Current Report Filing (8-k)

November 17 2015 - 12:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 17, 2015

HELEN OF TROY LIMITED

(Exact name of registrant as specified in its charter)

Commission File Number: 001-14669

|

Bermuda |

|

74-2692550 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

CLARENDON HOUSE

2 CHURCH STREET

HAMILTON, BERMUDA

(Address of principal executive offices)

ONE HELEN OF TROY PLAZA

EL PASO, TEXAS 79912

(United States mailing address of registrant and zip code)

915-225-8000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01 Regulation FD Disclosure.

On November 17, 2015, Helen of Troy Limited (the “Company”) posted presentation slides to the Investor Relations page of the Company’s website that will be used in investor presentations beginning November 17, 2015, which includes an update on the expected sales growth of the Nutritional Supplements segment of the Company. The update does not change the Company’s consolidated outlook for fiscal year 2016. The presentation can be accessed at: http://www.hotus.com. This investor presentation is also furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The Company desires to avail itself of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the “Act”) and is including this cautionary statement for the express purpose of availing itself of the protection afforded by the Act. This Current Report on Form 8-K and the accompanying investor presentation contains certain forward-looking statements, which are subject to change. The forward-looking statements contained in this Current Report on Form 8-K and the accompanying investor presentation should be read in conjunction with, and are subject to and qualified by, the risks described in the Company’s Form 10-K for the year ended February 28, 2015 and in our other filings with the SEC. The Company intends its forward-looking statements to speak only as of the time of such statements, and does not undertake to update or revise them as more information becomes available.

The information contained in this Current Report on Form 8-K is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. Furthermore, the information contained in this Item 7.01 and Exhibit 99.1 shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended.

2

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number |

|

Description |

|

|

|

|

|

99.1 |

|

Investor Presentation |

3

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HELEN OF TROY LIMITED |

|

|

|

|

|

|

|

Date: November 17, 2015 |

/s/ Brian Grass |

|

|

Brian Grass |

|

|

Chief Financial Officer |

4

EXHIBIT INDEX

|

Exhibit

Number |

|

Description |

|

|

|

|

|

99.1 |

|

Investor Presentation |

5

Exhibit 99.1

November 2015 Transformation

This presentation may contain certain forward looking statements that are based on management’s current expectation with respect to future events or financial performance. A number of risks or uncertainties could cause actual results to differ materially from historical or anticipated results. Generally, the words “anticipate,” “believes”, “expects,” and other similar words identify forward-looking statements. The Company cautions participants to not place undue reliance on forward-looking statements. Forward-looking statements are subject to risks that could cause such statements to differ materially from actual results. Factors that could cause actual results to differ from those anticipated are described in the Company’s Form 10-K, filed with the Securities and Exchange Commission, for the fiscal year ended February 28, 2015. This presentation may also include information that may be considered non-GAAP financial information as contemplated by SEC Regulation G, Rule 100. Accordingly, we have provided tables in the accompanying appendix that reconcile these measures to their corresponding GAAP-based measures, which can be obtained from the Consolidated Statements of Operations provided with our previous filings with the SEC. The Company believes that these non-GAAP measures provide useful information to management and investors regarding financial and business trends relating to its financial condition and results of operations. The Company believes that these non-GAAP measures, in combination with the Company’s financial results calculated in accordance with GAAP, provide investors with additional perspective. These non-GAAP measures are not an alternative to GAAP financial information and may be calculated differently than the non-GAAP financial information disclosed by other companies. The Company cautions participants or readers to not place undue reliance on forward-looking statements or non-GAAP information. Forward Looking Statements and Non-GAAP Information 2

HELE Business Overview A leading global consumer products company offering creative solutions for its customers through a strong diversified portfolio of well-recognized and widely-trusted brands in Health & Home, Housewares, Beauty and Nutritional Supplements. Health & Home2 ~42% Net Sales1 Beauty ~30% Net Sales1 Housewares ~20% Net Sales1 Nutritional Supplements ~7% Net Sales1 3 Based upon FY 15 Net Sales Revenues Formerly HealthCare and Home Environment Highly Favorable Business Fundamentals Powerful Global Brands Exciting Growth Drivers Highly Attractive Business Economics

