UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported) January 28, 2015

HOLOGIC, INC.

(Exact Name of Registrant as Specified

in Its Charter)

DELAWARE

(State or Other Jurisdiction of Incorporation)

| 1-36214 |

|

04-2902449 |

| (Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 35 Crosby Drive, Bedford, MA |

|

01730 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(781) 999-7300

(Registrant’s Telephone Number,

Including Area Code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On January 28, 2015, Hologic, Inc. issued

a press release announcing its financial results for the first quarter ended December 27, 2014. A copy of the press release is

attached hereto as Exhibit 99.1 and is incorporated herein in its entirety by reference.

Limitation on

Incorporation by Reference. The information furnished in this Item 2.02, including the press release attached

hereto as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such

information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act

except as set forth by specific reference in such a filing.

Cautionary Note

Regarding Forward-Looking Statements. Except for historical information contained in the press release attached as an exhibit

hereto, the press release contains forward-looking statements that involve certain risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by these statements. Please refer to the cautionary note in the press

release regarding these forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

Number |

|

Description |

| 99.1 |

|

Press release dated January 28, 2015 of Hologic, Inc.

announcing its financial results for the first quarter ended December 27, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: January 28, 2015 |

|

HOLOGIC, INC. |

| |

|

|

| |

|

By: |

/s/ Robert W. McMahon |

| |

|

|

Robert W. McMahon |

| |

|

|

Chief Financial Officer |

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

| 99.1 |

|

Press release dated January 28, 2015 of Hologic, Inc. announcing its financial results for the first quarter ended December 27, 2014. |

Hologic Announces Financial Results for

First Quarter Fiscal 2015

– Revenues Increase 6.6% to $652.8

Million –

– Company Records GAAP EPS of $0.10,

Non-GAAP EPS of $0.39 –

– Company Raises Full-Year Revenue

and Earnings Guidance –

Bedford, Mass. (January 28, 2015) – Hologic, Inc.

(NASDAQ: HOLX) announced today the Company’s financial results for the first fiscal quarter ended December 27, 2014.

Revenues for the quarter were $652.8 million, an increase of

6.6% compared to the prior year period. On a constant currency basis, revenues increased 7.7%. Revenues grew in all four business

segments:

| $s in millions |

Total

Revenues |

Change

(As Reported) |

Change

(Constant Currency) |

| Diagnostics |

$304.1 |

6.4% |

7.4% |

| Breast Health |

$242.0 |

6.9% |

8.2% |

| GYN Surgical |

$84.4 |

7.0% |

7.9% |

| Skeletal Health |

$22.3 |

4.5% |

6.1% |

| Total |

$652.8 |

6.6% |

7.7% |

GAAP net income was $29.2 million in the quarter, compared to

a net loss of ($5.3 million) in the prior year period. Non-GAAP net income of $111.6 million increased by 18.6% and represented

17.1% of revenues, compared to 15.4% of revenues in the prior year period.

GAAP earnings per share (EPS) were $0.10 on a fully diluted

basis in the quarter, compared to a net loss per diluted share of ($0.02) in the prior year period. Non-GAAP EPS were $0.39 on

a fully diluted basis in the quarter, an increase of 15.4% compared to the prior year period.

“We posted strong organic revenue and earnings growth

across the board in the first quarter,” said Steve MacMillan, Hologic’s President and Chief Executive Officer. “We

are pleased with the pace of progress we have made, as we recorded our fourth consecutive quarter of sequential revenue growth,

and our best quarterly growth rate in a number of years. While we realize there is still work to do, this quarter’s results

show that great products, great people, and new leadership are coming together in a powerful way at the Company. As a result, we

are raising our financial outlook for the year.”

Revenue Detail

In this section, all revenues are on a reported basis for the

first quarter of fiscal 2015, and are compared to the prior year period.

Diagnostics revenues of $304.1 million increased 6.4%. This

increase was driven by a 26.3% increase in blood screening revenue from our partner Grifols, mainly from new business with the

Japanese Red Cross, and by a 5.6% increase in molecular diagnostics revenue, mainly from the Aptima® product line. Revenue

from cytology and perinatal products declined by 1.2%, a lower rate of decline than in recent quarters.

