UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

INTUIT INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

000-21180 |

|

77-0034661 |

| (State or other Jurisdiction

of Incorporation or Organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

2700 Coast Avenue

Mountain View, CA 94043

(Address of Principal Executive Offices)

(Zip Code)

Kerry

McLean

Vice President, Deputy General Counsel

(650) 944-6000

(Name

and telephone number, including area code, of the person to contact in connection with this report)

Check the appropriate box to

indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| x |

Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1 – Conflict Minerals Disclosure

Items 1.01 and 1.02 Conflict Minerals Disclosure and Report; Exhibit

Conflict Minerals Disclosure

A copy of

Intuit Inc.’s Conflict Minerals Report is filed as Exhibit 1.01 hereto and is publicly available at http://www.intuit.com/company/strategic-sourcing/supplier-policies/.

Section 2 – Exhibits

Item 2.01

Exhibits

The following exhibit is filed as part of this report:

Exhibit 1.01 – Conflict Minerals Report as required by Item 1.01 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: June 1, 2015 |

|

|

|

INTUIT INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ R. Neil Williams |

|

|

|

|

|

|

Name: R. Neil Williams |

|

|

|

|

|

|

Title: SVP and Chief Financial Officer |

Exhibit 1.01

Intuit Inc.

Conflict

Minerals Report

For The Year Ended December 31, 2014

This is the Conflict Minerals Report (the “CMR”) of Intuit Inc. (“Intuit”) for the calendar year 2014 in accordance with Rule 13p-1 under

the Securities Exchange Act of 1934, as amended.

Introduction and Products Overview

Intuit creates business and financial management software solutions that simplify the business of life for small businesses, consumers and accounting

professionals. Its flagship products and services include software products such as QuickBooks®, Quicken® and TurboTax®, which make it easier to manage small businesses and payroll processing, personal finance, and tax preparation and filing. Mint.com provides a fresh, easy and intelligent way for people to manage

their money, while Demandforce® offers marketing and communication tools for small businesses. ProSeries® and Lacerte® are Intuit’s leading tax preparation offerings for professional accountants. Intuit has reviewed the products it distributes and has determined that none of its software products (including

software products that are distributed on CDs as well as software products distributed through downloading or as a cloud-based service) contain “conflict minerals” or “3TGs” (defined in Item 1.01 of Form SD as

columbite-tantalite (coltan), cassiterite, gold, wolframite and their derivatives, which are limited to tantalum, tin and tungsten).

In addition to these

core software offerings which account for in excess of 95% of Intuit’s revenue, Intuit also distributes a certain payment dongle that attaches to smart phones, tablets and Bluetooth card readers that allows merchants to process credit card

payments (the “Intuit Payment Devices”). For the 2014 reporting period, the only product that Intuit manufactured or contracted to manufacture containing conflict minerals that are necessary to the functionality or production of such

products are the Intuit Payment Devices.

Due Diligence Investigation

Intuit’s due diligence program was designed to conform, in all material respects, to the five-step framework laid out in the Organisation for Economic

Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and related Supplements on Tin, Tantalum and Tungsten and on Gold (the “OECD

Guidance”). In accordance with the OECD Guidance, we took the following measures as part of our due diligence process.

Establish Strong Company

Management Systems

Intuit has established strong company management systems relating to conflict minerals. In January 2013, a dedicated working group

was comprised of subject matter experts within the Supply Chain organization and Legal teams, and this working group has met regularly since its formation 2 years ago. The working group has reported regularly on progress to a disclosure committee of

senior executives, including the Chief Financial Officer, Chief Accounting Officer and General Counsel and has also updated the Audit Committee and Nominating and Governance Committee of the Board of Directors. Management has also developed a

Conflict Minerals Policy that is posted at http://www.intuit.com/company/strategic-sourcing/supplier-policies/conflict-minerals/ to clearly communicate Intuit’s commitment to developing and maintaining a conflict free mineral supply

chain to its suppliers and the public.

In addition, we maintain a company-level grievance mechanism, as described in our Code of Conduct and Ethics,

that enables employees to report concerns, including any concerns regarding Intuit’s conflict minerals supply chain. Intuit also maintains an integrity hotline that third parties can use to report on financial and ethical issues, including

issues concerning our conflict minerals supply chain. The number for this hotline is posted on Intuit’s website at

http://investors.intuit.com/corporate-governance/conduct-and-guidelines/report-concerns-about-financial-or-ethical-issues/default.aspx.

