Match Group Sets IPO Terms

November 09 2015 - 7:20AM

Dow Jones News

Match Group Inc. on Monday said it plans to raise up to $536.7

million in its long-awaited initial public offering, as the parent

company of sites including Tinder seeks to cash in on the booming

market for online dating.

The Dallas-based company said in a regulatory filing that it

would sell 33.3 million shares at $12 to $14 a piece. Underwriters

will have the option to buy up to an additional 5 million

shares.

Match's listing seeks to capitalize on the booming market for

dating sites in the U.S. The company, which counts 59 million

monthly active users, reported $888.3 million in revenue in 2014,

up about 11% from the previous year, according to its filing with

the Securities and Exchange Commission.

Match's IPO makes official a long-anticipated move. In June, the

company disclosed it plan to go public, saying it expected to

complete the process by the fourth quarter. Three months later, it

filed confidential IPO paperwork with the Securities and Exchange

Commission, people familiar with the matter told The Wall Street

Journal at the time.

IAC/InterActiveCorp., which owns Match, would retain control of

more than 50% of voting rights after the IPO under its ownership of

Class B shares, which have 10 votes apiece. Match also owns other

non-dating brands such as The Princeton Review.

Match said it intends to use the IPO proceeds to pay down debt

owed to IAC.

The underwriters for the IPO include J.P. Morgan, Allen &

Co. and Bank of America Merrill Lynch.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 09, 2015 07:05 ET (12:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

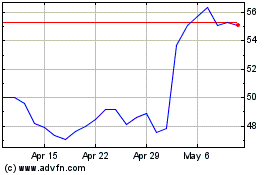

IAC (NASDAQ:IAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

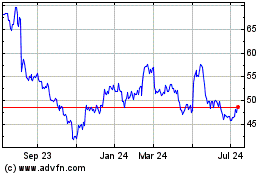

IAC (NASDAQ:IAC)

Historical Stock Chart

From Apr 2023 to Apr 2024