- GAAP Diluted Earnings Per Share

(EPS) of $2.07; Non-GAAP Adjusted Diluted EPS of $2.37

- Updates Net Sales Revenue

Outlook

- Raises GAAP Diluted EPS and Non-GAAP

Adjusted Diluted EPS Outlook

Helen of Troy Limited (NASDAQ, NM: HELE), designer, developer

and worldwide marketer of consumer brand-name housewares, health

and home, nutritional supplement and beauty products, today

reported results for the three-month period ended November 30,

2016.

Executive Summary

- Consolidated net sales decline of 0.2%,

which includes the negative impacts of approximately 1.6 percentage

points from Venezuela re-measurement, 0.8 percentage points from

foreign currency fluctuations and 2.4 percentage points from

business rationalization

- Hydro Flask net sales of $34.3 million

and diluted EPS of $0.38

- Beauty, Housewares and Nutritional

Supplements net sales in line with Company expectations despite

unfavorable currency impacts of 1.5 and 0.9 percentage points in

Beauty and Housewares, respectively

- Health & Home net sales below

expectations driven by a below average start to the cough/cold/flu

season and unfavorable currency

- Consolidated gross profit margin

expansion of 2.7 percentage points; 1.2 percentage point expansion

from the core business

- Reported operating income of $63.3

million, or 14.2% of net sales, including an unfavorable impact of

0.5 percentage points from Venezuela, compared to $55.6 million, or

12.5% of net sales in the same period last year

- Non-GAAP adjusted operating income of

$73.4 million compared to $71.4 million in the same period last

year, an increase in adjusted operating margin of 0.5 percentage

points, including an unfavorable impact of 0.4 percentage points

from Venezuela

- Cash flow from operations increase of

$32.0 million, or 149%, to $53.5 million from $21.5 million in the

same period last year

- Reported diluted EPS of $2.07, an

increase of 27.0% from $1.63 in the same period last year

- Non-GAAP adjusted diluted EPS of $2.37,

an increase of 14.5% from $2.07 in the same period last year

- Updates fiscal year 2017 net sales

revenue guidance to a range of $1.520 to $1.550 billion from a

range of $1.550 to $1.590 billion due primarily to expected

continued weakness of the cough/cold/flu season

- Raises fiscal year 2017 GAAP diluted

EPS guidance to a range of $4.72 to $4.92 from a range of $4.37 to

$4.77

- Raises fiscal year 2017 non-GAAP

adjusted diluted EPS to a range of $6.20 to $6.50 from a range of

$5.85 to $6.35

Net Sales

Revenue Operating Margin Adj Operating Margin

Q3 FY2017 Q3 FY2016 $ Change % Change

Q3 FY2017 Q3 FY2016 Q3 FY2017 Q3 FY2016

Housewares

$ 124,723 $ 87,816 $ 36,907 42.0 %

23.4 % 17.7 %

24.5 % 19.9 % Health

& Home

179,842 186,418 (6,576) (3.5) %

11.2

% 9.7 %

13.7 % 13.4 % Nutritional Supplements

32,163 37,492 (5,329) (14.2) %

(0.2) % 8.1 %

5.8 % 15.2 % Beauty

107,686

133,777 (26,091) (19.5) %

13.0 % 14.2 %

15.3 % 17.4 % Total

$ 444,414 $ 445,503

(1,089) (0.2) %

14.2 % 12.5 %

16.5 %

16.0 %

In addition, the Company:

- repurchased 922,731 shares of its

common stock in the open market during the quarter for $75

million;

- recently expanded the commitment under

its revolving credit facility from $650 million to $1.0 billion and

increased its leverage capacity for acquisitions;

- announced that Thurman Case has joined

the Helen of Troy Board as of January 1, 2017; and

- announces that Jay Caron will join the

Company as Chief Supply Chain Officer effective January 9,

2017.

Julien R. Mininberg, Chief Executive Officer, stated: “Our

transformation strategy, combined with the ongoing benefits of our

diversified business model, led to a strong quarter of

profitability highlighted by a 270 basis point increase in gross

profit margin and a 14.5% increase in adjusted EPS. We were pleased

to achieve this performance on slightly lower consolidated net

revenue, driven by the continued strength of our Hydro Flask

business, our efforts to sweeten our core business sales mix and

further operational efficiencies from our shared services platform.

Our focus on the disciplined management of our business and balance

sheet resulted in a 149% increase in cash flow from operations,

allowing us to repurchase $75 million of our common shares with

only a small increase in leverage. Hydro Flask contributed $34.3

million of net sales to our Housewares segment and was accretive to

the segment’s operating margin. Housewares also grew sales and

expanded operating margin in its core business. Health & Home

continued its trend of margin expansion even as a below average

start to the cough/cold/flu season weighed on sales. Beauty segment

sales declined in line with our guidance, but reflected a

sequential improvement from the second quarter. Beauty’s sales

performance continues to be impacted by our efforts to rationalize

lower margin and non-strategic business, Venezuela re-measurement,

unexpected retail holiday inventory reductions and even further

deterioration in foreign currency, which have overshadowed the

success of new innovations. In Nutritional Supplements, sales

declined in line with guidance as we continue the strategic

transition from offline channels to online, while investing in

system upgrades and a significant range of new marketing

initiatives to attract and convert a broader base of

consumers.”

