- GAAP Diluted Earnings Per Share

(EPS) of $0.68; Non-GAAP Adjusted Diluted EPS of $1.27

- Maintains Fiscal Year 2017 Net Sales

Revenue in a Range of $1.57 to $1.62 Billion

- Expects GAAP Diluted EPS in a Range

of $4.37 to $4.77; Maintains Non-GAAP Adjusted Diluted EPS in a

Range of $5.85 to $6.35

Helen of Troy Limited (NASDAQ, NM: HELE), designer, developer

and worldwide marketer of consumer brand-name housewares, health

and home, nutritional supplement and beauty products, today

reported results for the three-month period ended May 31, 2016.

Executive Summary for the First Quarter

of Fiscal Year 2017

- Net sales growth of 0.8%, which

includes a 1.1% decline from Venezuela and a 0.5% decline from

foreign currency;

- Hydro Flask net sales of $14.4 million,

ahead of expectations;

- Increase in gross profit margin of 2.3

percentage points;

- Reported operating income of $22.9

million compared to $26.5 million in the same period last

year;

- Non-GAAP adjusted operating income of

$44.6 million compared to $38.4 million in the same period last

year, an increase in adjusted operating margin of 1.7 percentage

points;

- Cash flow from operations of $41.7

million compared to $37.8 million in the same period last

year;

- Reported diluted EPS of $0.68 compared

to $0.70 in the same period last year; and

- Non-GAAP adjusted diluted EPS of $1.27

compared to $1.06 in the same period last year.

Adjusted Net Sales Revenue Operating Margin

Operating Margin Q1 FY2017 Q1 FY2016

$ Change

% Change Q1 FY2017 Q1 FY2016 Q1

FY2017 Q1 FY2016 Housewares

$

84,603 $ 65,186 $ 19,417 29.8 %

18.3 % 17.2 %

20.3 % 18.1 % Health & Home

146,355

143,042 3,313 2.3 %

6.6 % 5.9 %

11.3 %

8.7 % Nutritional Supplements

35,940 39,440 (3,500 ) (8.9 )

%

(14.7 ) % 6.6 %

6.5 % 11.4 %

Beauty

81,040 97,677 (16,637 ) (17.0 )

%

3.8 % 4.4 %

10.5 % 9.8 % Total

347,938 345,345 2,593 0.8 %

6.6 % 7.7 %

12.8 % 11.1 %

Julien R. Mininberg, Chief Executive Officer, stated: “Our

fiscal year is off to a solid start, with our first quarter results

highlighted by increased net sales revenue, expansion in adjusted

operating margin, and growth in adjusted earnings per share. These

results were driven by solid progress on our key strategic

priorities, which brought improvements in our gross profit margin

as we benefitted from sales mix, SKU rationalization initiatives,

the Hydro Flask acquisition and cost savings efforts. Our

Housewares and Health & Home segments led the way during the

quarter, with growth in revenues and profitability more than

sufficient to offset softer sales in our Beauty and Nutritional

Supplements segments. We believe this speaks to the strength of our

diversified business model and the discipline with which we

operate. Our Housewares segment net sales grew 29.8%, with the core

business contributing 7.8%, and the newly acquired Hydro Flask

business contributing 22% toward growth. Our Health & Home

segment net sales grew 2.3%, even as we rationalized certain parts

of that business to further improve profitability. While Beauty

adjusted operating margin grew during the first quarter, sales in

that segment performed below our expectations primarily due to

slower replenishment orders from some key retailers as they

adjusted their stocking patterns. Net sales and profitability for

our Nutritional Supplements segment also showed a decline, as we

continue to transition that business into new channels such as

online and select specialty nutrition, reducing the dependency on

legacy newsletter subscription and direct mail. Healthy Directions

remains a leader in the industry and we continue to strategically

invest in the long-term growth and profitability of this

business.”

Mr. Mininberg continued: “Although the retail headwinds and

macroeconomic uncertainties have intensified in certain segments of

our business, we are pleased to maintain our consolidated full year

outlook due to our diversified business model and the benefits from

the execution of our multi-year transformation strategy. We expect

to continue to invest in our strong portfolio of brands, our

operations, and our management talent to deliver strong cash flow

and shareholder value in fiscal year 2017.”

First Quarter Fiscal Year 2017

Consolidated Operating Results

- Net sales revenue increased 0.8% to

$347.9 million compared to $345.3 million in the first quarter of

fiscal year 2016. Core business net sales revenue decreased $12.5

million, or 3.6%, which includes a negative year-over-year impact

from Venezuela and foreign currency fluctuations of 1.1% and 0.5%,

respectively.

