Interactive Brokers Group, Inc. (NASDAQ GS: IBKR), an automated

global electronic broker and market maker, today reported its

Electronic Brokerage monthly performance metrics for February.

Highlights for the month included:

- 633 thousand Daily Average Revenue

Trades (DARTs), 9% higher than prior year and 6% lower than prior

month.

- Ending client equity of $60.3 billion,

24% higher than prior year and 7% higher than prior month.

- Ending client margin loan balances of

$16.6 billion, 16% higher than prior year and 1% higher than prior

month.

- Ending client credit balances of $31.5

billion, 20% higher than prior year and 3% higher than prior

month.

- 290 thousand client accounts, 17%

higher than prior year and 2% higher than prior month.

- 505 annualized average cleared DARTs

per client account.

- Average commission per cleared client

order of $3.87 including exchange, clearing and regulatory fees.

Key products:

February 2015 Average Commission per

Average Cleared Client Order Order Size Stocks

$2.23 1,559 shares Equity Options $5.79 9.6 contracts Futures $6.45

3.6 contracts

Futures include options on futures. We

estimate exchange, clearing and regulatory fees to be 59% of the

futures commissions.

In the interest of transparency, we quantify our clients’

all-in cost of trade execution below.

For the full multimedia release with graph see link:

https://www.interactivebrokers.com/MonthlyMetrics

- In February, clients’ total cost of

executing and clearing U.S. Reg.-NMS stocks through IB was 1.2

basis points of trade money1, as measured against a daily VWAP2

benchmark (0.9 basis points for the rolling twelve months).

Interactive Brokers Clients' Reg.-NMS Stock Trading Expense

Detail All amounts are in millions, except %

Previous Mar '14

Apr '14 May '14

Jun '14 Jul '14

Aug '14 Sep '14

Oct '14 Nov '14

Dec '14 Jan '15

Feb '15 12 Months #1a -

Number of orders Buys 1.88 1.83 1.62 1.61 1.76 1.57 1.88 2.32

1.63 1.93 1.99

1.88 21.90 Sells 1.75 1.73 1.55

1.49 1.62 1.47 1.71 2.22

1.49 1.79 1.83

1.76 20.41

Total 3.63 3.56 3.17 3.10 3.38 3.04 3.59 4.54 3.12 3.72 3.82

3.64 42.31 #1b - Number of shares purchased

or sold Shares bought 1,103 1,034 970 958 1,038 924 1,119 1,499

970 1,218 1,196

1,090 13,119 Shares sold 1,081 1,006

956 928 1,031 904 1,080

1,529 929 1,213 1,180

1,070

12,907

Total 2,184 2,040 1,926 1,886 2,069 1,828

2,199 3,028 1,899 2,431 2,376

2,160 26,026

#2 - Trade money including price, commissions and fees 2a

Buy money $39,492 $44,679 $36,818 $36,765 $40,794 $35,478 $42,991

$58,523 $35,855 $48,290 $55,913

$49,735 $525,333 2b Sell

money $39,105 $44,684 $36,537 $35,054

$39,940 $35,437 $41,693 $59,611 $34,281

$48,846 $55,478

$49,200 $519,866

2c Total $78,597 $89,363 $73,355 $71,819 $80,734 $70,915

$84,684 $118,134 $70,136 $97,136 $111,391

$98,935

$1,045,199 #3 - Trade value at Daily VWAP 3a

Buy value $39,490 $44,669 $36,815 $36,766 $40,778 $35,472 $42,984

$58,541 $35,849 $48,280 $55,881

$49,720 $525,245 3b Sell

value $39,106 $44,673 $36,543 $35,064

$39,937 $35,443 $41,694 $59,631 $34,290

$48,846 $55,452

$49,197 $519,876

3c Total $78,596 $89,342 $73,358 $71,830 $80,715 $70,915

$84,678 $118,172 $70,139 $97,126 $111,333

$98,917

$1,045,121 #4 - Total trade expense, including

commissions and fees, relative to Daily VWAP 4a Buys (2a-3a)

$2.2 $10.1 $3.4 ($0.9) $16.0 $5.9 $6.4 ($17.7) $5.7 $9.9 $32.2

$14.3 $87.5 4b Sells (3b-2b) $0.9 ($11.2) $5.3

$9.7 ($3.7) $6.6 $1.0 $20.7

$8.2 ($0.1) ($25.2)

