UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 2, 2016

Illumina, Inc.

(Exact name of registrant as specified in its charter)

001-35406

(Commission File Number)

|

| | |

| | |

| | |

Delaware | | 33-0804655 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

5200 Illumina Way, San Diego, CA 92122

(Address of principal executive offices) (Zip code)

(858) 202-4500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

Item 2.02 Results of Operations and Financial Condition.

On February 2, 2016, Illumina, Inc. (the "Company") issued a press release announcing financial results for the fourth quarter ended January 3, 2016. The full text of the Company’s press release is attached hereto as Exhibit 99.1.

The information furnished pursuant to this Item 2.02 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release dated February 2, 2016, announcing Illumina, Inc.’s financial results for the fourth quarter ended January 3, 2016.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | ILLUMINA, INC. |

Date: | February 2, 2016 | By: | /s/ MARC A. STAPLEY |

| | | Marc A. Stapley |

| | | Executive Vice President and Chief Administrative Officer |

Exhibit Index

|

| | | |

Exhibit Number | | Description |

99.1 |

| | Press release dated February 2, 2016 announcing Illumina, Inc.’s financial results for the fourth quarter ended January 3, 2016. |

Illumina Reports Financial Results for Fourth Quarter and Fiscal Year 2015

San Diego -- (BUSINESS WIRE) - February 2, 2016 - Illumina, Inc. (NASDAQ:ILMN) today announced its financial results for the fourth quarter and fiscal year 2015.

Fourth quarter 2015 results:

| |

• | Revenue of $592 million, a 15% increase compared to $512 million in the fourth quarter of 2014, and an increase of 19% on a constant currency basis |

| |

• | GAAP net income attributable to Illumina stockholders for the quarter of $104 million, or $0.70 per diluted share, compared to $153 million, or $1.03 per diluted share, for the fourth quarter of 2014 |

| |

• | Non-GAAP net income attributable to Illumina stockholders for the quarter of $121 million, or $0.81 per diluted share, compared to $129 million, or $0.87 per diluted share, for the fourth quarter of 2014 (see the table entitled “Itemized Reconciliation Between GAAP and Non-GAAP Net Income Attributable to Illumina Stockholders” for a reconciliation of these GAAP and non-GAAP financial measures) |

| |

• | Cash flow from operations of $240 million and free cash flow of $205 million for the quarter |

Gross margin in the fourth quarter of 2015 was 69.4% compared to 75.1% in the prior year period. Excluding the effect of non-cash stock compensation expense, amortization of acquired intangible assets, legal contingencies, and impairments, non-GAAP gross margin was 71.7% for the fourth quarter of 2015 compared to 72.3% in the prior year period.

Research and development (R&D) expenses for the fourth quarter of 2015 were $114.3 million compared to $142.9 million in the prior year period. R&D expenses included $10.8 million and $11.8 million of non-cash stock compensation expense in the fourth quarters of 2015 and 2014, respectively. Excluding these charges, contingent compensation, legal contingencies, and impairments, R&D expenses as a percentage of revenue were 17.5% compared to 15.7% in the prior year period.

Selling, general and administrative (SG&A) expenses for the fourth quarter of 2015 were $147.3 million compared to $122.2 million in the prior year period. SG&A expenses included $21.4 million and $23.7 million of non-cash stock compensation expense in the fourth quarters of 2015 and 2014, respectively. Excluding these charges, amortization of acquired intangible assets, and contingent compensation, SG&A expenses as a percentage of revenue were 20.9% compared to 18.9% in the prior year period.

Depreciation and amortization expenses were $32.8 million and capital expenditures were $35.5 million during the fourth quarter of 2015. The company settled $28.6 million of the 0.25% Convertible Senior Notes due 2016 and repurchased $202.0 million of common stock under the previously announced discretionary and 10b5-1 share

repurchase programs. At the close of the quarter, the company held $1.39 billion in cash, cash equivalents and short-term investments, compared to $1.34 billion as of December 28, 2014.

Fiscal 2015 results:

| |

• | Revenue of $2,220 million, a 19% increase compared to $1,861 million in fiscal 2014, and an increase of 23% on a constant currency basis |

| |

• | GAAP net income attributable to Illumina stockholders of $462 million, or $3.10 per diluted share, compared to $353 million, or $2.37 per diluted share, in fiscal 2014 |

| |

• | Non-GAAP net income attributable to Illumina stockholders of $495 million, or $3.32 per diluted share, compared to $407 million, or $2.74 per diluted share, in fiscal 2014 (see the table entitled “Itemized Reconciliation Between GAAP and Non-GAAP Net Income Attributable to Illumina Stockholders” for a reconciliation of these GAAP and non-GAAP financial measures) |

| |

• | Cash flow from operations of $660 million and free cash flow of $517 million for the fiscal year |

Gross margin for fiscal 2015 was 69.8% compared to 69.7% in the prior year. Excluding the effect of non-cash stock compensation expense, amortization of acquired intangible assets, legal contingencies, and impairments, non-GAAP gross margin was 72.4% for fiscal 2015 compared to 71.7% in the prior year.