Mr. Mininberg continued: “Just after quarter end, we expanded

the commitment under our revolving credit facility to $1 billion,

adding $350 million in additional borrowing capacity. The amended

credit agreement also increases the debt leverage allowed for

acquisitions. We believe the increase to this facility on favorable

terms positions us well for additional acquisition opportunities

that meet our disciplined criteria.

“We are pleased to have delivered three strong quarters of

profitability so far this fiscal year and are now raising our

adjusted EPS guidance for the full year to a range of $6.20 to

$6.50,” Mr. Mininberg stated further. “This increase comes even as

we make additional investments in key brands such as PUR, OXO, and

Hydro Flask in the fourth quarter. As we enter the final quarter of

the year, we now believe it is prudent to lower our annual

consolidated net revenue range to reflect the expectation that the

cough/cold/flu season will remain below average and the unfavorable

currency environment will remain at current levels. We remain

confident in our strategies and believe our continued focus on

product innovation, market share gains and margin expansion will

lead to long term growth in sales at increasing rates of

profitability. We believe this has us poised to increase value for

Helen of Troy stakeholders.”

Third Quarter Fiscal Year 2017

Consolidated Operating Results

- Net sales revenue decreased 0.2% to

$444.4 million compared to $445.5 million in the third quarter of

fiscal year 2016. Core business net sales revenue decreased $35.4

million, or 8.0%, which includes negative year-over-year impacts

from Venezuela and foreign currency fluctuations of 1.6 and 0.8

percentage points, respectively. The core business decline also

includes strategic decisions to rationalize certain lower margin

business to improve long-term profitability, which negatively

impacted net sales by approximately 2.4 percentage points

year-over-year.

- Gross profit margin increased 2.7

percentage points to 43.7% compared to 41.0% for the same period

last year. The increase in consolidated gross profit margin is

primarily due to favorable shifts in our core business sales mix,

product rationalization efforts, margin accretion from Hydro Flask,

and reductions in product costs, partially offset by the

unfavorable impact of foreign currency fluctuations.

- SG&A was 29.5% of net sales

compared to 28.5% of net sales for the same period last year. The

increase is primarily due to: (i) higher compensation costs due to

hourly wage increases; (ii) higher share-based incentive

compensation expense; (iii) higher advertising expense; and (iv)

the impact that lower net sales had on operating leverage in our

core business. These factors were partially offset by improved

distribution and logistics efficiency and lower outbound freight

costs and the comparative impact of $6.7 million of CEO succession

costs recorded last year.

- Operating income increased 13.8% to

$63.3 million compared to $55.6 million for the same period last

year primarily reflecting the overall improvement in core business

gross profit margin, accretion from the Hydro Flask acquisition,

lower foreign currency revaluation losses, improved distribution

and logistics efficiency and lower outbound freight costs, and the

comparative impact of $6.7 million of CEO succession costs recorded

last year. The increase was partially offset by: (i) a $3.1 million

decline from the Company’s Venezuela operations, due almost

entirely to the adoption of the DICOM exchange rate; (ii) an

increase in compensation expense; and, (iii) the negative impact of

foreign currency fluctuations on net sales and gross profit.

- Income tax expense as a percentage of

pretax income was 3.7% compared to 11.8% for the same period last

year. The year-over-year decrease in the Company’s effective tax

rate was primarily due to shifts in the mix of taxable income in

the Company’s various tax jurisdictions, benefits from the

finalization of certain tax returns and a change in an accounting

standard.

- Net income was $57.6 million, or $2.07

per diluted share on 27.8 million weighted average diluted shares

outstanding, compared to $46.8 million, or $1.63 per diluted share

on 28.6 million weighted average diluted shares outstanding in the

same period last year.

- Adjusted EBITDA (EBITDA excluding

non-cash asset impairment charges, non-cash share-based

compensation, CEO succession costs and patent litigation charges,

as applicable) increased $2.2 million to $77.5 million.

On an adjusted basis for the third quarter of fiscal years 2017

and 2016, excluding non-cash asset impairment charges, non-cash

amortization of intangible assets, non‐cash share based

compensation, CEO succession costs and patent litigation charges,

as applicable:

- Adjusted operating income was $73.4

million, or 16.5% of net sales, compared to $71.4 million, or 16.0%

of net sales, in the prior year, reflecting the overall improvement

in core business gross profit margin, the accretive impact of the

Hydro Flask acquisition, and improved distribution and logistics

efficiency and lower outbound freight costs, partially offset by

the unfavorable impact of foreign currency fluctuations and a

decline in operating income from the Company’s Venezuela operations

of $3.1 million, which negatively impacted consolidated adjusted

operating margin by 0.4 percentage points.

- Adjusted income was $66.0 million, or

$2.37 per diluted share, compared to $59.2 million, or $2.07 per

diluted share, in the prior year, primarily reflecting the

improvement in adjusted operating income and lower tax expense,

partially offset by higher interest expense.

Third Quarter Fiscal Year 2017 Segment

Results

Housewares net sales increased by 42.0% driven by net sales

growth of 39.1% from Hydro Flask and a 2.9% increase in core

business net sales revenue. In the core business, growth was fueled

by new products and expansion in the club channel, partially offset

by a decline in EMEA sales due to the negative impact of the

weakened British Pound. Adjusted operating margin improved 4.6

percentage points primarily due to the accretive impact of the

Hydro Flask acquisition and margin expansion in the core business.

Margin improvement in the core business came from greater operating

leverage, improvements in sales mix, and lower distribution,

logistics and outbound freight costs, partially offset by higher

advertising expenses and margin compression from new product

categories.