- Gross profit margin increased 2.3

percentage points to 43.8% compared to 41.5% for the same period

last year. The increase in consolidated gross profit margin is

primarily due to favorable shifts in product sales mix, product

rationalization efforts, margin accretion from Hydro Flask and

declines in product costs, partially offset by the unfavorable

impact of foreign currency fluctuations and lower sales in

Nutritional Supplements.

- SG&A was 35.1% of net sales

compared to 32.9% of net sales for the same period last year. The

increase is primarily due to: (i) higher share-based incentive

compensation expense, which increased the SG&A ratio by 1.0

percentage point; (ii) the impact of $1.5 million in patent

litigation charges, which increased the SG&A ratio by 0.4

percentage points, and (iii) the impact within our core business

that lower net sales had on operating leverage. These factors were

partially offset by lower outbound freight costs and lower

year-over-year foreign currency revaluation losses.

- Operating income was $22.9 million

compared to $26.5 million for the same period last year primarily

reflecting: (i) a non-cash impairment charge of $7.4 million

related to certain trademarks and brand assets in the Beauty and

Nutritional Supplements segments; (ii) a $1.7 million decline from

the Company’s Venezuela operations, due almost entirely to the

adoption of the new DICOM exchange rate; (iii) the impact of $1.5

million in patent litigation charges; (iv) an increase of $3.6

million in share-based incentive compensation expense; and, (v) the

negative impact of foreign currency fluctuations.

- Income tax expense as a percentage of

pretax income was 1.9% compared to 14.2% for the same period last

year. The year-over-year decrease in the Company’s effective tax

rate was primarily due to a $1.4 million tax benefit related to the

resolution of uncertain tax positions, and a $1.1 million tax

benefit resulting from the recognition of excess tax benefits from

share-based compensation in income tax expense rather than

additional paid in capital, reflecting a change in an accounting

pronouncement.

- Net income was $19.0 million, or $0.68

per diluted share on 28.1 million weighted average diluted shares

outstanding, compared to $20.4 million, or $0.70 per diluted share

on 29.1 million weighted average diluted shares outstanding in the

same period last year.

- Adjusted EBITDA (EBITDA excluding

non-cash asset impairment charges, non-cash share-based

compensation, and patent litigation charges, as applicable)

increased $6.4 million to $48.4 million.

On an adjusted basis for the first quarter of fiscal years 2017

and 2016, excluding non-cash asset impairment charges, non-cash

amortization of intangible assets, non‐cash share based

compensation, and patent litigation charges, as applicable:

- Adjusted operating income was $44.6

million, or 12.8% of net sales, compared to $38.4 million, or 11.1%

of net sales, in the prior year, reflecting the overall improvement

in consolidated gross profit margin, the accretive impact of the

Hydro Flask acquisition, lower outbound freight costs, lower

year-over-year foreign currency revaluation losses, partially

offset by the unfavorable impact of foreign currency fluctuations

and a decline in operating income from the Company’s Venezuela

operations of $1.7 million, due almost entirely to the adoption of

the new DICOM exchange rate.

- Adjusted income was $35.9 million, or

$1.27 per diluted share, compared to $30.7 million, or $1.06 per

diluted share, in the prior year, primarily reflecting the

improvement in adjusted operating income and lower tax

expense.

First Quarter Fiscal 2017 Segment

Results

Health & Home net sales rose 2.3% driven by strong sell-in

of seasonal fans and year-over-year gains in the thermometry and

air purification categories, which were partially offset by

declines in the hot/cold therapy category due to planned

rationalization of lower margin products and programs, and a

decline in water filtration due to the discontinuation of a large

seasonal promotion program in the club channel and a slowdown in

replenishment orders after strong sell-in during the fourth quarter

of fiscal year 2016. Adjusted operating margin improved 2.6

percentage points to 11.3% due to a better product sales mix,

product cost decreases, lower freight costs and better operating

leverage from higher net sales revenue.

Housewares net sales increased by 29.8% driven by net sales

growth of 22% from Hydro Flask, which was acquired on March 18,

2016 (with no comparable results in the same period last year), and

7.8% of core business net sales revenue growth primarily due to new

product introductions. Growth was slightly offset by higher

promotional spending in support of new product launches. Adjusted

operating margin improved 2.2 percentage points primarily due to

margin accretion from the Hydro Flask acquisition, partially offset

by higher advertising and promotional spending in support of new

product launches.

Beauty net sales decreased 17.0%, which includes the negative

impact of approximately 1.4% from foreign currency fluctuations and

an anticipated 4% decline from the Company’s Venezuelan operations,

due almost entirely to the adoption of the new DICOM exchange rate.

