UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 3, 2016

ICU MEDICAL, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

DELAWARE | | 0-19974 | | 33-0022692 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

951 Calle Amanecer, San Clemente, California | | 92673 |

(Address of principal executive offices) | | (Zip Code) |

(949) 366-2183

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

|

| | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

ICU Medical, Inc. announced its earnings for the fourth quarter of 2015.

Item 9.01. Financial Statements and Exhibits.

|

| | |

(c) | | Exhibits |

| |

99.1 | Press release, dated February 3, 2016 announcing ICU Medical, Inc.'s fourth quarter 2015 earnings. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | ICU Medical, Inc. |

Date: February 3, 2016 | | /s/ SCOTT E. LAMB Scott E. Lamb Secretary, Treasurer and Chief Financial Officer |

Exhibit 99.1

ICU Medical, Inc. Announces Fourth Quarter and Fiscal Year 2015 Results

Fiscal Year 2015 Adjusted EBITDA increased 54% to $114 Million

SAN CLEMENTE, Calif., Feb. 3, 2016 (GLOBE NEWSWIRE) -- ICU Medical, Inc. (Nasdaq:ICUI), a leader in the development, manufacture and sale of innovative medical devices used in infusion therapy, oncology and critical care applications, today announced financial results for the fourth quarter and fiscal year ended December 31, 2015.

Fourth Quarter 2015 Results

Fourth quarter 2015 revenue was $90.4 million, compared to $79.9 million in the same period last year. GAAP net income for the fourth quarter of 2015 was $5.5 million, or $0.33 per diluted share, as compared to GAAP net income of $7.4 million, or $0.46 per diluted share, for the fourth quarter of 2014. Adjusted diluted earnings per share for the fourth quarter of 2015 were $0.96 as compared to $0.68 for the fourth quarter of 2014. Also, adjusted EBITDA was $30.1 million for the fourth quarter of 2015 as compared to $21.9 million for the fourth quarter of 2014.

Full Fiscal Year 2015 Results

Fiscal year 2015 revenue was $341.7 million, compared to $309.3 million in the same period last year. GAAP net income for fiscal year 2015 was $45.0 million, or $2.73 per diluted share, as compared to GAAP net income of $26.3 million, or $1.68 per diluted share, for fiscal year 2014. Adjusted diluted earnings per share for fiscal year 2015 were $3.96 as compared to $2.38 for fiscal year 2014. Also, adjusted EBITDA was $113.9 million for fiscal year 2015 as compared to $73.9 million for fiscal year 2014.

Vivek Jain, ICU Medical's Chief Executive Officer, said, "Our revenue, gross margin and adjusted EBITDA results in the fourth quarter were above our expectations as we achieved growth in both our direct and OEM channels."

Revenue for the three and twelve months ended December 31, 2015 and 2014 were as follows:

|

| | | | | | | | | | | | | | | | | | |

(dollars in millions) |

| Fiscal year ended December 31, | Three months ended December 31, |

Market Segment | 2015 | 2014 | Change | 2015 | 2014 | Change |

Infusion Therapy | $ | 244.8 |

| $ | 216.3 |

| $ | 28.5 |

| $ | 66.1 |

| $ | 56.5 |

| $ | 9.6 |

|

Critical Care | 54.3 |

| 55.1 |

| (0.8 | ) | 13.1 |

| 13.8 |

| (0.7 | ) |

Oncology | 41.4 |

| 36.7 |

| 4.7 |

| 11.1 |

| 9.3 |

| 1.8 |

|

Other | 1.2 |

| 1.2 |

| — |

| 0.1 |

| 0.3 |

| (0.2 | ) |

| $ | 341.7 |

| $ | 309.3 |

| $ | 32.4 |

| $ | 90.4 |

| $ | 79.9 |

| $ | 10.5 |

|

The Company ended the fourth quarter with a strong balance sheet. As of December 31, 2015, cash, cash equivalents and investment securities totaled $377.4 million and working capital was $462.4 million. Additionally, the Company generated operating cash flow of $54.9 million for the fiscal year of 2015.

