Table of Contents

As filed with the Securities and Exchange Commission on December 11, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HELEN OF TROY LIMITED

(Exact name of registrant as specified in its charter)

|

BERMUDA |

|

74-2692550 |

|

(State or other jurisdiction of incorporation or

organization) |

|

(I.R.S. Employer Identification No.) |

Clarendon House

2 Church Street

Hamilton, Bermuda

(Address, including Zip Code, of Principal Executive Offices)

1 Helen of Troy Plaza

El Paso, Texas 79912

(Registrant’s United States Mailing Address)

Vincent D. Carson

c/o Helen of Troy L.P.

1 Helen of Troy Plaza

El Paso, Texas 79912

(915) 225-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

W. Crews Lott

Baker & McKenzie LLP

2300 Trammell Crow Center

2001 Ross Avenue

Dallas, Texas 75201

(214) 978-3000

(214) 978-3099 (facsimile)

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check One):

|

Large accelerated filer x |

|

Accelerated filer o |

|

Non-accelerated filer o (Do not check if smaller reporting company) |

|

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities

to be registered |

|

Amount to

be registered |

|

Proposed

Maximum

Offering Price

Per Share(1) |

|

Proposed

Maximum

Aggregate

Offering

Price |

|

Amount of

Registration Fee |

|

|

Common Shares, par value $0.10 per share |

|

160,536 shares |

|

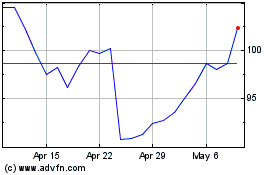

$ |

102.82 |

|

$ |

16,506,311.52 |

|

$ |

1,662.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Estimated pursuant to Rule 457(c), the offering price per share is based on the average of the high and low prices for our common shares on December 8, 2015, as reported on the NASDAQ Global Select Market.

Table of Contents

PROSPECTUS

160,536 Shares

HELEN OF TROY LIMITED

Common Shares

This prospectus is part of a resale registration statement that we filed with the Securities and Exchange Commission using a “shelf” registration, or continuous offering, process. Under this shelf registration process, the selling shareholder, who is identified under the section of this prospectus entitled “Selling Shareholder,” may, from time to time, sell or otherwise dispose of up to 160,536 of our common shares in one or more transactions at any time or from time to time.

We are not selling any common shares under this prospectus and will not receive any proceeds from the sale of common shares by the selling shareholder. The common shares to which this prospectus relates may be offered and sold from time to time directly by the selling shareholder or through broker-dealers or agents. Such common shares may be sold in one or more transactions, at fixed prices, at prevailing market prices at the time of sale or at negotiated prices. For additional information on the methods of sale, you should refer to the section of this prospectus entitled “Plan of Distribution.”

Investing in our common shares involves various risks. You should carefully consider the risks referenced under “Risk Factors” beginning on page 3 of this prospectus, as well as the other information contained or incorporated by reference in this prospectus or any supplement hereto, before making a decision to invest in our common shares.

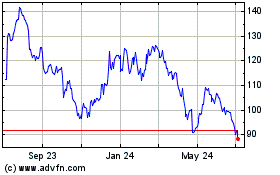

Our common shares are listed on the NASDAQ Global Select Market under the symbol “HELE.” On December 8, 2015, the closing price of our common shares was $102.14 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated December 11, 2015

Table of Contents

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, which we refer to as the SEC, using a “shelf” registration process. Under this prospectus, the selling shareholder may sell the common shares described in this prospectus in one or more offerings. This prospectus may be supplemented from time to time to add, update or change information contained in this prospectus. Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in a prospectus supplement. You should read both this prospectus and any prospectus supplement together with additional information described under the heading “Where You Can Find More Information.”

You should rely only on the information contained in or incorporated by reference into this prospectus and any prospectus supplement. We and the selling shareholder have not authorized any dealer, salesman or other person to provide you with additional or different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus and any prospectus supplement are not an offer to sell or the solicitation of an offer to buy any securities other than the securities to which they relate and are not an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make an offer or solicitation in that jurisdiction. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Except as required by law, neither we nor the selling shareholder undertake any obligation to update any statements herein for revisions or changes after the date of this prospectus.

Unless the context suggests otherwise or unless otherwise noted, all references in this prospectus or any accompanying prospectus supplement to “the Company”, “our Company”, “Helen of Troy”, “we”, “us”, or “our” refer to Helen of Troy Limited and its subsidiaries.

i

Table of Contents

THE COMPANY

We are a global consumer products company offering creative solutions for our customers through a strong portfolio of well-recognized and widely trusted brands. We have built our market positions through new product innovation, product quality and competitive pricing. People around the world use our products every day to help meet their household, health and beauty needs. We have four business segments:

· Housewares. Our Housewares segment provides a broad range of innovative consumer products for the home. Product offerings include food preparation tools, gadgets, storage containers, kitchen electrics, bakeware, and cleaning, organization, baby and toddler care products. Key brands include OXO, OXO Good Grips, OXO Soft Works, OXO tot, and OXO SteeL.

· Healthcare / Home Environment. The Healthcare / Home Environment segment focuses on healthcare devices such as thermometers, humidifiers, blood pressure monitors, and heating pads; water filtration systems; and small home appliances such as portable heaters, fans, air purifiers, and insect control devices. Key brands include Vicks, Braun, Honeywell, PUR, Febreze, Stinger, Duracraft, and SoftHeat.

· Nutritional Supplements. Our Nutritional Supplements segment is a leading provider of premium branded vitamins, minerals and supplements, as well as other health products sold directly to consumers. Key brands include Omega Q Plus Resveratrol®, Omega Q Plus®, Probiotic Advantage®, Vision Essentials®, Total Cardio Cover®, Joint Advantage Gold®, Triveratrol®, Trilane® and OxyRub®.

· Beauty. Our Beauty segment’s products include electric hair care, beauty care and wellness appliances; grooming tools and accessories; and liquid-, solid- and powder-based personal care and grooming products. Key brands include Revlon, Vidal Sassoon, Dr. Scholl’s, Toni&Guy, Sure, Pert Plus, Infusium 23, Brut, Ammens, Hot Tools, Bed Head, Karina, Sea Breeze, and Gold ‘N Hot.