($2.5)

$9.7

4c Total trade expense $3.1 ($1.1) $8.7 $8.8

$12.3 $12.5 $7.4 $3.0 $13.9 $9.8 $7.0

$11.8 $97.2

Trade expense as percentage of trade money

4c/2c 0.004% -0.001% 0.012% 0.012% 0.015% 0.018% 0.009%

0.003% 0.020% 0.010% 0.006%

0.012% 0.009%

#5 - Trade expense categories 5a Total commissions &

fees $9.9 $9.3 $8.0 $8.1 $9.0 $8.2 $9.6 $13.2 $8.6 $10.5 $10.3

$9.1 $113.8 5b Execution cost (4c-5a) ($6.8)

($10.4) $0.6 $0.7 $3.4 $4.3 ($2.2) ($10.2) $5.3 ($0.7) ($3.3)

$2.7 ($16.6) #6 - Trade expense categories

as percentage of trade money Total commissions & fees

(5a/2c) 0.013% 0.010% 0.011% 0.011% 0.011% 0.012% 0.012% 0.012%

0.012% 0.011% 0.009%

0.009% 0.011% Execution cost

(5b/2c) -0.009% -0.011% 0.001% 0.001%

0.004% 0.006% -0.003% -0.009% 0.008%

-0.001% -0.003%

0.003%

-0.002% Net Expense to IB Customers 0.004% -0.001%

0.012% 0.012% 0.015% 0.018% 0.009% 0.003% 0.020% 0.010% 0.006%

0.012% 0.009%

The above illustrates that the rolling twelve months’ average

all-in cost of a client U.S. Reg.-NMS stock trade was 0.9 basis

points.

_________________Note 1: Trade money is the total amount of

money clients spent or received, including all commissions and

fees. Note 2: Consistent with the clients’ trading activity,

the computed VWAP benchmark includes extended trading hours.

More information, including historical results for each of the

above metrics, can be found on the investor relations page of the

Company’s corporate web site, www.interactivebrokers.com/ir.

About Interactive Brokers Group, Inc.:

Interactive Brokers Group, Inc., together with its subsidiaries,

is an automated global electronic broker that specializes in

catering to financial professionals by offering state-of-the-art

trading technology, superior execution capabilities, worldwide

electronic access, and sophisticated risk management tools at

exceptionally low costs. The brokerage trading platform utilizes

the same innovative technology as the Company’s market making

business, which executes and processes trades in securities,

futures and foreign exchange instruments on more than 100

electronic exchanges and trading venues around the world. As a

market maker, we provide liquidity at these marketplaces and, as a

broker, we provide professional traders and investors with

electronic access to stocks, options, futures, forex, bonds and

mutual funds from a single IB Universal AccountSM. Employing

proprietary software on a global communications network,

Interactive Brokers Group continuously integrates its software with

a growing number of exchanges and trading venues into one

automatically functioning, computerized platform that requires

minimal human intervention.

Cautionary Note Regarding Forward-Looking Statements:

The foregoing information contains certain forward-looking

statements that reflect the company's current views with respect to

certain current and future events and financial performance. These

forward-looking statements are and will be, as the case may be,

subject to many risks, uncertainties and factors relating to the

company's operations and business environment which may cause the

company's actual results to be materially different from any future

results, expressed or implied, in these forward-looking statements.

Any forward-looking statements in this release are based upon

information available to the company on the date of this release.

The company does not undertake to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any statements expressed or implied therein will

not be realized. Additional information on risk factors that could

potentially affect the company's financial results may be found in

the company's filings with the Securities and Exchange

Commission.

For Interactive Brokers Group,

Inc.Investors:Patrick Brennan,

203-618-4070orMedia:Caitlin Duffy, 203-913-1369

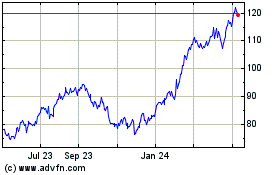

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

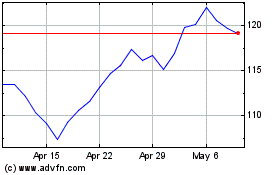

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024