Since

Intuit contracts to manufacture the Intuit Payment Devices with a supplier that is at least four levels removed from the actual mining of the 3TGs, Intuit has leveraged its sole direct supplier (the “Tier One Supplier”) to provide

information regarding the 3TG contained in those products, and the Tier One Supplier is similarly reliant upon information provided by its suppliers. Intuit has continued to work with its Tier One Supplier to establish controls over and transparency

for its 3TG supply chain. In this process, Intuit used the due diligence tools developed by the Conflict-Free Sourcing Initiative (“CFSI”), including the CFSI’s Conflict Minerals Reporting Template (the “Template”), which is

designed to identify the smelters and refiners that process the conflict minerals in a company’s supply chain.

Identify and Assess Risk in the

Supply Chain.

Intuit required its Tier One Supplier to disclose the original equipment manufacturers (“OEMs”) that manufacture all of the

components in the Intuit Payment Devices, and Intuit required all of the identified OEMs to complete the Template. Intuit has identified three OEMs that provide components to the Tier One Supplier, and all of these have submitted the Template to

Intuit. In addition, as a supplemental measure in 2014, Intuit requested and received a completed Template from the contract manufacturer responsible for packaging the OEM components for Intuit Payment Devices. Once Intuit received the completed

Templates, Intuit reviewed the Templates for completeness, accuracy and consistency. Where the Templates identified smelter and refiner facilities as sources of an OEM’s 3TG, Intuit compared the identified smelters and refiners against the list

of compliant smelters and refiners published by CFSI’s Conflict Free Smelter Program.

Based on the responses received, Intuit has determined that

the OEM component manufacturers obtain their components from a mix of certified conflict free smelters as well as smelters that have not yet been certified as conflict free. As a result, the primary risk in Intuit’s supply chain is the lack of

complete information on the origin of the components and the resulting inability of its Tier One Supplier to find OEM manufacturers that can certify that the 3TGs contained in the components utilized in the Intuit Payment Devices are sourced

exclusively from certified conflict free smelters.

Design and Implement a Strategy to Respond to Identified Risks

Intuit’s strategy to respond to the identified risks in its supply chain focuses on implementing requirements that its Tier One Suppliers source the

components in the Intuit Payment Devices from smelters and refiners certified under CFSI’s Conflict Free Smelter Program wherever possible. In this regard, where Template responses indicate that suppliers are not using certified conflict-free

sources, we engaged with the Tier One Supplier and/or OEM to encourage them to establish an alternative source of conflict minerals. Intuit also amended agreements with the Tier One Supplier to strengthen the contractual requirements to source from

certified conflict free sources, and has implemented best practices within its supply chain group on contractual requirements for any new suppliers that Intuit may contract with in the future.

Support Independent Third-Party Audit of Supply Chain Due Diligence

Intuit does not have direct relationships with smelters and refiners and does not perform direct audits of these entities’ supply chains for 3TGs.

However, Intuit supports the development of, and smelters’ and refiners’ participation in, independent third party audits of smelters’ and refiners’ sourcing practices, such as the CFSI’s Conflict-Free Smelter Program.

Report on Supply Chain Diligence

Intuit is committed to

full and transparent disclosure of its efforts to facilitate the sourcing of conflict-free minerals for its products. This CMR is available on Intuit’s website at

http://www.intuit.com/company/strategic-sourcing/supplier-policies/. Intuit will also post any developments with respect to conflict minerals that are material to its business on its website, under the Conflict Minerals Policy tab.

Results of Due Diligence

A large percentage of

the OEMs indicated that they were unable to provide at least some of the information requested in the Template, and that they are still completing due diligence on their supply chains, particularly with respect to information about the smelters and

refiners in their supply chains. Intuit’s efforts to determine the mine or location of origin of the conflict minerals in the Intuit Payment Devices with the greatest possible specificity consisted of the due diligence measures described in

this CMR, including our efforts to seek information from OEMs using the Template.

Although Intuit requested information at a product level, almost all

supplier responses provided information at a company or division level, but not at a product level, and, therefore, the information provided was not necessarily limited to smelters or refiners confirmed to be in Intuit’s supply chain. In

addition, many of the supplier responses were still incomplete as all supply chain participants continue to map their upstream supply chains. As a result, Intuit is unable to validate whether the facilities identified by the OEMs, which are listed

in Annex A below, in fact contributed conflict minerals to Intuit Payment Devices. Annex B below includes an aggregated list of the countries of origin from which the facilities listed in Annex A are known to source conflict minerals, based on

information provided by suppliers and CFSI.