Research and development (R&D) expenses for fiscal 2015 were $401.5 million compared to $388.1 million in the prior year. R&D expenses included $42.0 million and $50.9 million of non-cash stock compensation expense in fiscal 2015 and 2014, respectively. Excluding these charges, contingent compensation, legal contingencies, and impairments, R&D expenses as a percentage of revenue were 16.2% compared to 15.3% in the prior year.

Selling, general and administrative (SG&A) expenses for fiscal 2015 were $524.7 million compared to $466.3 million in the prior year. SG&A expenses included $79.1 million and $91.0 million of non-cash stock compensation expense in fiscal 2015 and 2014, respectively. Excluding these charges, amortization of acquired intangible assets, and contingent compensation, SG&A expenses as a percentage of revenue were 19.8% compared to 19.5% in the prior year.

“We closed 2015 with strong momentum as fourth quarter orders and revenue exceeded our expectations,” stated Jay Flatley, CEO. “Our recent product announcements of MiniSeq™ and Infinium® XT further enhance the most extensive genomics portfolio available. This portfolio, combined with our investments in Project Firefly, Helix, and GRAIL, will position us for long-term growth as we enable our continued penetration of the enormous markets ahead.”

Updates since our last earnings release:

| |

• | Announced the formation of GRAIL, a new company to enable asymptomatic cancer screening through the development of a pan-cancer screening test |

| |

• | Launched the MiniSeq System, a flexible benchtop sequencer priced at $49,500, and cost-efficient to run, which will allow virtually any laboratory to adopt next-generation sequencing (NGS), regardless of sample volume |

| |

• | Launched Infinium XT, a 96-sample BeadChip offering laboratories the ability to perform genotyping on larger numbers of samples |

| |

• | Previewed Project Firefly, a highly-reliable, easy-to-use NGS platform available in the second half of 2017 that will minimize hands-on time for both library preparation and sequencing |

| |

• | Launched EpiSeq™, an NGS service for epidemiological monitoring and control of healthcare-associated infections, in partnership with bioMérieux |

| |

• | Entered into partnership with Bio-Rad Laboratories, Inc. to develop NGS workflow for single-cell analysis |

| |

• | Entered into a collaboration with Novogene to develop clinical applications in the fields of reproductive health and oncology based on Illumina’s NGS technology |

Financial outlook and guidance

The non-GAAP financial guidance discussed below reflects certain pro forma adjustments to assist in analyzing and assessing our core operational performance. Please see our Reconciliation of Non-GAAP Financial Guidance included in this release for a reconciliation of the GAAP and non-GAAP financial measures.

For fiscal 2016, the Company is projecting approximately 16% revenue growth assuming current exchange rates, and non-GAAP earnings per diluted share attributable to Illumina stockholders of $3.55 to $3.65. These projections assume full year non-GAAP gross margin of approximately 73% and a net loss attributable to non-controlling interests of approximately $30 million. Full-year weighted average diluted shares outstanding, for the measurement of pro forma amounts, is expected to be approximately 149 million shares.

Quarterly conference call information

The conference call will begin at 2:00 pm Pacific Time (5:00 pm Eastern Time) on Tuesday, February 2, 2016. Interested parties may listen to the call by dialing 888.687.3295 (passcode: 21551023), or if outside North America by dialing +1.503.406.4070 (passcode: 21551023). Individuals may access the live teleconference in the Investor Relations section of Illumina’s web site under the “company” tab at www.illumina.com.

A replay of the conference call will be available from 5:00 pm Pacific Time (8:00 pm Eastern Time) on February 2, 2016 through February 9, 2016 by dialing 855.859.2056 (passcode: 21551023), or if outside North America by dialing +1.800.585.8367 (passcode: 21551023).

Statement regarding use of non-GAAP financial measures

The company reports non-GAAP results for diluted net income per share, net income, gross margins, operating expenses, operating margins, other income, and free cash flow in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

The company’s financial measures under GAAP include substantial charges such as stock compensation expense, amortization of acquired intangible assets, non-cash interest expense associated with the company’s convertible debt instruments that may be settled in cash, and others that are listed in the itemized reconciliations between GAAP and non-GAAP financial measures included in this press release. Management believes that presentation of operating results that excludes these items provides useful supplemental information to investors and facilitates the analysis of the company’s core operating results and comparison of operating results across reporting periods. Management also believes that this supplemental non-GAAP information is therefore useful to investors in analyzing and assessing the company’s past and future operating performance.

