Current Report Filing (8-k)

June 19 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported) June 18, 2015

HOLOGIC, INC.

(Exact Name of Registrant as Specified

in Its Charter)

DELAWARE

(State or Other Jurisdiction of Incorporation)

| |

|

|

| 1-36214 |

|

04-2902449 |

| (Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

| 35 Crosby Drive, Bedford, MA |

|

01730 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(781) 999-7300

(Registrant’s Telephone Number,

Including Area Code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events.

On June 18, 2015, Hologic, Inc. (Hologic or the Company) issued

a press release announcing that the Company has priced its previously announced private offering of $1.0 billion aggregate principal

amount of 5.250 % senior notes due 2022 (the "Offering").

A copy of the press release announcing the pricing of the Offering

is filed herewith as Exhibit 99.1 and is incorporated herein by reference.

Cautionary Note Regarding Forward-Looking Statements. Except

for historical information contained in the press release attached as Exhibit 99.1 hereto, the press release contains forward-looking

statements that involve certain risks and uncertainties that could cause actual results to differ materially from those expressed

or implied by these statements. Please refer to the cautionary notes in the press release regarding these forward-looking statements.

Item 9.01. Financial Statements and Exhibits.

Exhibit

Number |

|

Description |

| 99.1 |

|

Press Release issued by Hologic, Inc. on June 18, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

| Date: June 18, 2015 |

|

HOLOGIC, INC. |

| |

|

|

| |

|

By: |

|

/s/ Robert W. McMahon

|

| |

|

|

|

Robert W. McMahon |

| |

|

|

|

Chief Financial Officer |

Exhibit

99.1

Hologic Announces Pricing of Offering of $1.0 Billion Aggregate Principal Amount of 5.250% Senior Notes Due 2022

BEDFORD, Mass., June 18, 2015 /PRNewswire/ -- Hologic, Inc. (NASDAQ: HOLX) announced today that it has priced its previously announced private offering of $1.0 billion aggregate principal amount of 5.250% senior notes due 2022 at an issue price of $1,000 per $1,000. The 2022 notes will be unsecured obligations of the Company and will be guaranteed by certain of its direct and indirect subsidiaries. The offering is expected to close on July 2, 2015, subject to customary closing conditions.

Hologic intends to use the net proceeds of the offering, plus available cash, to redeem its outstanding 6.25% senior notes due 2020 in the aggregate

principal amount of $1.0 billion.

The 2022 notes will not be registered under the Securities Act of 1933, as amended, or any state securities laws. Unless so registered, the securities may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws. The 2022 notes are being offered only to qualified institutional buyers in reliance on Rule 144A under the Securities Act, and outside the United States in accordance with Regulation S under the Securities Act.

This press release is neither an offer to sell nor a solicitation of an offer to buy any of these securities, nor shall there be any offer, solicitation or sale of these securities in any jurisdiction where the offer, solicitation or sale is not permitted. This press release

shall not constitute a notice of redemption with respect to the 6.25% senior notes due 2020.

Forward-Looking Statements

This press release contains forward-looking information that involves risks and uncertainties, including statements about the Company's plans, objectives, expectations and intentions. Such statements include, without limitation, the Company's intention to issue the 2022 notes and the use of proceeds of the offering. These forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. The offering may also be adversely affected by prevailing credit markets, which have been subject to significant volatility, or adverse changes to Hologic's business or prospects. Hologic cannot assure it will complete the issuance of

the 2022 notes, on favorable terms, if at all. The risks included above are not exhaustive. Other factors that could adversely affect the Company's business and prospects are described in the filings made by Hologic with the SEC. Hologic expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements presented herein to reflect any change in expectations or any change in events, conditions or circumstances on which any such statements are based.

Contact

Michael Watts

Vice President, Investor Relations and

Corporate Communications

(858) 410-8588

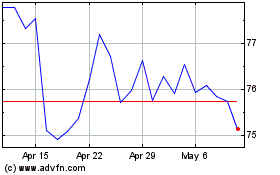

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Apr 2023 to Apr 2024