Gains from new product introductions were offset by the anticipated

decline in the foot care category of $4.0 million, or 4.1%, due to

competitive pressures and high inventory in the channel, as well as

inventory adjustments by a few key retailers following strong

shipments in the fourth quarter of fiscal year 2016. Adjusted

operating margin improved 0.7 percentage points despite a decline

in operating income of $1.7 million, or 1.7 percentage points, from

the segment’s Venezuelan operations. The increase in adjusted

operating margin was primarily due to an improvement in gross

profit margin from a better product sales mix, SKU rationalization

and lower product costs, as well as a decline in advertising

expense.

Nutritional Supplements net sales decreased 8.9%, reflecting

lower response rates in the offline channel and a decline in the

legacy newsletter subscription business, partially offset by growth

in the AutoDelivery program and selective distribution in

additional channels, as the Company broadens this segment’s

business model. Adjusted operating margin declined by 4.9

percentage points due to the impact of the net sales decline on

operating leverage, higher promotion, advertising, customer

acquisition and online channel development costs, and upfront

investment in direct response television to drive demand at

specialty retail.

Balance Sheet Highlights

- Cash and cash equivalents totaled $23.1

million at May 31, 2016, compared to $15.3 million at May 31,

2015.

- Total short- and long-term debt

increased to $587.5 million at May 31, 2016, compared to $434.0

million at May 31, 2015, a net increase of $153.5 million. The

increase primarily reflects $210.0 million drawn to fund the Hydro

Flask acquisition in March 2016.

- Accounts receivable turnover was 54.1

days at May 31, 2016, compared to 57.1 days at May 31, 2015.

- Inventory was $319.2 million at May 31,

2016, compared to $299.3 million at May 31, 2015. Inventory

turnover improved to 2.8 times per year from 2.7 times per year for

the same period last year.

Hydro Flask Acquisition

As previously reported, on March 18, 2016, the Company acquired

Steel Technology, LLC, doing business as Hydro Flask (“Hydro

Flask”). Hydro Flask is a leading designer, distributor and

marketer of high performance insulated stainless steel food and

beverage containers for active lifestyles. The aggregate purchase

price for the transaction was approximately $209.3 million in cash,

subject to customary adjustments. The purchase price was funded

with borrowings under the Company’s credit facility.

Fiscal Year 2017 Annual

Outlook

For fiscal year 2017, the Company continues to expect

consolidated net sales revenue in the range of $1.570 to $1.620

billion, which includes incremental sales from the Hydro Flask

acquisition in the range of $60.0 to $65.0 million for the period

subsequent to closing in fiscal year 2017. The Company’s sales

outlook implies consolidated sales growth of 1.6% to 4.8%, and core

business sales growth of -2.3% to 0.6%, both of which include the

following items that negatively impact the year-over-year

comparison of net sales revenue by a combined 3.3 percentage

points:

- The impact of the re-measurement of the

Company’s fiscal year 2017 Venezuela financial statements at the

DICOM rate, which is expected to negatively impact year-over-year

consolidated net sales revenue by approximately $22.0 million, or

1.4 percentage points;

- The assumption that end of June foreign

currency exchange rates will remain constant for the fiscal year,

which is expected to negatively impact year-over-year net sales

revenue by approximately $9.0 million, or 0.6 percentage

points;

- The rationalization of low profit

business, which is expected to negatively impact year-over-year net

sales revenue by approximately $16.0 million, or 1.0 percentage

point; and

- The overhang from excess cold/flu

inventory at retail due to the weak fiscal year 2016 cold/flu

season, which is expected to negatively impact the comparison of

net sales revenue by approximately $4.0 million, or 0.3 percentage

points.

Although the Company is maintaining its expectations for fiscal

year 2017 consolidated net sales, it is lowering its expectations

for the Nutritional Supplements segment. The Company now expects a

decline in net sales for the Nutritional Supplements segment of

mid-single digits for fiscal year 2017. The Company also expects

the Beauty segment to end fiscal year 2017 at the bottom end of the

Company’s original expected decline of 7% to 12%.

The Company now expects consolidated GAAP diluted EPS of $4.37

to $4.77, which includes an after-tax non-cash asset impairment

charge of $5.1 million and a patent litigation charge of $1.5

million. The Company is maintaining its adjusted diluted EPS

(non-GAAP) outlook in the range of $5.85 to $6.35, which excludes

after-tax non-cash asset impairment charges, patent litigation

charges, share-based compensation expense and intangible asset

amortization expense and includes incremental adjusted diluted EPS

(non-GAAP) from the Hydro Flask acquisition in the range of $0.28

to $0.32 per share.