The company encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand its business. Reconciliations between GAAP and non-GAAP results are presented in the tables of this release.

Use of forward-looking statements

This release contains projections, information about our financial outlook, earnings guidance, and other forward-looking statements that involve risks and uncertainties. These forward-looking statements are based on our expectations as of the date of this release and may differ materially from actual future events or results. Among the important factors that could cause actual results to differ materially from those in any forward-looking statements are (i) our ability to further develop and commercialize our instruments and consumables and to deploy new products, services, and applications, and expand the markets, for our technology platforms; (ii) our ability to manufacture robust instrumentation and consumables; (iii) our ability to successfully identify and integrate acquired technologies, products, or businesses; (iv) our expectations and beliefs regarding future conduct and growth of the business and the markets in which we operate; (v) challenges inherent in developing, manufacturing, and launching new products and services; and (vi) the application of generally accepted accounting principles, which are highly complex and involve many subjective assumptions, estimates, and judgments, together with other factors detailed in our filings with the Securities and Exchange Commission, including our most recent filings on Forms 10-K and 10-Q, or in information disclosed in public conference calls, the date and time of which are released beforehand. We undertake no obligation, and do not intend to update these forward-looking statements, to review or confirm analysts’ expectations, or to provide interim reports or updates on the progress of the current quarter.

About Illumina

Illumina is improving human health by unlocking the power of the genome. Our focus on innovation has established us as the global leader in DNA sequencing and array-based technologies, serving customers in the research, clinical and applied markets. Our products are used for applications in the life sciences, oncology, reproductive health, agriculture and other emerging segments. To learn more, visit www.illumina.com and follow @illumina.

# # #

Illumina, Inc.

Investors:

Rebecca Chambers

858.255.5243

rchambers@illumina.com

or

Media:

