Intuit to Divest Demandforce, QuickBase and Quicken -- Update

August 20 2015 - 7:33PM

Dow Jones News

By Josh Beckerman

Intuit Inc., the maker of TurboTax, said it plans to divest its

Demandforce, QuickBase and Quicken operations to sharpen its

focus.

The company also increased its dividend by 20% to 30 cents a

share from 25 cents.

Intuit said its loss excluding items for the fiscal fourth

quarter ended July 31 was five cents a share, while revenue rose 7%

to $696 million. Intuit had expected a loss excluding items of 10

cents to 12 cents a share on revenue of $720 million to $745

million.

Net income was $14 million, or five cents a share, compared with

a net loss of $29 million, or 10 cents a share, a year earlier.

The company said "small business momentum continues to build,"

with the addition of 110,000 QuickBooks Online subscribers during

the quarter for a total of 1.075 million.

Intuit shares fell 2.9% to $99.90 in after-hours trading.

The planned exit from Demandforce, QuickBase and Quicken is

expected to reduce revenue by about $250 million, and earnings

excluding items by about 10 cents a share for the year ending in

July 2016. Intuit expects revenue of $4.525 to $4.6 billion and

earnings excluding items of $3.40 to $3.45 for the year.

Intuit bought marketing and communications software business

Demandforce for about $423.5 million in 2012. QuickBase is a

collaboration platform, while Quicken is a personal-finance

software brand.

For the current quarter, Intuit expects a loss excluding items

of three cents to four cents a share on revenue of $660 million to

$680 million.

Write to Josh Beckerman at josh.beckerman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 20, 2015 19:18 ET (23:18 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

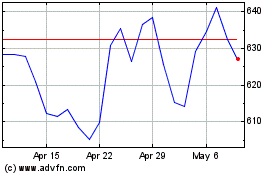

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024