page 4

Intuit announced guidance for the second quarter of fiscal year 2016, which ends Jan. 31. The company expects:

| |

• | Revenue of $880 million to $900 million, growth of 17 to 20 percent. |

| |

• | GAAP operating income of $15 million to $25 million, compared to an operating loss of $89 million in the year-ago quarter. |

| |

• | Non-GAAP operating income of $85 million to $95 million, compared to an operating loss of $22 million in the year-ago quarter. |

| |

• | GAAP earnings per share of $0.01 to $0.04, compared to a net loss per share of $0.23 in the year-ago quarter. |

| |

• | Non-GAAP earnings per share of $0.17 to $0.20, compared to a loss per share of $0.06 in the year-ago quarter. |

| |

• | QuickBooks Online subscribers of approximately 1.240 million. |

For full fiscal 2016, the company now expects:

| |

• | GAAP earnings per share of $2.55 to $2.60, versus previous guidance of $2.50 to $2.55. |

| |

• | Non-GAAP earnings per share of $3.45 to $3.50, versus previous guidance of $3.40 to $3.45. |

| |

• | Capital expenditures of $490 million to $510 million, versus previous guidance of $280 million to $300 million. The new guidance reflects the recently announced purchase of Intuit’s San Diego campus. |

Intuit also reiterated its revenue and operating income guidance for fiscal 2016.

Intuit executives will discuss the company’s financial results on a conference call at 1:30 p.m. Pacific time on Nov. 19. To hear the call, dial 866-348-8108 in the United States or 908-982-4619 from international locations. No reservation or access code is needed. The conference call can also be heard live at http://investors.intuit.com/events.cfm. Prepared remarks for the call will be available on Intuit’s website after the call ends.

Intuit Reports First Quarter Fiscal 2016 Earnings

Page 5

Replay Information

A replay of the conference call will be available for one week by calling 888-266-2081, or 703-925-2533 from international locations. The access code for this call is 1664405.

The audio webcast will remain available on Intuit’s website for one week after the conference call.

About Intuit

Intuit Inc. creates business and financial management solutions that simplify the business of life for small businesses, consumers and accounting professionals.

Its flagship products and services include QuickBooks® and TurboTax®, which make it easier to manage small businesses and tax preparation and filing. Mint.com provides a fresh, easy and intelligent way for people to manage their money, while ProSeries® and Lacerte® are Intuit's leading tax preparation offerings for professional accountants.

Founded in 1983, Intuit had revenue of $4.2 billion in its fiscal year 2015. The company has approximately 7,700 employees with major offices in the United States, Canada, the United Kingdom, India and other locations. More information can be found at www.intuit.com.

Intuit and the Intuit logo, among others, are registered trademarks and/or registered service marks of Intuit Inc. in the United States and other countries.

About Non-GAAP Financial Measures

This press release and the accompanying tables include non-GAAP financial measures. For a description of these non-GAAP financial measures, including the reasons management uses each measure, and reconciliations of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles, please see the section of the accompanying tables titled "About Non-GAAP Financial Measures" as well as the related Table B1, Table B2, and Table E. A copy of the press release issued by Intuit today can be found on the investor relations page of Intuit's Web site.

Cautions About Forward-looking Statements

This press release contains forward-looking statements, including forecasts of expected growth and future financial results of Intuit and its reporting segments; Intuit’s prospects for the business in fiscal 2016 and beyond; expectations regarding Intuit’s growth outside the US; expectations regarding timing and growth of revenue for each of Intuit’s reporting segments and from current or future products and services; expectations regarding customer growth; expectations regarding changes to our products and their impact on Intuit’s business; expectations regarding the amount and timing of any future dividends or share repurchases; expectations regarding availability of