The Nutritional Supplements segment sells directly to consumers. Our other segments sell their products primarily through mass merchandisers, drugstore chains, warehouse clubs, catalogs, grocery stores, and specialty stores. In addition, the Beauty segment sells extensively through beauty supply retailers and wholesalers, and the Healthcare / Home Environment segment sells certain of its product lines through medical distributors and other products through home improvement stores. We purchase our products from unaffiliated manufacturers, most of which are located in China, Mexico and the United States.

We incorporated as Helen of Troy Corporation in Texas in 1968 and were reorganized as Helen of Troy Limited in Bermuda in 1994. Our principal executive office is located at Clarendon House, 2 Church Street, Hamilton, Bermuda, our U.S. mailing address is 1 Helen of Troy Plaza, El Paso, Texas 79912, and our telephone number is (915) 225-8000. Our common shares are listed on the NASDAQ Global Select Market under the symbol “HELE.”

We maintain our main Internet site at the following address: http://www.hotus.com. The information on, or accessible through, our website is not part of this prospectus.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

Certain written and oral statements made by our Company and subsidiaries of our Company may constitute “forward-looking statements” as defined under the Private Securities Litigation Reform Act of 1995. This includes statements made in this prospectus, including the documents incorporated by reference into this prospectus, in press releases, and in certain other oral and written presentations. Generally, the words “anticipates”, “believes”, “expects”, “plans”, “may”, “will”, “should”, “seeks”, “estimates”, “project”, “predict”, “potential”, “continue”, “intends”, and other similar words identify forward-looking statements. All statements that address operating results, events or developments that we expect or anticipate will occur in the future, including statements related to sales, earnings per share results, and statements expressing general expectations about future operating results, are forward-looking statements and are based upon our current expectations and various assumptions. We believe there is a reasonable basis for our expectations and assumptions, but there can be no assurance that we will realize our expectations or that our assumptions will prove correct. Forward-looking statements are subject to risks that could cause them to differ materially from actual results. Accordingly, we caution readers not to place undue reliance on forward-looking statements. We believe that these risks include but are not limited to the risks described in this prospectus and under Part I, Item 1A., “Risk Factors” of our Annual Report on Form 10-K for the year ended

1

Table of Contents

February 28, 2015, and that are otherwise described from time to time in our SEC reports filed after the date of this prospectus. Such risks, uncertainties and other important factors include, among others:

· the retention and recruitment of key personnel;

· our ability to deliver products to our customers in a timely manner and according to their fulfillment standards;

· our relationships with key customers and licensors;

· the costs of complying with the business demands and requirements of large sophisticated customers;

· our dependence on the strength of retail economies and vulnerabilities to any prolonged economic downturn;

· expectations regarding our recent and future acquisitions, including our ability to realize anticipated cost savings, synergies and other benefits along with our ability to effectively integrate acquired businesses;

· foreign currency exchange rate fluctuations;

· disruptions in U.S., Eurozone, Venezuela, and other international credit markets;

· risks associated with weather conditions;

· our dependence on foreign sources of supply and foreign manufacturing, and associated operational risks including but not limited to long lead times, consistent local labor availability and capacity, and timely availability of sufficient shipping carrier capacity;

· risks to the Nutritional Supplements segment associated with the availability, purity and integrity of materials used in the manufacture of vitamins, minerals and supplements;

· the impact of changing costs of raw materials, labor and energy on cost of goods sold and certain operating expenses;

· the geographic concentration and peak season capacity of certain U.S. distribution facilities increases our exposure to significant shipping disruptions and added shipping and storage costs;

· difficulties encountered during the transition of certain businesses to our distribution facilities could interrupt our logistical systems and cause shipping disruptions;

· our projections of product demand, sales and net income are highly subjective in nature and future sales and net income could vary in a material amount from such projections;

· circumstances which may contribute to future impairment of goodwill, intangible or other long-lived assets;

· the risks associated with the use of trademarks licensed from and to third parties;

· our ability to develop and introduce a continuing stream of new products to meet changing consumer preferences;

· increased product liability and reputational risks associated with the formulation and distribution of vitamins, minerals and supplements;

· the risks associated with potential adverse publicity and negative public perception regarding the use of vitamins, minerals and supplements;

· trade barriers, exchange controls, expropriations, and other risks associated with foreign operations;

· debt leverage and the constraints it may impose on our cash resources and ability to operate our business;

· the costs, complexity and challenges of upgrading and managing our global information systems;

· the risks associated with information security breaches;

2

Table of Contents

· the increased complexity of compliance with a number of new government regulations as a result of adding vitamins, minerals and supplements to the Company’s portfolio of products;

· the risks associated with tax audits and related disputes with taxing authorities;

· the risks of potential changes in laws, including tax laws, health insurance laws and new regulations related to conflict minerals along with the costs and complexities of compliance with such laws; and

· our ability to continue to avoid classification as a controlled foreign corporation.

Although we undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as required by law, you are advised to consult any additional disclosures we make in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC. See “Where You Can Find More Information.”

RISK FACTORS

An investment in our securities involves risks. Before you invest in our securities, you should carefully consider, among other things, the matters discussed under Part I, Item 1A., “Risk Factors” of our most recent Annual Report on Form 10-K and in other documents that we incorporate by reference into this prospectus.

If any of these risks were to materialize, our business, results of operations, cash flows and financial condition could be materially adversely affected. In that case, our ability to pay interest on, or the principal of, any debt securities, may be reduced, the trading price of our securities could decline and you could lose all or part of your investment. In addition, you should consider carefully the risks below together with all of the other information included in, or incorporated by reference into, this prospectus before deciding whether to invest in our securities.

The market price for our common shares may be volatile, and the value of your investment could materially decline.