Health & Home net sales declined 3.5% reflecting the

Company’s de-emphasis of lower margin hot/cold therapy business and

declines in humidification due to retailers exiting last year’s

below average cough/cold/flu season with higher inventory levels.

These declines were partially offset by strong sales gains in PUR

water filtration, early seasonal shipments of thermometry products,

and growth in air purification. Adjusted operating margin improved

0.3 percentage points to 13.7% due to product cost reductions, a

better product sales mix, and lower outbound freight costs,

partially offset by higher advertising expense.

Beauty net sales decreased 19.5%, which includes anticipated

declines of 5.3% and 2.0%, respectively, from the Company’s

Venezuelan and North American personal care businesses, and the

negative impact of approximately 1.5% from foreign currency

fluctuations. Another 2.0% of the decline is due to our de-emphasis

of the foot care category, as it has become commoditized.

Additionally, rationalization of lower margin business negatively

impacted net sales by approximately 3.1%. The remaining decline is

primarily due to a softer than expected retail environment, tighter

retail inventory management and an overall decline in point of sale

activity for the broader retail beauty appliances category.

Adjusted operating margin declined 2.1 percentage points reflecting

an improvement in gross profit margin that was more than offset by

a 1.7 percentage point decline from Venezuela re-measurement,

unfavorable foreign currency and lower operating leverage from the

decline in sales.

Nutritional Supplements net sales decreased 14.2%, primarily

reflecting lower response rates in the offline channel, lower

average order values, an increase in discounts to promote buyer

file growth, and a decline in the legacy newsletter subscription

business, as the Company continues to implement a strategic

transition from offline to online channels. Adjusted operating

margin decreased by 9.4 percentage points due primarily to the

impact of the net sales decline on operating leverage and higher

promotion, advertising, customer acquisition and online channel

development costs.

Balance Sheet Highlights

- Cash and cash equivalents totaled $16.8

million at November 30, 2016, compared to $21.1 million at November

30, 2015. During the third quarter, the Company repurchased 922,731

million shares for a total of $75.0 million.

- Total short- and long-term debt

increased to $564.9 million at November 30, 2016, compared to

$470.4 million at November 30, 2015, a net increase of $94.5

million. The increase primarily reflects $210.0 million drawn to

fund the Hydro Flask acquisition in March 2016 and $75 million

drawn for share repurchases in the third quarter.

- Accounts receivable turnover was 57.8

days at November 30, 2016, compared to 58.8 days at November 30,

2015.

- Inventory was $301.1 million at

November 30, 2016, compared to $339.4 million at November 30, 2015.

Inventory turnover was 2.8 times, unchanged from the same period

last year.

Subsequent Event – Amendment to Credit

Agreement

On December 7, 2016, the Company entered into a First Amendment

to the Credit Agreement (the “Amendment”) with Bank of America,

N.A., as administrative agent and the other lenders party thereto.

The Amendment increases the unsecured revolving commitment of the

Credit Agreement from $650 million to $1 billion, subject to the

terms and limitations described in the Credit Agreement. The

maturity of the commitment under the Credit Agreement was extended

from January 16, 2020 to December 7, 2021. The Amendment also

increased the leverage ratio for acquisitions. In addition, the

amount the Company may request to increase the aggregate revolving

loan commitment under the accordion was increased from $150 million

to $200 million, subject to lender approval and the satisfaction of

certain other conditions.

Fiscal Year 2017 Annual

Outlook

For fiscal year 2017, the Company now expects consolidated net

sales revenue in the range of $1.520 to $1.550 billion compared to

the previous range of $1.55 to $1.59 billion. The Company is

raising expectations for consolidated GAAP diluted EPS in the range

of $4.72 to $4.92. The Company is also raising its adjusted diluted

EPS (non-GAAP) outlook in the range of $6.20 to $6.50, which

excludes after-tax non-cash asset impairment charges, patent

litigation charges, share-based compensation expense and intangible

asset amortization expense and includes incremental adjusted

diluted EPS from the Hydro Flask acquisition.

The Company’s outlook assumes that the severity of the

cough/cold/flu season will remain below historical averages. In

addition, the Company’s sales outlook now includes expected fiscal

year 2017 net sales revenue for the Health & Home segment in

line with the prior year and expected growth in Housewares’ core

business net sales revenue for fiscal year 2017 in the low-single

digits. The guidance also reflects the Company’s outlook for the

retail environment and the broader market and the assumption that

unfavorable currency environment will remain at current levels for

the remainder of the fiscal year.

The diluted EPS outlook is based on an estimated weighted

average shares outstanding of 28.0 million and an expected

effective tax rate of 10% to 12% for the full fiscal year 2017. The

likelihood and potential impact of any fiscal year 2017

acquisitions, future asset impairment charges, future foreign

currency fluctuations, or further share repurchases are unknown and

cannot be reasonably estimated; therefore, they are not included in

the Company’s sales and earnings outlook.

Conference Call and

Webcast

The Company will conduct a teleconference in conjunction with

today's earnings release. The teleconference begins at 4:45 pm

Eastern Time today, Thursday, January 5, 2017. Institutional

investors and analysts interested in participating in the call are

invited to dial (877) 545-1402 approximately ten minutes prior to

the start of the call. The conference call will also be webcast

live at: www.hotus.com. A telephone replay of this call will be

available at 7:45 p.m. Eastern Time on January 5, 2017 until 11:59

p.m. Eastern Time on January 12, 2017 and can be accessed by

dialing 877-870-5176 and entering replay pin number 1840483. A

replay of the webcast will remain available on the website for 60

days.

