Amended Current Report Filing (8-k/a)

July 28 2015 - 11:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2015

HERITAGE COMMERCE CORP

(Exact name of registrant as specified in its charter)

|

California |

|

000-23877 |

|

77-0469558 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification

No.) |

|

150 Almaden Boulevard, San Jose, California |

|

95113 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (408) 947-6900

|

Not Applicable |

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

x Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8. Other Events

Heritage Commerce Corp, the holding company (the “Company”) for Heritage Bank of Commerce, is scheduled to present at Keefe, Bruyette & Woods 2015 Community Bank Investor Conference at the The Grand Hyatt Grand Central in New York, New York. Walter T. Kaczmarek, President and Chief Executive Officer, is scheduled to present on Tuesday, July 28, 2015 at 5:30 a.m. PDT. The presentation will be archived for 90 days after the conference, and can be viewed at

http://wsw.com/webcast/kbw29/htbk.

A copy of the information in the slide presentation is included as Exhibit 99.2. This Form 8-K and the information included as exhibits shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended (“Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing. The furnishing of the information in this report is not intended to, and does not, constitute a determination or admission by the Company that the information in this report is material or complete, or that investors should consider this information before making an investment decision with respect to any security of the Registrant or any of its affiliates. The information in the materials is presented as of June 30, 2015, and the Company does not assume any obligations to update such information in the future.

Item 9.01 Financial statements and exhibits.

D) Exhibits

99.1 Slide presentation to investors to be presented on July 28, 2015 by the registrant’s President and Chief Executive Officer.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: July 27, 2015

Heritage Commerce Corp

By: /s/ Lawrence D. McGovern

Name: Lawrence D. McGovern

Executive Vice President and Chief Financial Officer

Index to Exhibits

|

Exhibit No. |

Description |

|

|

|

|

99.1 |

The Company’s presentation to investors to be presented on July 28, 2015 by the registrant’s President and Chief Executive Officer. |

Exhibit 99.1

|

|

Keefe, Bruyette & Woods 2015 Community Bank Investor Conference July 28 - 29, 2015 |

|

|

Forward Looking Statement Disclaimer Forward-looking statements are based on management’s knowledge and belief as of today and include information concerning the Heritage Commerce Corp’s, the holding company (“HCC”) for Heritage Bank of Commerce, possible or assumed future financial condition, and its results of operations, business and earnings outlook. These forward-looking statements are subject to risks and uncertainties. For a discussion of factors which could cause results to differ, please see HCC’s reports on Forms 10-K and 10-Q as filed with the Securities and Exchange Commission and HCC’s press releases. Readers should not place undue reliance on the forward-looking statements, which reflect management's view only as of the date hereof. HCC undertakes no obligation to publicly revise these forward-looking statements to reflect subsequent events or circumstances. Additional information about the Focus Business Bank Merger and where to find it In connection with the proposed merger with Focus Business Bank (“Focus”), HCC has filed with the United States Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 to register the shares of HCC common stock to be issued to the shareholders of Focus in the merger. The registration statement includes a proxy statement/prospectus of each of HCC and Focus has been sent to the shareholders of Focus and HCC seeking their approval of the merger and related matters in addition to other matters. In addition, HCC and Focus may file other relevant documents concerning the proposed merger with the SEC. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Shareholders of Focus and HCC are urged to read the registration statement on Form S-4 and the proxy statement/prospectus included within the registration statement and any other relevant documents to be filed with the SEC in connection with the proposed merger because they will contain important information about HCC, Heritage Bank of Commerce, Focus and the proposed transaction. Investors and shareholders may obtain free copies of these documents through the website maintained by the SEC at www.sec.gov. Free copies of the proxy statement/prospectus also may be obtained when it becomes available by directing a request by telephone or mail to Heritage Commerce Corp 150 Almaden Boulevard, San Jose, California, 95113, Attn: Corporate Secretary, telephone (408) 947-6900, or by accessing HCC’s website at www.heritagecommercecorp.com under “Investor Relations,” or by directing a request by telephone or mail to Focus Business Bank, 10 Almaden Boulevard, Suite 150, San Jose, California 95113, Attn: Investor Relations, telephone (408) 288-5900, or by accessing Focus’s website at www.focusbusinessbank.com under “Investor Relations.” The information on HCC’s website or Focus’s website is not, and shall not be deemed to be, a part of this filing or incorporated into other filings it makes with the SEC. 2 |