Investors who hold our common shares may not be able to sell their shares at or above the price at which they purchased such shares. The share price of our common shares has fluctuated materially from time to time, and we cannot predict the price of our common shares at any given time. The risk factors described herein and in the documents incorporated by reference into this prospectus could cause the price of our common shares to fluctuate materially. In addition, the stock market in general, including the market for companies in our industry, has experienced price and volume fluctuations. These broad market and industry factors may materially harm the market price of our common shares, regardless of our operating performance. In addition, the price of our common shares may be affected by the valuations and recommendations of the analysts who cover us, and if our results do not meet the analysts’ forecasts and expectations, the price of our common shares could decline as a result of analysts lowering their valuations and recommendations or otherwise. In the past, following periods of volatility in the market and/or in the price of a company’s capital stock, securities class-action litigation has often been instituted against other companies. Such litigation, if instituted against us, could result in substantial costs and diversion of management’s attention and resources, which could have a material adverse effect on our business, financial condition, results of operations, cash flows, and/or common share price. We also may undertake additional offerings of common shares or of securities convertible into or exchangeable or exercisable for common shares. The resulting increase in the number of the common shares issued and outstanding and the possibility of sales of such common shares or such securities convertible into or exchangeable or exercisable for common shares after any such additional offerings may depress the future trading price of the common shares. In addition, if additional offerings occur, the voting power of our then existing shareholders may be diluted.

We do not expect to pay any dividends on our common shares in the foreseeable future.

We do not expect to declare or pay any cash or other dividends on our common shares in the foreseeable future, as we intend to use cash flow generated by operations for general business purposes. Our credit facility and the agreements governing our outstanding indebtedness limit our ability to pay cash dividends on our common shares, and we may also enter into credit agreements or other borrowing arrangements in the future that limit or restrict our ability to declare or pay cash dividends on our common shares.

3

Table of Contents

USE OF PROCEEDS

The common shares to be offered and sold using this prospectus will be offered and sold by the selling shareholder named in this prospectus or in any supplement to this prospectus. We will not receive any proceeds from the sale of such common shares.

DESCRIPTION OF CAPITAL STOCK

For a description of our common shares, see the description contained in our Registration Statement on Form S-4, filed with the SEC on December 30, 1993, including any amendments or reports filed for the purpose of updating such description, which is incorporated herein by reference.

SELLING SHAREHOLDER

This prospectus covers the offering for resale of up to 160,536 of our common shares by the selling shareholder identified below. The selling shareholder acquired these common shares from us in a private placement pursuant to an exemption from registration in connection with separation compensation paid to the selling shareholder under his previous employment and separation agreements. The registration statement of which this prospectus forms a part has been filed pursuant to registration rights granted to the selling shareholder. The selling shareholder served as our Chairman of the Board, Chief Executive Officer and President until January 2014.

Under the terms of the registration rights held by the selling shareholder, we will pay all expenses of the registration of the common shares, including SEC filing fees, except that the selling shareholder will pay the fees and expenses of his own counsel and selling commissions, if any. Our expenses for the registration of the common shares are estimated to be approximately $66,662.

No offer or sale may occur unless this prospectus has been declared effective by the SEC, and remains effective at the time such selling shareholder offers or sells such common shares. We may be required to update this prospectus to reflect material developments in our business, financial position and results of operations.

In the table below, the percentage of shares beneficially owned is based on 28,286,416 common shares outstanding at December 7, 2015, determined in accordance with Rule 13d-3 under the Exchange Act. Under such rule, beneficial ownership includes any shares over which the selling shareholder has sole or shared voting power or investment power and also any shares that the selling shareholder has the right to acquire within 60 days of such date through the exercise of any options or other rights.

|

|

|

Prior to the Offering (1) |

|

Number of Common |

|

After the Offering (3) |

|

|

Name of Selling

Shareholder |

|

Number of Common

Shares Beneficially

Owned |

|

Percent of Common

Shares Outstanding |

|

Shares Being

Registered for Resale

(2) |

|

Number of Common

Shares Beneficially

Owned |

|

Percent of Common

Shares Outstanding |

|

|

Gerald J. Rubin |

|

169,936 |

|

* |

|

160,536 |

|

9,400 |

|

* |

|

* Represents less than one percent of the outstanding common shares as of December 7, 2015.

(1) The amounts set forth in these columns include the common shares beneficially owned by the selling shareholder as of December 7, 2015 (including any shares that the selling shareholder has the right to acquire within 60 days of such date through the exercise of any options or other rights).

(2) The amount set forth in this column is the number of common shares that may be offered by the selling shareholder using this prospectus. This amount does not include any other common shares that the selling shareholder may own beneficially or otherwise.

(3) Assumes all common shares being offered hereby are sold by the selling shareholder.

A selling shareholder who is a registered broker-dealer is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). In addition, a selling shareholder who is an affiliate of a registered broker-dealer is an “underwriter” within the meaning of the Securities Act if such selling shareholder (a) did not acquire its common shares in the ordinary course of business or (b) had an agreement or understanding, directly or indirectly, with any person to distribute the common shares. To our knowledge, the selling shareholder is not a registered broker-dealer or an affiliate of a registered broker-dealer.

4

Table of Contents

The selling shareholder listed in the above table may have sold or transferred, in transactions exempt from the registration requirements of the Securities Act, some or all of the common shares since the date on which the information in the above table was provided to us. Information about the selling shareholder may change over time.

Because the selling shareholder may offer all or some of his common shares from time to time, we cannot estimate the number of our common shares that will be held by the selling shareholder upon the termination of any particular offering by such selling shareholder. See “Plan of Distribution.”

PLAN OF DISTRIBUTION

We are registering the common shares covered by this prospectus to permit the selling shareholder to conduct public secondary trading of such shares from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale of the common shares offered by this prospectus. The aggregate proceeds to the selling shareholder from the sale of such common shares will be the purchase price of the common shares less any discounts and commissions. The selling shareholder reserves the right to accept and, together with its agents, to reject, any proposed purchases of common shares to be made directly or through agents.

The common shares offered by this prospectus may be sold from time to time to purchasers:

· directly by the selling shareholder and its successors, which includes their donees, pledgees or transferees or their successors-in-interest;

· through broker-dealers or agents, who may receive compensation in the form of commissions or agent’s commissions from the selling shareholder or the purchasers of the common shares. These commissions may be in excess of those customary in the types of transactions involved; or

· through any other method permitted under applicable law.