Non-GAAP Financial

Measures:

The Company reports and discusses its operating results using

financial measures consistent with accounting principles generally

accepted in the United States of America (“GAAP”). To supplement

its presentation, the Company discloses certain financial measures

that may be considered non-GAAP financial measures, such as

adjusted operating income, adjusted operating margin, adjusted

income, adjusted diluted EPS, EBITDA and adjusted EBITDA, which are

presented in accompanying tables to this press release along with a

reconciliation of these financial measures to their corresponding

GAAP-based measures presented in the Company’s consolidated

statements of income.

About Helen of Troy

Limited:

Helen of Troy Limited (NASDAQ, NM: HELE) is a leading global

consumer products company offering creative solutions for its

customers through a strong portfolio of well-recognized and

widely-trusted brands, including OXO®, OXO Tot®, Hydro Flask®,

Vicks®, Braun®, Honeywell®, PUR®, Febreze®; Revlon®, Pro Beauty

Tools®, Sure®, Pert®, Infusium23®, Brut®, Ammens®, Hot Tools®, Bed

Head®, Dr. Sinatra®, Dr. David Williams®, and Dr. Whitaker®. All

trademarks herein belong to Helen of Troy Limited (or its

affiliates) and/or are used under license from their respective

licensors.

For more information about Helen of Troy, please visit

www.hotus.com.

Forward Looking

Statements:

Certain written and oral statements made by our Company and

subsidiaries of our Company may constitute "forward-looking

statements" as defined under the Private Securities Litigation

Reform Act of 1995. This includes statements made in this press

release. Generally, the words "anticipates", "believes", "expects",

"plans", "may", "will", "should", "seeks", "estimates", "project",

"predict", "potential", "continue", "intends", and other similar

words identify forward-looking statements. All statements that

address operating results, events or developments that we expect or

anticipate will occur in the future, including statements related

to sales, earnings per share results, and statements expressing

general expectations about future operating results, are

forward-looking statements and are based upon our current

expectations and various assumptions. We believe there is a

reasonable basis for our expectations and assumptions, but there

can be no assurance that we will realize our expectations or that

our assumptions will prove correct. Forward-looking statements are

subject to risks that could cause them to differ materially from

actual results. Accordingly, we caution readers not to place undue

reliance on forward-looking statements. The forward-looking

statements contained in this press release should be read in

conjunction with, and are subject to and qualified by, the risks

described in the Company's Form 10-K for the year ended February

29, 2016 and in our other filings with the SEC. Investors are urged

to refer to the risk factors referred to above for a description of

these risks. Such risks include, among others, our ability to

deliver products to our customers in a timely manner and according

to their fulfillment standards, our relationships with key

customers and licensors, the costs of complying with the business

demands and requirements of large sophisticated customers, our

dependence on the strength of retail economies and vulnerabilities

to any prolonged economic downturn, the retention and recruitment

of key personnel, expectations regarding our recent and future

acquisitions, including our ability to realize anticipated cost

savings, synergies and other benefits along with our ability to

effectively integrate acquired businesses, foreign currency

exchange rate fluctuations, disruptions in U.S., U.K., Euro zone,

Venezuela, and other international credit markets, risks associated

with weather conditions, the duration and severity of the cold and

flu season and other related factors, our dependence on foreign

sources of supply and foreign manufacturing, and associated

operational risks including, but not limited to, long lead times,

consistent local labor availability and capacity, and timely

availability of sufficient shipping carrier capacity, risks to the

Nutritional Supplements segment associated with the availability,

purity and integrity of materials used in the manufacture of

vitamins, minerals and supplements, the impact of changing costs of

raw materials, labor and energy on cost of goods sold and certain

operating expenses, the geographic concentration and peak season

capacity of certain U.S. distribution facilities increases our

exposure to significant shipping disruptions and added shipping and

storage costs, our projections of product demand, sales and net

income are highly subjective in nature and future sales and net

income could vary in a material amount from such projections,

circumstances which may contribute to future impairment of

goodwill, intangible or other long-lived assets, the risks

associated with the use of trademarks licensed from and to third

parties, our ability to develop and introduce a continuing stream

of new products to meet changing consumer preferences, increased

product liability and reputational risks associated with the

formulation and distribution of vitamins, minerals and supplements,

the risks associated with potential adverse publicity and negative

public perception regarding the use of vitamins, minerals and

supplements, trade barriers, exchange controls, expropriations, and

other risks associated with foreign operations, debt leverage and

the constraints it may impose on our cash resources and ability to

operate our business, the costs, complexity and challenges of

upgrading and managing our global information systems, the risks

associated with information security breaches, the increased

complexity of compliance with a number of new government

regulations as a result of adding vitamins, minerals and

supplements to the Company’s portfolio of products, the risks

associated with product recalls, product liability, other claims,

and related litigation against us, the risks associated with tax

audits and related disputes with taxing authorities, the risks of

potential changes in laws, including tax laws, health insurance

laws and regulations related to conflict minerals along with the

costs and complexities of compliance with such laws, and our

ability to continue to avoid classification as a controlled foreign

corporation. We undertake no obligation to publicly update or

revise any forward-looking statements as a result of new

information, future events or otherwise.