Intuit Reports First Quarter Fiscal 2016 Earnings

Page 6

our offerings; expectations regarding the impact of our strategic decisions on Intuit’s business; and all of the statements under the heading “Forward-looking Guidance”.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. These factors include, without limitation, the following: inherent difficulty in predicting consumer behavior; difficulties in receiving, processing, or filing customer tax submissions; consumers may not respond as we expected to our advertising and promotional activities; product introductions and price competition from our competitors can have unpredictable negative effects on our revenue, profitability and market position; governmental encroachment in our tax businesses or other governmental activities or public policy affecting the preparation and filing of tax returns could negatively affect our operating results and market position; we may not be able to successfully innovate and introduce new offerings and business models to meet our growth and profitability objectives, and current and future offerings may not adequately address customer needs and may not achieve broad market acceptance, which could harm our operating results and financial condition; business interruption or failure of our information technology and communication systems may impair the availability of our products and services, which may damage our reputation and harm our future financial results; as we upgrade and consolidate our customer facing applications and supporting information technology infrastructure, any problems with these implementations could interfere with our ability to deliver our offerings; any failure to properly use and protect personal customer information and data could harm our revenue, earnings and reputation; if we are unable to develop, manage and maintain critical third party business relationships, our business may be adversely affected; increased government regulation of our businesses may harm our operating results; if we fail to process transactions effectively or fail to adequately protect against potential fraudulent activities, our revenue and earnings may be harmed; related publicity regarding such fraudulent activity could cause customers to lose confidence in using our software and adversely impact our results; any significant offering quality problems or delays in our offerings could harm our revenue, earnings and reputation; our participation in the Free File Alliance may result in lost revenue opportunities and cannibalization of our traditional paid franchise; the continuing global economic downturn may continue to impact consumer and small business spending, financial institutions and tax filings, which could negatively affect our revenue and profitability; year-over-year changes in the total number of tax filings that are submitted to government agencies due to economic conditions or otherwise may result in lost revenue opportunities; our revenue and earnings are highly seasonal and the timing of our revenue between quarters is difficult to predict, which may cause significant quarterly fluctuations in our financial results; our financial position may not make repurchasing shares advisable or we may issue additional shares in an acquisition causing our number of outstanding shares to grow; our inability to adequately protect our intellectual property rights may weaken our competitive position and reduce our revenue and earnings; our acquisition and divestiture activities may disrupt our ongoing business, may involve increased expenses and may present risks not contemplated at the time of the transactions; our use of significant amounts of debt to finance acquisitions or other activities could harm our financial condition and results of operation; and litigation involving intellectual property, antitrust, shareholder and other matters may increase our costs. More details about the risks that may impact our business are included in our Form 10-K for fiscal 2015 and in our other SEC filings. You can locate these reports through our website at http://investors.intuit.com. Forward-looking statements are based on information as of November 19, 2015 and we do not undertake any duty to update any forward-looking statement or other information in these materials.

TABLE A

INTUIT INC.

GAAP CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | |

| Three Months Ended |

| October 31,

2015 | | October 31,

2014 |

Net revenue: | | | |

Product | $ | 271 |

| | $ | 228 |

|

Service and other | 442 |

| | 384 |

|

Total net revenue | 713 |

| | 612 |

|

Costs and expenses: | | | |

Cost of revenue: | | | |

Cost of product revenue | 29 |

| | 33 |

|

Cost of service and other revenue | 131 |

| | 119 |

|

Amortization of acquired technology | 6 |

| | 7 |

|

Selling and marketing | 244 |

| | 251 |

|

Research and development | 213 |

| | 189 |

|

General and administrative | 117 |

| | 119 |

|

Amortization of other acquired intangible assets | 2 |

| | 3 |

|

Total costs and expenses [A] | 742 |

| | 721 |

|

Operating loss from continuing operations | (29 | ) | | (109 | ) |

Interest expense | (7 | ) | | (7 | ) |

Interest and other income (expense), net | (4 | ) | | — |

|

Loss before income taxes | (40 | ) | | (116 | ) |

Income tax benefit [B] | (9 | ) | | (35 | ) |

Net loss from continuing operations | (31 | ) | | (81 | ) |

Net loss from discontinued operations [C] | — |

| | (3 | ) |

Net loss | $ | (31 | ) | | $ | (84 | ) |

| | | |

Basic net loss per share from continuing operations | $ | (0.11 | ) | | $ | (0.28 | ) |

Basic net loss per share from discontinued operations | — |

| | (0.01 | ) |

Basic net loss per share | $ | (0.11 | ) | | $ | (0.29 | ) |

Shares used in basic per share calculations | 272 |

| | 286 |

|

| | | |

Diluted net loss per share from continuing operations | $ | (0.11 | ) | | $ | (0.28 | ) |

Diluted net loss per share from discontinued operations | — |

| | (0.01 | ) |

Diluted net loss per share | $ | (0.11 | ) | | $ | (0.29 | ) |

Shares used in diluted per share calculations | 272 |

| | 286 |

|

| | | |

Cash dividends declared per common share | $ | 0.30 |

| | $ | 0.25 |

|

See accompanying Notes.