The selling shareholder and any broker-dealers or agents who participate in the sale or distribution of the common shares may be deemed to be “underwriters” within the meaning of the Securities Act. Any selling shareholder that is a registered broker-dealer will be deemed to be an underwriter. As a result, any profits on the sale of the common shares by such selling shareholder and any commissions or agent’s commissions received by it may be deemed to be underwriting commissions under the Securities Act. A selling shareholder who is deemed to be an “underwriter” within the meaning of Section 2(11) of the Securities Act will be subject to prospectus delivery requirements of the Securities Act. Underwriters are subject to certain statutory liabilities, including, but not limited to, Sections 11, 12 and 17 of the Securities Act.

The common shares may be sold in one or more transactions at:

· fixed prices;

· prevailing market prices at the time of sale;

· prices related to such prevailing market prices;

· varying prices determined at the time of sale; or

· negotiated prices.

These sales may be effected in one or more transactions:

· on any national securities exchange or quotation on which the common shares may be listed or quoted at the time of the sale;

· in the over-the-counter market;

· in transactions other than on such exchanges or services or in the over-the-counter market;

· through the writing of options (including the issuance by the selling shareholder of derivative securities), whether the options or such other derivative securities are listed on an options exchange or otherwise;

· through the settlement of short sales; or

5

Table of Contents

· through any combination of the foregoing.

These transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides of the trade.

In connection with the sales of the common shares, the selling shareholder may enter into hedging transactions with broker-dealers or other financial institutions which in turn may:

· engage in short sales of the common shares in the course of hedging their positions;

· sell the common shares short and deliver the common shares to close out short positions;

· loan or pledge the common shares to broker-dealers or other financial institutions that in turn may sell the common shares;

· enter into option or other transactions with broker-dealers or other financial institutions that require the delivery to the broker-dealer or other financial institution of the common shares, which the broker-dealer or other financial institution may resell under the prospectus; or

· enter into transactions in which a broker-dealer makes purchases as a principal for resale for its own account or through other types of transactions.

To our knowledge, there are currently no plans, arrangements or understandings between the selling shareholder and any broker-dealer or agent regarding the sale of the common shares by the selling shareholder.

There can be no assurance that the selling shareholder will sell any or all of the common shares under this prospectus. Further, we cannot assure you that the selling shareholder will not transfer, devise or gift the common shares by other means not described in this prospectus. In addition, any common shares covered by this prospectus that qualifies for sale under Rule 144 or Rule 144A of the Securities Act may be sold under Rule 144 or Rule 144A rather than under this prospectus. The common shares covered by this prospectus may also be sold to non-U.S. persons outside the U.S. in accordance with Regulation S under the Securities Act rather than under this prospectus. The common shares may be sold in some states only through registered or licensed brokers or dealers. In addition, in some states the common shares may not be sold unless such shares have been registered or qualified for sale or an exemption from registration or qualification is available and complied with.

The selling shareholder and any other person participating in the sale of the common shares will be subject to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the common shares by the selling shareholder and any other such person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the common shares to engage in market-making activities with respect to the particular common shares being distributed. This may affect the marketability of the common shares and the ability of any person or entity to engage in market-making activities with respect to the common shares.

LEGAL MATTERS

The validity of the common shares will be passed upon for us by Conyers Dill & Pearman Limited, Bermuda counsel of Helen of Troy.

EXPERTS

The audited consolidated financial statements, schedule, and management’s assessment of the effectiveness of internal control over financial reporting included in our Annual Report on Form 10-K for the year ended February 28, 2015, incorporated by reference in this prospectus and elsewhere in this registration statement have been so incorporated by reference in reliance upon the reports of Grant Thornton LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing.

6

Table of Contents

INFORMATION INCORPORATED BY REFERENCE

The rules of the SEC allow us to incorporate by reference information into this prospectus. The information incorporated by reference is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. This prospectus incorporates by reference the documents listed below (other than portions of these documents that are either (1) described in paragraphs (d)(1), (d)(2), (d)(3) or (e)(5) of Item 407 of Regulation S-K promulgated by the SEC or (2) furnished under applicable SEC rules rather than filed and exhibits furnished in connection with such items):

· Our Annual Report on Form 10-K for the fiscal year ended February 28, 2015, filed with the SEC on April 29, 2015 (the “Annual Report”);

· The information specifically incorporated by reference into the Annual Report from our definitive proxy statement on Schedule 14A, filed with the SEC on June 29, 2015;

· Our Quarterly Reports on Form 10-Q for the periods ended May 31, 2015 and August 31, 2015, filed with the SEC on July 10, 2015 and October 13, 2015, respectively;

· Our Current Reports on Form 8-K, filed with the SEC on August 7, 2015, August 25, 2015, and November 16, 2015; and

· The description of our common shares contained in our Registration Statement on Form S-4, filed with the SEC on December 30, 1993, including any amendments or reports filed for the purpose of updating such description.

All reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of this offering shall be deemed to be incorporated by reference in this prospectus and to be part hereof from the date of filing of such reports and other documents. However, we are not incorporating by reference any information provided in these documents that is described in paragraphs (d)(1), (d)(2), (d)(3) or (e)(5) of Item 407 of Regulation S-K promulgated by the SEC or furnished under applicable SEC rules rather than filed and exhibits furnished in connection with such items.

Helen of Troy hereby undertakes to provide without charge to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written or oral request of any such person, a copy of any or all of the information that has been or may be incorporated by reference in this prospectus, excluding all exhibits unless an exhibit has been specifically incorporated by reference into this prospectus. Requests for such copies should be directed to Helen of Troy Investor Relations, at the following address:

Helen of Troy Limited

Attention: Investor Relations

1 Helen of Troy Plaza

El Paso, Texas 79912

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports and other information with the SEC. You may read and copy any materials we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-888-SEC-0330 for further information about the Public Reference Room. The SEC also maintains an internet website at www.sec.gov that contains periodic and current reports, proxy and information statements, and other information regarding registrants that file electronically with the SEC.