The following items negatively impact the year-over-year

comparison of earnings per diluted share by a combined $0.69 per

share:

- The impact of the re-measurement of the

Company’s fiscal year 2017 Venezuela financial statements at the

current DICOM rate, which is expected to negatively impact the

year-over-year comparison by approximately $0.30 per diluted

share;

- The assumption that end of June foreign

currency exchange rates will remain constant for the fiscal year,

which is expected to negatively impact the year-over-year

comparison by approximately $0.18 per diluted share;

- The significant and well-publicized

shift in the hourly wage landscape is expected to have a negative

impact of approximately $0.14 per diluted share in fiscal year

2017; and

- The comparative impact of $0.07 per

diluted share of tax benefits in fiscal year 2016 that are not

expected to repeat in fiscal year 2017.

Consistent with the Company’s strategy of investing in core

business growth, its outlook includes approximately $0.45 per share

year-over-year in incremental investments in marketing,

advertising, new product and new channel development.

The Company’s outlook assumes that the severity of the cold/flu

season will be in line with historical averages. The diluted EPS

outlook is based on an estimated weighted average shares

outstanding of 28.3 million and an expected effective tax rate of

13% to 15% for the full fiscal year 2017. The guidance also

reflects the Company’s outlook for the retail environment and

recent declining trends in the retail sector and the broader

market. The likelihood and potential impact of any fiscal year 2017

acquisitions, future asset impairment charges, future foreign

currency fluctuations, or further share repurchases are unknown and

cannot be reasonably estimated; therefore, they are not included in

the Company’s sales and earnings outlook.

Conference Call and

Webcast

The Company will conduct a teleconference in conjunction with

today's earnings release. The teleconference begins at 4:45 pm

Eastern Time today, Thursday, July 7, 2016. Institutional investors

and analysts interested in participating in the call are invited to

dial (888) 572-7034 approximately ten minutes prior to the start of

the call. The conference call will also be webcast live at:

www.hotus.com. A telephone replay of this call will be available at

7:45 p.m. Eastern Time on July 7, 2016 until 11:59 p.m. Eastern

Time on July 14, 2016 and can be accessed by dialing (877) 870-5176

and entering replay pin number 2456521. A replay of the webcast

will remain available on the website for 60 days.

Non-GAAP Financial

Measures:

The Company reports and discusses its operating results using

financial measures consistent with accounting principles generally

accepted in the United States of America (“GAAP”). To supplement

its presentation, the Company discloses certain financial measures

that may be considered non-GAAP financial measures, such as

adjusted operating income, adjusted operating margin, adjusted

income, adjusted diluted EPS, EBITDA and adjusted EBITDA, which are

presented in accompanying tables to this press release along with a

reconciliation of these financial measures to their corresponding

GAAP-based measures presented in the Company’s consolidated

statements of income.

About Helen of Troy

Limited:

Helen of Troy Limited (NASDAQ, NM: HELE) is a leading global

consumer products company offering creative solutions for its

customers through a strong portfolio of well-recognized and

widely-trusted brands, including OXO®, Good Grips®, Hydro

Flask®, OXO tot®, OXO on®, Vicks®, Braun®, Honeywell®,

PUR®, Febreze®; Revlon®, Pro Beauty Tools®, Sure®, Pert®,

Infusium23®, Brut®, Ammens®, Hot Tools®, Bed Head®, Dr. Sinatra®,

Dr. David Williams®, and Dr. Whitaker®. All trademarks herein

belong to Helen of Troy Limited (or its affiliates) and/or are used

under license from their respective licensors.

For more information about Helen of Troy, please visit

www.hotus.com.

Forward Looking

Statements:

Certain written and oral statements made by our Company and

subsidiaries of our Company may constitute "forward-looking

statements" as defined under the Private Securities Litigation

Reform Act of 1995. This includes statements made in this press

release. Generally, the words "anticipates", "believes", "expects",

"plans", "may", "will", "should", "seeks", "estimates", "project",

"predict", "potential", "continue", "intends", and other similar

words identify forward-looking statements. All statements that

address operating results, events or developments that we expect or

anticipate will occur in the future, including statements related

to sales, earnings per share results, and statements expressing

general expectations about future operating results, are

forward-looking statements and are based upon our current

expectations and various assumptions. We believe there is a

reasonable basis for our expectations and assumptions, but there

can be no assurance that we will realize our expectations or that

our assumptions will prove correct. Forward-looking statements are

subject to risks that could cause them to differ materially from

actual results. Accordingly, we caution readers not to place undue

reliance on forward-looking statements. The forward-looking

statements contained in this press release should be read in

conjunction with, and are subject to and qualified by, the risks

described in the Company's Form 10-K for the year ended February

29, 2016 and in our other filings with the SEC. Investors are urged

to refer to the risk factors referred to above for a description of

these risks. Such risks include, among others, our ability to

deliver products to our customers in a timely manner and according

to their fulfillment standards, our relationships with key

customers and licensors, the costs of complying with the business

demands and requirements of large sophisticated customers, our

dependence on the strength of retail economies and vulnerabilities

to any prolonged economic downturn, the retention and recruitment

of key personnel, expectations regarding our recent and future

acquisitions, including our ability to realize anticipated cost

savings, synergies and other benefits along with our ability to

effectively integrate acquired businesses, foreign currency

exchange rate fluctuations, disruptions in U.S., U.K., Euro zone,

Venezuela, and other international credit markets, risks associated

with weather conditions, the duration and severity of the cold and

flu season and other related factors, our dependence on foreign

sources of supply and foreign manufacturing, and associated

operational risks including, but not limited to, long lead times,

consistent local labor availability and capacity, and timely

availability of sufficient shipping carrier capacity, risks to the

Nutritional Supplements segment associated with the availability,

purity and integrity of materials used in the manufacture of

vitamins, minerals and supplements, the impact of changing costs of

raw materials, labor and energy on cost of goods sold and certain

operating expenses, the geographic concentration and peak season

capacity of certain U.S. distribution facilities increases our

exposure to significant shipping disruptions and added shipping and

storage costs, our projections of product demand, sales and net

income are highly subjective in nature and future sales and net

income could vary in a material amount from such projections,

circumstances which may contribute to future impairment of

goodwill, intangible or other long-lived assets, the risks

associated with the use of trademarks licensed from and to third

parties, our ability to develop and introduce a continuing stream

of new products to meet changing consumer preferences, increased

product liability and reputational risks associated with the

formulation and distribution of vitamins, minerals and supplements,

the risks associated with potential adverse publicity and negative

public perception regarding the use of vitamins, minerals and

supplements, trade barriers, exchange controls, expropriations, and

other risks associated with foreign operations, debt leverage and

the constraints it may impose on our cash resources and ability to

operate our business, the costs, complexity and challenges of

upgrading and managing our global information systems, the risks

associated with information security breaches, the increased

complexity of compliance with a number of new government

regulations as a result of adding vitamins, minerals and

supplements to the Company’s portfolio of products, the risks

associated with product recalls, product liability, other claims,

and related litigation against us, the risks associated with tax

audits and related disputes with taxing authorities, the risks of

potential changes in laws, including tax laws, health insurance

laws and regulations related to conflict minerals along with the

costs and complexities of compliance with such laws, and our

ability to continue to avoid classification as a controlled foreign

corporation. We undertake no obligation to publicly update or

revise any forward-looking statements as a result of new

information, future events or otherwise.

HELEN OF TROY LIMITED AND SUBSIDIARIES

Consolidated Condensed Statements of Income and Reconciliation

of Non-GAAP Financial Measures – Adjusted Operating Income,

Adjusted Income and Adjusted Diluted Earnings per Share ("EPS")

(1) (Unaudited) (in thousands, except per share

data) Three Months Ended May 31,

2016 2015 As Reported

(GAAP) Adjustments

Adjusted(non-GAAP)

As Reported (GAAP)

Adjustments

Adjusted(non-GAAP)

Sales revenue, net $ 347,938 100.0 % $ - $ 347,938

100.0 % $ 345,345 100.0 % $ - $ 345,345 100.0 % Cost

of goods sold 195,511 56.2 % -

195,511 56.2 % 202,026 58.5

% - 202,026 58.5 % Gross

profit 152,427 43.8 % - 152,427 43.8 % 143,319 41.5 % - 143,319

41.5 % Selling, general, and administrative expense

("SG&A") 122,129 35.1 % - 107,843 31.0 % 113,776 32.9 % -

104,901 30.4 % (5,614 ) (2 ) (2,061 ) (2 ) (7,204 ) (3 ) (6,814 )

(3 ) (1,468 ) (4 ) - Asset impairment charges 7,400

2.1 % (7,400 ) (5 ) - - %

3,000 0.9 % (3,000 ) (5 ) - -

% Operating income 22,898 6.6 %

21,686 44,584 12.8 % 26,543

7.7 % 11,875 38,418 11.1

% Nonoperating income, net 149 - % - 149 - % 138 - %

- 138 - % Interest expense (3,651 ) (1.0 ) % -

(3,651 ) (1.0 ) % (2,892 ) (0.8 ) % -

(2,892 ) (0.8 ) % Total other expense (3,502 ) (1.0 )

