Current Report Filing (8-k)

July 22 2015 - 8:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2015

Illumina, Inc.

(Exact name of registrant as specified in its charter)

001-35406

(Commission File Number)

|

| | |

| | |

| | |

Delaware | | 33-0804655 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

5200 Illumina Way, San Diego, CA 92122

(Address of principal executive offices) (Zip code)

(858) 202-4500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On July 21, 2015, Illumina, Inc. (the "Company") issued a press release announcing financial results for the second quarter ended June 28, 2015. Additional information regarding the Company’s quarterly performance is listed below in the format of a Q&A.

Please note, the total shipments of all models of HiSeq (2500, 3000 and 4000), excluding the HiSeq X, increased both year-over-year and sequentially. During the conference call, however, the X qualifier was inadvertently dropped from the following statement, “As expected, shipments of HiSeq X instruments were lower sequentially and year-over-year.”

Top Q&A:

Q: Were sequencing consumables down sequentially?

A: Q2 sequencing consumable revenue increased sequentially to approximately $250M. This sequential increase was offset by a greater decline in array consumables.

Q: What is the health of the sequencing consumables franchise?

A: The health of the sequencing consumables franchise is very robust. As a reminder, in Q2 HiSeq X and NextSeq utilization per instrument was above our guidance ranges while MiSeq and HiSeq were within their respective ranges, indicating sequencing consumables exceeded our expectations in the quarter. As a reminder, the annual utilization ranges for each instrument are noted in the following table:

|

| |

Instrument Family | Annual Utilization Guidance (per instrument) |

MiSeq | $40K-$45K |

NextSeq | $80K-$100K |

HiSeq | $300K-$350K |

HiSeq X | $600K-$650K |

Q: How does the second quarter book to bill compare to prior quarters?

A: Q2 was a strong order quarter which resulted in a book to bill of 1.1, a notable increase versus our typical trend for this metric.

Q: When citing your quarterly HiSeq X order rate expectations were you referring to HiSeq X Ten/X Five total systems or HiSeq X instrument units?

A: As clarification, our expected normalized quarterly order rate includes a total of 20 to 30 HiSeq X units, not systems. As a reminder a HiSeq X Five system is five units and a HiSeq X Ten system is ten units.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | ILLUMINA, INC. |

Date: | July 22, 2015 | By: | /s/ MARC A. STAPLEY |

| | | Marc A. Stapley |

| | | Senior Vice President and Chief Financial Officer |

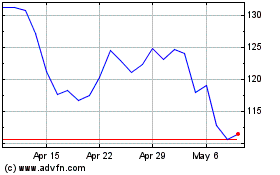

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

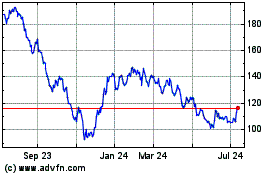

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Apr 2023 to Apr 2024