Additional Mitigation Efforts

Intuit is a member of the Electronic Industry Citizenship Coalition (the “EICC”) and has developed procedures consistent with the EICC

recommendations for responsible sourcing of conflict minerals, as set forth in the OECD Guidance. Intuit also attends the weekly EICC Conflict Minerals Due Diligence Calls chaired by the EICC and has implemented the best practices that are relevant

to its supply chain that have been developed by the CFSI. As an active member of the EICC, Intuit will continue to monitor and implement relevant best practices recommendations from the EICC as well as conflict mineral trends that impact

Intuit’s business.

Further Intuit:

| |

• |

|

Conducts benchmarking sessions with manufacturers and other technology companies in Silicon Valley; |

| |

• |

|

Sets up Webinars with its suppliers to address concerns and questions; and |

| |

• |

|

Continues to work with suppliers to ensure that they have robust due diligence practices. |

In addition, in

order to improve on the quality of information provided by its supply chain, as discussed above Intuit has already amended its agreements with its Tier One Supplier to strengthen the contractual requirements to source from certified conflict-free

sources. Intuit will require the inclusion of similar provisions in its agreements with new suppliers, and if such prospective supplier is unable to make this certification, Intuit will seek out alternative suppliers if alternative suppliers are

available that can make such certification.

ANNEX A

2014 Facility List

The following is a

list of the facilities that the suppliers we surveyed reported as being in their supply chains.