Fiscal Year 2016 Guidance

For the year, the Company expects revenue to be in the range of $355 million to $365 million; adjusted diluted earnings per share to be in the range of $4.34 to $4.46, and adjusted EBITDA to be in the range of $123 million to $127 million.

Conference Call

The Company will be conducting a conference call concerning these announcements at 4:30 p.m. EST (1:30 p.m. PST), today, Wednesday, February 3, 2016. The call can be accessed at 800-936-9761, international 408-774-4587, conference ID 34390619. The conference call will be simultaneously available by webcast, which can be accessed by going to the Company's website at www.icumed.com, clicking on the Investors tab, clicking on the Webcast icon and following the prompts. The webcast will also be available by replay by dialing (855) 859-2056, (404) 537-3406 international.

Use of Non-GAAP Financial Information

This press release contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). Our management believes that the non-GAAP data provides useful supplemental information to management and investors regarding our performance and facilitates a more meaningful comparison of results of operations between current and prior periods. The non-GAAP financial measures included in this press release are adjusted EBITDA and adjusted diluted earnings per share ("Adjusted Diluted EPS"). Adjusted EBITDA excludes intangible asset amortization expense, depreciation expense, stock compensation expense, restructuring and strategic transaction expense, gain on sale of building, legal settlements, impairment of assets held for sale and income tax expense. Adjusted Diluted EPS excludes, net of tax, intangible asset amortization expense, stock compensation expense, restructuring and strategic transaction expense, gain on sale of building, legal settlements and impairment of assets held for sale.

The non-GAAP financial measures should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. There are limitations in using these non-GAAP financial measures because they are not prepared in accordance with GAAP and may be different from non-GAAP financial measures used by other companies.

Reconciliations of our GAAP to non-GAAP financial are included in the financial tables in this press release.

About ICU Medical, Inc.

About ICU Medical, Inc. (Nasdaq:ICUI) develops, manufactures and sells innovative medical devices used in vascular therapy, oncology and critical care applications. ICU Medical’s products improve patient outcomes by helping prevent bloodstream infections and protecting healthcare workers from exposure to infectious diseases or hazardous drugs. The company’s complete product line includes custom IV systems, closed delivery systems for hazardous drugs, needlefree IV connectors, catheters and cardiac monitoring systems. ICU Medical is headquartered in San Clemente, California. More information about ICU Medical, Inc. can be found at www.icumed.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements contain words such as ''will,'' ''expect,'' ''believe,'' ''could,'' ''would,'' ''estimate,'' ''continue,'' ''build,'' ''expand'' or the negative thereof or comparable terminology, and may include (without limitation) information regarding the Company's expectations, goals or intentions regarding the future. These forward-looking statements are based on Management's current expectations, estimates, forecasts and projections about the Company, our full year 2016 guidance and assumptions Management believes are reasonable, all of which are subject to risks and uncertainties that could cause actual results and events to differ materially from those stated in the forward-looking statements. These risks and uncertainties include, but are not limited to, decreased demand for the Company's products, decreased free cash flow, the inability to recapture conversion delays or part/resource shortages on anticipated timing, or at all, changes in product mix, increased competition from competitors, lack of continued growth or improving efficiencies and unexpected changes in the Company's arrangements with its largest customers. Future results are subject to risks and uncertainties, including the risk factors, and other risks and uncertainties, described in the Company's filings with the Securities and Exchange Commission, which include those in the Annual Report on Form 10-K for the year ended December 31, 2014. Forward-looking statements contained in this press release are made only as of the date hereof, and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

ICU MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except per share data)