HELEN OF TROY LIMITED AND

SUBSIDIARIES Consolidated Condensed Statements of Income

(Unaudited) (in thousands, except per share data)

Three Months Ended November 30, 2016

2015 Sales revenue, net $ 444,414 100.0 % $ 445,503 100.0 %

Cost of goods sold 250,199 56.3 % 262,979 59.0 %

Gross profit 194,215 43.7 % 182,524 41.0 % Selling, general,

and administrative expense ("SG&A") 130,896 29.5 % 126,891 28.5

% Asset impairment charges - - % - - % Operating

income 63,319 14.2 % 55,633 12.5 %

Nonoperating income, net 106 - % 142 - % Interest expense

(3,625) (0.8) % (2,741) (0.6) % Income before income taxes

59,800 13.5 % 53,034 11.9 % Income tax expense 2,188

0.5 % 6,256 1.4 % Net income $ 57,612 13.0 % $ 46,778 10.5 %

Diluted EPS $ 2.07 $ 1.63 Weighted average shares of

common stock used in computing diluted EPS 27,802 28,634

Nine Months Ended November 30, 2016

2015 Sales revenue, net $ 1,160,522 100.0 % $ 1,159,977

100.0 % Cost of goods sold 650,912 56.1 % 686,129

59.2 % Gross profit 509,610 43.9 % 473,848 40.8 % Selling,

general, and administrative expense ("SG&A") 378,506 32.6 %

356,240 30.7 % Asset impairment charges 7,400 0.6 %

3,000 0.3 % Operating income 123,704 10.7 % 114,608

9.9 % Nonoperating income, net 343 - % 233 - % Interest

expense (11,142) (1.0) % (8,135) (0.7) % Income

before income taxes 112,905 9.7 % 106,706 9.2 % Income tax

expense 7,912 0.7 % 15,066 1.3 % Net income $ 104,993

9.0 % $ 91,640 7.9 % Diluted EPS $ 3.74 $ 3.17

Weighted average shares of common stock used in computing diluted

EPS 28,058 28,903

HELEN OF TROY LIMITED AND SUBSIDIARIES Net Sales Revenue

by Segment (7) (Unaudited) (in thousands)

Three Months Ended November 30, % of Sales Revenue,

net 2016 2015 $ Change % Change

2016 2015 Sales revenue by segment, net Housewares $

124,723 $ 87,816 $ 36,907 42.0 % 28.1 % 19.7 % Health & Home

179,842 186,418 (6,576) (3.5) % 40.5 % 41.8 % Nutritional

Supplements 32,163 37,492 (5,329) (14.2) % 7.2 % 8.4 % Beauty

107,686 133,777 (26,091) (19.5) % 24.2 % 30.0

% Total sales revenue, net $ 444,414 $ 445,503 $ (1,089) (0.2) %

100.0 % 100.0 %

Nine Months Ended November 30,

% of Sales Revenue, net 2016 2015 $

Change % Change 2016 2015 Sales revenue by

segment, net Housewares $ 315,302 $ 231,850 $ 83,452 36.0 % 27.2 %

20.0 % Health & Home 470,650 472,714 (2,064) (0.4) % 40.6 %

40.8 % Nutritional Supplements 101,215 114,980 (13,765) (12.0) %

8.7 % 9.9 % Beauty 273,355 340,433 (67,078)

(19.7) % 23.6 % 29.3 % Total sales revenue, net $ 1,160,522 $

1,159,977 $ 545 0.0 % 100.0 % 100.0 %

HELEN

OF TROY LIMITED AND SUBSIDIARIES Selected Consolidated

Balance Sheet, Cash Flow and Liquidity Information

(Unaudited) (in thousands) November 30,

2016 2015 (a) Balance Sheet: Cash and cash

equivalents $ 16,780 $ 21,141 Receivables, net 289,943 288,979

Inventory, net 301,088 339,397 Total assets, current 620,062

659,702 Total assets 1,889,077 1,758,623 Total liabilities, current

327,503 292,832 Total long-term liabilities 581,696 497,859 Total

debt 564,902 470,425 Stockholders' equity 979,878 967,932

Cash Flow: Depreciation and amortization $ 33,323 $ 31,946 Net cash

provided by operating activities 139,140 73,748 Capital and

intangible asset expenditures 14,989 12,418 Payments to acquire

businesses, net of cash received 209,258 42,750 Net amounts

borrowed (repaid) (55,800) 41,500 Payments for repurchases of

common stock 75,000 50,000 Liquidity: Working Capital $

292,559 $ 366,870

_________________________

(a) As a result of the adoption of new accounting standards

for fiscal year 2017, amounts reported as of November 30, 2015 have

be reclassified to conform with current year’s presentation.