Track Record of Sustained Growth Net Sales ($ in Millions) CAGR = 17.4% Adjusted EBITDA ($ in Millions) Adjusted Diluted EPS $648 FY 10 $777 FY 11 $1,445 FY 15 $1,317 FY 14 $1,288 FY 13 $1,182 FY 12 $2.55 FY 10 $3.33 FY 11 $5.85 FY 15 $4.50 FY 14 $4.47 FY 13 $4.17 FY 12 $107 FY 10 $134 FY 11 $220 FY 15 $196 FY 14 $189 FY 13 $171 FY 12 CAGR = 15.5% CAGR = 18.1% New leadership New strategic plan New global shared services platform Significant cultural shift Revenue growth +9.7% Core business* growth: +2.1% 30% adjusted EPS growth Made accretive acquisition Returned capital through ~12% share buy-back YOY FY15 Events 4 * Core Business: Sales, expense or operating income associated with product lines or brands after the first twelve months from the date the product line or brand was acquired. Sales, expense and operating income from developed brands or product lines are always considered core business.

New Transformational Strategy 5

FY 2015 and Beyond FY 2014 Efficient, Collaborative Operating Structure Transforming from Holding Company to Operating Company Global Shared Services Platform Strategic Plan Culture Improved Performance Collaboration & Best Practices Housewares Beauty Nutritional Supplements Health & Home Housewares Healthcare & Home Environment Corporate & Support Services Beauty 6

Comprehensive New Strategy and Operating Model Global Shared Services Platform Strategic Plan Culture Improved Performance Collaboration & Best Practices Housewares Beauty Nutritional Supplements Healthcare & Home Environment More Efficient and Collaborative Operating Structure Transformational Strategy World Class Brands + + 7

Nutritional Supplements FY15 Net Sales: $100MM Housewares FY15 Net Sales: $296MM With Proven Ability to Acquire and Integrate in Attractive Sectors Beauty FY15 Net Sales: $435MM Health & Home FY15 Net Sales: $613MM FY15 Net sales of $1.45 B: built from acquisition and organic growth Bolting On: success adding new categories, geographies and channels Tucking In: new brands and adjacencies for additional growth Right Balance: of integration and independence 8 2003 2004 2007 2008 2009 2010 2010 2011 2014 2015

Disciplined Acquisitions are Core to Our Strategy Selected Acquisition Criteria Favor brands with #1 or #2 market position Accretive to cash flow and Adjusted Diluted EPS Enhances revenue growth and sweetens the mix HELE likely to add value and operational efficiency HELE can accelerate growth of acquired business Bias toward high margin, proprietary consumables Global potential Recent Examples 9

We Leverage the Power of World Class Brands Licensing Is A Core Competency World Class Licensors P&G’s oldest, largest, and most global trademark licensee Honeywell’s largest and most global licensee Revlon’s largest and most global licensee Strong Unilever licensing portfolio Long-term deals on the majority of licenses or licensed revenue World Class Brands World Class Partnerships New 10

Our Brands Hold Strong Leadership Positions #1 Professional Curling Irons in U.S. #2 Retail Appliances in U.S. Beauty #1 Direct-to-consumer marketer of premium, doctor-branded nutritional supplements Nutritional Supplements #1 Premium National Brand of Kitchen Gadgets Housewares #1 Ear Thermometers #1 Air Purifiers in North America, Taiwan #1 Pharmacy Humidifiers in North America #1 Faucet Mount Water Purifiers in U.S. Health &Home 11