Eric Endicott

858.882.6822

pr@illumina.com

|

| | | | | | | |

Illumina, Inc. |

Condensed Consolidated Balance Sheets |

(In thousands) |

| | | |

| January 3,

2016 | | December 28,

2014 |

ASSETS | (unaudited) | | |

Current assets: | | | |

Cash and cash equivalents | $ | 768,770 |

| | $ | 636,154 |

|

Short-term investments | 617,450 |

| | 702,217 |

|

Accounts receivable, net | 385,529 |

| | 289,458 |

|

Inventory | 270,777 |

| | 191,144 |

|

Deferred tax assets, current portion | — |

| | 40,786 |

|

Prepaid expenses and other current assets | 54,297 |

| | 29,844 |

|

Total current assets | 2,096,823 |

| | 1,889,603 |

|

Property and equipment, net | 342,694 |

| | 265,264 |

|

Goodwill | 752,629 |

| | 724,904 |

|

Intangible assets, net | 273,621 |

| | 314,500 |

|

Deferred tax assets, long-term portion | 134,515 |

| | 49,848 |

|

Other assets | 87,465 |

| | 95,521 |

|

Total assets | $ | 3,687,747 |

| | $ | 3,339,640 |

|

| | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

Accounts payable | $ | 139,226 |

| | $ | 82,626 |

|

Accrued liabilities | 396,339 |

| | 335,276 |

|

Long-term debt, current portion | 74,929 |

| | 304,256 |

|

Total current liabilities | 610,494 |

| | 722,158 |

|

Long-term debt | 1,015,649 |

| | 986,780 |

|

Other long-term liabilities | 180,505 |

| | 167,904 |

|

Redeemable noncontrolling interests | 32,546 |

| | — |

|

Stockholders’ equity | 1,848,553 |

| | 1,462,798 |

|

Total liabilities and stockholders’ equity | $ | 3,687,747 |

| | $ | 3,339,640 |

|

|

| | | | | | | | | | | | | | | |

Illumina, Inc. |

Condensed Consolidated Statements of Income |

(In thousands, except per share amounts) |

(unaudited) |

| | | | | | | |

| Three Months Ended | | Years Ended |

| January 3,

2016 | | December 28,

2014 | | January 3,

2016 | | December 28,

2014 |

Revenue: | | | | | | | |

Product revenue | $ | 497,922 |

| | $ | 450,329 |

| | $ | 1,890,633 |

| | $ | 1,619,511 |

|

Service and other revenue | 93,626 |

| | 62,050 |

| | 329,129 |

| | 241,847 |

|

Total revenue | 591,548 |

| | 512,379 |

| | 2,219,762 |

| | 1,861,358 |

|

Cost of revenue: | | | | | | | |

Cost of product revenue (a) | 130,775 |

| | 93,069 |

| | 490,812 |

| | 431,920 |

|

Cost of service and other revenue (a) | 39,561 |

| | 23,757 |

| | 133,850 |

| | 92,355 |

|

Amortization of acquired intangible assets | 10,853 |

| | 10,616 |

| | 45,810 |

| | 39,373 |

|

Total cost of revenue | 181,189 |

| | 127,442 |

| | 670,472 |

| | 563,648 |

|

Gross profit | 410,359 |

| | 384,937 |

| | 1,549,290 |

| | 1,297,710 |

|

Operating expense: | | | | | | | |

Research and development (a) | 114,347 |

| | 142,947 |

| | 401,527 |

| | 388,055 |

|

Selling, general and administrative (a) | 147,251 |

| | 122,173 |

| | 524,657 |

| | 466,283 |

|

Legal contingencies | 4,000 |

| | (82,043 | ) | | 19,000 |

| | (74,338 | ) |

Headquarter relocation | 436 |

| | 1,281 |

| | (2,611 | ) | | 5,638 |

|

Acquisition related expense (gain), net | 325 |

| | (2,304 | ) | | (6,124 | ) | | (2,639 | ) |

Total operating expense | 266,359 |

| | 182,054 |

| | 936,449 |

| | 782,999 |

|

Income from operations | 144,000 |

| | 202,883 |

| | 612,841 |

| | 514,711 |

|

Other expense, net | (8,993 | ) | | (10,822 | ) | | (29,699 | ) | | (65,953 | ) |

Income before income taxes | 135,007 |

| | 192,061 |

| | 583,142 |

| | 448,758 |

|

Provision for income taxes | 32,143 |

| | 38,781 |

| | 125,752 |

| | 95,407 |

|

Consolidated net income | 102,864 |

| | 153,280 |

| | 457,390 |

| | 353,351 |

|

Add: Net loss attributable to noncontrolling interests | 1,613 |

| | — |

| | 4,169 |

| | — |

|

Net income attributable to Illumina stockholders | $ | 104,477 |

| | $ | 153,280 |

| | $ | 461,559 |

| | $ | 353,351 |

|

Earnings per share attributable to Illumina stockholders: | | | | | | | |

Basic | $ | 0.72 |

| | $ | 1.08 |

| | $ | 3.19 |

| | $ | 2.61 |

|

Diluted | $ | 0.70 |

| | $ | 1.03 |

| | $ | 3.10 |

| | $ | 2.37 |

|

Shares used in computing earnings per common share: | | | | | | | |

Basic | 145,963 |

| | 142,342 |

| | 144,826 |

| | 135,553 |

|

Diluted | 148,952 |

| | 148,657 |

| | 149,069 |

| | 148,977 |

|

| | | | | | | |

(a) Includes total stock-based compensation expense for stock-based awards: | | | | |

| | | | | | | |

| Three Months Ended | | Years Ended |

| January 3,

2016 | | December 28,

2014 | | January 3,

2016 | | December 28,

2014 |

Cost of product revenue | $ | 2,829 |

| | $ | 2,635 |

| | $ | 9,841 |

| | $ | 9,451 |

|

Cost of service and other revenue | 366 |

| | 324 |

| | 1,609 |

| | 1,204 |

|

Research and development | 10,849 |

| | 11,837 |

| | 42,001 |

| | 50,880 |

|

Selling, general and administrative | 21,445 |

| | 23,666 |

| | 79,142 |

| | 91,016 |

|

Stock-based compensation expense before taxes | $ | 35,489 |

| | $ | 38,462 |

| | $ | 132,593 |

| | $ | 152,551 |

|

|

| | | | | | | | | | | | | | | | |

Illumina, Inc. |

Condensed Consolidated Statements of Cash Flows |

(In thousands) |

(unaudited) |

| | | | | | | | |

| | Three Months Ended | | Years Ended |

| | January 3,

2016 | | December 28,

2014 | | January 3,

2016 | | December 28,

2014 |

Net cash provided by operating activities (a) | | $ | 240,378 |

| | $ | 140,549 |

| | $ | 659,596 |

| | $ | 501,271 |

|

Net cash provided by (used in) investing activities | | 229,398 |

| | (332,783 | ) | | (106,146 | ) | | (406,624 | ) |

Net cash (used in) provided by financing activities (a) | | (253,141 | ) | | 202 |

| | (418,762 | ) | | (166,748 | ) |

Effect of exchange rate changes on cash and cash equivalents | | 606 |

| | (1,709 | ) | | (2,072 | ) | | (3,382 | ) |

Net increase (decrease) in cash and cash equivalents | | 217,241 |

| | (193,741 | ) | | 132,616 |

| | (75,483 | ) |

Cash and cash equivalents, beginning of period | | 551,529 |

| | 829,895 |

| | 636,154 |

| | 711,637 |

|

Cash and cash equivalents, end of period | | $ | 768,770 |

| | $ | 636,154 |

| | $ | 768,770 |

| | $ | 636,154 |

|

| | | | | | | | |

Calculation of free cash flow: | | | | | | | | |

Net cash provided by operating activities (a) | | $ | 240,378 |

| | $ | 140,549 |

| | $ | 659,596 |

| | $ | 501,271 |

|

Purchases of property and equipment | | (35,486 | ) | | (34,832 | ) | | (142,847 | ) | | (105,996 | ) |