|

|

|

|

|

| Mineral |

|

Facility Name |

|

Facility Location |

| Gold |

|

Aida Chemical Industries Co. Ltd. |

|

JAPAN |

| Gold |

|

Allgemeine Gold-und Silberscheideanstalt A.G. |

|

GERMANY |

| Gold |

|

Argor-Heraeus SA |

|

SWITZERLAND |

| Gold |

|

Asahi Pretec Corporation |

|

JAPAN |

| Gold |

|

Asaka Riken Co Ltd |

|

JAPAN |

| Gold |

|

Caridad |

|

MEXICO |

| Gold |

|

Chugai Mining |

|

JAPAN |

| Gold |

|

Codelco |

|

CHILE |

| Gold |

|

Daejin Indus Co. Ltd |

|

KOREA, REPUBLIC OF |

| Gold |

|

DaeryongENC |

|

KOREA, REPUBLIC OF |

| Gold |

|

Do Sung Corporation |

|

KOREA, REPUBLIC OF |

| Gold |

|

Dowa |

|

JAPAN |

| Gold |

|

Heraeus Ltd. Hong Kong |

|

HONG KONG |

| Gold |

|

Heraeus Precious Metals GmbH & Co. KG |

|

GERMANY |

| Gold |

|

Hwasung CJ Co. Ltd |

|

KOREA, REPUBLIC OF |

| Gold |

|

Ishifuku Metal Industry Co., Ltd. |

|

JAPAN |

| Gold |

|

Johnson Matthey Inc |

|

UNITED STATES |

| Gold |

|

Johnson Matthey Ltd |

|

CANADA |

| Gold |

|

JX Nippon Mining & Metals Co., Ltd. |

|

JAPAN |

| Gold |

|

Kojima Chemicals Co., Ltd |

|

JAPAN |

| Gold |

|

Korea Metal Co. Ltd |

|

KOREA, REPUBLIC OF |

| Gold |

|

LS-NIKKO Copper Inc. |

|

KOREA, REPUBLIC OF |

| Gold |

|

Materion |

|

UNITED STATES |

| Gold |

|

Matsuda Sangyo Co., Ltd. |

|

JAPAN |

| Gold |

|

Metalor Switzerland |

|

SWITZERLAND |

| Gold |

|

Metalor Technologies (Hong Kong) Ltd |

|

HONG KONG |

| Gold |

|

Metalor Technologies (Singapore) Pte. Ltd. |

|

SINGAPORE |

| Gold |

|

Metalor Technologies SA |

|

SWITZERLAND |

| Gold |

|

Metalor USA Refining Corporation |

|

UNITED STATES |

| Gold |

|

Mitsubishi Materials Corporation |

|

JAPAN |

|

|

|

|

|

| Mineral |

|

Facility Name |

|

Facility Location |

| Gold |

|

Mitsui Mining and Smelting Co., Ltd. |

|

JAPAN |

| Gold |

|

Navoi Mining and Metallurgical Combinat |

|

UZBEKISTAN |

| Gold |

|

Nihon Material Co. LTD |

|

JAPAN |

| Gold |

|

Ohio Precious Metals, LLC |

|

UNITED STATES |

| Gold |

|

Royal Canadian Mint |

|

CANADA |

| Gold |

|

Sabin Metal Corp. |

|

UNITED STATES |

| Gold |

|

SAMWON METALS Corp. |

|

KOREA, REPUBLIC OF |

| Gold |

|

Shandong Zhaojin Gold & Silver Refinery Co. Ltd |

|

CHINA |

| Gold |

|

Solar Applied Materials Technology Corp. |

|

TAIWAN |

| Gold |

|

Sumitomo Metal Mining Co., Ltd. |

|

JAPAN |

| Gold |

|

Tanaka Kikinzoku Kogyo K.K. |

|

JAPAN |

| Gold |

|

Umicore SA Business Unit Precious Metals Refining |

|

BELGIUM |

| Gold |

|

Yokohama Metal Co Ltd |

|

JAPAN |

| Gold |

|

Zhongyuan Gold Smelter of Zhongjin Gold Corporation |

|

CHINA |

|

|

|

| Tantalum |

|

Exotech Inc. |

|

UNITED STATES |

| Tantalum |

|

F&X Electro-Materials Ltd. |

|

CHINA |

| Tantalum |

|

Global Advanced Metals |

|

UNITED STATES |

| Tantalum |

|

H.C. Starck Group |

|

GERMANY |

| Tantalum |

|

Mitsui Mining & Smelting |

|

JAPAN |

| Tantalum |

|

Ningxia Orient Tantalum Industry Co., Ltd. |

|

CHINA |

| Tantalum |

|

Solikamsk Metal Works |

|

RUSSIAN FEDERATION |

| Tantalum |

|

Ulba |

|

KAZAKHSTAN |

| Tantalum |

|

Zhuzhou Cement Carbide |

|

CHINA |

|

|

|

| Tin |

|

Alpha |

|

UNITED STATES |

| Tin |

|

Cooper Santa |

|

BRAZIL |

| Tin |

|

CV United Smelting |

|

INDONESIA |

| Tin |

|

EM Vinto |

|

BOLIVIA |

| Tin |

|

Gejiu Non-Ferrous Metal Processing Co. Ltd. |

|

CHINA |

| Tin |

|

Gejiu Zi-Li |

|

CHINA |

| Tin |

|

Gold Bell Group |

|

CHINA |

| Tin |

|

Liuzhou China Tin |

|

CHINA |

| Tin |

|

Malaysia Smelting Corporation (MSC) |

|

MALAYSIA |

| Tin |

|

Metallo Chimique |

|

BELGIUM |

|

|

|

|

|

| Mineral |

|

Facility Name |

|

Facility Location |

| Tin |

|