We Partner With a Diversified Blue Chip Customer Base 12

Global Business Segments Global Shared Services Vince Carson Brian Grass Tom Benson John Conklin Jack Jancin Alex Lee Jon Kosheff Leah Bailey Connie Hallquist Global Leadership Council (GLC) New Highly Experienced Leadership Team Global Leadership Council (GLC) CEO 13 CEO Chief Legal, HR & External Relations Officer Chief Financial Officer Chief Operations Officer Chief Information Officer SVP Corporate Bus Dev President Housewares President Healthcare & Home Environment President Beauty President Nutritional Supplements

Outstanding Cash Flow and Financial Flexibility Strong Operating Cash Flow Efficient Tax Structure Strong Balance Sheet Healthy use of leverage 2.11x EBITDA1 as of 8/31/15 Financial flexibility $179MM in FY2015 +24MM YOY increase 16% YOY increase Operationally efficient structure FY2016E tax rate: 14-16% Growth Productivity 14 Delivering 1 EBITDA = EBIT (Earnings before Non-Cash Charges, Interest Expense and Taxes) + Depreciation and Amortization Expense + Share Based Compensation. The leverage ratio is computed as defined in the Company's revolving credit agreement, which is: (Funded Indebtedness) / (EBITDA + Pro Forma Effect of Acquisitions)

Creating Value for Shareholders – Improving Fundamentals Adjusted Operating Income ($ in Millions) 4 YR. CAGR = 13% Cash Flow from Operations ($ in Millions) Adjusted Income ($ in Millions) $126 $206 $183 $177 $162 $104 $170 $146 $143 $132 $87 $179 $154 $88 $104 4 YR. CAGR = 20% 4 YR. CAGR = 13% Adjusted Operating Margin Cash Flow Productivity 1 Return on Capital2 Adjusted Return on Capital3 16.2% 13.7% 13.7% 13.9% 14.2% 88% 80% 63% 133% 131% 10.9% 12.2% 10.3% 12.4% 10.0% 12.3% 7.1% 12.1% 10.2% 13.3% FY 11 FY12 FY13 FY14 FY15 1 ((Cash flow from operations - Capital Expenditures) ÷ Net Income) 2 Net income ÷ average of beginning and ending debt and equity 3 Adjusted income ÷ average of beginning and ending debt and equity 15

Creating Value for Shareholders – Cumulative Returns New Strategic Plan Improving Operating Performance Accretive Acquisitions - June 2014: Healthy Directions - March 2015: VapoSteam Share Repurchase - FY15: Repurchased 4.1MM shares for ~$274MM - FY16: Repurchased .556 MM shares for ~$50MM - ~$215 MM Authorization Remaining 16 Key Drivers 50.00 100.00 150.00 200.00 250.00 300.00 350.00 400.00 2010 2011 2012 2013 2014 2015 2016-Q2 COMPARISON OF CUMULATIVE RETURNS FOR HELEN OF TROY LIMITED, PEER GROUP INDEX AND NASDAQ MARKET INDEX HELEN OF TROY LIMITED PEER GROUP INDEX NASDAQ MARKET INDEX

Our Capital Philosophy Capital Priorities Investments in Core Growth Infrastructure Investments Accretive Acquisitions Return of Capital to Shareholders Access to Capital Conservative Approach to Debt Strong Cash Flow Generation Access to favorable terms Capacity to Change Capital Structure Capital Expenditures $10 - $15 million expected for FY 16 17