Free cash flow (b) | | $ | 204,892 |

| | $ | 105,717 |

| | $ | 516,749 |

| | $ | 395,275 |

|

______________________________________________________________________________________________________

(a) Net cash provided by operating activities excludes excess tax benefit related to stock-based compensation of $126.7 million in fiscal 2015, of which $5.0 million was recorded in Q4, and $126.5 million in fiscal 2014, of which $23.8 million was recorded in Q4. Net cash used in financing activities reflects the excess tax benefit as a corresponding in-flow in the respective periods.

(b) Free cash flow, which is a non-GAAP financial measure, is calculated as net cash provided by operating activities reduced by purchases of property and equipment. Free cash flow is useful to management as it is one of the metrics used to evaluate our performance and to compare us with other companies in our industry. However, our calculation of free cash flow may not be comparable to similar measures used by other companies.

|

| | | | | | | | | | | | | | | | |

Illumina, Inc. |

Results of Operations - Non-GAAP |

(In thousands, except per share amounts) |

(unaudited) |

| | | | |

ITEMIZED RECONCILIATION BETWEEN GAAP AND NON-GAAP EARNINGS PER SHARE ATTRIBUTABLE TO ILLUMINA STOCKHOLDERS: |

| | | | | | | | |

| | Three Months Ended | | Years Ended |

| | January 3,

2016 | | December 28,

2014 | | January 3,

2016 | | December 28,

2014 |

GAAP earnings per share attributable to Illumina stockholders - diluted | | $ | 0.70 |

| | $ | 1.03 |

| | $ | 3.10 |

| | $ | 2.37 |

|

Amortization of acquired intangible assets | | 0.09 |

| | 0.08 |

| | 0.35 |

| | 0.32 |

|

Non-cash interest expense (a) | | 0.06 |

| | 0.07 |

| | 0.26 |

| | 0.26 |

|

Legal contingencies (b) | | 0.03 |

| | (0.40 | ) | | 0.13 |

| | (0.24 | ) |

Contingent compensation expense (c) | | — |

| | — |

| | — |

| | 0.03 |

|

Headquarter relocation | | — |

| | 0.01 |

| | (0.02 | ) | | 0.04 |

|

Loss on extinguishment of debt | | — |

| | — |

| | 0.03 |

| | 0.21 |

|

Acquisition related expense (gain), net (d) | | — |

| | (0.02 | ) | | (0.04 | ) | | (0.02 | ) |

Cost-method investment gain, net (e) | | — |

| | — |

| | (0.10 | ) | | (0.03 | ) |

Tax benefit related to cost-sharing arrangement (f) | | — |

| | — |

| | (0.17 | ) | | — |

|

Incremental non-GAAP tax (expense) benefit (g) | | (0.07 | ) | | 0.10 |

| | (0.22 | ) | | (0.20 | ) |

Non-GAAP earnings per share attributable to Illumina stockholders - diluted (h) | | $ | 0.81 |

| | $ | 0.87 |

| | $ | 3.32 |

| | $ | 2.74 |

|

Shares used in calculating non-GAAP diluted earnings per share attributable to Illumina stockholders | | 148,952 |