Breast Health revenues of $242.0 million grew 6.9%. This increase

was primarily driven by a 10.9% increase in breast imaging and service revenue, as customers continued to adopt Hologic 3D mammographyTM,

while interventional breast revenue declined 2.3%.

GYN Surgical revenues of $84.4 million grew 7.0%, driven by

a 27.4% increase in MyoSure system sales. NovaSure system sales also increased 0.1% in the quarter, an improvement compared to

the declines seen in recent quarters.

Skeletal Health revenues of $22.3 million grew 4.5%, primarily

driven by increased sales of the Company’s new HorizonTM bone densitometry system.

Balance Sheet and Cash Flows

Hologic continues to focus on reducing its debt. Total debt

outstanding at quarter-end was $3,954.8 million, a $312.9 million decrease from the end of fiscal 2014 that resulted primarily

from a $300 million voluntary pre-payment of the Term Loan B facility in December. The Company ended the first fiscal quarter with

cash and equivalents of $549.1 million.

Adjusted non-GAAP earnings before interest, taxes, depreciation

and amortization (EBITDA) were $233.1 million in the quarter. Operating cash flow was $153.5 million, while free cash flow, defined

as operating cash flow less capital expenditures, was $132.4 million.

Updated Financial Guidance

Based on the Company’s strong performance in the first

quarter of fiscal 2015, Hologic is raising its full year 2015 revenue and non-GAAP EPS guidance, as shown in the table below. The

guidance for reported results is based on recent foreign exchange rates. Percentage changes from the prior year exclude one-time

benefits associated with the restructuring of the Roka license, which totaled $20.1 million of revenue and $0.05 of EPS in 2014.

| |

Initial Guidance

From 11/5/14 |

Updated Guidance |

Change vs. Prior Year

(As Reported) |

Change vs. Prior Year

(Constant Currency) |

| Revenues |

$2.54 to $2.57 billion |

$2.57 to $2.60 billion |

2.4% to 3.6% |

4.4% to 5.6% |

| Non-GAAP EPS |

$1.50 to $1.54 |

$1.54 to $1.57 |

5.5% to 7.5% |

8.9% to 11.0% |

Since the Company provided its initial financial guidance on

November 5, 2014, the US dollar has strengthened significantly. If the US dollar were at the same level today as it was in early

November, the Company’s updated revenue guidance would have been approximately $25 million higher, and its updated EPS guidance

would have been approximately $0.02 higher.

For the second quarter of fiscal 2015, the Company now expects:

| |

Guidance |

Change vs. Prior Year Period (As Reported) |

Change vs. Prior Year Period (Constant Currency) |

| Revenues |

$640 to $650 million |

2.4% to 4.0% |

4.5% to 6.1% |

| Non-GAAP EPS |

$0.38 to $0.39 |

2.7% to 5.4% |

5.5% to 8.0% |

Use of Non-GAAP Financial Measures

The Company has presented the following non-GAAP financial measures

in this press release: constant currency revenues; net income; EPS; and adjusted EBITDA. The Company defines adjusted EBITDA as

its non-GAAP net income plus net interest expense, income taxes, and depreciation and amortization expense included in its non-GAAP

net income. The Company defines its non-GAAP net income and EPS to exclude: (i) the amortization of intangible assets and impairment

of goodwill and intangible assets; (ii) acquisition-related charges and effects, such as charges for contingent consideration,

transaction costs, integration costs including retention, and credits and/or charges associated with the write-up of acquired inventory

and fixed assets to fair value; (iii) non-cash interest expense related to amortization of the debt discount from the equity conversion

option of the convertible debt securities; (iv) restructuring and divestiture charges; (v) debt extinguishment losses and related

transaction costs; (vi) litigation settlement charges (benefits); (vii) other-than-temporary impairment losses on investments;

(viii) other one-time, nonrecurring, unusual or infrequent charges, expenses or gains that may not be indicative of the Company’s

core business results; and (ix) income taxes related to such adjustments.