|

|

Heritage Commerce Corp Strategy Build a significant community business bank in Northern California (primarily the San Francisco Bay Area) Providing a diversified mix of lending and deposit products oriented to small to medium sized privately held companies and their owners and to professionals Delivering our products and services through full-service offices located in key communities in Northern California (primarily the San Francisco Bay Area) Building the franchise through: Organic growth New loan team de novo office locations Acquisitions 3 |

|

|

Heritage Bank Profile Relationship Banking A community business bank founded in 1994 headquartered in San Jose, California that offers a full range of banking services to small and medium sized businesses and their owners, managers and employees using a relationship banking approach Core Clientele Small to medium sized closely held businesses Professionals High net worth individuals Specialty Expertise SBA lending and loan sales Corporate finance/asset-based lending Cash management Non-profit organizations, education, and churches Construction lending Factoring Well-positioned in three affluent counties of San Francisco Bay Area Heritage Bank of Commerce ranks fifth in deposit market share amongst Independent Community Banks headquartered in the San Francisco Bay Area(1) (1) Market refers to Alameda, Contra Costa, Marin, San Francisco, San Mateo, and Santa Clara counties. Source: FDIC, Summary of Deposits as of June 30, 2014. 4 |

|

|

Experienced Management Team Regional Line Managers average over 20 years of experience in market(1) (1) Market refers to Alameda, Contra Costa, and Santa Clara counties 5 Years at Years of Banking Name Position HTBK Experience Walter T. Kaczmarek President & CEO 10 34 Keith A. Wilton EVP / Chief Operating Officer 1 33 Michael E. Benito EVP / Business Banking Division 11 29 Lawrence D. McGovern EVP / Chief Financial Officer 17 32 David E. Porter EVP / Chief Credit Officer 3 40 Debbie K. Reuter EVP / Chief Risk Officer 20 39 |

|

|

Located in the Economically Vibrant San Francisco Bay Area 6 Projected Projected 2015 5-Yr 5-Yr Median Household Population Household Income County Population Growth Income Growth Santa Clara 1,896,736 5.79% $ 93,827 8.10% Alameda 1,605,167 5.68% 72,465 7.36% Contra Costa 1,109,179 5.34% 76,218 5.84% San Francisco 849,774 5.21% 75,910 9.25% San Mateo 758,900 5.27% 89,434 10.24% Marin 260,082 3.55% 92,999 9.16% San Benito 58,563 5.47% 65,781 3.12% California 38,822,536 4.34% 60,244 3.56% National 319,459,991 3.52% 53,706 6.68% Source: SNL as of 12/31/14 |

|

|

Key Events 2014 Acquisition of Bay View Funding on November 1, 2014 30 year old factoring company with strong managerial experience As of June 30, 2015, we have $42.3 million of factored receivables 2015 Announced Merger Agreement with Focus Business Bank on April 23, 2015. All stock merger: 8 year old financial institution Single branch located 2 blocks from the HTBK San Jose headquarters Focus has approximately $400 million of assets as of 12/31/14 Focus has approximately $342 million of core deposits as of 12/31/14 7 |

|

|

Focus Snapshot - The Opportunity Strong geographic and strategic fit Consolidating branch, enhancing presence in Santa Clara County Positions HTBK to be the last independent community bank headquartered in San Jose, CA HTBK Branch FCSB Branch 2 Blocks Apart 8 Source: SNL Financial and Company Reports |

