IAC/InterActiveCorp Offers to Buy Angie's List

November 11 2015 - 5:10PM

Dow Jones News

IAC/InterActiveCorp. on Wednesday made public its $512 million

cash offer for Angie's List Inc., a deal that could combine the

services marketplace and consumer-review site with Internet brands

such as About.com and Vimeo.

The offer of $8.75 a share is a 10% premium to Angie's List's

closing price on Wednesday. Shares of Angie's jumped 11% to $8.83

in after-hours trading, while IAC's shares were inactive.

IAC said it also was willing to consider combining Angie's List

with its HomeAdvisor business through a stock-for-stock exchange.

IAC said such a tie-up would create a home-services platform with

more than $700 million in revenue.

A representative for Angie's List was not immediately available

for comment. In a letter sent to Angie's List's board on Wednesday,

IAC indicated that Angie's board had resisted its offer. IAC Chief

Executive Joey Levin wrote in the letter that IAC was

"disappointed" by Angie's unwilligness to engage in discussions

about a transaction after an Oct. 23 meeting.

IAC owns a number of media and Internet businesses such as

search site About.com, video-sharing site Vimeo, and e-commerce

site ShoeBuy. It also owns Match Group, the parent of dating sites

Match and Tinder, but is taking that business public.

Angie's List has posted mostly losses since going public in

2011, as expansion efforts have ratcheted up costs. In October,

Angie's List cut its guidance for the year even as it eked out a

rare quarterly profit.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 16:55 ET (21:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

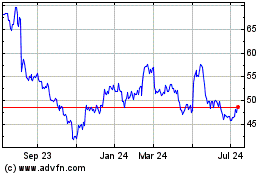

IAC (NASDAQ:IAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

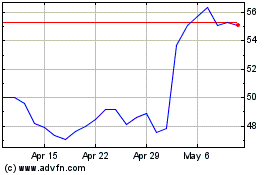

IAC (NASDAQ:IAC)

Historical Stock Chart

From Apr 2023 to Apr 2024