The Company believes the use of non-GAAP financial measures

is useful to investors by eliminating certain of the more significant effects of its acquisitions and related activities, non-cash

charges resulting from the application of GAAP to convertible debt instruments with cash settlement features, charges related to

debt extinguishment losses, investment impairments, litigation settlements, and restructuring and divestiture initiatives. These

non-GAAP measures also reflect how Hologic manages its businesses internally. In addition to the adjustments set forth in the calculation

of the Company’s non-GAAP net income and EPS, its adjusted EBITDA eliminates the effects of financing, income taxes and the

accounting effects of capital spending. As with the items eliminated in its calculation of non-GAAP net income, these items may

vary for different companies for reasons unrelated to the overall operating performance of a company’s business. When analyzing

the Company’s operating performance, investors should not consider these non-GAAP financial measures as a substitute for

net income prepared in accordance with GAAP.

Future Non-GAAP Adjustments

Future GAAP EPS may be affected by changes in ongoing assumptions

and judgments relating to the Company’s acquired businesses, and may also be affected by nonrecurring, unusual or unanticipated

charges, expenses or gains, which are excluded in the calculation of the Company’s non-GAAP EPS guidance as described in

this press release. It is therefore not practicable to reconcile non-GAAP EPS guidance to the most comparable GAAP measure.

Conference Call and Webcast

Hologic’s management will host a conference call at 4:30

p.m. ET today to discuss its first quarter fiscal 2015 operating results. Approximately 10 minutes before the call, dial 877-675-4750

(US and Canada) or 719-325-4801 (international) and enter access code 9937337. A replay will be available starting two hours after

the call ends through February 18, 2015, at 888-203-1112 or 719-457-0820 for international callers, access code 9937337. The Company

will also provide a live webcast of the call at www.investors.hologic.com/investors-overview. A PowerPoint presentation related

to the conference call will be posted to the same site.

About Hologic, Inc.

Hologic, Inc. is a leading developer, manufacturer and supplier

of premium diagnostic products, medical imaging systems and surgical products. The Company's core business units focus on

diagnostics, breast health, GYN surgical, and skeletal health. With a unified suite of technologies and a robust research

and development program, Hologic is dedicated to The Science of Sure. For more information on Hologic, visit www.hologic.com.

Hologic, Aptima, Horizon, MyoSure, NovaSure, The Science of

Sure, ThinPrep and associated logos are trademarks and/or registered trademarks of Hologic, Inc. and/or its subsidiaries in the

United States and/or other countries.

Forward-Looking Statements

This News Release contains forward-looking information that

involves risks and uncertainties, including statements about the Company’s plans, objectives, expectations and intentions.

Such statements include, without limitation: financial or other information included herein based upon or otherwise incorporating

judgments or estimates relating to future performance, events or expectations; the Company’s strategies, positioning, resources,

capabilities, and expectations for future performance; and the Company's outlook and financial and other guidance. These forward-looking

statements are based upon assumptions made by the Company as of the date hereof and are subject to known and unknown risks and

uncertainties that could cause actual results to differ materially from those anticipated.

Risks and uncertainties that could adversely affect the Company’s

business and prospects, and otherwise cause actual results to differ materially from those anticipated, include without limitation:

the ability of the Company to successfully manage leadership and organizational changes, including the ability of the Company to

attract, motivate and retain key employees; U.S., European and general worldwide economic conditions and related uncertainties;

the Company’s reliance on third-party reimbursement policies to support the sales and market acceptance of its products,

including the possible adverse impact of government regulation and changes in the availability and amount of reimbursement and

uncertainties for new products or product enhancements; uncertainties regarding healthcare reform legislation, including associated

tax provisions, or budget reduction or other cost containment efforts; changes in guidelines, recommendations and studies published

by various organizations that could affect the use of the Company’s products; uncertainties inherent in the development of

new products and the enhancement of existing products, including FDA approval and/or clearance and other regulatory risks, technical

risks, cost overruns and delays; the risk that products may contain undetected errors or defects or otherwise not perform as anticipated;

risks associated with strategic alliances and the ability of the Company to realize anticipated benefits of those alliances; risks

associated with acquisitions, including without limitation, the Company’s ability to successfully integrate acquired businesses,

the risks that the acquired businesses may not operate as effectively and efficiently as expected even if otherwise successfully

integrated, and the risks that acquisitions may involve unexpected costs or unexpected liabilities; the risks of conducting business

internationally; the risk of adverse exchange rate fluctuations on the Company’s international activities and businesses;

manufacturing risks, including the Company’s reliance on a single or limited source of supply for key components, and the

need to comply with especially high standards for the manufacture of many of its products; the Company’s ability to predict

accurately the demand for its products, and products under development, and to develop strategies to address its markets successfully;

the early stage of market development for certain of the Company’s products; the Company’s leverage risks, including

the Company’s obligation to meet payment obligations and financial covenants associated with its debt; risks related to the

use and protection of intellectual property; expenses, uncertainties and potential liabilities relating to litigation, including,

without limitation, commercial, intellectual property, employment and product liability litigation; technical innovations that

could render products marketed or under development by the Company obsolete; and competition.

