Horizon Bancorp (NASDAQ: HBNC) (“Horizon”) and LaPorte Bancorp,

Inc. (NASDAQ: LPSB) (“LaPorte Bancorp”), jointly announced that the

Office of the Comptroller of the Currency and the Federal Reserve

Board have approved or not objected to the proposed merger of

LaPorte Bancorp and its wholly-owned subsidiary, The LaPorte

Savings Bank, with and into Horizon’s wholly-owned bank subsidiary,

Horizon Bank, N.A.

“We are very pleased to have received these regulatory approvals

to complete the merger and that the approval process went smoothly

and efficiently,” said Craig Dwight, Chairman and Chief Executive

Officer of Horizon. “This helps keep us on target to complete the

merger by our original target date of July 2016,” continued

Dwight.

Michele Thompson, President and Chief Financial Officer of

LaPorte Bancorp, stated, “I am extremely happy with the progress

being made by both The LaPorte Savings Bank and Horizon Bank

integration teams, and we are pleased that these regulatory

approvals have been obtained in such a timely fashion. I am

confident that our teams will continue to work well together,

meeting the anticipated closing date of the merger.”

The merger is expected to be completed in July 2016 and remains

subject to approval by LaPorte Bancorp’s stockholders as well as

the satisfaction of various other closing conditions. LaPorte

Bancorp will hold its special meeting of stockholders to approve

the merger on Monday, July 11, 2016, at 5:00 PM, local time, at the

main office of The LaPorte Savings Bank located at 710 Indiana

Avenue, LaPorte, Indiana 46350.

Additionally, Horizon and LaPorte Bancorp announced that the

election deadline for LaPorte Bancorp stockholders to elect the

type of merger consideration they will receive, subject to

allocation and proration procedures, is 5:00 p.m., Eastern Time, on

July 8, 2016. The merger agreement provides that 65% of the

outstanding shares of LaPorte Bancorp common stock will be

exchanged for Horizon common stock and 35% of the outstanding

shares of LaPorte Bancorp common stock will be exchanged for cash.

When the elections of all LaPorte Bancorp stockholders have been

received, Horizon will determine the exact amount of cash and/or

shares of Horizon common stock to be distributed to LaPorte Bancorp

stockholders based on their election choices and the proration

procedures described in the merger agreement and the proxy

statement/prospectus.

About Horizon Bancorp

Horizon Bancorp is a locally owned, independent, commercial bank

holding company serving northern and central Indiana and southwest

and central Michigan through its commercial banking subsidiary

Horizon Bank, NA. Horizon also offers mortgage-banking services

throughout the Midwest. Horizon Bancorp may be reached online at

www.horizonbank.com. Its common stock

is traded on the NASDAQ Global Select Market under the symbol

HBNC.

About LaPorte Bancorp, Inc.

LaPorte Bancorp, Inc. is an Indiana corporation headquartered in

LaPorte, Indiana with The LaPorte Savings Bank as its wholly owned

subsidiary. The LaPorte Savings Bank was founded in 1871 and offers

a full range of banking services with seven branch locations

serving northeast Indiana and a loan production office in Saint

Joseph, Michigan. LaPorte Bancorp may be reached online at

www.laportesavingsbank.com. Its common

stock is traded on the NASDAQ Capital Market under the symbol

LPSB.

Additional Information

In connection with the proposed merger, on May 18, 2016, Horizon

filed with the SEC a Registration Statement on Form S-4 that

includes a proxy statement of LaPorte Bancorp and a prospectus of

Horizon, as well as other relevant documents concerning the

proposed transaction. The Form S-4 has been declared effective and

the definitive proxy statement/prospectus has been mailed to

stockholders of LaPorte Bancorp on or about June 8, 2016.

Stockholders and investors are urged to read the Registration

Statement and the proxy statement/prospectus regarding the merger

and any other relevant documents filed with the SEC, as well as any

amendments or supplements to those documents, because they contain

important information.