|

|

Focus Snapshot - Strategic Rationale Strategic, financial, and cultural fit with a similar small to middle-market business banking focus in San Jose and the San Francisco Bay Area Combines two leading commercial banking franchises headquartered in San Jose, resulting in more than $2 billion in combined assets with like minded community focus Additive to Key Lines of Business Business Banking Preferred SBA Lender Not-for-profit Sector Homeowner Association Services Operational leverage Efficiency Liquidity Capital 9 |

|

|

Focus Snapshot - Transaction Rationale Valuable low-cost core deposit franchise Core deposits of $342 million(1) (94.6% of total deposits) Noninterest bearing deposits of $95 million(1) (26.3% of total deposits) Q4 2014 cost of deposits – 18bps Focus adds $182 million in loans(1) Financially Attractive Accretive to EPS in the first full year after close and conversion Significant cost savings and operational synergies due to branch overlap Relatively Low Execution Risk (1) Actual as of 12/31/2014; Core deposits = total deposits less CDs > $100,000 10 |

|

|

Current Heritage Snapshot – 11 Branches (Pre-close of Focus Merger) (1)For the quarter ended 6/30/15 (2)Before dividends on preferred stock 11 Financial Highlights 6/30/15 n Total Assets $ 1.7 billion n Total Loans $ 1.1 billion n Total Deposits $ 1.4 billion n Total Shareholders' Equity $ 187 million n Tangible Equity $ 171 million n TE/Tangible Assets 10.3% n Total RBC Ratio 13.0% n Loans/Deposits 78.3% n Net Interest Margin(TEY)(1) 4.66% n Efficiency Ratio(1) 63.70% n 2Q'15 Net Income(1)(2) $ 4.5 million n Quarterly Common Stock Dividend $ 0.08 per share |

|

|

Market Share Ranks fifth amongst Independent Community Banks headquartered in the San Francisco Bay Area(1) (1) San Francisco Bay Area refers to Alameda, Contra Costa, Marin, San Francisco, San Mateo, and Santa Clara counties. Source: FDIC, Summary of Deposits as of June 30, 2014. 12 Top Regional Banks Deposits 2014 Branch in Bay Area(1) Rank Bank Count ($000) 1 Mechanics Bank 24 2,623,910 2 Fremont Bank 18 2,271,865 3 Bridge Bank, NA 1 1,442,892 4 Bank of Marin 16 1,410,880 5 Heritage Bank of Commerce 11 1,281,617 6 First National Bank of Northern California 12 791,148 7 Pacific Coast Banker's Bank 1 491,209 8 Avidbank 1 427,933 9 Presidio Bank 4 409,405 10 Bank of the Orient 7 341,924 11 Focus Business Bank 1 340,429 Top National Franchises Deposits 2014 Branch in Bay Area(1) Rank Bank Count ($000) 1 Wells Fargo Bank, NA 229 88,739,437 2 Silicon Valley Bank 4 25,848,709 3 JPMorgan Chase Bank, NA 208 22,620,198 4 Citibank, NA 117 20,679,496 5 First Republic Bank 33 18,359,284 Totals for Market(1) Deposits Branch in Bay Area(1) Count ($000) 1,449 406,160,115 |

|

|

Operating Performance (in $000’s) 13 For the Periods Ended: YTD YTD 2Q 2015 2Q 2014 % Change 6/30/2015 6/30/2014 % Change Net Interest Income $17,642 $13,685 29% $34,500 $27,019 28% Provision (Credit) for Loan Losses 22 (198) 111% (38) (208) 82% Net Interest Income after Provision for Loan Losses 17,620 13,883 27% 34,538 27,227 27% Noninterest Income 2,164 2,047 6% 4,090 4,064 1% Noninterest Expense 12,617 10,769 17% 24,893 21,315 17% Income Before Income Taxes 7,167 5,161 39% 13,735 9,976 38% Income Tax Expense 2,690 1,837 46% 5,120 3,576 43% Net Income (Before dividends on preferred stock) $4,477 $3,324 35% $8,615 $6,400 35% Efficiency Ratio 63.70% 68.45% -7% 64.51% 68.57% -6% |