The risks included above are not exhaustive. Other factors that

could adversely affect the Company's business and prospects are described in the filings made by the Company with the SEC. The

Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements presented

herein to reflect any change in expectations or any change in events, conditions or circumstances on which any such statements

are based.

Contact:

Michael Watts

Vice President, Investor Relations and

Corporate Communications

(858) 410-8588

HOLOGIC, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In millions, except number of shares, which are reflected in thousands, and per share data)

| | |

Three Months Ended | |

| | |

December 27, 2014 | | |

December 28, 2013 | |

| | |

| | |

| |

| Revenues: | |

| | | |

| | |

| Product | |

$ | 546.6 | | |

$ | 512.4 | |

| Service and other | |

| 106.2 | | |

| 100.1 | |

| Total revenues | |

| 652.8 | | |

| 612.5 | |

| | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | |

| Product | |

| 186.7 | | |

| 176.9 | |

| Amortization of intangible assets | |

| 73.9 | | |

| 76.7 | |

| Service and other | |

| 53.6 | | |

| 53.3 | |

| Total cost of revenues | |

| 314.2 | | |

| 306.9 | |

| | |

| | | |

| | |

| Gross profit | |

| 338.6 | | |

| 305.6 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 52.0 | | |

| 48.7 | |

| Selling and marketing | |

| 86.0 | | |

| 83.3 | |

| General and administrative | |

| 61.3 | | |

| 67.8 | |

| Amortization of intangible assets | |

| 27.8 | | |

| 26.2 | |

| Restructuring and divestiture charges | |

| 8.0 | | |

| 18.3 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 235.1 | | |

| 244.3 | |

| | |

| | | |

| | |

| Income from operations | |

| 103.5 | | |

| 61.3 | |

| | |

| | | |

| | |

| Other expense: | |

| | | |

| | |

| Interest expense | |

| (52.5 | ) | |

| (61.3 | ) |

| Other (expense) income, net | |

| (0.2 | ) | |

| 1.5 | |

| Debt extinguishment loss | |

| (6.7 | ) | |

| (2.9 | ) |

| Total other expense | |

| (59.4 | ) | |

| (62.7 | ) |

| | |

| | | |

| | |

| Income (loss) before income taxes | |

| 44.1 | | |

| (1.4 | ) |

| Provision for income taxes | |

| 14.9 | | |

| 3.9 | |

| | |

| | | |

| | |

| Net income (loss) | |

$ | 29.2 | | |

$ | (5.3 | ) |

| | |

| | | |

| | |

| Net income (loss) per common share: | |

| | | |

| | |

| Basic | |

$ | 0.10 | | |

$ | (0.02 | ) |

| Diluted | |

$ | 0.10 | | |

$ | (0.02 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding: | |

| | | |

| | |

| Basic | |

| 278,671 | | |

| 272,708 | |

| Diluted | |

| 283,176 | | |

| 272,708 | |

HOLOGIC, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In millions)

| | |

December 27, 2014 | | |

September 27, 2014 | |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 544.0 | | |

$ | 736.1 | |

| Restricted cash | |

| 5.1 | | |

| 5.5 | |

| Accounts receivable, net | |

| 400.5 | | |

| 396.0 | |

| Inventories | |

| 310.3 | | |

| 330.6 | |

| Deferred income taxes | |

| 39.0 | | |

| 39.4 | |

| Other current assets | |

| 37.7 | | |

| 58.2 | |

| Total current assets | |

| 1,336.6 | | |

| 1,565.8 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 458.2 | | |

| 461.9 | |

| Goodwill and intangible assets | |

| 6,142.0 | | |

| 6,244.4 | |

| Other assets | |

| 141.3 | | |

| 142.6 | |

| Total assets | |

$ | 8,078.1 | | |

$ | 8,414.7 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Current portion of long-term debt | |