INTUIT INC.

NOTES TO TABLE A

| |

[A] | The following table summarizes the total share-based compensation expense that we recorded in operating loss from continuing operations for the periods shown. |

|

| | | | | | | |

| Three Months Ended |

(in millions) | October 31, 2015 | | October 31, 2014 |

Cost of revenue | $ | 2 |

| | $ | 1 |

|

Selling and marketing | 19 |

| | 16 |

|

Research and development | 21 |

| | 19 |

|

General and administrative | 25 |

| | 21 |

|

Total share-based compensation expense | $ | 67 |

| | $ | 57 |

|

| |

[B] | We compute our provision for or benefit from income taxes by applying the estimated annual effective tax rate to income or loss from recurring operations and adding the effects of any discrete income tax items specific to the period. Our effective tax rate for the three months ended October 31, 2015 was approximately 22%. Excluding discrete tax items primarily related to share-based compensation as well as including the effects of losses in certain jurisdictions where we do not recognize a tax benefit, our effective tax rate for the three months ended October 31, 2015 was approximately 36% and did not differ significantly from the federal statutory rate of 35%. |

Our effective tax rate for the three months ended October 31, 2014 was approximately 31%. Excluding discrete tax items primarily related to share-based compensation and a state tax law change as well as including the effects of losses in certain jurisdictions where we do not recognize a tax benefit, our effective tax rate for the period was approximately 37% and did not differ significantly from the federal statutory rate of 35%.

[C] In the fourth quarter of fiscal 2015 we determined that our Demandforce, QuickBase, and Quicken businesses became long-lived assets held for sale and we accounted for them as discontinued operations.

We have segregated the operating results for these three businesses in our statements of operations for all periods presented. Net revenue from these businesses totaled $59 million for the three months ended October 31, 2015 and $61 million for the three months ended October 31, 2014. Net income or loss from discontinued operations was not significant for any period presented.

We have reclassified our balance sheets for all periods presented to reflect these businesses as discontinued operations. Because the cash flows of these businesses were not material for any period presented, we have not segregated them from continuing operations on our statements of cash flows.

TABLE B1

INTUIT INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Fiscal 2016 |

| | | | | | | | | Three Months Ended |

| Q1 | | Q2 | | Q3 | | Q4 | | October 31, 2015 |

GAAP operating income (loss) from continuing operations | $ | (29 | ) | | $ | — |

| | $ | — |

| | $ | — |

| | $ | (29 | ) |

Amortization of acquired technology | 6 |

| | — |

| | — |

| | — |

| | 6 |

|

Amortization of other acquired intangible assets | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Share-based compensation expense | 67 |

| | — |

| | — |

| | — |

| | 67 |

|

Non-GAAP operating income (loss) from continuing operations | $ | 46 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 46 |

|

| | | | | | | | | |

GAAP net income (loss) | $ | (31 | ) | | $ | — |

| | $ | — |

| | $ | — |

| | $ | (31 | ) |

Amortization of acquired technology | 6 |

| | — |

| | — |

| | — |

| | 6 |

|

Amortization of other acquired intangible assets | 2 |

| | — |

| | — |

| | — |

| | 2 |

|

Share-based compensation expense | 67 |

| | — |

| | — |

| | — |

| | 67 |

|

Net (gain) loss on debt securities and other investments | 1 |

| | — |

| | — |

| | — |

| | 1 |

|

Income tax effects and adjustments | (21 | ) | | — |

| | — |

| | — |

| | (21 | ) |

Non-GAAP net income (loss) | $ | 24 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 24 |

|

| | | | | | | | | |

GAAP diluted net income (loss) per share | $ | (0.11 | ) | | $ | — |

| | $ | — |

| | $ | — |

| | $ | (0.11 | ) |

Amortization of acquired technology | 0.02 |

| | — |

| | — |

| | — |

| | 0.02 |

|

Amortization of other acquired intangible assets | 0.01 |

| | — |

| | — |

| | — |

| | 0.01 |

|

Share-based compensation expense | 0.25 |

| | — |

| | — |

| | — |

| | 0.25 |

|

Net (gain) loss on debt securities and other investments | — |

| | — |

| | — |

| | — |

| | — |

|

Income tax effects and adjustments | (0.08 | ) | | — |

| | — |

| | — |

| | (0.08 | ) |

Non-GAAP diluted net income (loss) per share | $ | 0.09 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 0.09 |

|

| | | | | | | | | |

Shares used in diluted per share calculation | 275 |

| | — |

| | — |

| | — |

| | 275 |

|

See “About Non-GAAP Financial Measures” immediately following Table E for information on these measures, the items excluded from the most directly comparable GAAP measures in arriving at non-GAAP financial measures, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure.

