Fed Targets Banks Over 'Amend-And-Pretend' Loans

April 14 2010 - 4:36PM

Dow Jones News

The Federal Reserve is taking aim at a banking practice known as

"amend and pretend."

That's what bankers call the desperate strategy of extending or

restructuring failing loans that are likely to eventually fail

anyway, usually to delay the reckoning of hefty losses.

Of the Federal Reserve's public enforcement actions against

banks this year, more than a third, or 22, include provisions that

strictly limit the banks' ability to change loan terms for troubled

borrowers without first getting approval from the banks' boards of

directors. The regulatory agreements also note the Fed's specific

concerns about restructured loans to bank insiders.

First Banks Inc. in Clayton, Mo., is one notable example of the

recent Fed enforcement actions.

Less than two years ago, the U.S. Treasury used its Troubled

Asset Relief Program, or TARP, to give the bank some $295 million

in government funds--or more TARP funds than any other privately

held bank. At least four other banks that received TARP funds are

subject to the recent Fed actions.

Troubled TARP banks carry a tandem of risks for U.S. banking

regulators, since failures can drain the government's deposit

insurance fund, and also turn government investments in banks into

losses.

In early April, the Federal Reserve disclosed First Banks had

signed an enforcement action in which the Fed mandated First Banks

and its affiliates "shall not...extend, renew or restructure any"

of the bank's troubled loans "without the prior approval of a

majority of the full board of directors."

Terrance McCarthy, First Banks chief executive, said: "The

language in the provision...is almost identical to what was used by

regulators 20 years ago" during the last banking crisis. "We don't

consider it a limitation." He added, "Banks are not prohibited from

extending problem loans if it's in the interest of the bank for the

best collection of the loan."

First Banks' agreement with regulators marks the latest chapter

in the bank's rise-and-stumble trip through the credit bubble and

financial crisis.

During 2005 to 2007, the bank expanded in California, Florida

and Illinois--now three hotbeds of the banking crisis--and also

made big bets on commercial real-estate loans. The bank did well

for a while, producing profit of $112 million in 2006.

Early last year, in a letter to TARP Inspector General Neil

Barofsky, McCarthy said the bank had renewed $157.8 million in

construction loans in January and February of 2009.

But by the end of last year, First Banks faced piles of failing

loans. The bank lost $449 million in 2009--or about four years'

worth of boom-time profits. In last year's fourth quarter, First

Banks took $122 million in losses just from loans tied to

construction projects.

Asked about the renewals, McCarthy said: "We regularly extend

loans where there's a prudent course to do so. You'll find that at

any bank working their way through the cycle."

The Federal Reserve has signed similar agreements with four

other banks that received TARP. They are Heritage Commerce Corp.

(HTBK), which received $40 million; Bankers' Bank of the West

Bancorp Inc., which received $13 million; Idaho Bancorp (IDBC),

which received $7 million; and Rising Sun Bancorp, which received

$6 million.

The banks didn't have any immediate comment.

It can be nearly impossible to see from publicly available data

which banks are extending or restructuring loans they believe will

one day fail anyway. But bankers are privately adamant that many

struggling banks are using amend-and-pretend strategies to delay

coming losses, especially from commercial real-estate loans.

Extending highly distressed loans can have two significant

effects in the broader banking system. First, extending troubled

loans can conceal coming losses and lead to costlier bank failures

that strain deposit insurance funds at the Federal Deposit

Insurance Corp.

But lenders also risk becoming "zombie banks" when they extend

or restructure too many failing loans. That's because when lenders

know they're at high risk of loss, they have little incentive to

make new, sounder loans, since they know they'll eventually need

their capital to offset losses.

-By Marshall Eckblad, Dow Jones Newswires; 212-416-2156;

marshall.eckblad@dowjones.com

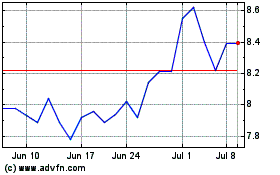

Heritage Commerce (NASDAQ:HTBK)

Historical Stock Chart

From Mar 2024 to Apr 2024

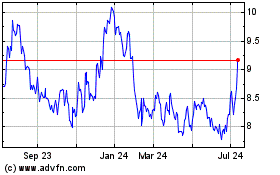

Heritage Commerce (NASDAQ:HTBK)

Historical Stock Chart

From Apr 2023 to Apr 2024