You should rely only on the information contained or incorporated by reference in this prospectus, in any accompanying prospectus supplement, and in any related free writing prospectus we prepare or authorize. We have not authorized anyone to provide you with information different from that contained in this prospectus. The securities offered under this prospectus are offered only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered hereby.

This prospectus is part of a registration statement that we filed with the SEC, using a “shelf” registration process under the Securities Act relating to the securities to be offered. This prospectus does not contain all of the information set forth in the registration statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC. The registration statement, including the exhibits thereto, may be inspected at the Public Reference Room maintained by the SEC at the address set forth above. Statements contained herein concerning any document filed as an exhibit are not necessarily complete, and, in each instance, reference is made to the copy of such document filed as an exhibit to the registration statement. Each such statement is qualified in its entirety by such reference.

7

Table of Contents

SEC POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing provisions, the registrant has been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

8

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

Set forth below are the expenses (other than commissions) expected to be incurred in connection with the distribution of the securities registered hereby. With the exception of the Securities and Exchange Commission (the “SEC”) registration fee, the amounts set forth below are estimates.

|

SEC registration fee |

|

$ |

1,662.19 |

|

|

Fees and expenses of legal counsel |

|

$ |

49,000.00 |

|

|

Accounting fees and expenses |

|

$ |

15,000.00 |

|

|

Miscellaneous |

|

$ |

1,000.00 |

|

|

|

|

|

|

|

Total |

|

$ |

66,662.19 |

|

Item 15. Indemnification of Directors and Officers.

Section 98 of the Companies Act 1981 of Bermuda (as amended, the “Act”) provides generally that we, as a Bermuda company, may indemnify our directors, officers and auditors against any liability which by virtue of any rule of law would be imposed on them in relation to us, except in cases where such liability arises from fraud or dishonesty of which such officer, director or auditor may be guilty in relation to us. Section 98 further provides that we may indemnify our directors, officers and auditors against any liability incurred against them in defending any proceedings, whether civil or criminal, in which judgment is awarded in their favor or they are acquitted or granted relief by the Supreme Court of Bermuda in certain proceedings arising under Section 281 of the Act.

We have adopted provisions in our Memorandum of Association and Bye-Laws that provide that we will indemnify our officers and directors to the maximum extent permitted under the Act. We have also entered into indemnification agreements with each of our directors and officers to provide them with the maximum indemnification allowed under our Memorandum of Association, Bye-Laws and the Act.

The Act also permits us to purchase and maintain insurance for the benefit of our officers and directors covering certain liabilities. We maintain a policy of officers’ and directors’ liability insurance for the benefit of our officers and directors.

The preceding discussion of the our Memorandum of Association and Bye-Laws, the Act and the indemnity agreements is not intended to be exhaustive and is qualified in its entirety by the Memorandum of Association, Bye-Laws, the Act and the indemnity agreements.

Item 16. Exhibits and Financial Statement Schedules.

The following documents are filed as exhibits to this registration statement:

|

Exhibit

Number |

|

Description |

|

2.1 |

|

Agreement and Plan of Merger dated as of December 8, 2010, among Helen of Troy Texas Corporation, KI Acquisition Corp., Kaz, Inc., the Company, and the Kaz, Inc. shareholders party thereto (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on December 9, 2010). |

|

4.1 |

|

Memorandum of Association (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-4, File No. 33-73594, filed with the Securities and Exchange Commission on December 30, 1993). |

|

4.2 |

|

Bye-Laws, as amended (incorporated by reference to Exhibit 3.2 to the Company’s Quarterly Report on Form 10-Q for the period ending August 31, 2007, filed with the Securities and Exchange Commission on October 10, 2007). |

II-1

Table of Contents

|

4.3* |

|

Registration rights. |

|

5.1* |

|

Opinion of Conyers Dill & Pearman Limited. |

|

23.1* |

|

Consent of Conyers Dill & Pearman Limited (included in Exhibit 5.1). |

|

23.2* |

|

Consent of Grant Thornton LLP. |

|

24.1* |

|

Power of Attorney (included on the signature page to this Registration Statement). |

* Filed herewith.

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(a) To include any prospectus required by section 10(a)(3) of the Securities Act of 1933, as amended (the “Securities Act”);

(b) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

(c) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs 1(a), 1(b) and 1(c) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act to any purchaser:

(a) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(b) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no

II-2

Table of Contents

statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the registrant undertakes that in a primary offering of securities of the registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, each undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(a) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(b) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(c) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(d) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

(6) That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Exchange Act that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

II-3

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, Helen of Troy Limited certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of El Paso, State of Texas, on December 10, 2015.

|

|

HELEN OF TROY LIMITED |

|

|

|

|

|

|

|

|

By: |

/s/ Julien R. Mininberg |

|

|

Julien R. Mininberg |

|

|

Chief Executive Officer and Director |

POWER OF ATTORNEY

Each person whose signature appears below hereby authorizes Julien R. Mininberg to file one or more amendments (including post-effective amendments) to this registration statement, which amendments may make such changes in this registration statement as each of them deems appropriate, and each such person hereby appoints Julien R. Mininberg as attorney-in-fact to execute in the name and on behalf of the company and any such person, individually and in each capacity stated below, any such amendments to this registration statement.