TABLE B2

INTUIT INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Fiscal 2015 |

| Q1 | | Q2 | | Q3 | | Q4 | | Full Year |

GAAP operating income (loss) from continuing operations | $ | (109 | ) | | $ | (89 | ) | | $ | 1,066 |

| | $ | (130 | ) | | $ | 738 |

|

Amortization of acquired technology | 7 |

| | 7 |

| | 8 |

| | 8 |

| | 30 |

|

Amortization of other acquired intangible assets | 3 |

| | 3 |

| | 3 |

| | 3 |

| | 12 |

|

Professional fees for business combinations | — |

| | 1 |

| | 1 |

| | — |

| | 2 |

|

Goodwill and intangible asset impairment charges | — |

| | — |

| | 114 |

| | 34 |

| | 148 |

|

Gain on sale of long-lived assets | — |

| | — |

| | (30 | ) | | (1 | ) | | (31 | ) |

Share-based compensation expense | 57 |

| | 56 |

| | 59 |

| | 70 |

| | 242 |

|

Non-GAAP operating income (loss) from continuing operations | $ | (42 | ) | | $ | (22 | ) | | $ | 1,221 |

| | $ | (16 | ) | | $ | 1,141 |

|

| | | | | | | | | |

GAAP net income (loss) | $ | (84 | ) | | $ | (66 | ) | | $ | 501 |

| | $ | 14 |

| | $ | 365 |

|

Amortization of acquired technology | 7 |

| | 7 |

| | 8 |

| | 8 |

| | 30 |

|

Amortization of other acquired intangible assets | 3 |

| | 3 |

| | 3 |

| | 3 |

| | 12 |

|

Professional fees for business combinations | — |

| | 1 |

| | 1 |

| | — |

| | 2 |

|

Goodwill and intangible asset impairment charges | — |

| | — |

| | 114 |

| | 34 |

| | 148 |

|

Gain on sale of long-lived assets | — |

| | — |

| | (30 | ) | | (1 | ) | | (31 | ) |

Share-based compensation expense | 57 |

| | 56 |

| | 59 |

| | 70 |

| | 242 |

|

Net (gain) loss on debt securities and other investments | 1 |

| | — |

| | 3 |

| | 2 |

| | 6 |

|

Income tax effects and adjustments | (19 | ) | | (25 | ) | | (10 | ) | | (29 | ) | | (83 | ) |

Net (income) loss from discontinued operations | 3 |

| | 6 |

| | 155 |

| | (116 | ) | | 48 |

|

Non-GAAP net income (loss) | $ | (32 | ) | | $ | (18 | ) | | $ | 804 |

| | $ | (15 | ) | | $ | 739 |

|

| | | | | | | | | |

GAAP diluted net income (loss) per share | $ | (0.29 | ) | | $ | (0.23 | ) | | $ | 1.78 |

| | $ | 0.05 |

| | $ | 1.28 |

|

Amortization of acquired technology | 0.02 |

| | 0.02 |

| | 0.03 |

| | 0.03 |

| | 0.10 |

|

Amortization of other acquired intangible assets | 0.01 |

| | 0.01 |

| | 0.01 |

| | 0.01 |

| | 0.04 |

|

Professional fees for business combinations | — |

| | — |

| | — |

| | — |

| | 0.01 |

|

Goodwill and intangible asset impairment charges | — |

| | — |

| | 0.40 |

| | 0.12 |

| | 0.52 |

|

Gain on sale of long-lived assets | — |

| | — |

| | (0.11 | ) | | — |

| | (0.11 | ) |

Share-based compensation expense | 0.20 |

| | 0.20 |

| | 0.21 |

| | 0.25 |

| | 0.85 |

|

Net (gain) loss on debt securities and other investments | — |

| | — |

| | 0.01 |

| | 0.01 |

| | 0.02 |

|

Income tax effects and adjustments | (0.06 | ) | | (0.08 | ) | | (0.03 | ) | | (0.10 | ) | | (0.29 | ) |

Net (income) loss from discontinued operations | 0.01 |

| | 0.02 |

| | 0.55 |

| | (0.42 | ) | | 0.17 |

|

Non-GAAP diluted net income (loss) per share | $ | (0.11 | ) | | $ | (0.06 | ) | | $ | 2.85 |

| | $ | (0.05 | ) | | $ | 2.59 |

|

| | | | | | | | | |

Shares used in diluted per share calculation | 286 |

| | 285 |

| | 282 |

| | 277 |

| | 286 |

|

See “About Non-GAAP Financial Measures” immediately following Table E for information on these measures, the items excluded from the most directly comparable GAAP measures in arriving at non-GAAP financial measures, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure.