(unaudited)

|

| | | | | | | |

| December 31, |

| 2015 | | 2014 |

ASSETS | | | |

CURRENT ASSETS: | | | |

Cash and cash equivalents | $ | 336,164 |

| | $ | 275,812 |

|

Investment securities | 41,233 |

| | 70,952 |

|

Cash, cash equivalents and investment securities | 377,397 |

| | 346,764 |

|

Accounts receivable, net of allowance for doubtful accounts of $1,101 and $1,127 at December 31, 2015 and 2014, respectively | 57,847 |

| | 39,051 |

|

Inventories | 43,632 |

| | 36,933 |

|

Prepaid income taxes | 14,366 |

| | 3,963 |

|

Prepaid expenses and other current assets | 7,631 |

| | 5,818 |

|

Assets held for sale | 4,134 |

| | — |

|

Total current assets | 505,007 |

|

| 432,529 |

|

| | | |

PROPERTY AND EQUIPMENT, net | 74,320 |

| | 86,091 |

|

GOODWILL | 6,463 |

| | 1,478 |

|

INTANGIBLE ASSETS, net | 23,936 |

| | 7,063 |

|

DEFERRED INCOME TAXES | 17,099 |

| | 13,941 |

|

| $ | 626,825 |

| | $ | 541,102 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | |

CURRENT LIABILITIES: | |

| | |

Accounts payable | $ | 13,670 |

| | $ | 11,378 |

|

Accrued liabilities | 28,948 |

| | 17,350 |

|

Total current liabilities | 42,618 |

| | 28,728 |

|

| | | |

LONG-TERM LIABILITIES | 1,476 |

| | — |

|

DEFERRED INCOME TAXES | 1,372 |

| | 1,376 |

|

INCOME TAX LIABILITY | 1,488 |

| | 2,746 |

|

COMMITMENTS AND CONTINGENCIES | — |

| | — |

|

STOCKHOLDERS’ EQUITY: | |

| | |

Convertible preferred stock, $1.00 par value Authorized-500 shares; Issued and outstanding- none | — |

| | — |

|

Common stock, $0.10 par value — Authorized—80,000 shares; Issued and outstanding, 16,086 shares at December 31, 2015 and 15,595 shares at December 31, 2014 | 1,608 |

| | 1,559 |

|

Additional paid-in capital | 145,125 |

| | 107,336 |

|

Retained earnings | 453,896 |

| | 408,911 |

|

Accumulated other comprehensive loss | (20,758 | ) | | (9,554 | ) |

Total stockholders’ equity | 579,871 |

| | 508,252 |

|

| $ | 626,825 |

| | $ | 541,102 |

|

ICU MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Amounts in thousands, except per share data)

(unaudited)

|

| | | | | | | | | | | |

| Year ended December 31, |

| 2015 | | 2014 | | 2013 |

REVENUES: | | | | | |

Net sales | $ | 341,254 |

| | $ | 308,770 |

| | $ | 313,056 |

|

Other | 414 |

| | 490 |

| | 660 |

|

TOTAL REVENUE | 341,668 |

| | 309,260 |

| | 313,716 |

|

COST OF GOODS SOLD | 160,871 |

| | 157,859 |

| | 158,984 |

|

Gross profit | 180,797 |

| | 151,401 |

| | 154,732 |

|

OPERATING EXPENSES: | |

| | | | |

Selling, general and administrative | 83,216 |

| | 88,939 |

| | 89,006 |

|

Research and development | 15,714 |

| | 18,332 |

| | 12,407 |

|

Restructuring and strategic transaction | 8,451 |

| | 5,093 |

| | 1,370 |

|

Gain on sale of building | (1,086 | ) | | — |

| | — |

|

Legal settlements | 1,798 |

| | — |

| | — |

|

Impairment of assets held for sale | 4,139 |

| | — |

| | — |

|

Total operating expenses | 112,232 |

| | 112,364 |

| | 102,783 |

|

Income from operations | 68,565 |

| | 39,037 |

| | 51,949 |

|

OTHER INCOME | 1,134 |

| | 755 |

| | 765 |

|

Income before income taxes | 69,699 |

| | 39,792 |

| | 52,714 |

|

PROVISION FOR INCOME TAXES | (24,714 | ) | | (13,457 | ) | | (12,296 | ) |

NET INCOME | $ | 44,985 |

| | $ | 26,335 |

| | $ | 40,418 |

|

NET INCOME PER SHARE | |

| | | | |

Basic | $ | 2.84 |

| | $ | 1.72 |

| | $ | 2.75 |

|

Diluted | $ | 2.73 |

| | $ | 1.68 |

| | $ | 2.65 |

|

WEIGHTED AVERAGE NUMBER OF SHARES | |

| | | | |

Basic | 15,848 |

| | 15,282 |

| | 14,688 |

|

Diluted | 16,496 |

| | 15,647 |

| | 15,274 |

|

ICU MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Amounts in thousands, except per share data)

