OneChicago Offers Derivatives To Counter Europe Short-Selling Ban

August 18 2011 - 2:53PM

Dow Jones News

A small U.S. derivatives exchange on Thursday rolled out

contracts that allow traders to take bearish positions on European

stocks affected by new short-selling restrictions, highlighting the

tough task regulators can face in trying to limit market

activity.

OneChicago LLC developed the contracts in the week since the

tougher short-selling rules were introduced in an effort to limit

market declines, with products linked to exchange-traded funds

composed of stocks listed in France, Spain, Italy and Belgium.

"This is another way to get exposure to those markets without

touching those foreign exchanges," said David Downey, chief

executive of OneChicago. "When we heard about the short-selling

bans in those countries I instructed our staff to go through and

find any ETFs based on those countries' markets that we did not

currently list for trading."

Downey said in an interview that he didn't anticipate a sharp

upswing in volume, but large banks and other financial institutions

with long exposures to the affected European markets would be

potential users.

Ten-year-old OneChicago's core business is trading futures

contracts on individual stocks and exchange-traded funds. The bulk

of its offerings are linked to U.S.-listed securities, but the

platform offers 228 contracts on American Depository Receipts,

which allow traders on U.S. exchanges to buy and sell stock in

foreign companies. Another 21 contracts are on ETFs made up of

nondomestic stocks.

Trading futures on individual securities lets investors position

for the price of a stock or ETF falling, achieving a similar

outcome to short-selling. That practice involves borrowing shares

and selling them to another investor, with the aim of buying them

back more cheaply later when the price has fallen and pocketing the

difference.

France, Spain, Belgium and Italy last week banded together to

restrict short-selling of stocks as pressure mounted on the euro

zone's financial sector. Regulators hoped to stave off a piling-on

of bearish bets that some feared could destabilize banks central to

the region.

While European short-selling bans extend to short positions

achieved through trading of derivatives, short-selling of related

ADRs in the U.S. remains permitted, enabling OneChicago to continue

offering the related futures contracts its market.

The newly listed futures track anticipated movements in French,

Spanish, Italian and Belgian ETFs compiled by MSCI Inc. (MSCI).

OneChicago is jointly owned by Interactive Brokers Group (IBKR),

CBOE Holdings Inc. (CBOE) and CME Group Inc. (CME).

-By Jacob Bunge, Dow Jones Newswires; 312 750 4117;

jacob.bunge@dowjones.com

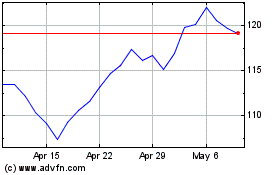

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

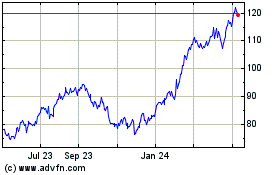

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024