| | 148,657 |

| | 149,069 |

| | 148,815 |

|

| | | | | | | | |

ITEMIZED RECONCILIATION BETWEEN GAAP AND NON-GAAP NET INCOME ATTRIBUTABLE TO ILLUMINA STOCKHOLDERS: |

GAAP net income attributable to Illumina stockholders | | $ | 104,477 |

| | $ | 153,280 |

| | $ | 461,559 |

| | $ | 353,351 |

|

Amortization of acquired intangible assets | | 12,376 |

| | 12,203 |

| | 51,829 |

| | 48,165 |

|

Non-cash interest expense (a) | | 8,705 |

| | 10,099 |

| | 38,589 |

| | 38,154 |

|

Legal contingencies (b) | | 4,000 |

| | (59,483 | ) | | 19,000 |

| | (35,931 | ) |

Contingent compensation expense (c) | | 685 |

| | 433 |

| | 934 |

| | 4,265 |

|

Headquarter relocation | | 436 |

| | 1,281 |

| | (2,611 | ) | | 5,638 |

|

Loss on extinguishment of debt | | 325 |

| | — |

| | 4,062 |

| | 31,360 |

|

Acquisition related expense (gain), net (d) | | 325 |

| | (2,304 | ) | | (6,124 | ) | | (2,639 | ) |

Cost-method investment gain, net (e) | | (119 | ) | | — |

| | (15,601 | ) | | (4,427 | ) |

Impairments (i) | | — |

| | (485 | ) | | — |

| | (485 | ) |

Tax benefit related to cost-sharing arrangement (f) | | (56 | ) | | — |

| | (24,813 | ) | | — |

|

Incremental non-GAAP tax (expense) benefit (g) | | (10,584 | ) | | 13,925 |

| | (31,621 | ) | | (30,234 | ) |

Non-GAAP net income attributable to Illumina stockholders (h) | | $ | 120,570 |

| | $ | 128,949 |

| | $ | 495,203 |

| | $ | 407,217 |

|

| | | | | | | | |

ITEMIZED RECONCILIATION BETWEEN GAAP AND NON-GAAP DILUTED NUMBER OF SHARES ATTRIBUTABLE TO ILLUMINA STOCKHOLDERS: |

Weighted average shares used in calculation of GAAP diluted earnings per share | | 148,952 |

| | 148,657 |

| | 149,069 |

| | 148,977 |

|

Weighted average dilutive potential common shares issuable of redeemable convertible senior notes | | — |

| | — |

| | — |

| | (162 | ) |

Weighted average shares used in calculation of non-GAAP diluted earnings per share attributable to Illumina stockholders | | 148,952 |

| | 148,657 |

| | 149,069 |

| | 148,815 |

|

______________________________________________________________________________________________________

(a) Non-cash interest expense is calculated in accordance with the authoritative accounting guidance for convertible debt instruments that may be settled in cash.

(b) Legal contingencies in fiscal 2015 represent charges related to patent litigation. Legal contingencies in fiscal 2014 primarily represent a gain related to the settlement of our patent litigation with Syntrix Biosystems, Inc., partially offset by the expenses recorded upon our litigation settlement and pooling of patents with Sequenom, Inc.

(c) Contingent compensation expense relates to contingent payments for post-combination services associated with an acquisition.

(d) Acquisition related expense (gain), net consists of changes in fair value of contingent consideration and transaction related costs.

(e) Cost-method investment gain, net consists primarily of gains on disposition of investments partially offset by impairment charges on other investments.

(f) Tax benefit related to cost-sharing arrangement refers to the exclusion of stock compensation from prior period cost-sharing charges as a result of a recent tax court ruling.

(g) Incremental non-GAAP tax (expense) benefit reflects the tax impact related to the non-GAAP adjustments listed above.

(h) Non-GAAP net income attributable to Illumina stockholders and diluted earnings per share attributable to Illumina stockholders exclude the effect of the pro forma adjustments as detailed above. Non-GAAP net income attributable to Illumina stockholders and diluted earnings per share attributable to Illumina stockholders are key drivers of the Company’s core operating performance and major factors in management’s bonus compensation each year. Management has excluded the effects of these items in these measures to assist investors in analyzing and assessing our past and future core operating performance.

(i) Impairments in fiscal 2014 consisted of a gain on an asset sale associated with a non-core product line discontinued in 2013, partially offset by an intangible asset impairment.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Illumina, Inc. |

Results of Operations - Non-GAAP (continued) |

(Dollars in thousands) |

(unaudited) |

ITEMIZED RECONCILIATION BETWEEN GAAP AND NON-GAAP RESULTS OF OPERATIONS AS A PERCENT OF REVENUE: |

| Three Months Ended | | Years Ended |

| January 3,

2016 | | December 28,

2014 | | January 3,

2016 | | December 28,

2014 |

GAAP gross profit | $ | 410,359 |

| | 69.4 | % | | $ | 384,937 |

| | 75.1 | % | | $ | 1,549,290 |

| | 69.8 | % | | $ | 1,297,710 |

| | 69.7 | % |

Stock-based compensation expense | 3,195 |

| | 0.5 | % | | 2,959 |

| | 0.6 | % | | 11,450 |

| | 0.5 | % | | 10,655 |

| | 0.6 | % |

Amortization of acquired intangible assets | 10,853 |

| | 1.8 | % | | 10,616 |

| | 2.1 | % | | 45,810 |

| | 2.1 | % | | 39,373 |

| | 2.1 | % |

Legal contingencies (a) | — |

| | — |

| | (26,240 | ) | | (5.1 | )% | | — |

| | — |

| | (10,393 | ) | | (0.6 | )% |

Impairments (b) | — |

| | — |

| | (2,000 | ) | | (0.4 | )% | | — |

| | — |

| | (2,000 | ) | | (0.1 | )% |

Non-GAAP gross profit (c) | $ | 424,407 |

| | 71.7 | % | | $ | 370,272 |

| | 72.3 | % | | $ | 1,606,550 |

| | 72.4 | % | | $ | 1,335,345 |

| | 71.7 | % |

| | | | | | | | | | | | | | | |

GAAP research and development expense | $ | 114,347 |

| | 19.3 | % | | $ | 142,947 |

| | 27.9 | % | | $ | 401,527 |

| | 18.1 | % | | $ | 388,055 |

| | 20.8 | % |

Stock-based compensation expense | (10,849 | ) | | (1.8 | )% | | (11,837 | ) | | (2.3 | )% | | (42,001 | ) | | (1.9 | )% | | (50,880 | ) | | (2.7 | )% |