TABLE C

INTUIT INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

(Unaudited)

|

| | | | | | | |

| October 31, 2015 | | July 31, 2015 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 474 |

| | $ | 808 |

|

Investments | — |

| | 889 |

|

Accounts receivable, net | 124 |

| | 91 |

|

Income taxes receivable | 100 |

| | 84 |

|

Deferred income taxes | 244 |

| | 231 |

|

Prepaid expenses and other current assets | 121 |

| | 94 |

|

Current assets of discontinued operations | 17 |

| | 26 |

|

Current assets before funds held for customers | 1,080 |

| | 2,223 |

|

Funds held for customers | 347 |

| | 337 |

|

Total current assets | 1,427 |

| | 2,560 |

|

| | | |

Long-term investments | 28 |

| | 27 |

|

Property and equipment, net | 701 |

| | 682 |

|

Goodwill | 1,274 |

| | 1,266 |

|

Acquired intangible assets, net | 77 |

| | 87 |

|

Other assets | 107 |

| | 111 |

|

Long-term assets of discontinued operations | 219 |

| | 235 |

|

Total assets | $ | 3,833 |

| | $ | 4,968 |

|

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Borrowings under credit facility | $ | 350 |

| | $ | — |

|

Accounts payable | 178 |

| | 190 |

|

Accrued compensation and related liabilities | 139 |

| | 283 |

|

Deferred revenue | 635 |

| | 691 |

|

Other current liabilities | 165 |

| | 150 |

|

Current liabilities of discontinued operations | 73 |

| | 93 |

|

Current liabilities before customer fund deposits | 1,540 |

| | 1,407 |

|

Customer fund deposits | 347 |

| | 337 |

|

Total current liabilities | 1,887 |

| | 1,744 |

|

| | | |

Long-term debt | 500 |

| | 500 |

|

Long-term deferred revenue | 157 |

| | 152 |

|

Other long-term obligations | 184 |

| | 172 |

|

Long-term obligations of discontinued operations | 54 |

| | 68 |

|

Total liabilities | 2,782 |

| | 2,636 |

|

| | | |

Stockholders’ equity | 1,051 |

| | 2,332 |

|

Total liabilities and stockholders’ equity | $ | 3,833 |

| | $ | 4,968 |

|

TABLE D

INTUIT INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

|

| | | | | | | |

| Three Months Ended |

| October 31, 2015 | | October 31, 2014 |

Cash flows from operating activities: | | | |

Net loss | $ | (31 | ) | | $ | (84 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | |

Depreciation | 45 |

| | 36 |

|

Amortization of acquired intangible assets | 10 |

| | 18 |

|

Share-based compensation expense | 69 |

| | 61 |

|

Deferred income taxes | (2 | ) | | (6 | ) |

Tax benefit from share-based compensation plans | 9 |

| | 18 |

|

Excess tax benefit from share-based compensation plans | (9 | ) | | (18 | ) |

Other | 10 |

| | 12 |

|

Total adjustments | 132 |

| | 121 |

|

Changes in operating assets and liabilities: | | | |

Accounts receivable | (28 | ) | | (4 | ) |

Income taxes receivable | (17 | ) | | (56 | ) |

Prepaid expenses and other assets | (29 | ) | | (3 | ) |

Accounts payable | (6 | ) | | 32 |

|

Accrued compensation and related liabilities | (145 | ) | | (139 | ) |

Deferred revenue | (54 | ) | | 28 |

|

Other liabilities | (19 | ) | | (13 | ) |

Total changes in operating assets and liabilities | (298 | ) | | (155 | ) |

Net cash used in operating activities | (197 | ) | | (118 | ) |

Cash flows from investing activities: | | | |

Purchases of available-for-sale debt securities | (117 | ) | | (365 | ) |

Sales of available-for-sale debt securities | 940 |

| | 147 |

|

Maturities of available-for-sale debt securities | 64 |

| | 229 |

|

Net change in money market funds and other cash equivalents held to satisfy customer fund obligations | (10 | ) | | (69 | ) |