$ | 139.4 | | |

$ | 114.5 | |

| Accounts payable and accrued liabilities | |

| 320.0 | | |

| 354.2 | |

| Deferred revenue | |

| 148.4 | | |

| 150.9 | |

| Total current liabilities | |

| 607.8 | | |

| 619.6 | |

| | |

| | | |

| | |

| Long-term debt, net of current portion | |

| 3,815.4 | | |

| 4,153.2 | |

| Deferred income taxes | |

| 1,345.7 | | |

| 1,375.4 | |

| Other long-term liabilities | |

| 206.8 | | |

| 203.5 | |

| Total liabilities | |

| 5,975.7 | | |

| 6,351.7 | |

| Total stockholders' equity | |

| 2,102.4 | | |

| 2,063.0 | |

| Total liabilities and stockholders’ equity | |

$ | 8,078.1 | | |

$ | 8,414.7 | |

HOLOGIC, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In millions)

| | |

Three Months Ended | |

| | |

December 27, 2014 | | |

December 28, 2013 | |

| OPERATING ACTIVITIES | |

| | | |

| | |

| Net income (loss) | |

$ | 29.2 | | |

$ | (5.3 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 20.3 | | |

| 24.9 | |

| Amortization | |

| 101.7 | | |

| 102.9 | |

| Non-cash interest expense | |

| 16.7 | | |

| 19.7 | |

| Stock-based compensation expense | |

| 12.1 | | |

| 13.7 | |

| Excess tax benefit related to equity awards | |

| (3.0 | ) | |

| (3.0 | ) |

| Deferred income taxes | |

| (30.5 | ) | |

| (125.1 | ) |

| Asset impairment charges | |

| — | | |

| 3.1 | |

| Debt extinguishment loss | |

| 6.7 | | |

| 2.9 | |

| Loss on disposal of property and equipment | |

| 1.7 | | |

| 1.4 | |

| Other | |

| 1.2 | | |

| (0.9 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (9.7 | ) | |

| 15.6 | |

| Inventories | |

| 18.7 | | |

| (14.1 | ) |

| Prepaid income taxes | |

| 22.4 | | |

| 44.7 | |

| Prepaid expenses and other assets | |

| (3.0 | ) | |

| 2.1 | |

| Accounts payable | |

| (24.8 | ) | |

| 10.4 | |

| Accrued expenses and other liabilities | |

| (5.0 | ) | |

| 53.7 | |

| Deferred revenue | |

| (1.2 | ) | |

| 2.6 | |

| Net cash provided by operating activities | |

| 153.5 | | |

| 149.3 | |

| INVESTING ACTIVITIES | |

| | | |

| | |

| Net proceeds from sale of business | |

| — | | |

| 2.4 | |

| Purchase of property and equipment | |

| (10.8 | ) | |

| (8.4 | ) |

| Increase in equipment under customer usage agreements | |

| (10.3 | ) | |

| (8.0 | ) |

| Net (purchases) sales of insurance contracts | |

| (6.4 | ) | |

| 13.8 | |

| Purchases of mutual funds | |

| — | | |

| (29.7 | ) |

| Sales of mutual funds | |

| 6.4 | | |

| 15.9 | |

| Increase in other assets | |

| (0.9 | ) | |

| (0.4 | ) |

| Net cash used in investing activities | |

| (22.0 | ) | |

| (14.4 | ) |

| FINANCING ACTIVITIES | |

| | | |

| | |

| Repayment of long-term debt | |

| (328.8 | ) | |

| (521.3 | ) |

| Net proceeds from issuance of common stock pursuant to employee stock plans | |

| 15.2 | | |

| 12.9 | |

| Excess tax benefit related to equity awards | |

| 3.0 | | |

| 3.0 | |

| Payment of minimum tax withholdings on net share settlements of equity awards | |

| (10.6 | ) | |

| (9.1 | ) |

| Net cash used in financing activities | |

| (321.2 | ) | |

| (514.5 | ) |

| Effect of exchange rate changes on cash and cash equivalents | |

| (2.4 | ) | |

| (0.4 | ) |

| Net decrease in cash and cash equivalents | |

| (192.1 | ) | |

| (380.0 | ) |

| Cash and cash equivalents, beginning of period | |

| 736.1 | | |

| 822.5 | |

| Cash and cash equivalents, end of period | |

$ | 544.0 | | |

$ | 442.5 | |

HOLOGIC, INC.