SELECTED OTHER DATA Reconciliation of Non-GAAP

Financial Measures – GAAP Operating Income to Adjusted

Operating Income (non-GAAP) (1) (7) (Unaudited) (in

thousands) Three Months Ended November 30, 2016

Housewares Health & Home Nutritional

Supplements

Beauty Total Operating income, as reported (GAAP) $

29,223 23.4 % $ 20,155 11.2 % $ (80) (0.2) % $ 14,021 13.0 % $

63,319 14.2 % Non-cash share-based compensation (3) 671 0.5 % 872

0.5 % 369 1.1 % 991 0.9 % 2,903 0.7 % Amortization of intangible

assets (4) 658 0.5 % 3,546 2.0 % 1,571 4.9 %

1,424 1.3 % 7,199 1.6 % Adjusted operating income

(non-GAAP) $ 30,552 24.5 % $ 24,573 13.7 % $ 1,860 5.8 % $ 16,436

15.3 % $ 73,421 16.5 %

Three Months Ended November 30,

2015 Housewares Health & Home

Nutritional

Supplements

Beauty Total Operating income, as reported (GAAP) $

15,536 17.7 % $ 18,072 9.7 % $ 3,034 8.1 % $ 18,991 14.2 % $ 55,633

12.5 % CEO succession costs (2) 1,348 1.5 % 2,722 1.5

% 704 1.9 % 1,933 1.4 % 6,707 1.5 % Subtotal

16,884 19.2 % 20,794 11.2 % 3,738 10.0 % 20,924 15.6 % 62,340 14.0

% Non-cash share-based compensation (3) 303 0.3 % 657 0.4 % 398 1.1

% 851 0.6 % 2,209 0.5 % Amortization of intangible assets (4)

326 0.4 % 3,532 1.9 % 1,564 4.2 % 1,439

1.1 % 6,861 1.5 % Adjusted operating income (non-GAAP) $

17,513 19.9 % $ 24,983 13.4 % $ 5,700 15.2 % $ 23,214 17.4 % $

71,410 16.0 %

Nine Months Ended November 30, 2016

Housewares Health & Home Nutritional

Supplements

Beauty Total Operating income, as reported (GAAP) $

68,956 21.9 % $ 39,156 8.3 % $ (6,581) (6.5) % $ 22,173 8.1 % $

123,704 10.7 % Patent litigation charge (5) - - % 1,468 0.3 % - - %

- - % 1,468 0.1 % Asset impairment charges (6) - - %

- - % 5,000 4.9 % 2,400 0.9 % 7,400 0.6 %

Subtotal 68,956 21.9 % 40,624 8.6 % (1,581) (1.6) % 24,573 9.0 %

132,572 11.4 % Non-cash share-based compensation (3) 2,404 0.8 %

3,787 0.8 % 1,734 1.7 % 3,736 1.4 % 11,661 1.0 % Amortization of

intangible assets (4) 1,986 0.6 % 10,626 2.3 %

4,713 4.7 % 4,300 1.6 % 21,625 1.9 % Adjusted

operating income (non-GAAP) $ 73,346 23.3 % $ 55,037 11.7 % $ 4,866

4.8 % $ 32,609 11.9 % $ 165,858 14.3 %

Nine Months Ended

November 30, 2015 Housewares Health & Home

Nutritional

Supplements

Beauty Total Operating income, as reported (GAAP) $

41,861 18.1 % $ 31,298 6.6 % $ 8,623 7.5 % $ 32,826 9.6 % $ 114,608

9.9 % CEO succession costs (2) 1,348 0.6 % 2,722 0.6 % 704 0.6 %

1,933 0.6 % 6,707 0.6 % Asset impairment charges (6) - - %

- - % - - % 3,000 0.9 % 3,000 0.3 %

Subtotal 43,209 18.6 % 34,020 7.2 % 9,327 8.1 % 37,759 11.1 %

124,315 10.7 % Non-cash share-based compensation (3) 934 0.4 %

1,785 0.4 % 974 0.8 % 2,454 0.7 % 6,147 0.5 % Amortization of

intangible assets (4) 976 0.4 % 10,900 2.3 %

4,692 4.1 % 4,315 1.3 % 20,883 1.8 % Adjusted

operating income (non-GAAP) $ 45,119 19.5 % $ 46,705 9.9 % $ 14,993

13.0 % $ 44,528 13.1 % $ 151,345 13.0 %

SELECTED OTHER DATA Reconciliation of Non-GAAP Financial

Measures - EBITDA (Earnings Before Interest, Taxes,

Depreciation and Amortization) and Adjusted EBITDA (1) (7)

(Unaudited) (in thousands)

Three Months Ended November

30,

Nine Months Ended November

30,

2016 2015 2016 2015 Net income

(GAAP) $ 57,612 $ 46,778 $ 104,993 $ 91,640 Interest

expense, net 3,604 2,698 11,052 8,066 Income tax expense

2,188 6,256 7,912 15,066 Depreciation and amortization,

excluding amortized interest 11,225 10,719

33,323 31,946 EBITDA 74,629 66,451 157,280 146,718

Add: CEO succession costs (2) - 6,707 - 6,707

Non-cash share-based compensation (3) 2,903 2,209 11,661 6,147

Patent litigation charge (5) - - 1,468 - Non-cash

asset impairment charges (6) - - 7,400

3,000 Adjusted EBITDA (non-GAAP) $ 77,532 $ 75,367 $ 177,809

$ 162,572

SELECTED OTHER DATA

Reconciliation of Non-GAAP Financial Measures - EBITDA

(Earnings Before Interest, Taxes, Depreciation and Amortization)

and Adjusted EBITDA by Segment (1) (7) (Unaudited)

