Intuit February Small Business Index Reveals

Continued Revenue Decline

Intuit Inc. (Nasdaq:INTU) today issued its

monthly Small Business Employment and Revenue Indexes. Below are

topline results from each of the reports.

Small Business Employment Index

• U.S. small businesses added 15,000 new jobs in March, making

for more than 895,000 jobs added since March 2010.

• Hourly employees worked an average of 107.4 hours in March,

down 23 minutes from February’s revised figure.

• Small business employees’ monthly pay fell by 0.16 percent,

with average compensation reaching $2,760, down $4.30 from

February.

These findings come from the monthly Intuit QuickBooks Small

Business Employment Index and are based on data from Intuit Online

Payroll and QuickBooks Online Payroll, covering the period from

Feb. 24 – March 23.

Small Business Revenue Index

• Revenues per small business across all industries fell by 0.14

percent in February, which translates to a decline of 1.7 percent

when annualized.

• The Professional Services category showed the largest monthly

increase in revenue, at 0.2 percent.

• The Real Estate category continued to post the largest revenue

decline, falling 0.5 percent in February and 6.3 percent on an

annualized basis.

This index is based on data from QuickBooks Online, covering the

period from Feb. 1 - 28.

A Closer Look at Results

• The Small Business Employment Index

Small business employment rose by 15,000 jobs in March, while

the hiring rate fell slightly.

“This is a modest increase in the employment level for small

business – just 1 percent above a year ago and far below the 2.5

percent increase for the overall economy,” said Susan Woodward, the

economist who works with Intuit to produce the Small Business

Employment and Revenue Indexes.

“Businesses with fewer than 20 employees employ 20.6 million

people, up by nearly 900,000 jobs since the trough in the

recession, but still below the peak of 21.2 million in March 2007.

Total private payrolls and total payrolls, which include both

private and governments, have passed their previous peaks.”

Wages for hourly employees rose by two cents in March, an

increase of 0.1 percent, and are 2.6 percent higher than a year

ago. Meanwhile, inflation has been zero since March 2014. “This

change represents real wage gains over the past year,” Woodward

said.

At the same time, hours worked by hourly employees fell by 23

minutes, to 107.5 hours. The fraction of hourly workers who worked

full time fell 0.3 percent to 29 percent. Total compensation fell

by $4.30 for the month, to $2,760. Employment rose in nearly all

states separately reported by Intuit in March. Exceptions were all

east of the Mississippi River, with Minnesota, Wisconsin, Kentucky,

and Alabama seeing the biggest declines. Hours worked fell in all

states except Oregon, Idaho, and Iowa. Total compensation also fell

in most states.

“We see some softness in small business employment – fewer

hourly people working full time, a decline in hours worked, and a

decline in the hiring rate, despite a rise in the hourly wage and

overall, a rise in employment,” Woodward said. “While the figures

are adjusted for the seasons, they are not adjusted for unusual

weather, so some of the softness may be the result of an unusually

cold and snowy winter in the East and Midwest.”

• Small Business Revenue Index

Revenues for small businesses continued to fall in February but

at a slower rate of decline than in January. Revenue is reported

one month behind employment.

Real Estate Services saw the largest decline, followed by

Retail, and Accommodation, which includes restaurants and bars.

“The falling revenue we have seen over the last few months is

the first such episode since revenues began expanding again in

August 2008,” said Woodward. “This appears to be weather related.

The revenue figures, like the employment figures, are adjusted for

seasonality but not for especially bad weather. Real Estate

Services and Retail may have been especially influenced by the bad

weather this winter. Across businesses of all size, retail sales

were down, especially for large durables, such as cars and

furniture, but not for groceries and online purchases. In past bad

winters, retail sales made up for lost sales once the weather

improves.”

Not all industries saw revenue fall. The fastest revenue growth

was among companies in the Professional Services sector, whose

revenue grew 0.2 percent, or 2.2 percent annualized.

About the Intuit Small Business Indexes

The Intuit Small Business Indexes provide unique, near real-time

information each month on the activity of the smallest businesses

in the U.S. in terms of revenue, hiring and compensation

trends.

The Employment Index is based on anonymized, non-identifiable

aggregated data from approximately 263,400 small business

employers, a subset of users that use Intuit Online Payroll and

QuickBooks Online Payroll. The Revenue Index is based on

anonymized, non-identifiable aggregated data from approximately

150,000 small businesses, a subset of users that use Intuit’s

QuickBooks Online financial management offering and are matched in

Dun & Bradstreet’s small business industry classifications.

Together, the indexes provide a more complete picture of the

economic health of the nation’s small businesses. More information

on the Intuit Small Business Indexes is available at

index.intuit.com.

About Intuit Inc.

Intuit Inc. creates business and financial management solutions

that simplify the business of life for small businesses, consumers

and accounting professionals.

Its flagship products and services include QuickBooks®, Quicken®

and TurboTax®, which make it easier to manage small businesses and

payroll processing, personal finance, and tax preparation and

filing. Mint.com provides a fresh, easy and intelligent way for

people to manage their money, while Demandforce® offers marketing

and communication tools for small businesses. ProSeries® and

Lacerte® are Intuit's leading tax preparation offerings for

professional accountants.

Founded in 1983, Intuit had revenue of $4.5 billion in its

fiscal year 2014. The company has approximately 8,000 employees

with major offices in the United States, Canada, the United

Kingdom, India and other locations. More information can be found

at www.intuit.com.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20150331005727/en/

Intuit Inc.Stephen Sharpe,

650-224-2362Stephen_Sharpe@Intuit.comorAccess CommunicationsBitsy

Rich, 917-522-3516brich@accesspr.com

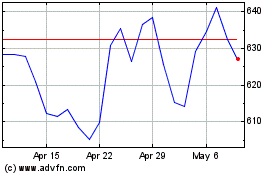

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Apr 2023 to Apr 2024