Contingent compensation expense (d) | (83 | ) | | — |

| | (433 | ) | | (0.1 | )% | | (127 | ) | | — |

| | (1,509 | ) | | (0.1 | )% |

Legal contingencies (a) | — |

| | — |

| | (48,800 | ) | | (9.5 | )% | | — |

| | — |

| | (48,800 | ) | | (2.6 | )% |

Impairments (b) | — |

| | — |

| | (1,515 | ) | | (0.3 | )% | | — |

| | — |

| | (1,515 | ) | | (0.1 | )% |

Non-GAAP research and development expense | $ | 103,415 |

| | 17.5 | % | | $ | 80,362 |

| | 15.7 | % | | $ | 359,399 |

| | 16.2 | % | | $ | 285,351 |

| | 15.3 | % |

| | | | | | | | | | | | | | | |

GAAP selling, general and administrative expense | $ | 147,251 |

| | 24.9 | % | | $ | 122,173 |

| | 23.8 | % | | $ | 524,657 |

| | 23.6 | % | | $ | 466,283 |

| | 25.1 | % |

Stock-based compensation expense | (21,445 | ) | | (3.6 | )% | | (23,666 | ) | | (4.6 | )% | | (79,142 | ) | | (3.5 | )% | | (91,016 | ) | | (4.9 | )% |

Amortization of acquired intangible assets | (1,523 | ) | | (0.3 | )% | | (1,587 | ) | | (0.3 | )% | | (6,019 | ) | | (0.3 | )% | | (8,792 | ) | | (0.6 | )% |

Contingent compensation expense (d) | (602 | ) | | (0.1 | )% | | — |

| | — |

| | (807 | ) | | — |

| | (2,756 | ) | | (0.1 | )% |

Non-GAAP selling, general and administrative expense | $ | 123,681 |

| | 20.9 | % | | $ | 96,920 |

| | 18.9 | % | | $ | 438,689 |

| | 19.8 | % | | $ | 363,719 |

| | 19.5 | % |

| | | | | | | | | | | | | | | |

GAAP operating profit | $ | 144,000 |

| | 24.3 | % | | $ | 202,883 |

| | 39.6 | % | | $ | 612,841 |

| | 27.6 | % | | $ | 514,711 |

| | 27.7 | % |

Stock-based compensation expense | 35,489 |

| | 6.0 | % | | 38,462 |

| | 7.5 | % | | 132,593 |

| | 5.9 | % | | 152,551 |

| | 8.2 | % |

Amortization of acquired intangible assets | 12,376 |

| | 2.1 | % | | 12,203 |

| | 2.4 | % | | 51,829 |

| | 2.4 | % | | 48,165 |

| | 2.6 | % |

Legal contingencies (a) | 4,000 |

| | 0.7 | % | | (59,483 | ) | | (11.6 | )% | | 19,000 |

| | 0.9 | % | | (35,931 | ) | | (1.9 | )% |

Contingent compensation expense (d) | 685 |

| | 0.1 | % | | 433 |

| | 0.1 | % | | 934 |

| | — |

| | 4,265 |

| | 0.2 | % |

Headquarter relocation | 436 |

| | 0.1 | % | | 1,281 |

| | 0.2 | % | | (2,611 | ) | | (0.1 | )% | | 5,638 |

| | 0.2 | % |

Acquisition related expense (gain), net (e) | 325 |

| | 0.1 | % | | (2,304 | ) | | (0.4 | )% | | (6,124 | ) | | (0.3 | )% | | (2,639 | ) | | (0.1 | )% |

Impairments (b) | — |

| | — |

| | (485 | ) | | (0.1 | )% | | — |

| | — |

| | (485 | ) | | — |

|

Non-GAAP operating profit (c) | $ | 197,311 |

| | 33.4 | % | | $ | 192,990 |

| | 37.7 | % | | $ | 808,462 |

| | 36.4 | % | | $ | 686,275 |

| | 36.9 | % |

| | | | | | | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

GAAP other expense, net | $ | (8,993 | ) | | (1.5 | )% | | $ | (10,822 | ) | | (2.1 | )% | | $ | (29,699 | ) | | (1.3 | )% | | $ | (65,953 | ) | | (3.5 | )% |

