Amended Tender Offer Statement by Issuer (sc To-i/a)

December 15 2016 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. 1)

HOLOGIC, INC.

(Name of Subject Company (Issuer) and Filing Person (Issuer))

2.00% Convertible Exchange Senior Notes due 2037

(Title of Class of Securities)

436440 AB7

(CUSIP Number

of Class of Securities)

John M. Griffin

General

Counsel

Hologic, Inc.

250 Campus Drive, Marlborough, MA 01752

Tel: (508) 263-2900

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

Copies to:

Philip J. Flink, Esquire

Brown Rudnick LLP

One

Financial Center

Boston, MA 02111

CALCULATION

OF FILING FEE

|

|

|

|

|

Transaction Valuation*

|

|

Amount of Filing Fee**

|

|

$8,520,360

|

|

$987.51

|

|

*

|

Calculated solely for purposes of determining the filing fee. The purchase price of the 2.00% Convertible Exchange Senior Notes due 2037 issued November 23, 2010 (the “

Notes

”), as described herein,

is 100% of the original principal amount of the Notes plus any accrued but unpaid interest thereon. As of November 9, 2016, there was $8,436,000 aggregate principal amount of Notes outstanding and, as of the date of repurchase, if all

outstanding Notes were submitted for repurchase, there would be $84,360 of accrued and unpaid interest on the Notes, resulting in an aggregate maximum purchase price of $8,520,360.

|

|

**

|

The amount of the filing fee was calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, and equals $115.90 for each $1,000,000 of the value of the transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $987.51

|

|

Filing Party: Hologic, Inc.

|

|

Form or Registration No.: Schedule TO

|

|

Date Filed: November 9, 2016

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule 14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

|

☐

|

going-private transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ☒

INTRODUCTORY STATEMENT

This Amendment No. 1 (“

Amendment No. 1

”) amends and supplements the Tender Offer Statement on Schedule TO originally filed with the

Securities and Exchange Commission (“

SEC

”) on November 9, 2016 (the “

Schedule TO

”) by Hologic, Inc., a Delaware corporation (the “

Company

”). The Schedule TO relates to the right of each holder

(each a “

Holder

”) of the Company’s 2.00% Convertible Exchange Senior Notes due 2037 issued November 23, 2010 (the “

Notes

”) to require the Company to repurchase the Notes upon the terms and subject to the

conditions set forth in the Indenture (as defined below), the Notes, and the Company’s Put Right Notice to Holders of 2.00% Convertible Exchange Senior Notes due 2037, dated November 9, 2016, filed as an exhibit to the Schedule TO (the

“

Put Right Notice

”). The right of a Holder to require the Company to repurchase the Notes, as described in the Put Right Notice, is referred to as the “

Put Option

.”

The Notes were issued under an Indenture, dated as of December 10, 2007 (the “

Base Indenture

”), by and between the Company, as issuer,

and Wilmington Trust Company, as trustee (the “

Trustee

”), as supplemented by the Second Supplemental Indenture, dated as of November 23, 2010 (the “

Supplemental Indenture

,” and together with the Base Indenture,

the “

Indenture

”), by and between the Company and the Trustee.

This Amendment No. 1 includes only the items in the Schedule TO that

are being amended. Unaffected items are not included herein. Except as specifically set forth herein, this Amendment No. 1 does not modify any of the information previously reported in the Schedule TO. Capitalized terms used but not defined

herein have the respective meanings given to such terms in the Put Right Notice. You should read this Amendment No. 1 together with the Schedule TO and the exhibits thereto and hereto.

This Amendment No. 1 constitutes the final amendment pursuant to Rule 13e-4(c)(4) under the Securities Exchange Act of 1934, as amended.

The Put Option expired at 5:00 p.m., New York City time, on Wednesday, December 14, 2016 (the “

Expiration Date

”). Based on final

information provided to the Company by the Trustee, no Notes were validly surrendered for repurchase.

Any Notes not submitted for conversion prior to the

Conversion Deadline (5:00 p.m., New York City time, on Friday, December 16, 2016) will be redeemed by the Company on December 19, 2016 (the “

Redemption Date

”) pursuant to the terms of the Indenture, the Notes and the

Company’s Notice of Redemption to Holders of 2.00% Convertible Exchange Senior Notes due 2037, dated November 9, 2016. Following the Redemption Date, no Notes will remain outstanding.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

(a)(1)(A)

|

|

Put Right Notice to Holders of 2.00% Convertible Exchange Senior Notes due 2037, dated November 9, 2016, including form of Optional Put Repurchase Notice (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(a)(1)(B)

|

|

IRS Form W-9 (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(a)(5)

|

|

Press Release issued by the Company on November 9, 2016 (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

(d)(1)

|

|

Indenture, dated as of December 10, 2007, by and between the Company and the Trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on December 10, 2007).

|

|

|

|

|

(d)(2)

|

|

Second Supplemental Indenture, dated as of November 23, 2010, by and between the Company and the Trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on November 18,

2010).

|

|

|

|

|

(d)(3)

|

|

Notice of Redemption to Holders of 2.00% Convertible Exchange Senior Notes due 2037, dated November 9, 2016 (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

(h)

|

|

Not applicable.

|

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

HOLOGIC, INC.

|

|

|

|

|

By:

|

|

/s/ Robert W. McMahon

|

|

Name:

|

|

Robert W. McMahon

|

|

Title:

|

|

Chief Financial Officer

|

|

|

|

|

Date:

|

|

December 15, 2016

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

(a)(1)(A)

|

|

Put Right Notice to Holders of 2.00% Convertible Exchange Senior Notes due 2037, dated November 9, 2016, including form of Optional Put Repurchase Notice (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(a)(1)(B)

|

|

IRS Form W-9 (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(a)(5)

|

|

Press Release issued by the Company on November 9, 2016 (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

(d)(1)

|

|

Indenture, dated as of December 10, 2007, by and between the Company and the Trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on December 10, 2007).

|

|

|

|

|

(d)(2)

|

|

Second Supplemental Indenture, dated as of November 23, 2010, by and between the Company and the Trustee (incorporated by reference to Exhibit 4.1 to the Company’s Current Report on Form 8-K filed on November 18,

2020).

|

|

|

|

|

(d)(3)

|

|

Notice of Redemption to Holders of 2.00% Convertible Exchange Senior Notes due 2037, dated November 9, 2016 (previously filed with the Schedule TO on November 9, 2016).

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

(h)

|

|

Not applicable.

|

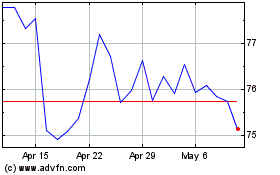

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Apr 2023 to Apr 2024