* * * *

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

NAME |

|

TITLE |

|

DATE |

|

|

|

|

|

|

|

/s/ Julien R. Mininberg |

|

Chief Executive Officer, |

|

December 10, 2015 |

|

Julien R. Mininberg |

|

Director and Principal Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Brian L. Grass |

|

Chief Financial Officer |

|

December 10, 2015 |

|

Brian L. Grass |

|

and Principal Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Richard J. Oppenheim |

|

Financial Controller |

|

December 10, 2015 |

|

Richard J. Oppenheim |

|

and Principal Accounting Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Timothy F. Meeker |

|

Director, Chairman of the Board |

|

December 10, 2015 |

|

Timothy F. Meeker |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Gary B. Abromovitz |

|

Director |

|

December 5, 2015 |

|

Gary B. Abromovitz |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ John B. Butterworth |

|

Director |

|

December 10, 2015 |

|

John B. Butterworth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Alexander M. Davern |

|

Director |

|

December 10, 2015 |

|

Alexander M. Davern |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Beryl B. Raff |

|

Director |

|

December 7, 2015 |

|

Beryl B. Raff |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ William F. Susetka |

|

Director |

|

December 5, 2015 |

|

William F. Susetka |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Darren G. Woody |

|

Director |

|

December 7, 2015 |

|

Darren G. Woody |

|

|

|

|

II-4

Table of Contents

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

2.1 |

|

Agreement and Plan of Merger dated as of December 8, 2010, among Helen of Troy Texas Corporation, KI Acquisition Corp., Kaz, Inc., the Company, and the Kaz, Inc. shareholders party thereto (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K, filed with the Securities and Exchange Commission on December 9, 2010). |

|

4.1 |

|

Memorandum of Association (incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-4, File No. 33-73594, filed with the Securities and Exchange Commission on December 30, 1993). |

|

4.2 |

|

Bye-Laws, as amended (incorporated by reference to Exhibit 3.2 to the Company’s Quarterly Report on Form 10-Q for the period ending August 31, 2007, filed with the Securities and Exchange Commission on October 10, 2007). |

|

4.3* |

|

Registration rights. |

|

5.1* |

|

Opinion of Conyers Dill & Pearman Limited. |

|

23.1* |

|

Consent of Conyers Dill & Pearman Limited (included in Exhibit 5.1). |

|

23.2* |

|

Consent of Grant Thornton LLP. |

|

24.1* |

|

Power of Attorney (included on the signature page to this Registration Statement). |

* Filed herewith.

II-5

Exhibit 4.3

Registration Rights Provisions

1.1 Filing of Registration Statement. Subject to the terms and conditions of this Agreement, the Company shall prepare a Registration Statement on Form S-3, or other applicable form if Form S-3 is not available or has been rescinded or replaced (the “Registration Statement”), solely with respect to the 160,536 common shares, par value 0.10 per share, of the Company issued pursuant to this Agreement (“Registrable Securities”) and shall file the Registration Statement with the Securities and Exchange Commission (the “SEC”) as soon as reasonably practical but in any event within 30 days following the date hereof. The Registration Statement shall not be filed as a confidential filing and the Company shall file a responsive amendment to any SEC comments received regarding the Registration Statement as soon as reasonably practical after receipt of such comments. The Company represents and warrants that, as of the date hereof, the Company meets the qualifications to file a Registration Statement on Form S-3 and that there are no matters known to the Company that would cause the Company to delay filing the Registration Statement in accordance with this Section 1.1. All expenses relating to the registration of the Registrable Securities, including (without limitation) all registration, filing, qualification, printers, accounting and legal fees and disbursements shall be borne by the Company; provided that each Party shall be responsible for its fees (including legal fees) and expenses incurred in connection with the preparation and negotiation of this Agreement. The Company shall (i) cause all Registrable Securities registered hereunder to be listed on each securities exchange on which the Registrable Securities are listed by the Company, (ii) maintain a transfer agent and registrar for all Registrable Securities registered hereunder and a CUSIP number for all such Registrable Securities and (iii) make any Blue Sky filings to the extent required to register or qualify Registrable Securities under state Blue Sky laws, provided that the Company shall not be required in connection therewith or as a condition thereof to qualify to do business, where not otherwise required, or to file a general consent to service of process in any state or jurisdiction.

1.2 Effectiveness of Registration Statement. The Company shall use commercially reasonable efforts to: (a) have the Registration Statement declared effective by the SEC as soon as reasonably practical following the receipt of notice from the SEC of either no comments or the clearance of comments but in any event within 90 days following the date hereof; (b) subject to Section 1.3, prepare and file with the SEC such amendments and supplements to the Registration Statement and the prospectus used in connection therewith as may be necessary to keep the Registration Statement effective with respect to any Registrable Securities, until the earlier of (i) the date on which such Registrable Securities covered by the Registration Statement have been sold by the holder of the Registrable Securities, (ii) the date on which either such Registrable Securities are distributed to the public pursuant to Rule 144 promulgated by the SEC pursuant to the Securities Act (or any similar provision then in effect), (iii) the second anniversary of the date hereof (provided, however, that such two-year period will be extended for a period of time equal to the period such holder is required to suspend sales of such Registrable Securities pursuant to the terms of this Agreement), or (iv) the date on which such Registrable Securities are sold to the Company (but not before the expiration of the applicable prospectus delivery requirements); and (c) comply with the provisions of the Securities Act of 1933, as amended (the “Securities Act”) with respect to the disposition of all securities covered by the Registration Statement during such period in accordance with the intended methods of disposition by the holder of the Registrable Securities set forth in the Registration Statement.

1.3 Information and Copies.

(a) The Company shall furnish to the holder of the Registrable Securities such number of copies of the Registration Statement, each amendment and supplement thereto, the prospectus included in the Registration Statement (including each preliminary prospectus), and such other documents as Rubin may reasonably request in order to facilitate the disposition of the Registrable Securities owned by such holder.

(b) The Company shall notify the holder of the Registrable Securities of the happening of any event as a result of which the prospectus included in the Registration Statement contains an untrue statement of a material fact or omits to state any material fact required to be stated therein or necessary to make the statements therein not misleading in light of the circumstances then existing and shall use commercially reasonable efforts to prepare and file with the SEC, and promptly notify each holder of Registrable Securities of the filing of, a supplement to such prospectus or an amendment to the Registration Statement so that, as thereafter delivered to the purchasers of Registrable Securities, such prospectus will not contain an untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein not misleading in light of the circumstances under which they were made and in the case of an amendment to the Registration Statement, use reasonable best efforts to cause it to become effective as soon as possible. Upon receipt of any notice from the Company of the happening of any event of the kind described above, the holder of the Registrable Securities will forthwith discontinue disposition of Registrable Securities pursuant to the Registration Statement until such holder’s receipt of the copies of the supplemented or amended prospectus, or until it is advised in writing by the Company that the use of the prospectus may be resumed.