Fiscal 2016 Outlook and Key Assumptions Tailwinds New product and category introductions Consumer-centric investment in greatest opportunities Accretion and synergies from recent acquisitions Headwinds Strong cold/flu season in FY15 $0.44 of non-routine items in FY15 $0.59 F/X impact vs. FY 15 Consolidated sales growth of 3% to 6% Core business growth of -2% to +1% with 2 pts. FX drag Operating margin flat despite 0.9 pts. of expected FX drag Net revenue expectations by segment: Housewares: Mid single digit YOY growth Health & Home: Low single digits YOY growth Nutritional Supplements: Now expect flat to low single digit growth during comparable 8 month YOY period in FY 16 Beauty: low single digit decline YOY Healthy Directions now expecting flat to low single digit growth for comparable 8 month YOY period in FY 16 Est. FX Drag on Net Sales of ~$28MM Est. FX Drag on Net Income of ~$17MM 18 Normal cold/flu season vs. strong season in FY15 Currency rates at end of September 2015 assumed for remainder of year Cash flow hedges in place for portion of exposure Considering foreign debt and structural changes No share repurchases, impairments or acquisitions other than VapoSteam Effective tax rate between 14% and 16% for the year Cadence of sales and earnings: Expect higher proportion of investment in 1H Q1 is first full quarter of recent FX volatility Sales and earnings more heavily than 2H FY15 Placement fill-in and order shift from Q1 FY16 into Q4 FY15 Key Assumptions FY 16 Outlook Core Business: Sales, expense or operating income associated with product lines or brands after the first twelve months from the date the product line or brand was acquired. Sales, expense and operating income from developed brands or product lines are always considered core business. 18

Business Results Midway Through Fiscal Year 2016 FY16 Six Months YTD Financial Highlights vs. First Six Months of FY15 Revenue growth +13.1% (includes FX Drag) Net Income Growth of 27% Core business growth1: +4.5% Growth in Beauty despite 2.4% FX impact Strong Health & Home growth despite 4% FX impact Strong growth in Housewares, prior to launches of OXO On and Bakeware Significant investments across the Company in new products, marketing, and new organizational capability 19 1 Core Business: Sales, expense or operating income associated with product lines or brands after the first twelve months from the date the product line or brand was acquired. Sales, expense and operating income from developed brands or product lines are always considered core business.

HELE Long-Term Growth Targets * Excludes share buybacks, acquisitions and material currency fluctuations Core Business Revenue Growth Target 2%-3%/YR Average Operating Margin Expansion Target 30 – 40 bps/YR Adjusted Diluted EPS* Growth Target 7%/YR 20 Core Business: Sales, expense or operating income associated with product lines or brands after the first twelve months from the date the product line or brand was acquired. Sales, expense and operating income from developed brands or product lines are always considered core business.

In Summary...Key Investment Highlights Powerful global brands; many market leaders Accelerating innovation and market share Outstanding cash flow and financial flexibility Proven ability to acquire and integrate New shared services infrastructure Upgraded & elevated management talent Transformational new strategy & culture 21

Business Segments 23

Business Profile FY15 ~ $435 Million Net Sales FY15 Operating Income ~ $42 Million 24 Retail Appliances Professional Appliances Personal Care Brushes, Combs & Accessories

Phase I: Stabilize Sales & Profitability Grow Professional Appliance Stabilize Retail Appliance and Personal Care Modest Brush, Comb and Accessory Growth International Growth Phase II: Invest for Profitable Growth 25 Value Creation

26 Professional Appliance New Products Extra-Long 24k Gold Curling Irons

27 Retail Appliance New Products United States Europe

Relaunch Pro Beauty Tools Old New 28 “Prosumer” Retail Proposition New Packaging Consumer focused, salon inspired Designed to win vs. competition

29 Personal Care New Products & New Claims New Products New Package and New Claims

30 United States & Canada Latin America & Asia Europe New Adjacencies - Foot and Nail Care Shine Addict Nail Buffer

Old BEST BETTER GOOD New Revlon Packaging 31 New

A $600+ Million Global Branded Consumer Device and Consumable Platform Healthcare Home Environment Heaters Air Purifiers Non-Invasive Thermometers Blood Pressure Seasonal Humidifiers & Dehumidifiers Fans Stick Thermometers Humidifiers Lawn & Garden 32 Other

33 New Products New & Improved 360° Surround Heater HHF360V / HHF360W 360° Digital Surround Heater HHF360V / HHF360W Heaters & Fans Thermometers Humidifiers

