Online Brokerages Raised Margin Requirements On Some Chinese Stocks

June 09 2011 - 4:28PM

Dow Jones News

Four major online brokerages, including Charles Schwab Corp.

(SCHW) and Fidelity Investments, have recently raised margin

requirements on some Chinese securities, as concerns mount over

accounting discrepancies at some companies trading in the U.S.

Schwab, the largest discount brokerage by market capitalization,

said in an emailed statement it "adjusted maintenance requirements

for many, and made some unmarginable based on current

information."

Buying stocks on margin refers to purchasing the securities with

money borrowed from the brokerage. Buying on margin can increase

gains and losses on stocks; higher margin requirements can cut into

demand for volatile shares.

TD Ameritrade Holding Corp. (AMTD) also raised its margin

requirements for some Chinese stocks, while E*Trade Financial Corp.

(ETFC) initiated a similar change in March. E*Trade currently has

127 stocks that have margin requirements of 100%, according to a

company spokeswoman, who wouldn't say how many of those were

Chinese companies. Fidelity said it "adjusted" margin requirements

on some Chinese stocks "weeks ago."

The brokerages say such a move isn't unusual as they look to

protect their clients and themselves from volatility, and what one

spokesman termed "suspicious" activity.

Recently, some Chinese companies traded in the U.S. have fallen

sharply in price. Some have in recent months acknowledged problems

with their accounting. The Securities and Exchange Commission is

investigating accounting and disclosure issues at some Chinese

companies that list on U.S. exchanges through "reverse mergers,"

arrangements that can avoid the regulatory scrutiny that comes with

an initial public offering. In a reverse merger, a company acquires

a public stock listing by merging with a shell company with

publicly traded shares.

The Schwab spokesman said the company will "continue to monitor

the situation to determine if we need to make further changes."

Recently, Interactive Brokers Group Inc. (IBKR) announced on its

website that it barred clients from using borrowed money to buy

shares of over 130 Chinese companies because of "elevated risk

concerns."

-By Brett Philbin, Dow Jones Newswires; 212-416-2173;

brett.philbin@dowjones.com

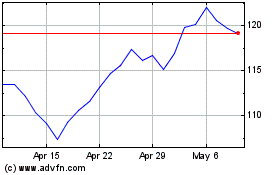

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

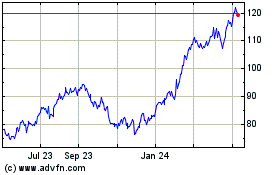

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024