(c) In the event of the issuance of any stop order suspending the effectiveness of the Registration Statement, or of any order suspending or preventing the use of any related prospectus or suspending the qualification of any Registrable Securities included in the Registration Statement for sale in any jurisdiction, the Company will promptly notify the holder of the Registrable Securities of such and will use reasonable efforts to obtain the withdrawal of such order.

(d) The Company reserves the right to postpone for a reasonable period of time, not to exceed in the aggregate 90 days from the date notification of such delay is sent to the holders of Registrable Securities during any 365 day period, the filing or the effectiveness of the Registration Statement if the Company in the good faith judgment of the Board of Directors determines that (i) such registration might have a material adverse effect on any of the Company’s plans or proposals with respect to any financing, acquisition, recapitalization, reorganization, or other material transaction, or (ii) the Company is in possession of material non-public information that, if publicly disclosed, could result in a material disruption of a major corporate development or transaction then pending or in progress or in other material adverse consequences to the Company.

1.4 Nature of Sale. Notwithstanding any other provision of this Agreement, Registrable Securities shall be treated as Registrable Securities only if and so long as they have not been (a) sold to or through a broker or dealer or underwriter in a public distribution or a public securities transaction, or (b) sold in a transaction exempt from the registration and prospectus delivery requirements of the Securities Act under Section 4(1) thereof so that all transfer restrictions, and restrictive legends with respect thereto, if any, are removed upon the consummation of such sale.

1.5 Suspension of Sales. If any Registrable Securities are included in a Registration Statement pursuant to the terms of this Agreement, the holder thereof will not (until further notice) effect sales thereof after receipt of written notice from the Company of the occurrence of an event specified in order to permit the Company to correct or update the Registration Statement or prospectus. Following the end of the period during which the Company is obligated to keep the Registration Statement current and effective as described herein, each holder of Registrable Securities included in the Registration Statement shall discontinue sales thereof pursuant to such Registration Statement, unless such holder has received written notice from the Company of its intention to continue the effectiveness of such Registration Statement with respect to any of such securities which remain unsold.

1.6 Furnish Information. It shall be a condition precedent to the Company’s obligations to take any action pursuant to this Agreement with respect to the Registrable Securities of any selling holder that such holder shall furnish to the Company such information regarding itself, the Registrable Securities held by it, and the intended method of disposition of such securities as shall be required to effect the registration of such holder’s Registrable Securities or as the Company shall otherwise reasonably request. The obligations of the Company under this Agreement shall be suspended as to any holder of Registrable Securities unless and until such holder complies with the preceding sentence.

1.7 Indemnification.

(a) The Company agrees to indemnify and hold harmless, to the fullest extent permitted by law, each holder of the Registrable Securities and each person, if any, who controls (within the meaning of Section 15 of the Securities Act or Section 20 of the Exchange Act) such holder of Registrable Securities, from and against any and all losses, claims, damages, liabilities, and expenses joint or several (including reasonable fees of counsel in connection with investigating or defending any claim) (collectively, “Losses”) to which any of the foregoing may become subject insofar as such Loss arises out of or is based upon: (i) any untrue statement or alleged untrue statement of a material fact contained in the Registration Statement, related preliminary prospectus or prospectus (or any amendment or supplement thereto), or any omission or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading; or (ii) any violation or alleged violation by the Company of Section 5 of the Securities Act or any rule or regulation thereunder or any similar state law relating to the Registration Statement, except insofar as such Losses arise out of or are based upon an untrue statement or alleged untrue statement or omission or alleged omission that is based upon or made in conformity with information relating to any holder of Registrable Securities furnished in writing to the Company by or on behalf of any holder of Registrable Securities. To the extent that a court of competent jurisdiction determines that the indemnification rights of a holder of Registrable Securities under this Section 1.7(a) are not enforceable, then the Company shall contribute to the Losses of such holder of Registrable Securities in such proportion as is appropriate to reflect the relative fault of such holder of Registrable Securities and the Company in connection with the statements, omissions or other actions that resulted in the Loss as well as other relevant equitable considerations.

(b) Each holder of Registrable Securities agrees to indemnify and hold harmless, to the fullest extent permitted by law, the Company, its directors, officers, employees, and agents, and each person who controls (within the meaning of Section 15 of the Securities Act or Section 20 of the Exchange Act) the Company from and against any and all Losses to which any such persons may become subject insofar as such Loss arises out of or is based upon: (i) any untrue statement or alleged untrue statement of a material fact contained in the Registration Statement, related preliminary prospectus or prospectus (or any amendment or supplement thereto), or any omission or alleged omission to state therein a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading, but only to the extent, that such untrue statement, alleged untrue statement, omission or alleged omission is contained in any information furnished in writing by such holder of Registrable Securities relating to such holder for use in the preparation of the documents described in this Section 1.7(b); or (ii) any violation or alleged violation by the such holder of Section 5 of the Securities Act or any rule or regulation thereunder or any similar state law relating to the Registration Statement. To the extent that a court of competent jurisdiction determines that the indemnification rights of the Company under this Section 1.7(b) are not enforceable, then such holder of Registrable Securities shall contribute to the Losses of the Company in such proportion as is appropriate to reflect the relative fault of such holder of Registrable Securities and the Company in connection with the statements, omissions or other actions that resulted in the Loss as well as other relevant equitable considerations.

