Intel's Earnings Rise but Outlook Disappoints

October 18 2016 - 5:10PM

Dow Jones News

Intel Corp. reported an 8.7% rise in third-quarter earnings, as

a lengthy slide in the personal computer market eased a bit and

cloud companies stocked up on servers.

Shares of the chip giant slid 3.6% to $36.39 in after-hours

trading as the company also provided a lackluster revenue outlook

for the current quarter.

Intel, whose chips provide processing power for the vast

majority of computers, in July reported a 51% profit drop on

charges resulting from a plan to reduce its workforce by 12,000

people by mid-2017. The company linked those cuts to a strategy to

reduce its dependence on selling chips for PCs, emphasizing servers

and noncomputer devices associated with a trend called the Internet

of Things.

For the moment, though, PC chips remain the company's largest

source of revenue. Intel in September boosted its financial

guidance for the third quarter, citing moves by PC makers to

rebuild their inventories and some signs of stronger customer

demand. Gartner Inc. and International Data Corp. last week

reported the latest in a series of shipment declines for the PC

business, though IDC said the decline was less severe than

expected.

Intel reported Tuesday that revenue for its client computing

group—composed largely of PC chips—increased to $8.89 billion from

$8.51 billion a year ago. Besides shipment volumes, revenue in the

unit can fluctuate according to whether customers selected

higher-priced chips or not.

In the company's data center group, whose products are priced

higher and command wider profit margins than PC chips, Intel said

third quarter revenue rose to $4.54 billion from $4.14 billion.

Analysts had been expecting revenue of about $4.6 billion,

according to FactSet, based partly on expectations of higher

spending by cloud computing services.

Intel said revenue in its Internet of Things group increased

$689 million from $581 million.

Brian Krzanich, Intel's chief executive, said Tuesday that the

results show Intel's continuing transformation to a company that

powers the cloud and connected devices.

In all, Intel reported net income of $3.38 billion, or 69 cents

a share, compared with profit in the year-earlier period of $3.1

billion, or 64 cents a share. Revenue rose to $15.78 billion from

$14.47 billion.

Excluding one-time items, Intel put per share profit at 80 cents

a share. Analysts on that basis had predicted earnings per share of

72 cents on revenue of $15.6 billion, in line with the figure Intel

projected last month.

For the current quarter, Intel projected revenue between $15.2

billion and $16.2 billion. Analysts, on average, had projected

revenue of $15.9 billion.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

October 18, 2016 16:55 ET (20:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

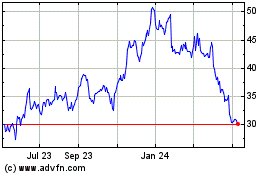

Intel (NASDAQ:INTC)

Historical Stock Chart

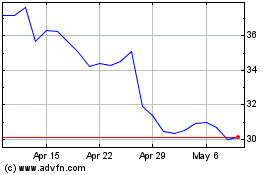

From Mar 2024 to Apr 2024

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024