A free copy of the proxy statement/prospectus, as well as any

other documents either Horizon or LaPorte Bancorp has filed with

the SEC, may be obtained free of charge at the SEC’s website at

www.sec.gov. In addition, you may obtain copies of these documents,

free of charge, from Horizon at www.horizonbank.com under the tab

“About Us – Investor Relations – Documents – SEC Filings” and from

LaPorte Bancorp at www.laportesavingsbank.com under the tab “About

Us – Investor Relations”. Alternatively, these documents can be

obtained free of charge from Horizon upon written request to

Horizon Bancorp, Attn: Dona Lucker, Shareholder Relations Officer,

515 Franklin Square, Michigan City, Indiana 46360 or by calling

(219) 874-9272, or from LaPorte Bancorp upon written request to

LaPorte Bancorp, Inc., Attn: Michele Thompson, 710 Indiana Avenue,

LaPorte, Indiana 46350 or by calling (219) 362-7511. The

information available through Horizon’s website and LaPorte

Bancorp’s website is not and shall not be deemed part of this press

release or incorporated by reference into other filings either

Horizon or LaPorte Bancorp makes with the SEC. This communication

does not constitute an offer to sell or the solicitation of an

offer to buy any securities.

Horizon and LaPorte Bancorp and certain of their directors and

executive officers may be deemed to be participants in the

solicitation of proxies from the stockholders of LaPorte Bancorp in

connection with the proposed merger. Information about the

directors and executive officers of Horizon is set forth in

Horizon’s Annual Report on Form 10-K filed with the SEC on February

29, 2016 and in the proxy statement for Horizon’s 2016 annual

meeting of shareholders, as filed with the SEC on a Schedule 14A on

March 15, 2016. Information about the directors and executive

officers of LaPorte Bancorp is set forth in LaPorte Bancorp’s

Annual Report on Form 10-K for the year ended December 31, 2015, as

filed with the SEC on March 24, 2016. Additional information

regarding the interests of these participants and any other persons

who may be deemed participants in the transaction may be obtained

by reading the proxy statement/prospectus regarding the proposed

merger. Free copies of this document may be obtained as described

in the preceding paragraph.

Forward Looking Statements

This press release may contain forward-looking statements

regarding the financial performance, business prospects, growth and

operating strategies of Horizon and LaPorte Bancorp. For these

statements, Horizon and LaPorte Bancorp claim the protections of

the safe harbor for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995. Statements in

this press release should be considered in conjunction with the

other information available about Horizon and LaPorte Bancorp,

including the information in the filings each makes with the

Securities and Exchange Commission. Forward-looking statements

provide current expectations or forecasts of future events and are

not guarantees of future performance. The forward-looking

statements are based on management’s expectations and are subject

to a number of risks and uncertainties. Horizon and LaPorte Bancorp

have tried, wherever possible, to identify such statements by using

words such as “anticipate,” “estimate,” “project,” “intend,”

“plan,” “believe,” “will” and similar expressions in connection

with any discussion of future operating or financial

performance.

Although Horizon’s and LaPorte Bancorp’s management believe that

the expectations reflected in such forward-looking statements are

reasonable, actual results may differ materially from those

expressed or implied in such statements. Risks and uncertainties

that could cause actual results to differ materially include risk

factors relating to the banking industry and the other factors

detailed from time to time in Horizon’s and LaPorte Bancorp’s

respective Annual Reports on Form 10-K and other periodic filings

with the Securities and Exchange Commission. Undue reliance should

not be placed on the forward-looking statements, which speak only

as of the date hereof. Horizon and LaPorte Bancorp do not

undertake, and specifically disclaim any obligation, to publicly

release the result of any revisions that may be made to update any

forward-looking statement to reflect the events or circumstances

after the date on which the forward-looking statement is made, or

reflect the occurrence of unanticipated events, except to the

extent required by law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160616006370/en/

Horizon Contact Information:Craig M. DwightChairman and

Chief Executive OfficerPhone: (219) 873-2725orMark E. SecorChief

Financial OfficerPhone: (219) 873-2611Fax: (219)

874-9280orLaPorte Bancorp Contact Information:Lee A.

BradyChief Executive OfficerPhone: (219) 362-7511orMichele M.

ThompsonPresident and Chief Financial OfficerPhone: (219)

362-7511

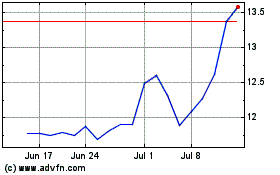

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

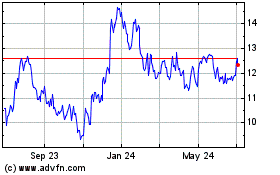

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024