(c) Promptly after receipt by an indemnified party hereunder of written notice of the commencement of any action, suit, proceeding, investigation, or threat thereof with respect to which a claim for indemnification may be made pursuant hereto, such indemnified party shall, if a claim in respect thereto is to be made against an indemnifying party, give written notice to the indemnifying party of the threat or commencement thereof; provided, however, that the failure to so notify the indemnifying party shall not relieve it from any liability which it may have to any indemnified party except to the extent that the indemnifying party is actually prejudiced by such failure to give notice. If any such claim or action referred to hereunder is brought against any indemnified party and it then notifies the indemnifying party of the threat or commencement thereof, the indemnifying party shall be entitled to participate therein and, to the extent that it wishes, jointly with any other indemnifying party similarly notified, to assume the defense thereof with counsel reasonably satisfactory to such indemnified party (which counsel shall not, except with the consent of the indemnified party, be counsel to the indemnifying party). The indemnifying party shall not be liable to an indemnified party hereunder for any legal expenses of counsel or any other expenses incurred by such indemnified party in connection with the defense thereof, unless the indemnifying party has failed to assume the defense of such claim or action or to employ counsel reasonably satisfactory to such indemnified party. Notwithstanding the foregoing, the indemnified party shall have the right to retain its own counsel, with the fees and expenses to be paid by the indemnified party, if representation of such indemnified party by the counsel retained by the indemnifying party would be inappropriate due to actual conflicting interests between such indemnified party and any indemnifying party. The indemnifying party shall not be required to indemnify the indemnified party with respect to any amounts paid in settlement of any action, proceeding, or investigation entered into without the written consent of the indemnifying party, which consent shall not be unreasonably withheld. No indemnifying party shall consent to the entry of any judgment or enter into any settlement without the consent of the indemnified party, which consent shall not be unreasonably withheld.

1.8 Termination. The obligations of the Company under this Agreement shall terminate on the date on which is the earlier of (a) the date on which the Company’s obligations under Section 1.2 terminate or (b) the date on which all Registrable Securities covered by the Registration Statement have been sold.

1.9 Reports Under the Exchange Act. With a view to making available to the holder of the Registrable Securities the benefits of Rule 144 promulgated under the Securities Act, and any other rule or regulation of the SEC that may at any time permit a holder to sell securities of the Company to the public without registration, the Company agrees to make and keep public information available, as those terms are understood and defined in SEC Rule 144, at all times until the termination of the obligations of the Company under this Agreement. The Company shall take all commercially reasonable actions as may be necessary so that, subject to the compliance by the holder of Registrable Securities with all applicable securities laws, such holder may freely sell the Registrable Shares pursuant to a Registration Statement in accordance with the provisions of the Securities Act, including, but not limited to, preparing and filing with the SEC all amendments and supplements to the Registration Statement and the prospectus used in connection with the Registration Statement (including, if necessary, filing a new Registration Statement on Form S-1 or otherwise).

1.10 Investment Representations.

(a) Rubin understands and acknowledges that the Registrable Securities are characterized as “restricted securities” under the federal securities laws of the United States inasmuch as they are being acquired from the Company in a transaction not involving a public offering and that under such laws and

applicable regulations such securities may not be resold without registration or an applicable exemption under the Securities Act and applicable state securities laws, except in certain limited circumstances. Rubin represents that he is familiar with Rule 144 under the Securities Act, as presently in effect, and understands the resale limitations imposed thereby and by the Securities Act.

(b) Rubin understands that the Registrable Securities will be imprinted with a legend in accordance with the customary practice of the transfer agent of the Company, which prohibits the transfer of the shares unless such transfer will not be in violation of the Securities Act of 1933, as amended, and/or applicable state securities laws and/or any rule or regulation promulgated thereunder. The Company will cooperate with any reasonable request of the holder of the Registrable Securities in removing any such legend (i) with respect to such Registrable Securities that are registered for resale under the Securities Act and are being sold by such holder or (ii) if such holder of Registrable Securities provides the Company with reasonable assurance that such Registrable Securities can be sold, assigned or transferred pursuant to Rule 144 promulgated under the Securities Act.

1.11 Successors and Assigns. Except as otherwise provided in this Agreement, the terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors, assigns and legal representatives of the Parties. Notwithstanding the foregoing, Rubin shall not assign any rights or obligations set forth in this Agreement other than in connection with an assignment or transfer of Registrable Securities to a Family Transferee. For the purpose of this Agreement, “Family Transferee” shall mean any family members of Rubin, any estate or legal representative of Rubin or a family member, or any trust for the benefit of any family member.

For purposes of this Agreement, the “Company” shall mean Helen of Troy Limited, “Rubin” shall mean Gerald J. Rubin, the “date hereof” shall mean November 12, 2015, and the “Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

Exhibit 5.1

10 December, 2015

Matter No.:127169

Doc Ref: JEM:nc/10533594

Tel: 1-441-299 4925

Email: Julie.McLean@conyersdill.com

Helen of Troy Limited

c/o Helen of Troy L.P.

One Helen of Troy Plaza

El Paso, Texas 79912

U.S.A.

Dear Sirs,

Re: Helen of Troy Limited (the “Company”)

We have acted as special Bermuda legal counsel to the Company in connection with a registration statement on Form S-3 filed with the Securities and Exchange Commission (the “Commission”) on 10 December, 2015 (the “Registration Statement”, which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto) relating to the shelf registration under the United States Securities Act of 1933, as amended, (the “Securities Act”) of 160,536 common shares, par value US$0.10 per share, of the Company (the “Common Shares”), being offered for sale by the Selling Shareholder (as such term is defined in the Registration Statement).

For the purposes of giving this opinion, we have examined an electronic copy of the Registration Statement. We have also reviewed the memorandum of association and the bye-laws of the Company, each certified by the Assistant Secretary of the Company on 10 December, 2015, a PDF copy of written resolutions of its board of directors effective 18 November, 2015 (the “Resolutions”) and such other documents and made such enquiries as to questions of law as we have deemed necessary in order to render the opinion set forth below.

We have assumed (a) the genuineness and authenticity of all signatures and the conformity to the originals of all copies (whether or not certified) of all documents examined by us and the authenticity and completeness of the originals from which such copies were taken, (b) that where a document has been examined by us in draft form, it will be or has been executed and/or filed in the form of that draft, and where a number of drafts of a document have been examined by us all changes thereto have been marked or otherwise drawn to our attention, (c) the accuracy and completeness of all factual representations made in the Registration Statement and other documents reviewed by us, (d) that there is no provision of the law of any jurisdiction, other than Bermuda, which would have any implication in relation to the opinions expressed herein and (e) that the Company’s shares will be listed on an appointed stock exchange, as defined in the Companies Act 1981, as amended, and the consent to the issue and free transfer of the Common Shares given by the Bermuda Monetary Authority dated 18 June, 2008 will not have been revoked or amended at the time of issuance of any Common Shares.