(unaudited)

|

| | | | | | | |

| Three months ended December 31, |

| 2015 | | 2014 |

REVENUES: | | | |

Net sales | $ | 90,378 |

| | $ | 79,773 |

|

Other | 9 |

| | 123 |

|

TOTAL REVENUE | 90,387 |

| | 79,896 |

|

COST OF GOODS SOLD | 42,130 |

| | 40,211 |

|

Gross profit | 48,257 |

| | 39,685 |

|

OPERATING EXPENSES: | | | |

Selling, general and administrative | 22,519 |

| | 20,299 |

|

Research and development | 4,057 |

| | 5,080 |

|

Restructuring and strategic transaction | 5,040 |

| | 2,253 |

|

Impairment of assets held for sale | 4,139 |

| | — |

|

Total operating expenses | 35,755 |

| | 27,632 |

|

Income from operations | 12,502 |

| | 12,053 |

|

OTHER INCOME | 139 |

| | 183 |

|

Income before income taxes | 12,641 |

| | 12,236 |

|

PROVISION FOR INCOME TAXES | (7,178 | ) | | (4,864 | ) |

NET INCOME | $ | 5,463 |

| | $ | 7,372 |

|

NET INCOME PER SHARE | | | |

Basic | $ | 0.34 |

| | $ | 0.48 |

|

Diluted | $ | 0.33 |

| | $ | 0.46 |

|

WEIGHTED AVERAGE NUMBER OF SHARES | | | |

Basic | 16,020 |

| | 15,469 |

|

Diluted | 16,697 |

| | 15,934 |

|

ICU MEDICAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(unaudited)

|

| | | | | | | | | | | |

| Year ended December 31, |

| 2015 | | 2014 | | 2013 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | |

Net income | $ | 44,985 |

| | $ | 26,335 |

| | $ | 40,418 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | | |

Depreciation and amortization | 18,073 |

| | 19,447 |

| | 19,506 |

|

Provision for doubtful accounts | 54 |

| | 34 |

| | 185 |

|

Provision for warranty and returns | 52 |

| | (360 | ) | | 671 |

|

Stock compensation | 12,827 |

| | 9,592 |

| | 5,434 |

|

(Gain) loss on disposal of property and equipment | (1,106 | ) | | 8 |

| | (36 | ) |

Bond premium amortization | 1,670 |

| | 2,188 |

| | 2,715 |

|

Impairment of assets held for sale | 4,139 |

| | — |

| | — |

|

Changes in operating assets and liabilities: | |

| | | | |

Accounts receivable | (20,515 | ) | | 4,912 |

| | 3,556 |

|

Inventories | (8,337 | ) | | (3,836 | ) | | 2,319 |

|

Prepaid expenses and other assets | (1,832 | ) | | 1,970 |

| | (383 | ) |

Accounts payable | 3,118 |

| | (621 | ) | | (31 | ) |

Accrued liabilities | 9,454 |

| | 2,344 |

| | (2,215 | ) |

Income taxes, including excess tax benefits and deferred income taxes | (7,717 | ) | | (1,373 | ) | | (6,413 | ) |

Net cash provided by operating activities | 54,865 |

| | 60,640 |

| | 65,726 |

|

CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | | |

Purchases of property and equipment | (12,984 | ) | | (16,604 | ) | | (18,415 | ) |

