Cavium to Buy Networking Products Company QLogic

June 15 2016 - 11:40PM

Dow Jones News

Semiconductor products company Cavium Inc. has agreed to buy

QLogic Corp., a maker of adapters, switches and other networking

products.

The deal, which has an enterprise value of about $1 billion,

will enhance Cavium's data-center and storage business and is

projected to boost 2017 adjusted earnings per share by 60 cents to

70 cents.

The cash-and-stock deal has an equity value of about $1.36

billion, inclusive of about $355 million of QLogic's balance sheet

cash, based on Cavium's stock price in recent days. It is valued at

about $15.50 a share, a 14% premium to QLogic's Wednesday closing

price.

Cavium said the deal would provide "substantial customer and

revenue diversification."

The company expects to realize $45 million of synergies by the

end of 2017.

In a tender offer, each QLogic share will be exchanged for $11

in cash and 0.098 of a Cavium share. The deal is expected to close

during the third quarter.

Cavium products, which include ThunderX processors and XPliant

switches, are used for networking, data center and wireless

applications. Cavium's revenue last year was $412.7 million.

QLogic's revenue was $458.9 million for its fiscal year ended

April 3.

Margin pressure has contributed to a wave of consolidation in

the semiconductor industry. Avago Technologies Ltd. bought Broadcom

Corp. for $37 billion, forming Broadcom Ltd., while Intel Corp.

purchased Altera Corp. for $16.7 billion.

Cavium completed the purchase of Xpliant Inc. in early 2015.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

June 15, 2016 23:25 ET (03:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

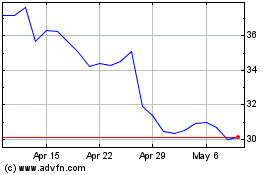

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

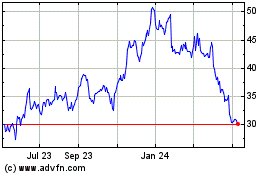

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024