(in thousands) Three Months Ended November 30,

2016 Housewares

Health & Home

Nutritional Supplements

Beauty Total Operating Income (GAAP) $

29,223 $ 20,155 $ (80) $ 14,021 $ 63,319 Depreciation and

amortization, excluding amortized interest 1,429 5,221 2,108 2,467

11,225 Nonoperating income, net - - -

85 85 EBITDA 30,652 25,376 2,028 16,573 74,629

Add: Non-cash share-based compensation (3) 671

872 369 991 2,903 Adjusted EBITDA

(non-GAAP) $ 31,323 $ 26,248 $ 2,397 $ 17,564 $ 77,532

Three Months Ended November 30, 2015

Housewares

Health & Home

Nutritional Supplements

Beauty Total Operating Income (GAAP) $ 15,536 $

18,072 $ 3,034 $ 18,991 $ 55,633 Depreciation and

amortization, excluding amortized interest 1,065 5,281 1,956 2,417

10,719 Nonoperating income, net - - -

99 99 EBITDA 16,601 23,353 4,990 21,507 66,451

Add: CEO succession costs (2) 1,348 2,722 704 1,933 6,707

Non-cash share-based compensation (3) 303 657

398 851 2,209 Adjusted EBITDA

(non-GAAP) $ 18,252 $ 26,732 $ 6,092 $ 24,291 $ 75,367

SELECTED OTHER DATA Reconciliation of Non-GAAP

Financial Measures - EBITDA (Earnings Before Interest,

Taxes, Depreciation and Amortization) and Adjusted EBITDA by

Segment (1) (7) (Unaudited) (in thousands)

Nine Months Ended November 30, 2016 Housewares

Health & Home

Nutritional Supplements

Beauty Total Operating income (GAAP) $

68,956 $ 39,156 $ (6,581) $ 22,173 $ 123,704 Depreciation

and amortization, excluding amortized interest 4,200 15,738 6,242

7,143 33,323 Nonoperating income, net - -

- 253 253 EBITDA 73,156 54,894 (339)

29,569 157,280 Add: Non-cash share-based compensation (3)

2,404 3,787 1,734 3,736 11,661 Patent litigation charge (5)

- 1,468 - - 1,468 Non-cash asset impairment charges (6)

- - 5,000 2,400 7,400

Adjusted EBITDA (non-GAAP) $ 75,560 $ 60,149 $ 6,395 $ 35,705 $

177,809

Nine Months Ended November 30, 2015

Housewares

Health & Home

Nutritional Supplements

Beauty Total Operating income (GAAP) $ 41,861 $

31,298 $ 8,623 $ 32,826 $ 114,608 Depreciation and

amortization, excluding amortized interest 3,148 15,858 5,889 7,051

31,946 Nonoperating income, net - - -

164 164 EBITDA 45,009 47,156 14,512 40,041

146,718 Add: CEO succession costs (2) 1,348 2,722 704 1,933

6,707 Non-cash share-based compensation (3) 934 1,785 974

2,454 6,147 Non-cash asset impairment charges (6) -

- - 3,000 3,000 Adjusted EBITDA

(non-GAAP) $ 47,291 $ 51,663 $ 16,190 $ 47,428 $ 162,572

HELEN OF TROY LIMITED AND

SUBSIDIARIES

Reconciliation of GAAP Net Income and

Earnings Per Share (EPS) to Adjusted Income and Adjusted EPS

(non-GAAP) (1) (7) (8)

(Unaudited) (dollars in thousands, except per share

data) Three Months Ended November 30, Basic

EPS Diluted EPS 2016 2015

2016 2015 2016 2015 Net income as

reported (GAAP) $ 57,612 $ 46,778 $ 2.10 $ 1.66 $ 2.07 $ 1.63 CEO

succession costs, net of tax (2) - 4,645 -

0.17 - 0.16 Subtotal 57,612 51,423 2.10 1.83

2.07 1.80 Non-cash share-based compensation, net of tax (3) 2,197

1,813 0.08 0.06 0.08 0.06 Amortization of intangible assets, net of

tax (4) 6,190 5,936 0.23 0.22

0.22 0.21 Adjusted income (non-GAAP) $ 65,999 $ 59,172 $

2.40 $ 2.10 $ 2.37 $ 2.07

Weighted average shares of common stock

used in computing basic and diluted EPS

27,484 28,129 27,802 28,634

Nine Months Ended November 30, Basic EPS Diluted

EPS 2016 2015 2016 2015 2016

2015 Net income as reported (GAAP) $ 104,993 $ 91,640 $ 3.79

$ 3.23 $ 3.74 $ 3.17 CEO succession costs, net of tax (2) - 4,645 -

0.16 - 0.16 Patent litigation charge, net of tax (5) 1,464 - 0.05 -

0.05 - Asset impairment charges, net of tax (6) 5,097

2,656 0.18 0.09 0.18 0.09 Subtotal

111,554 98,941 4.03 3.49 3.98 3.42 Non-cash share-based

compensation, net of tax (3) 8,741 5,158 0.32 0.18 0.31 0.18

Amortization of intangible assets, net of tax (4) 18,620

18,108 0.67 0.64 0.66 0.63

Adjusted income (non-GAAP) $ 138,915 $ 122,207 $ 5.01 $ 4.31 $ 4.95

$ 4.23

Weighted average shares of common stock

used in computing basic and diluted EPS

27,700 28,361 28,058 28,903

HELEN OF TROY

LIMITED AND SUBSIDIARIES Reconciliation of Fiscal Year 2017

Outlook for GAAP Diluted EPS to Adjusted Diluted EPS

(non-GAAP) (1) (8) (9) (Unaudited) Fiscal Year

Ended February 28, 2017

Nine Months Ended November 30,

2016

Outlook for the Balance of

the Fiscal Year (Three Months)

Outlook for the Fiscal Year

(Twelve Months)