Proceeds from sale of assets | 3,592 |

| | 5 |

| | 49 |

|

Intangible asset additions | (951 | ) | | (989 | ) | | (1,080 | ) |

Business acquisitions, net of cash acquired | (56,786 | ) | | — |

| | — |

|

Proceeds from sale of business | 28,970 |

| | — |

| | — |

|

Purchases of investment securities | (56,137 | ) | | (93,588 | ) | | (86,022 | ) |

Proceeds from sale of investment securities | 83,054 |

| | 89,426 |

| | 92,348 |

|

Net cash used by investing activities | (11,242 | ) | | (21,750 | ) | | (13,120 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | | |

Proceeds from exercise of stock options | 15,042 |

| | 16,998 |

| | 18,004 |

|

Proceeds from employee stock purchase plan | 2,162 |

| | 2,485 |

| | 2,457 |

|

Tax benefits from exercise of stock options | 9,330 |

| | 5,700 |

| | 6,966 |

|

Purchase of treasury stock | (1,523 | ) | | (5,836 | ) | | (3,033 | ) |

Net cash provided by financing activities | 25,011 |

| | 19,347 |

| | 24,394 |

|

Effect of exchange rate changes on cash | (8,282 | ) | | (8,447 | ) | | 2,122 |

|

NET INCREASE IN CASH AND CASH EQUIVALENTS | 60,352 |

| | 49,790 |

| | 79,122 |

|

CASH AND CASH EQUIVALENTS, beginning of period | 275,812 |

| | 226,022 |

| | 146,900 |

|

CASH AND CASH EQUIVALENTS, end of period | $ | 336,164 |

| | $ | 275,812 |

| | $ | 226,022 |

|

| | | | | |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | | | |

Cash paid during the year for income taxes | $ | 22,998 |

| | $ | 8,668 |

| | $ | 12,172 |

|

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING ACTIVITIES: | | | | | |

Accrued liabilities for property and equipment | $ | 182 |

| | $ | 789 |

| | $ | 212 |

|

ICU Medical, Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures

(Amounts in thousands, except per share data)

(unaudited)