% - (3,502 ) (1.0 ) % (2,754 ) (0.8 ) %

- (2,754 ) (0.8 ) % Income before income taxes

19,396 5.6 % 21,686 41,082 11.8 % 23,789 6.9 % 11,875 35,664 10.3 %

Income tax expense 370 0.1 %

4,830 (7 ) 5,200 1.5 % 3,379

1.0 % 1,583 (7 ) 4,962

1.4 % Net income $ 19,026 5.5 % $ 16,856

$ 35,882 10.3 % $ 20,410 5.9 % $

10,292 $ 30,702 8.9 % Diluted EPS $

0.68 $ 0.59 $ 1.27 $ 0.70 $ 0.36 $ 1.06 Weighted average

shares of common stock used in computing diluted EPS 28,147 -

28,147 29,088 - 29,088

HELEN OF TROY LIMITED AND

SUBSIDIARIES Net Sales Revenue by Segment (6)

(Unaudited) (in thousands) Three

Months Ended May 31,

% of Sales Revenue, net 2016

2015 $ Change % Change

2016 2015 Sales revenue by segment, net

Housewares $ 84,603 $ 65,186 $ 19,417 29.8 % 24.3 % 18.9 % Health

& Home 146,355 143,042 3,313 2.3 % 42.1 % 41.4 % Nutritional

Supplements 35,940 39,440 (3,500 ) (8.9 ) % 10.3 % 11.4 % Beauty

81,040 97,677 (16,637 ) (17.0 ) % 23.3 % 28.3

% Total sales revenue, net $ 347,938 $ 345,345 $ 2,593 0.8

% 100.0 % 100.0 %

HELEN OF TROY LIMITED AND

SUBSIDIARIES Selected Consolidated Balance Sheet,

Cash Flow and Liquidity Information (Unaudited) (in

thousands) May 31,

2016

2015 (a) Balance Sheet: Cash and cash equivalents $

23,115 $ 15,262 Receivables, net 204,544 210,001 Inventory, net

319,249 299,300 Total assets, current 560,408 540,381 Total assets

1,841,516 1,656,935 Total liabilities, current 277,386 267,279

Total long-term liabilities 607,659 457,519 Total debt 587,491

433,966 Stockholders' equity 956,471 932,137 Cash Flow:

Depreciation and amortization $ 10,956 $ 10,354 Net cash provided

by operating activities 41,736 37,818 Capital and intangible asset

expenditures 5,154 2,717 Payments to acquire businesses, net of

cash received 209,258 42,750 Net amounts borrowed (32,700 ) 5,600

Liquidity: Working Capital $ 283,023 $ 273,102

(a) As a result of the adoption of new accounting standards

for fiscal year 2017, balances as of May 31, 2015 have be

reclassified to conform with current year’s presentation.

SELECTED OTHER DATA Reconciliation of Non-GAAP

Financial Measures – GAAP Operating Income to Adjusted

Operating Income (non-GAAP) (1) (6) (Unaudited) (in

thousands) Three Months Ended May 31, 2016

Housewares

Health & Home

NutritionalSupplements

Beauty Total Operating income, as

reported (GAAP) $ 15,500 18.3 % $ 9,604 6.6 % $

(5,272 ) (14.7 ) % $ 3,066 3.8 % $ 22,898 6.6

% Patent litigation charge (4) - - % 1,468 1.0 % - - % - - % 1,468

0.4 % Asset impairment charges (5) - - % - - %

5,000 13.9 % 2,400 3.0 % 7,400 2.1 %

Subtotal 15,500 18.3 % 11,072 7.6 % (272 ) (0.8 ) % 5,466 6.7 %

31,766 9.1 % Non-cash share-based compensation (2) 1,028 1.2 %

1,910 1.3 % 1,032 2.9 % 1,644 2.0 % 5,614 1.6 % Amortization of

intangible assets (3) 657 0.8 % 3,538 2.4 %

1,571 4.4 % 1,438 1.8 % 7,204 2.1 %

Adjusted operating income (non-GAAP) $ 17,185 20.3 % $ 16,520 11.3

% $ 2,331 6.5 % $ 8,548 10.5 % $ 44,584 12.8 %

Three Months Ended May 31, 2015

Housewares

Health & Home

NutritionalSupplements

Beauty Total Operating income,

as reported (GAAP) $ 11,183 17.2 % $ 8,418 5.9 % $

2,620 6.6 % $ 4,322 4.4 % $ 26,543

7.7 % Asset impairment charges (5) - - % - - %

- - % 3,000 3.1 % 3,000 0.9 %

Subtotal 11,183 17.2 % 8,418 5.9 % 2,620 6.6 % 7,322 7.5 % 29,543

8.6 % Non-cash share-based compensation (2) 306 0.5 % 595 0.4 % 303

0.8 % 857 0.9 % 2,061 0.6 % Amortization of intangible assets (3)

312 0.5 % 3,500 2.4 % 1,564 4.0

% 1,438 1.5 % 6,814 2.0 % Adjusted operating income

(non-GAAP) $ 11,801 18.1 % $ 12,513 8.7 % $ 4,487 11.4

% $ 9,617 9.8 % $ 38,418 11.1 %

SELECTED

OTHER DATA Reconciliation of Non-GAAP Financial

Measures - EBITDA (Earnings Before Interest, Taxes,

Depreciation and Amortization) and Adjusted EBITDA (1) (6)