Vicks and Braun Products Remain #1 Brands in the U.S. 34 75.4% Market Share; flat vs PY 32.6% Market Share; +1.2 pts vs. PY Source: AC Nielsen 52W ending 8/29/15 Vicks 62% HoT PL 13% Crane 9% Private Label 8% MyPurMist 4% Safety 1st 3% Other 1% US Humidifier $ Share “Pharmacy” Vicks 13% Braun 21% Private Label 45% Exergen 8% Safety 1st 4% Other 9% US Thermometer $ Share

#1 Position in Air Purifiers - US 2014 $ Share Key Air Purifier Retail Brands 9 Consecutive Years of Market Share Growth! 52% Deep Consumer Understanding Product Innovation Excellent Retail and Consumer Execution >3x 35 Source: AC Nielsen, NPD Traqline and internal Health & Home estimates for devices only 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 15% 19% 26% 30% 38% 39% 40% 42% 49% 52%

2005 2006 2008 2009 2010 2011 2012 2013 2014 2015 Fiscal Year Number of Countries Housewares Based Upon Universal Design: To provide products and environments that are easily usable and comfortable for the largest spectrum of people possible. 11 11 13 12 16 17 17 16 15 16 36 37 53 57 59 65 66 67 75 78 * * Proforma FY 2005 Sales – HOT acquired June 2004 Number of Categories 2007 13 45 Food Storage, Grinders, Coffee & Tea Cleaning, Bath Organization & Barware Weights, Measures, Baking & Hydration Tot Cookware & Kitchen Electrics Tools & Gadgets 36 $82 $98 $128 $138 $164 $175 $199 $217 $237 $259 $274 $296

37

38 Housewares Category Expansion Continues

Nutritional Supplements #1 direct-to-consumer marketer of premium, doctor-branded nutritional supplements and other health products in the U.S. 39 Dietary supplements Anti-Aging skincare Topical analgesic Top Health Categories Types Products Heart health General health Multivitamin packets Digestive health Joint health Vision health 39

40 Doctors Blood Sugar (1991) Heart Health (1995) Naturopathic Medicine (2015) Joint/Digestion Health (1997) Women’s Health (2000) Dr. Yan Ping Xu Traditional Chinese Medicine (2014) Safe Beauty (2011) Sleep (2012) Pain Management (2012)

41 Searching the World For Better Health® New Products

42 Dr. Daniel Amen: Nationally Recognized Brain Health Expert Joins Healthy Directions’ Team of Experts Well Known Brain Expert Double board certified psychiatrist #1 New York Times bestselling author Dr. Amen is a Distinguished Fellow of the American Psychiatric Association, the highest award given to members "By almost any measure, Dr. Amen is the most popular psychiatrist in America.” - Washington Post “Dr. Amen is the #1 most influential mental health expert and advocate on the web.” – Sharecare Highly Credentialed Board Certified, American Board of Psychiatry and Neurology, General Psychiatry, April 1988 Board Certified, American Board of Psychiatry and Neurology, Child Psychiatry, October 1988 Medical License: California 1983, Washington State 2003, Virginia 2003, Arizona 2009, New York, 2009 Radioactive Material License for Nuclear Brain Imaging, California 1995, Washington 2003, Virginia 2004 New

Appendix 43

Health & Home Environment Marlborough, MA Beauty Personal Care Danbury, CT Housewares New York City Nutritional Supplements Bethesda, MD EMEA RMO Lausanne, Switzerland Asia/Pacific RMO Hong Kong China Shared Service Centers Shenzhen & Macao Latin America RMO Mexico City Shared Warehouses Mississippi Canada RMO Toronto Canada Shared Service Center El Paso, Texas Beauty Appliances El Paso, Texas Operating Division HQ Shared Service HQ Regional Market Org. HQ Our Global Footprint U.S. HQ 44

