Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

April 14 2016 - 12:57PM

Edgar (US Regulatory)

Filed by Horizon Bancorp

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Horizon Bancorp

Commission File No. 000-10792

This filing relates to the proposed merger transaction between Horizon Bancorp (“Horizon”) and Kosciusko Financial, Inc. (“KFI”) pursuant to the terms of an Agreement and Plan of Merger dated as of February 4, 2016 (the “Merger Agreement”) between Horizon and KFI. The Merger Agreement is on file with the Securities and Exchange Commission (“SEC”) as Appendix A to the joint proxy statement/prospectus of Horizon and KFI filed by Horizon on April 14, 2016.

Set forth below is a letter from James Caskey, KFI’s Chairman, and J. Gregory Maxwell, KFI’s President and Chief Executive Officer, which was mailed to shareholders of KFI in connection with the proposed merger transaction between Horizon and KFI.

Additional Information for Shareholders

In connection with the proposed merger, Horizon has filed with the SEC a Registration Statement on Form S-4 that includes a proxy statement of KFI and a prospectus of Horizon, as well as other relevant documents concerning the proposed transaction. Horizon and KFI have mailed the definitive joint proxy statement/prospectus to shareholders of KFI (which mailings were first made on or about April 13, 2016). Shareholders are urged to read the Registration Statement and the joint proxy statement/prospectus regarding the merger and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they contain important information. A free copy of the joint proxy statement/prospectus, as well as other filings containing information about Horizon, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Horizon at www.horizonbank.com under the tab “About Us” and then under the heading “Investor Relations” and then “SEC Filings.” The information available through Horizon’s website is not and shall not be deemed part of this filing or incorporated by reference into other filings Horizon makes with the SEC.

Horizon and KFI and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of KFI in connection with the proposed merger. Information about the directors and executive officers of Horizon is set forth in the proxy statement for Horizon’s 2016 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 15, 2016. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger. Free copies of this document may be obtained as described in the preceding paragraph.

Forward-Looking Statements

This filing contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects,” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could,” “may,” or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks, and uncertainties which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. In addition to factors previously disclosed in Horizon’s reports filed with the SEC, the following factors among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by KFI’s shareholders, on the expected terms and schedule; delay in closing the merger; difficulties and delays in integrating Horizon’s and KFI’s businesses or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of Horizon’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital market activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms, including those associated with the Dodd-Frank Wall Street Reform and Consumer Protection Act.

* * * * * * * * * *

|

Kosciusko Financial, Inc

.

Mentone, IN

|

|

Farmers State Bank

Subsidiary

|

Mailing Address:

433 Anchorage Road

Warsaw, IN 46580

574-269-2408

888-480-2408

|

|

The board of directors of Kosciusko Financial, Inc. has unanimously agreed to merge Kosciusko Financial, Inc. with Horizon Bancorp, and simultaneously to merge Farmers State Bank, the wholly owned subsidiary of Kosciusko Financial, Inc., with and into Horizon Bank, N.A., the wholly owned subsidiary of Horizon Bancorp.

Under the terms of the Agreement and Plan of Merger, shareholders of Kosciusko will have the option to receive $81.75 per share in cash or 3.0122 shares of Horizon common stock for each share of Kosciusko’s common stock, or a combination thereof, provided the overall shares exchanged consist of 65% Horizon stock and 35% cash. Based upon the April 8, 2016, closing price of $24.08 per share of Horizon common stock, the transaction has an implied valuation of approximately $22.5 million.

A special meeting of Kosciusko Financial, Inc. shareholders will be held at Bell Memorial Library, 101 West Main Street, Mentone, Indiana, 46539, on

Wednesday, May 25,

2016

at 10:00 a.m. EDT. At the special meeting, you will be asked to approve the Agreement and Plan of Merger dated as of February 4

th

, 2016, among Kosciusko Financial, Inc., and Horizon Bancorp. The completion of the Merger requires the receipt of bank regulatory approvals, and the approval of a majority of the shares of Kosciusko Financial Inc. common stock outstanding on April 8, 2016, the record date. Kosciusko Financial’s board of directors unanimously recommends that you vote

FOR

approval of the Merger Agreement and urges you to sign and date the enclosed proxy card and return it promptly in the postage-paid enclosed envelope to make sure that your vote is counted. Of course, if you attend the meeting, you may vote in person, even if you have returned your proxy.

The joint proxy statement – prospectus attached to this letter provides you with information about the special meeting of shareholders and the proposed Merger. We encourage you to read the entire joint proxy statement – prospectus carefully.

Your vote is important. Whether or not you plan to attend the meeting in person, please vote as soon as possible by marking, signing, dating and promptly returning the enclosed proxy card in the envelope provided.

If you fail to return your proxy card, your shares effectively will be counted as a vote against the Merger proposal.

Thank you for your continued loyalty and support.

|

|

|

|

|

|

|

James Caskey, Chairman

|

J. Gregory Maxwell,

|

|

|

|

|

President and Chief Executive Officer

|

|

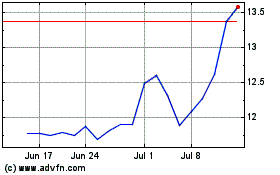

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

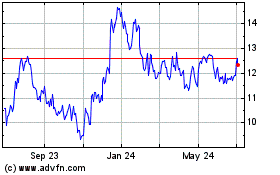

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024