Non-cash interest expense (f) | 8,705 |

| | 1.5 | % | | 10,099 |

| | 2.0 | % | | 38,589 |

| | 1.7 | % | | 38,154 |

| | 2.0 | % |

Loss on extinguishment of debt | 325 |

| | — |

| | — |

| | — |

| | 4,062 |

| | 0.2 | % | | 31,360 |

| | 1.7 | % |

Cost-method investment gain, net (g) | (119 | ) | | — |

| | — |

| | — |

| | (15,601 | ) | | (0.7 | )% | | (4,427 | ) | | (0.2 | )% |

Non-GAAP other expense, net (c) | $ | (82 | ) | | — |

| | $ | (723 | ) | | (0.1 | )% | | $ | (2,649 | ) | | (0.1 | )% | | $ | (866 | ) | | — |

|

______________________________________________________________________________________________________

(a) Legal contingencies in fiscal 2015 represent charges related to patent litigation. Legal contingencies recorded in fiscal 2014 primarily represent a gain related to the settlement of our patent litigation with Syntrix Biosystems, Inc., or Syntrix, partially offset by the expenses recorded upon our litigation settlement and pooling of patents with Sequenom, Inc., or Sequenom. The gain associated with the Syntrix settlement was recorded partially as a reversal of cost of sales and partially as a reduction of operating expense. The upfront payments to Sequenom were recorded in research and development expense.

(b) Impairments in fiscal 2014 consisted of a gain recorded in cost of sales on an asset sale associated with a non-core product line discontinued in 2013, partially offset by an intangible asset impairment recorded in research and development expense.

(c) Non-GAAP gross profit, included within non-GAAP operating profit, is a key measure of the effectiveness and efficiency of manufacturing processes, product mix and the average selling prices of the Company’s products and services. Non-GAAP operating profit, and non-GAAP other expense, net, exclude the effects of the pro forma adjustments as detailed above. Management has excluded the effects of these items in these measures to assist investors in analyzing and assessing past and future core operating performance.

(d) Contingent compensation expense relates to contingent payments for post-combination services associated with an acquisition.

(e) Acquisition related expense (gain), net consists of changes in fair value of contingent consideration and transaction related costs.

(f) Non-cash interest expense is calculated in accordance with the authoritative accounting guidance for convertible debt instruments that may be settled in cash.

(g) Cost-method investment gain, net consists primarily of gains on disposition of investments partially offset by impairment charges on other investments.

Illumina, Inc.

Reconciliation of Non-GAAP Financial Guidance

The Company’s future performance and financial results are subject to risks and uncertainties, and actual results could differ materially from the guidance set forth below. Some of the factors that could affect the Company’s financial results are stated above in this press release. More information on potential factors that could affect the Company’s financial results is included from time to time in the Company’s public reports filed with the Securities and Exchange Commission, including the Company’s Form 10-K for the fiscal year ended December 28, 2014, and the Company’s Form 10-Q for the fiscal quarters ended March 29, 2015, June 28, 2015, and September 27, 2015. The Company assumes no obligation to update any forward-looking statements or information.

|

| |

| Fiscal Year 2016 |

Gross margin | |

Non-GAAP gross margin | 73% |

Amortization of acquired intangible assets | (2)% |

GAAP gross margin | 71% |

| |

Operating margin | |

Non-GAAP operating margin (a) | 33% |

Stock-based compensation expense | (6)% |

Amortization of acquired intangible assets | (2)% |

GAAP operating margin | 25% |

| |

Diluted earnings per share attributable to Illumina stockholders | |

Non-GAAP diluted earnings per share attributable to Illumina stockholders | $3.55 - $3.65 |

Amortization of acquired intangible assets | (0.32) |

Non-cash interest expense (b) | (0.20) |

Contingent compensation (c) | (0.02) |

Headquarter relocation (d) | (0.01) |

Incremental non-GAAP tax expense (e) | 0.19 |

GAAP diluted earnings per share attributable to Illumina stockholders | $3.19 - $3.29 |

______________________________________________________________________________________________________

(a) Operating margin implied at the mid-point of guidance provided for non-GAAP diluted earnings per share.

(b) Non-cash interest expense is calculated in accordance with the authoritative accounting guidance for convertible debt instruments that may be settled in cash.

(c) Contingent compensation expense relates to contingent payments for post-combination services associated with an acquisition.

(d) Headquarter relocation represents accretion of interest expense on lease exit liability and changes in estimate of such liability.

(e) Incremental non-GAAP tax expense reflects the tax impact related to the non-GAAP adjustments listed above.

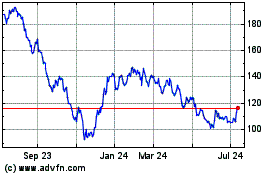

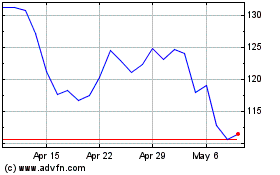

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Apr 2023 to Apr 2024