|

|

Financial Highlights (in $000’s) 14 For the Periods Ended: 06/30/15 06/30/14 % Change n Total Assets $ 1,680,206 $ 1,480,619 13% n Total Loans $ 1,133,603 $ 990,341 14% n Core Deposits $ 1,246,101 $ 1,061,438 17% n Total Deposits $ 1,447,137 $ 1,267,848 14% |

|

|

Strong Deposit Base (in $000’s) 15 Balance % of Total Demand, noninterest-bearing $ 574,210 39.7% Demand, interest-bearing 235,922 16.3% Savings and money market 380,398 26.3% Time deposits - under $250 55,571 3.8% Core Deposits 1,246,101 86.1% Time deposits - $250 and over 160,106 11.1% Time deposits - brokered 26,139 1.8% CDARS - money market and time deposits 14,791 1.0% Total $ 1,447,137 100.0% |

|

|

Diversified Loan Portfolio (in $000’s) 16 Balance % of Total Commercial $471,651 41.6% CRE - Owner Occupied 245,377 21.6% CRE - Investor/Other 263,120 23.2% Land & Construction 68,666 6.1% Equity Lines 71,579 6.3% Consumer & Other 13,210 1.2% Total $1,133,603 100.0% |

|

|

Net Interest Margin Trend (TEY) 17 |

|

|

Solid Credit Quality Metrics (in $000’s) 18 Selected Ratios for 2Q15 Balance at 2Q15 (in $000's) 1. NPA's/Total Assets = 0.31% 1. Classified Assets(1) $11,168 2. ALLL/ NPL's = 388.18% 2. NPA's $5,253 3. ALLL $18,757 (1) net of SBA guarantees |

|

|

Positioned for Growth Small to medium size business customer relationship focus Competitive loan and cash management products catering to businesses Highly experienced management team throughout the company 20+ years experience of Regional Managers in market Solid credit quality at 2Q 2015 0.31% nonperforming assets to total assets Balanced loan portfolio with real estate well under all regulatory guidelines 19 |

|

|

Positioned for Growth (continued) Excellent capital and liquidity at 2Q 2015 13.0% total risk-based capital ratio under Basel III 78.33% loan to deposit ratio Quarterly common dividend at $0.08 per share in the second quarter of 2015 Profitable operations 20 consecutive quarters of profitability Solid loan & deposit growth Good locations and markets with solid market share among community banks 11 branch locations Fifth in deposit market share amongst independent community banks(1) San Francisco and San Jose combined MSA’s are second in the state of California in households with income greater than $200,000 (1) Market refers to Alameda, Contra Costa, Marin, San Francisco, San Mateo, and Santa Clara counties. Source: FDIC, Summary of Deposits as of June 30, 2014. 20 |

|

|

Contact Information Walter T. Kaczmarek President and Chief Executive Officer 408.494.4500 Keith A. Wilton Executive Vice President Chief Operating Officer 408.494.4534 Michael E. Benito Executive Vice President Business Banking Division 408.792.4085 Lawrence D. McGovern Executive Vice President Chief Financial Officer 408.494.4562 David E. Porter Executive Vice President Chief Credit Officer 408.792.4029 Debbie K. Reuter Executive Vice President Chief Risk Officer & Corporate Secretary 408.494.4542 21 Corporate Headquarters 150 Almaden Boulevard San Jose, CA 95113 NASDAQ: HTBK |

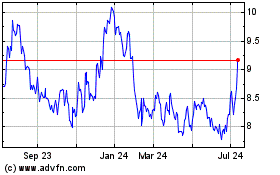

Heritage Commerce (NASDAQ:HTBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

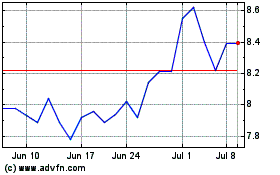

Heritage Commerce (NASDAQ:HTBK)

Historical Stock Chart

From Apr 2023 to Apr 2024