(Unaudited) (in thousands) Three

Months Ended May 31, 2016 2015 Net income

$ 19,026 $ 20,410 Interest expense, net 3,608 2,874

Income tax expense 370 3,379 Depreciation and amortization,

excluding amortized interest 10,956 10,354

EBITDA (Earnings before interest, taxes, depreciation and

amortization) 33,960 37,017 Add: Non-cash share-based

compensation (2) 5,614 2,061 Patent litigation charge (4)

1,468 - Non-cash asset impairment charges (5) 7,400

3,000 Adjusted EBITDA $ 48,442 $ 42,078

SELECTED OTHER DATA Reconciliation of Non-GAAP

Financial Measures - EBITDA (Earnings Before Interest,

Taxes, Depreciation and Amortization) and Adjusted EBITDA by

Segment (1) (6) (Unaudited) (in thousands)

Three Months Ended May 31, 2016 Housewares

Health &Home

NutritionalSupplements

Beauty Total Operating Income $ 15,500

$ 9,604 $ (5,272 ) $ 3,066 $ 22,898 Depreciation and

amortization, excluding amortized interest 1,329 5,233 1,960 2,434

10,956 Other income / (expense) - - -

106 106 EBITDA (Earnings before interest,

taxes, depreciation and amortization) 16,829 14,837 (3,312 ) 5,606

33,960 Add: Non-cash share-based compensation (2) 1,028

1,910 1,032 1,644 5,614 Patent litigation charge (4) - 1,468

- - 1,468 Non-cash asset impairment charges (5) -

- - 7,400 7,400 Adjusted

EBITDA $ 17,857 $ 18,215 $ (2,280 ) $ 14,650 $ 48,442

Three Months Ended May 31, 2015 Housewares

Health& Home

NutritionalSupplements

Beauty Total Operating Income $ 11,183 $ 8,418 $

2,620 $ 4,322 $ 26,543 Depreciation and amortization,

excluding amortized interest 1,008 5,063 1,968 2,315 10,354

Other income / (expense) - - -

120 120 EBITDA (Earnings before interest, taxes,

depreciation and amortization) 12,191 13,481 4,588 6,757 37,017

Add: Non-cash share-based compensation (2) 306 595 303 857

2,061 Non-cash asset impairment charges (5) -

- - 3,000 3,000 Adjusted EBITDA

$ 12,497 $ 14,076 $ 4,891 $ 10,614 $ 42,078

HELEN OF TROY LIMITED AND SUBSIDIARIES

Reconciliation of GAAP Net Income and

Earnings Per Share (EPS) to Adjusted Income and Adjusted EPS

(non-GAAP) (1) (6) (7)

(dollars in thousands, except per share data)

(Unaudited) Three Months Ended May 31,

Basic EPS Diluted EPS 2016

2015 2016 2015 2016

2015 Net income as reported (GAAP) $ 19,026 $ 20,410

$ 0.69 $ 0.72 $ 0.68 $ 0.70 Patent litigation charge, net of tax

(4) 1,464 - 0.05 - 0.05 - Asset impairment charges, net of tax (5)

5,097 2,656 0.18 0.09 0.18

0.09 Subtotal 25,587 23,066 0.92 0.81 0.91 0.79 Non-cash

share-based compensation, net of tax (2) 4,093 1,742 0.15 0.06 0.15

0.06 Amortization of intangible assets, net of tax (3) 6,202

5,894 0.22 0.21 0.22 0.20

Adjusted income (non-GAAP) $ 35,882 $ 30,702 $ 1.29 $ 1.08 $ 1.27 $

1.06 Weighted average shares of common stock used in

computing basic and diluted earnings per share 27,773 28,520 28,147

29,088

HELEN OF TROY LIMITED AND SUBSIDIARIES

Reconciliation of Fiscal Year 2017 Outlook for GAAP Diluted

EPS to Adjusted Diluted EPS (non-GAAP) (1) (7) (8)

(Unaudited) Fiscal Year Ended February 28,

2017

Quarter Ended

Outlook for the

May 31, 2016 Balance of the Fiscal Outlook for

the (Three Year Fiscal Year Months)

(Nine Months) (Twelve Months) Diluted EPS, as

reported (GAAP) $ 0.68 $ 3.69 -

$ 4.09 4.37 - $ 4.77 Patent litigation

charge, net of tax (4) 0.05 - - - 0.05 - 0.05 Asset impairment

charges, net of tax (5) 0.18 - -

- 0.18 -

0.18 Subtotal 0.91 3.69 - 4.09 4.60 - 5.00 Non-cash

share-based compensation, net of tax (2) 0.15 0.25 - 0.29 0.40 -

0.44 Amortization of intangible assets, net of tax (3) 0.22

0.63 - 0.69

0.85 - 0.91 Adjusted diluted EPS

(non-GAAP) (1) $ 1.27 $ 4.58 - $

5.08 $ 5.85 - $ 6.35

HELEN OF TROY LIMITED AND SUBSIDIARIES

Notes to Press Release

(1) This press release contains non-GAAP financial measures.

