A group of 10 clearing firms began dividing the former clients

of MF Global Holding Ltd.'s (MFGLQ) U.S. brokerage among

themselves--one of the first steps by rivals to fill the vacuum

left by the huge commodities firm's collapse.

Major banks and brokerages such as BNP Paribas S.A. (BNPQY) and

Newedge Group shared the stage with niche firms such as Penson

Financial Services Inc. in vetting lists of MF Global account

holders Thursday morning, according to a person familiar with the

process.

The effort--spearheaded by CME Group Inc. (CME) after a New York

bankruptcy judge approved the action--is an attempt to make

progress on unlocking the assets of hundreds of thousands of

investors and businesses whose accounts have been largely frozen

since MF Global filed for bankruptcy Monday.

The 10 firms will receive bulk transfers of segregated-client

accounts and distribute some funds back to those clients. And in

the process, the firms will get the first crack at former customers

of one of the largest commodities broker-dealers in the U.S.

Investors that haven't had access to their open trading

positions, or bets on the market, this week will be able to close

out or offset those trades once they post sufficient funds at the

new clearing firm.

"It's a big relief to be making trades again," said Jack

Scoville of Price Futures Group in Chicago. After being locked out

of the market all week, Scoville midday Thursday was able resume

trading after his open bets were transferred to a new clearing firm

and he fulfilled the margin requirements on those positions.

The transfers are only the first step in the quest by customers

to receive the estimated $5.45 billion in assets currently due them

by MF Global.

The bankruptcy court approved the movement of some funds in

about 50,000 accounts.

As of Thursday, only those assets backing open market bets were

accessible. Initially, about 60% of customers' margin will move

with the corresponding trades in the transfer to other clearing

firms, according to a person familiar with the process.

In addition to BNP, Newedge and Penson, the other firms

receiving funds are Dorman Trading LLC; R.J. O'Brien &

Associates LLC; Mizuho Securities USA Inc., a unit of Mizuho

Financial Group (MFG); FC Stone LLC; Rosenthal Collins Group LLC;

ADM Investor Services Inc., a unit of Archer Daniels Midland Co.

(ADM), and Macquarie Futures USA, according to a person familiar

with the situation.

Interactive Brokers Group Inc. (IBKR), which nearly bought MF

Global earlier this week, decided against joining the 10 firms that

would be receiving the failed brokerage's accounts.

Interactive Brokers said it "reluctantly" declined to join the

plan to divide up MF Global's customer base and move them to other

firms, Chief Executive Thomas Peterffy said in an email.

Peterffy cited potential market exposure and legal risks that

could come along with the business, adding that "MF Global put the

exchanges and regulators in a very tough position."

After the transfer, former MF Global customers would have the

option to keep the accounts with the new clearing firm, transfer

them elsewhere, or liquidate them.

Transferring some of the funds to other clearing firms doesn't

necessarily mean that former customers of MF Global will be able to

pull out the cash. The new clearing firms are seen asking the

failed firm's clients to up their collateral requirements,

according to people involved in the process.

And clearing firms won't take clients en masse without first

analyzing their credit-worthiness and other factors.

"Don't forget all those names need to be vetted by your company,

you need to run credit on all of them," said a person familiar with

the situation at one of the 10 firms. "You're going to look through

all those names and say yes to some and no to others."

CME Group, the biggest futures market operator in the U.S., is

aiming to open the transfer process to other exchanges and

trade-clearing facilities operated by IntercontinentalExchange Inc.

(ICE), Depository Trust & Clearing Corp., NYSE Euronext (NYX)

and the OCC, which clears trades on all U.S. stock-option markets,

according to a person involved in the process.

Earlier this week, steps toward the fund transfer were met with

confusion by clearing firms and MF Global customers alike.

Investors scrambled to learn their options from a myriad of

sources including CME, market regulators, MF Global and other

clearing firms.

On Tuesday, clearing firms were invited to view a list of MF

Global clients in order to begin the process of transferring

accounts, according to another person involved with the process.

But the firms weren't given enough information to judge the

credit-worthiness of the prospective clients.

"It was literally a list of names, without positions," said the

person. "The information was useless."

For most of the week, floor traders, small investors and even

large commodity hedge funds spent tortuous days trying to speed the

process of regaining money that was in MF Global accounts.

"We're in a state of anger and shock," said Davide Accomazzo,

chief investment officer at Cervino Capital, which has about $5

million tied up at MF Global.

"We're trying to access information from everywhere. We're

talking to our trading desk," he said. "In terms of official news,

we're relying on the website that the official trustee has put

up...but it's complete confusion."

EMC Master Fund--which invests in commodity futures and

options--filed a motion late Wednesday urging the bankruptcy judge

overseeing the MF Global liquidation to allow cash funds backing

its trading positions to be transferred to a new clearing firm,

Peregrine Financial Group, or PFG.

The fund said it faces "substantial, if not total, losses" if it

isn't allowed to quickly transfer funds frozen in MF Global

accounts.

EMC's filing said the trustee responsible for the transfer of

accounts allowed EMC to move its market bets, but not its cash, to

PFG. Without such cash, the fund will be unable to meet margin

requirements on its positions and "will be forced to abandon the

trading strategy for the positions, which may result in substantial

losses," the fund said in the filing.

On Thursday, the EMC motion was denied. EMC declined to

comment.

For others, just receiving the funds backing open bets was seen

as progress.

-By Jerry A. DiColo, Dow Jones Newswires; 212-416-2155;

jerry.dicolo@dowjones.com

--Tatyana Shumsky and Leslie Josephs contributed to this

article.

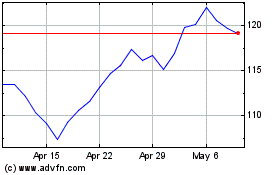

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

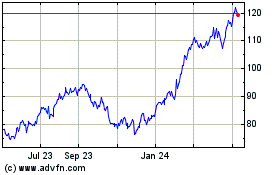

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024