Diluted EPS, as reported (GAAP) $ 3.74 $ 0.97 - $ 1.17 $ 4.72 - $

4.92 Patent litigation charge, net of tax (5) 0.05 - - - 0.05 -

0.05 Asset impairment charges, net of tax (6) 0.18 -

- - 0.18 - 0.18

Subtotal 3.98 0.97 - 1.17 4.95 - 5.15 Non-cash share-based

compensation, net of tax (3) 0.31 0.09 - 0.13 0.40 - 0.44

Amortization of intangible assets, net of tax (4) 0.66

0.19 - 0.25 0.85 -

0.91 Adjusted diluted EPS (non-GAAP) $ 4.95 $ 1.25 -

$ 1.55 $ 6.20 - $ 6.50

HELEN OF TROY LIMITED AND

SUBSIDIARIES

___________________

Notes to Press Release (1) This press release

contains non-GAAP financial measures. Adjusted operating income,

adjusted operating margin, adjusted income, adjusted diluted EPS,

EBITDA, and adjusted EBITDA (“Non-GAAP measures”) that are

discussed in the accompanying press release or in the preceding

tables are considered non-GAAP financial information as

contemplated by SEC Regulation G, Rule 100. Accordingly, we are

providing the preceding tables that reconcile these measures to

their corresponding GAAP-based measures presented in our

Consolidated Condensed Statements of Income in the accompanying

tables to the press release. The Company believes that these

non-GAAP measures provide useful information to management and

investors regarding financial and business trends relating to its

financial condition and results of operations. The Company believes

that these non-GAAP measures, in combination with the Company's

financial results calculated in accordance with GAAP, provide

investors with additional perspective. Additionally, the non-GAAP

financial measures are used by management for measuring and

evaluating the Company’s performance. The Company further believes

that the items excluded from certain non-GAAP measures do not

accurately reflect the underlying performance of its continuing

operations for the periods in which they are incurred, even though

some of these excluded items may be incurred and reflected in the

Company's GAAP financial results in the foreseeable future. The

material limitation associated with the use of the non-GAAP

financial measures is that the non-GAAP measures do not reflect the

full economic impact of the Company's activities. These non-GAAP

measures are not prepared in accordance with GAAP, are not an

alternative to GAAP financial information, and may be calculated

differently than non-GAAP financial information disclosed by other

companies. Accordingly, undue reliance should not be placed on

non-GAAP information. (2)

Adjustments consist of CEO succession

costs of $6.71 million ($4.64 million after tax) incurred in

connection with the settlement of a dispute with our former CEO for

the three- and nine-months ended November 30, 2015.

(3) Adjustments consist of non-cash share-based compensation

expense of $2.90 million ($2.12 million after tax) and $2.21

million ($1.81 million after tax) for the three months ended

November 30, 2016 and 2015, respectively, and $11.66 million ($8.74

million after tax) and $6.15 million ($5.16 million after tax), for

the nine months ended November 30, 2016 and 2015, respectively.

(4) Adjustments consist of non-cash intangible asset

amortization expense of $7.20 million ($6.19 million after tax) and

$6.86 million ($5.94 million after tax) for the three months ended

November 30, 2016 and 2015, respectively, and $21.63 million

($18.62 million after tax) and $20.88 million ($18.11 million after

tax) for the nine months ended November 30, 2016 and 2015,

respectively. (5) Adjustment consists of a patent litigation

charge of $1.47 million ($1.46 million after tax) for the nine

months ended November 30, 2016. (6) Adjustments consist of

non-cash asset impairment charges of $7.40 million ($5.10 million

after tax) and $3.00 million ($2.66 million after tax) for the nine

months ended November 30, 2016 and 2015, respectively. The non-cash

charges relate to certain brand assets and trademarks in our

Nutritional Supplements and Beauty segments, which were written

down to their estimated fair values, determined on the basis of

future discounted cash flows using the relief from royalty

valuation method. (7) The VapoSteam business was acquired on

March 31, 2015 and its operations are reported in the Health &

Home segment. Results reported for the nine months ended November

30, 2016 include one incremental month of operating results

compared to the same period last year. The Hydro Flask

business was acquired on March 18, 2016 and its operations are

reported in the Housewares segment. Results reported for the three-

and nine-months ended November 30, 2016 include three months and

approximately eight and a half months of operating results,

respectively, with no comparable results for the same periods last

year. (8) Total tax effects of adjustments described in

Notes 2 through 6, for each of the periods presented:

Three Months Ended November

30,

Nine Months Ended November

30,

(In thousands) 2016 2015 2016

2015 CEO succession costs (2) $ - $ (2,062) $ - $ (2,062)

Non-cash share-based compensation (3) (706) (396) (2,920) (989)

Amortization of intangible assets (4) (1,009) (925) (3,005) (2,775)

Patent litigation charge (5) - - (4) - Asset impairment charges (6)

- - (2,303) (344) Total $ (1,715) $

(3,383) $ (8,232) $ (6,170) (9) The diluted EPS

outlook is based on an estimated weighted average shares

outstanding of 28.00 million for fiscal year 2017.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170105006385/en/

Investors:ICR, Inc.Allison Malkin, 203-682-8200

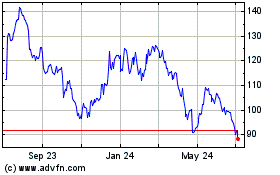

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Mar 2024 to Apr 2024

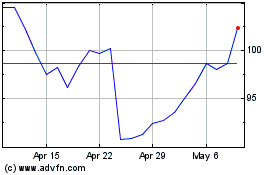

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Apr 2023 to Apr 2024