Angie's List Rejects IAC Buyout Offer

November 17 2015 - 9:40AM

Dow Jones News

Angie's List said Tuesday it won't pursue an unsolicited buyout

offer from IAC/InterActiveCorp. because it undervalued the company,

which wants an opportunity to develop and enact a new growth plan

before considering any potential mergers.

Scott Durchslag, chief executive of Angie's List, said in

prepared remarks that the board thinks Angie's List should have the

chance to evaluate its so-called profitable growth plan and share

it with its stockholders before making any merger decisions.

Mr. Durchslag, who was named to his post in September, has been

developing the profitable growth plan. In a letter sent to IAC, he

added that the company has identified $10 million in cost

reductions, among other changes in progress.

He added that Angie's List had already detailed many of the same

reasons for rejecting the latest offer after it also waved off an

earlier offer from IAC.

Last week, IAC made public a $512 million cash offer for Angie's

List, in a proposed deal that would combine the services

marketplace and consumer-review site with Internet brands such as

About.com and Vimeo. The offer of $8.75 a share was a 10% premium

to Angie's List's closing price on Nov. 11. IAC said it also was

willing to consider combining Angie's List with its HomeAdvisor

business through a stock-for-stock exchange.

In a letter sent to Angie's List's board last week, IAC

indicated that Angie's board had resisted its offer. IAC Chief

Executive Joey Levin wrote that IAC was "disappointed" by Angie's

unwillingness to engage in discussions about a transaction after an

Oct. 23 meeting.

Angie's List has posted mostly losses since going public in

2011, as expansion efforts have ratcheted up costs. In October, it

cut its guidance for the year even as it eked out a rare quarterly

profit.

IAC owns a number of media and Internet businesses such as

About.com, Vimeo and e-commerce site ShoeBuy. It also owns Match

Group, the parent of dating sites Match and Tinder, but is taking

that business public. The Match business accounted for a third of

IAC's overall revenue in the third quarter.

With Match Group's separation from the company, IAC will be

dependent on its search and applications unit, which includes sites

like About.com and Ask.com, at a time when many search businesses

aren't thriving.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 17, 2015 09:25 ET (14:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

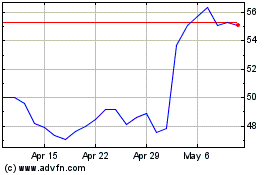

IAC (NASDAQ:IAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

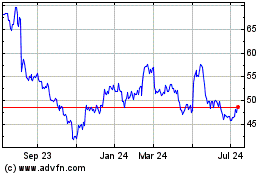

IAC (NASDAQ:IAC)

Historical Stock Chart

From Apr 2023 to Apr 2024