Core Business Growth Rate Progression Consolidated Health & Home Housewares Beauty 45 FYTD 16 +5.6% FX Drag: NM* FY 15 +9.1% FX Drag: NM* FY 14 +6.0% FX Drag: NM* FY 13 +7.9% FX Drag: NM* FYTD 16 +4.0% FX Drag -4.5 pts FY 15 8.0% FX Drag -0.7 pts FY 14 +5.5% FX Drag: NM* FY 13 +1.0% FX Drag -1.0 pts FY 14 -3.3% FX Drag -1.0 pts FY 15 -8.3% FX Drag -0.8 pts * Amounts not meaningful FYTD 16 +4.5% FX Drag -2.6 pts FY 15 +2.1% FX Drag -0.6 pts FY 14 +2.2% FX Drag -0.4 pts FY 13 +1.7% FX Drag -0.5 pts FYTD 16 +2.4% FX Drag -2.6 pts FY 13 -1.2% FX Drag -0.3 pts

New Shenzhen Shared Service Office 46

To unite all business segments, regions, departments and sites 47

English Chinese Spanish 48 New Transformational Strategy

Creating A Best-in-Class Supply Chain Lower Cost Lower COGS Improved Working Capital Identified $10MM+ savings within Shared Services $2MM in FY 15 accomplished $4MM in FY 16 targeted Cost savings reinvested towards core growth and used to offset FX headwinds Project Fuel For Growth 49 Leverage Global Supply Chain Increase global collaboration Capitalize on lower commodity prices & transportation Use sourcing and engineering best practices Leverage scale and expertise across divisions Invest in necessary system upgrades Optimize forecasting to improve inventory turns Focus on training, process improvements and standardization Quality Improvements

We Employ a Balanced Approach to Growth and Margin Expansion Margin Expansion Add and grow high margin consumables Trim lower performing products/customers Develop best in class supply chain Leverage economies of scale and shared services Mix improvement from recent acquisitions Growth Feed core brands Selectively enter new categories Leverage marketing mix analysis and consumer research Invest in innovation to drive margin and revenues Accretive acquisition 50

Our Segment Operating Margin Drivers Housewares Supply chain efficiencies Leverage of scale and shared services Initial entry into consumables New categories expected to pressure margin Investment for category expansion and to maintain growth Lower corporate overhead Health and Home Environment Sweeter mix of healthcare and consumables New products with higher margins Trim lower performing product lines Leverage of scale and shared services Lower corporate overhead Healthy Directions Grow Auto Delivery business Integration synergies Decreased dependency on direct mail; invest in on-line alternatives Addition of corporate overhead Beauty Feed core brands with right to win Diversify with new categories Leverage marketing mix analysis and consumer research Invest in innovation to drive margin and revenues Trim lower performing products and reduce SKU count Lower corporate overhead 51

Reconciliation of Non-GAAP Financial Measures The Company reports and discusses its operating results using financial measures consistent with accounting principles generally accepted in the United States of America (“GAAP”). To supplement its presentation, the Company discloses certain financial measures that may be considered non-GAAP financial measures, such as adjusted operating income, adjusted income, adjusted diluted EPS, EBITDA and adjusted EBITDA, which are presented in accompanying tables to this presentation along with a reconciliation of these financial measures to their corresponding GAAP-based measures presented in the Company’s consolidated statements of income. 52

Reconciliation of Operating Income to Adjusted Operating Income (In Thousands) APPENDIX - 1 53

Reconciliation of Net Income to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA (In Thousands) APPENDIX - 1 54

Reconciliation of Net Income (GAAP) to Adjusted Income (non-GAAP) (In Thousands) APPENDIX - 3 55

Reconciliation of Diluted Earnings Per Share (EPS) to Adjusted Diluted EPS 56

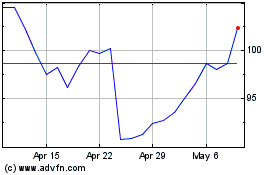

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Mar 2024 to Apr 2024

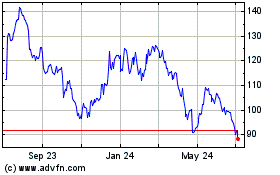

Helen of Troy (NASDAQ:HELE)

Historical Stock Chart

From Apr 2023 to Apr 2024