Mineração Taboca S.A. |

|

BRAZIL |

| Tin |

|

Minsur |

|

PERU |

| Tin |

|

Mitsubishi Materials Corporation |

|

JAPAN |

| Tin |

|

OMSA |

|

BOLIVIA |

| Tin |

|

PT Bangka Kudai Tin |

|

INDONESIA |

| Tin |

|

PT Bangka Putra Karya |

|

INDONESIA |

| Tin |

|

PT Belitung Industri Sejahtera |

|

INDONESIA |

| Tin |

|

PT Bukit Timah |

|

INDONESIA |

| Tin |

|

PT Eunindo Usaha Mandiri |

|

INDONESIA |

| Tin |

|

PT HP Metals Indonesia |

|

INDONESIA |

| Tin |

|

PT Koba Tin |

|

INDONESIA |

| Tin |

|

PT Mitra Stania Prima |

|

INDONESIA |

| Tin |

|

PT Sariwiguna Binasentosa |

|

INDONESIA |

| Tin |

|

PT Stanindo Inti Perkasa |

|

INDONESIA |

| Tin |

|

PT Tambang Timah |

|

INDONESIA |

| Tin |

|

PT Timah (Persero), Tbk |

|

INDONESIA |

| Tin |

|

PT Timah Nusantara |

|

INDONESIA |

| Tin |

|

PT Tinindo Inter Nusa |

|

INDONESIA |

| Tin |

|

Thaisarco |

|

THAILAND |

| Tin |

|

White Solder Metalurgia e Mineração Ltda. |

|

BRAZIL |

| Tin |

|

Yunnan Chengfeng Non-ferrous Metals Co.,Ltd. |

|

CHINA |

| Tin |

|

Yunnan Tin Company, Ltd. |

|

CHINA |

|

|

|

| Tungsten |

|

China Minmetals Corp |

|

CHINA |

| Tungsten |

|

China Minmetals Nonferrous Metals Co Ltd |

|

CHINA |

| Tungsten |

|

Chongyi Zhangyuan Tungsten Co Ltd |

|

CHINA |

| Tungsten |

|

Dayu Weiliang Tungsten Co., Ltd. |

|

CHINA |

| Tungsten |

|

DAYU WEILIANG TUNGSTEN CO.,LTD |

|

CHINA |

| Tungsten |

|

Fujian Jinxin Tungsten Co., Ltd. |

|

CHINA |

| Tungsten |

|

Ganzhou Grand Sea W & Mo Group Co Ltd |

|

CHINA |

| Tungsten |

|

Ganzhou Huaxing Tungsten Products Co., Ltd. |

|

CHINA |

| Tungsten |

|

Ganzhou Seadragon W & Mo Co., Ltd. |

|

CHINA |

| Tungsten |

|

Global Tungsten & Powders Corp. |

|

UNITED STATES |

| Tungsten |

|

HC Starck GmbH |

|

GERMANY |

|

|

|

|

|

| Mineral |

|

Facility Name |

|

Facility Location |

| Tungsten |

|

Hunan Chunchang Nonferrous Metals Co., Ltd. |

|

CHINA |

| Tungsten |

|

Japan New Metals Co Ltd |

|

JAPAN |

| Tungsten |

|

Jiangxi Rare Earth & Rare Metals Tungsten Group Corp |

|

CHINA |

| Tungsten |

|

Jiangxi Tungsten Industry Group Co Ltd |

|

CHINA |

| Tungsten |

|

Kennametal Huntsville |

|

UNITED STATES |

| Tungsten |

|

Kennemetal Inc |

|

UNITED STATES |

| Tungsten |

|

Wolfram Company CJSC |

|

RUSSIAN FEDERATION |

| Tungsten |

|

Xiamen Tungsten (H.C.) Co., Ltd. |

|

CHINA |

| Tungsten |

|

Xiamen Tungsten Co., Ltd. |

|

CHINA |

| Tungsten |

|

Zhuzhou Cemented Carbide Group Co Ltd |

|

CHINA |

ANNEX B

Countries of origin of the conflict minerals that the facilities listed in Annex A process are believed to include the following countries, based on

information provided by suppliers and CFSI:

|

|

|

| Angola |

|

Luxembourg |

| Argentina |

|

Madagascar |

| Australia |

|

Malaysia |

| Austria |

|

Mongolia |

| Belgium |

|

Mozambique |

| Bolivia |

|

Myanmar |

| Brazil |

|

Namibia |

| Burundi |

|

Netherlands |

| Canada |

|

Nigeria |

| Central African Republic |

|

Peru |

| Chile |

|

Portugal |

| China |

|

Rwanda |

| Columbia |

|

Republic of Congo |

| Czech Republic |

|

Russia |

| Djibouti |

|

Sierra Leone |

| Egypt |

|

Singapore |

| Estonia |

|

Slovakia |

| Ethiopia |

|

South Africa |

| France |

|

South Korea |

| Germany |

|

South Sudan |

| Guyana |

|

Spain |

| Hungary |

|

Suriname |

| India |

|

Switzerland |

| Indonesia |

|

Taiwan |

| Ireland |

|

Tanzania |

| Israel |

|

Uganda |

| Ivory Coast |

|

United Kingdom |

| Japan |

|

United States of America |

| Kazakhstan |

|

Vietnam |

| Kenya |

|

Zambia |

| Laos |

|

Zimbabwe |

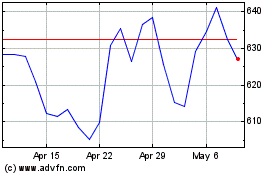

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024