Net change in customer fund deposits | 10 |

| | 69 |

|

Purchases of property and equipment | (70 | ) | | (55 | ) |

Acquisitions of businesses, net of cash acquired | — |

| | (9 | ) |

Other | (1 | ) | | (8 | ) |

Net cash provided by (used in) investing activities | 816 |

| | (61 | ) |

Cash flows from financing activities: | | | |

Proceeds from borrowings under credit facility | 350 |

| | — |

|

Net proceeds from issuance of stock under employee stock plans | 24 |

| | 47 |

|

Cash paid for purchases of treasury stock | (1,253 | ) | | (114 | ) |

Dividends and dividend rights paid | (82 | ) | | (74 | ) |

Excess tax benefit from share-based compensation plans | 9 |

| | 18 |

|

Net cash used in financing activities | (952 | ) | | (123 | ) |

Effect of exchange rates on cash and cash equivalents | (1 | ) | | (5 | ) |

Net decrease in cash and cash equivalents | (334 | ) | | (307 | ) |

Cash and cash equivalents at beginning of period | 808 |

| | 849 |

|

Cash and cash equivalents at end of period | $ | 474 |

| | $ | 542 |

|

TABLE E

INTUIT INC.

RECONCILIATION OF FORWARD-LOOKING GUIDANCE FOR NON-GAAP FINANCIAL MEASURES

TO PROJECTED GAAP REVENUE, OPERATING INCOME (LOSS), AND EPS

(In millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Forward-Looking Guidance |

| | GAAP Range of Estimate | | | | | | Non-GAAP Range of Estimate |

| | From | | To | | Adjmts | | | | From | | To |

Three Months Ending January 31, 2016 | | | | | | | | | | | | |

Revenue | | $ | 880 |

| | $ | 900 |

| | $ | — |

| | | | $ | 880 |

| | $ | 900 |

|

Operating income | | $ | 15 |

| | $ | 25 |

| | $ | 70 |

| | [a] | | $ | 85 |

| | $ | 95 |

|

Diluted earnings per share | | $ | 0.01 |

| | $ | 0.04 |

| | $ | 0.16 |

| | [b] | | $ | 0.17 |

| | $ | 0.20 |

|

| | | | | | | | | | | | |

Twelve Months Ending July 31, 2016 | | | | | | | | | | | | |

Revenue | | $ | 4,525 |

| | $ | 4,600 |

| | $ | — |

| | | | $ | 4,525 |

| | $ | 4,600 |

|

Operating income | | $ | 1,115 |

| | $ | 1,145 |

| | $ | 335 |

| | [c] | | $ | 1,450 |

| | $ | 1,480 |

|

Diluted earnings per share | | $ | 2.55 |

| | $ | 2.60 |

| | $ | 0.90 |

| | [d] | | $ | 3.45 |

| | $ | 3.50 |

|

See “About Non-GAAP Financial Measures” immediately following this Table E for information on these measures, the items excluded from the most directly comparable GAAP measures in arriving at non-GAAP financial measures, and the reasons management uses each measure and excludes the specified amounts in arriving at each non-GAAP financial measure.

| |

[a] | Reflects estimated adjustments for share-based compensation expense of approximately $62 million; amortization of acquired technology of approximately $6 million; and amortization of other acquired intangible assets of approximately $2 million. |

| |

[b] | Reflects the estimated adjustments in item [a], income taxes related to these adjustments, and other income tax effects related to the use of the long-term non-GAAP tax rate. |

| |

[c] | Reflects estimated adjustments for share-based compensation expense of approximately $303 million; amortization of acquired technology of approximately $24 million; and amortization of other acquired intangible assets of approximately $8 million. |

| |

[d] | Reflects the estimated adjustments in item [c], income taxes related to these adjustments, and other income tax effects related to the use of the long-term non-GAAP tax rate. |

INTUIT INC.

ABOUT NON-GAAP FINANCIAL MEASURES

The accompanying press release dated November 19, 2015 contains non-GAAP financial measures. Table B1, Table B2 and Table E reconcile the non-GAAP financial measures in that press release to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles (GAAP). These non-GAAP financial measures include non-GAAP operating income (loss), non-GAAP net income (loss) and non-GAAP net income (loss) per share.

Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures do not reflect a comprehensive system of accounting, differ from GAAP measures with the same names and may differ from non-GAAP financial measures with the same or similar names that are used by other companies.

We compute non-GAAP financial measures using the same consistent method from quarter to quarter and year to year. We may consider whether other significant items that arise in the future should be excluded from our non-GAAP financial measures.

We exclude the following items from all of our non-GAAP financial measures:

| |

• | Share-based compensation expense |

| |

• | Amortization of acquired technology |

| |

• | Amortization of other acquired intangible assets |

| |

• | Goodwill and intangible asset impairment charges |

| |

• | Professional fees for business combinations |

We also exclude the following items from non-GAAP net income (loss) and diluted net income (loss) per share:

| |

• | Gains and losses on debt and equity securities and other investments |

| |

• | Income tax effects and adjustments |

We believe that these non-GAAP financial measures provide meaningful supplemental information regarding Intuit’s operating results primarily because they exclude amounts that we do not consider part of ongoing operating results when planning and forecasting and when assessing the performance of the organization, our individual operating segments or our senior management. Segment managers are not held accountable for share-based compensation expense, amortization, or the other excluded items and, accordingly, we exclude these amounts from our measures of segment performance. We believe that our non-GAAP financial measures also facilitate the comparison by management and investors of results for current periods and guidance for future periods with results for past periods.

The following are descriptions of the items we exclude from our non-GAAP financial measures.

Share-based compensation expenses. These consist of non-cash expenses for stock options, restricted stock units and our Employee Stock Purchase Plan. When considering the impact of equity awards, we place greater emphasis on overall shareholder dilution rather than the accounting charges associated with those awards.

Amortization of acquired technology and amortization of other acquired intangible assets. When we acquire an entity, we are required by GAAP to record the fair values of the intangible assets of the entity and amortize them over their useful lives. Amortization of acquired technology in cost of revenue includes amortization of software and other technology assets of acquired entities. Amortization of other acquired intangible assets in operating expenses includes amortization of assets such as customer lists, covenants not to compete and trade names.

Goodwill and intangible asset impairment charges. We exclude from our non-GAAP financial measures non-cash charges to adjust the carrying value of goodwill and other acquired intangible assets to their estimated fair values.

Professional fees for business combinations. We exclude from our non-GAAP financial measures the professional fees we incur to complete business combinations. These include investment banking, legal and accounting fees.

Gains and losses on debt and equity securities and other investments. We exclude from our non-GAAP financial measures gains and losses that we record when we sell or impair available-for-sale debt and equity securities and other investments.

Income tax effects and adjustments. We use a long-term non-GAAP tax rate for evaluating operating results and for planning, forecasting, and analyzing future periods. This long-term non-GAAP tax rate excludes the income tax effects of the non-GAAP pre-tax adjustments described above, assumes the federal research and experimentation credit is continuously in effect, and eliminates the effects of non-recurring and period specific items which can vary in size and frequency. Based on our current long-term projections, we are using a long-term non-GAAP tax rate of 34% which is consistent with the average of our normalized fiscal year tax rate over a four year period that includes the past three fiscal years plus the current fiscal year forecast. We will evaluate this long-term non-GAAP tax rate on an annual basis and whenever any significant events occur which may materially affect this long-term rate. This long-term non-GAAP tax rate could be subject to change for various reasons including significant changes in our geographic earnings mix or fundamental tax law changes in major jurisdictions in which we operate.

Operating results and gains and losses on the sale of discontinued operations. From time to time, we sell or otherwise dispose of selected operations as we adjust our portfolio of businesses to meet our strategic goals. In accordance with GAAP, we segregate the operating results of discontinued operations as well as gains and losses on the sale of these discontinued operations from continuing operations on our GAAP statements of operations but continue to include them in GAAP net income or loss and net income or loss per share. We exclude these amounts from our non-GAAP financial measures.

The reconciliations of the forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures in Table E include all information reasonably available to Intuit at the date of this press release. These tables include adjustments that we can reasonably predict. Events that could cause the reconciliation to change include acquisitions and divestitures of businesses, goodwill and other asset impairments, and sales of available-for-sale debt securities and other investments.

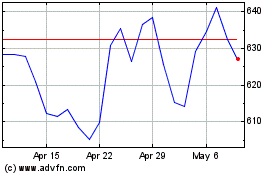

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024