Adjusted operating income, adjusted operating margin, adjusted

income, adjusted diluted EPS, EBITDA and adjusted EBITDA (“Non-GAAP

measures”) that are discussed in the accompanying press release or

in the preceding tables are considered non-GAAP financial

information as contemplated by SEC Regulation G, Rule 100.

Accordingly, we are providing the preceding tables that reconcile

these measures to their corresponding GAAP-based measures presented

in our Consolidated Condensed Statements of Income in the

accompanying tables to the press release. The Company believes that

these non-GAAP measures provide useful information to management

and investors regarding financial and business trends relating to

its financial condition and results of operations. The Company

believes that these non-GAAP measures, in combination with the

Company's financial results calculated in accordance with GAAP,

provides investors with additional perspective. Additionally, the

non-GAAP financial measures are used by management for measuring

and evaluating the Company’s performance. The Company further

believes that the items excluded from certain non-GAAP measures do

not accurately reflect the underlying performance of its continuing

operations for the periods in which they are incurred, even though

some of these excluded items may be incurred and reflected in the

Company's GAAP financial results in the foreseeable future. The

material limitation associated with the use of the non-GAAP

financial measures is that the non-GAAP measures do not reflect the

full economic impact of the Company's activities. These non-GAAP

measures are not prepared in accordance with GAAP, are not an

alternative to GAAP financial information, and may be calculated

differently than non-GAAP financial information disclosed by other

companies. Accordingly, undue reliance should not be placed on

non-GAAP information. (2) Adjustments consist of non-cash

share-based compensation expense of $5.61 million ($4.09 million

after tax) and $2.06 million ($1.74 million after tax),

respectively, for the three months ended May 31, 2016 and 2015,

respectively. Share-based compensation expense is recognized for

share-based awards outstanding under share-based compensation

plans. (3) Adjustments consist of non-cash intangible asset

amortization expense of $7.20 million ($6.20 million after tax) and

$6.81 million ($5.89 million after tax), respectively, for the

three months ended May 31, 2016 and 2015, respectively. (4)

Adjustment consists of a patent litigation charge of $1.47 million

($1.46 million after tax) recorded during the three months ended

May 31, 2016. (5) Adjustments consist of non-cash asset

impairment charges of $7.40 million ($5.10 million after tax) and

$3.00 million ($2.66 million after tax), respectively, for the

three months ended May 31, 2016 and 2015, respectively. The

non-cash charges relate to certain brand assets and trademarks in

our Nutritional Supplements and Beauty segments, which were written

down to their estimated fair values, determined on the basis of

future discounted cash flows using the relief from royalty

valuation method. (6) The VapoSteam business was acquired on

March 31, 2015 and its operations are reported in the Health &

Home segment. Results reported for the three months ended May 31,

2016 includes one incremental month of operating results compared

to the same period last year. The Hydro Flask business was

acquired on March 18, 2016 and its operations are reported in the

Housewares segment. Results reported for the three months ended May

31, 2016 include approximately two and a half months of operating

results, with no comparable results for the same period last year.

(7) Total tax effects of adjustments described in Notes 2

through 5, for each of the periods presented:

Three Months Ended May 31, (In thousands)

2016

2015 Non-cash share-based compensation

(2) (1,521 ) (319 ) Amortization of intangible assets (3)

(1,002 ) (920 ) Patent litigation charge (4) (4 ) - Asset

impairment charges (5) (2,303 ) (344 ) Total $ (4,830

) $ (1,583 ) (8) The diluted EPS outlook is based on

an estimated weighted average shares outstanding of 28.30 million

for fiscal year 2017.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160707006357/en/

Investors:ICR, Inc.Allison Malkin / Anne Rakunas203-682-8200 /

310-954-1113

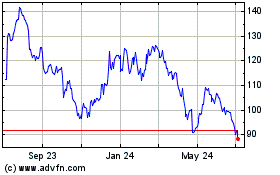

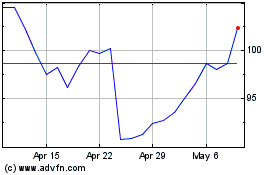

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Apr 2023 to Apr 2024