RECONCILIATION OF GAAP EPS AND NET INCOME (LOSS) TO NON-GAAP EPS, NET INCOME

AND ADJUSTED EBITDA

(Unaudited)

(In millions, except earnings per share)

| |

| | |

Three Months Ended | |

| | |

December 27, 2014 | | |

December 28, 2013 | |

| | |

| | |

| |

| Earnings (loss) per share: | |

| | | |

| | |

| GAAP earnings (loss) per share - Diluted | |

$ | 0.10 | | |

$ | (0.02 | ) |

| Adjustment to net earnings (loss) (as detailed below) | |

| 0.29 | | |

| 0.36 | |

| Non-GAAP earnings per share – diluted | |

$ | 0.39 | (1) | |

$ | 0.34 | (1) |

| | |

| | | |

| | |

| Net income (loss): | |

| | | |

| | |

| GAAP net income (loss) | |

$ | 29.2 | | |

$ | (5.3 | ) |

| Adjustments: | |

| | | |

| | |

| Amortization of intangible assets | |

| 101.7 | (2) | |

| 102.9 | (2) |

| Non-cash interest expense relating to convertible notes | |

| 8.8 | (3) | |

| 11.5 | (3) |

| Restructuring, divestiture and acquisition-related charges | |

| 8.2 | (4) | |

| 23.5 | (4) |

| Fair value adjustments | |

| 1.4 | (5) | |

| 3.1 | (5) |

| Debt extinguishment loss | |

| 6.7 | (6) | |

| 2.9 | (6) |

| Other charges | |

| 0.2 | (7) | |

| 1.2 | (7) |

| Income tax effect of reconciling items | |

| (44.6 | )(8) | |

| (45.7 | )(8) |

| Non-GAAP net income | |

$ | 111.6 | | |

$ | 94.1 | |

| | |

| | | |

| | |

| Adjusted EBITDA: | |

| | | |

| | |

| Non-GAAP net income | |

$ | 111.6 | | |

$ | 94.1 | |

| Interest expense, net, not adjusted above | |

| 43.2 | | |

| 49.4 | |

| Provision for income taxes | |

| 59.5 | | |

| 49.6 | |

| Depreciation expense, not adjusted above | |

| 18.8 | | |

| 20.4 | |

| Adjusted EBITDA | |

$ | 233.1 | | |

$ | 213.5 | |

Explanatory Notes to Reconciliations:

| |

(1) |

Non-GAAP earnings per share was calculated based on 283,176 and 275,471 weighted average diluted shares outstanding for the three months ended December 27, 2014 and December 28, 2013, respectively. |

| |

(2) |

To reflect a non-cash charge attributable to the amortization of intangible assets. |

| |

(3) |

To reflect certain non-cash interest expense related to the amortization of the debt discount from the equity conversion option of the Company’s convertible notes. |

| |

(4) |

To reflect certain costs associated with the Company’s acquisition(s) and integration plans, which primarily include retention costs, transfer costs, and asset impairments, as well as restructuring and divestiture charges. |

| |

(5) |

To reflect non-cash fair value adjustments for additional depreciation expense related to the fair value write-up of fixed assets acquired in the Gen-Probe acquisition. |

| |

(6) |

To reflect a non-cash loss for partial extinguishment related to voluntary prepayments under the Credit Agreement. |

| |

(7) |

To reflect the net impact from miscellaneous transactions during the period. |

| |

(8) |

To reflect an estimated annual effective tax rate of 34.75% for the three months ended December 27, 2014 and an annual effective tax rate of 34.5% for the three months ended December 28, 2013 on a non-GAAP basis. |

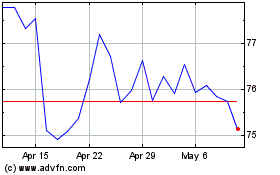

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hologic (NASDAQ:HOLX)

Historical Stock Chart

From Apr 2023 to Apr 2024