|

| | | | | | | | | | | | | | | |

| Adjusted EBITDA |

| Q4 | | Year Ended |

| 2015 | | 2014 | | 2015 | | 2014 |

GAAP net income | $ | 5,463 |

| | $ | 7,372 |

| | $ | 44,985 |

| | $ | 26,335 |

|

| | | | | | | |

Non-GAAP adjustments: | | | | | | | |

Stock compensation expense (a) | 3,522 |

| | 2,602 |

| | 12,827 |

| | 9,592 |

|

Depreciation and amortization expense (b) | 4,807 |

| | 4,805 |

| | 18,073 |

| | 19,447 |

|

Restructuring and strategic transaction expense (c) | 5,040 |

| | 2,253 |

| | 8,451 |

| | 5,093 |

|

Gain on sale of building (d) | — |

| | — |

| | (1,086 | ) | | — |

|

Legal settlements (e) | — |

| | — |

| | 1,798 |

| | — |

|

Impairment of assets held for sale (f) | 4,139 |

| | — |

| | 4,139 |

| | — |

|

Provision for income taxes (g) | 7,178 |

| | 4,864 |

| | 24,714 |

| | 13,457 |

|

Total non-GAAP adjustments | 24,686 |

| | 14,524 |

| | 68,916 |

| | 47,589 |

|

| | | | | | | |

Adjusted EBITDA | $ | 30,149 |

| | $ | 21,896 |

| | $ | 113,901 |

| | $ | 73,924 |

|

| | | | | | | |

| | | | | | | |

| Adjusted diluted earnings per share |

| Q4 | | Year Ended |

| 2015 | | 2014 | | 2015 | | 2014 |

GAAP diluted earnings per share | $ | 0.33 |

| | $ | 0.46 |

| | $ | 2.73 |

| | $ | 1.68 |

|

| | | | | | | |

Non-GAAP adjustments: | | | | | | | |

Stock compensation expense (a) | $ | 0.21 |

| | $ | 0.16 |

| | $ | 0.78 |

| | $ | 0.61 |

|

Amortization expense (h) | $ | 0.04 |

| | $ | 0.04 |

| | $ | 0.13 |

| | $ | 0.15 |

|

Restructuring and strategic transaction expense (c) | $ | 0.30 |

| | $ | 0.14 |

| | $ | 0.51 |

| | $ | 0.33 |

|

Gain on sale of building (d) | $ | — |

| | $ | — |

| | $ | (0.07 | ) | | $ | — |

|

Legal settlements (e) | $ | — |

| | $ | — |

| | $ | 0.11 |

| | $ | — |

|

Impairment of assets held for sale (f) | $ | 0.25 |

| | $ | — |

| | $ | 0.25 |

| | $ | — |

|

Estimated income tax impact from adjustments (i) | $ | (0.17 | ) | | $ | (0.12 | ) | | $ | (0.48 | ) | | $ | (0.39 | ) |

Adjusted diluted earnings per share | $ | 0.96 |

| | $ | 0.68 |

| | $ | 3.96 |

| | $ | 2.38 |

|

| | | | | | | |

| | | | | | | |

(a) Stock-based compensation expense in accordance with ASC 718. | | | | | |

(b) Depreciation of fixed assets and amortization of intangible assets. | | |

(c) Restructuring and strategic transaction expense. | | | | | | |

(d) Gain on sale of building. | | | | | | |

(e) Legal settlements. | | | | | | |

(f) Impairment of assets held for sale. | | | | | |

(g) Income tax expense recognized during the period. | | | | | |

(h) Amortization expense | | | | | | | |

(i) Estimated income tax effect on adjustments for stock compensation expense, amortization expense, restructuring and strategic transaction expense, gain on sale of building, legal settlements and impairment of assets held for sale. |

ICU Medical, Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Measures - Fiscal Year 2016 Outlook

(Amounts in millions, except per share data)

(unaudited)

|

| | | | | | | |

GAAP net income | $ | 61 |

| | $ | 63 |

|

| | | |

Non-GAAP adjustments: | | | |

Stock compensation expense (a) | 15 |

| | 15 |

|

Depreciation and amortization expense (b) | 19 |

| | 19 |

|

Provision for income taxes (c) | 28 |

| | 30 |

|

Total non-GAAP adjustments | 62 |

| | 64 |

|

| | | |

Adjusted EBITDA | $ | 123 |

| | $ | 127 |

|

| | | |

| | | |

| | | |

| | | |

GAAP diluted earnings per share | $ | 3.62 |

| | $ | 3.74 |

|

| | | |

Non-GAAP adjustments: | | | |

Stock compensation expense (a) | $ | 0.89 |

| | $ | 0.89 |

|

Amortization expense (d) | $ | 0.17 |

| | $ | 0.17 |

|

Estimated income tax impact from adjustments (e) | $ | (0.34 | ) | | $ | (0.34 | ) |

Adjusted diluted earnings per share | $ | 4.34 |

| | $ | 4.46 |

|

| | | |

(a) Stock-based compensation expense in accordance with ASC 718. |

(b) Depreciation of fixed assets and amortization of intangible assets. |

(c) Income tax expense recognized during the period. | | |

(d) Amortization expense | | | |

(e) Estimated income tax effect on adjustments for stock compensation expense and amortization expense. |

CONTACT:

ICU Medical, Inc.

Scott Lamb, Chief Financial Officer

(949) 366-2183

ICR, Inc.

John Mills, Partner

(646) 277-1254

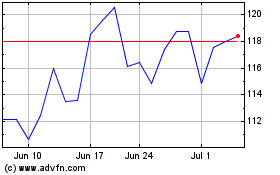

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Mar 2024 to Apr 2024

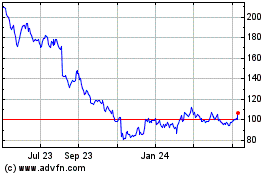

ICU Medical (NASDAQ:ICUI)

Historical Stock Chart

From Apr 2023 to Apr 2024