(NASDAQ: HBNC) – Horizon Bancorp today announced its unaudited

financial results for the three and nine-month periods ended

September 30, 2015.

SUMMARY:

- On July 1, 2015, Horizon closed the

acquisition of Peoples Bancorp (“Peoples”) and its wholly-owned

subsidiary, Peoples Federal Savings Bank of DeKalb County,

headquartered in Auburn, Indiana.

- The quarterly dividend was increased

from $.14 to $.15 per share on September 15, 2015.

- Third quarter 2015 net income was $4.3

million or $.36 diluted earnings per share.

- Excluding merger expenses and gain on

sale of investment securities, net income for the third quarter of

2015 increased 52.8% compared to the same period of 2014 to $6.7

million or $.56 diluted earnings per share.

- Net income for the first nine months of

2015 was $14.4 million or $1.37 diluted earnings per share.

- Excluding merger expenses, gain on sale

of investment securities and the death benefit on bank owned life

insurance, net income for the first nine months of 2015 increased

28.3% compared to the same period of 2014 to $17.2 million or $1.64

diluted earnings per share.

- Net interest income for the first nine

months of 2015 increased 17.3% or $8.1 million compared to the same

period in 2014.

- The net interest margin, excluding the

impact of acquisitions (“core net interest margin”), decreased 7

basis points from the linked quarter and 3 basis points in the

first nine months of 2015 compared to the same periods in

2014.

- Non-interest income for the first nine

months of 2015 increased 15.9% or $3.1 million compared to the same

period in 2014.

- Excluding the Peoples acquisition,

mortgage warehouse loans and loans held for sale, loans increased

11.9% on an annualized basis during the third quarter of 2015.

- Horizon’s tangible book value per share

increased to $16.37 at September 30, 2015, compared to $16.26 at

December 31, 2014 and $15.75 at September 30, 2014.

- Horizon Bank’s capital ratios,

including Tier 1 Capital to Average Assets of 9.35% and Total

Capital to Risk Weighted Assets of 13.03% as of September 30, 2015,

continue to be well above the regulatory standards for

well-capitalized banks.

Craig Dwight, Chairman and CEO, commented: “Horizon continued

its growth story in the third quarter of 2015 with positive

contributions from all four revenue streams - retail banking,

business banking, mortgage banking and wealth management. These

results are particularly noteworthy as the Peoples integration and

systems conversion required a tremendous amount of teamwork and

dedication during the quarter.”

Dwight continued, “Horizon’s growth drove a substantial increase

in net income and earnings per share compared to the same periods

of 2014. Net income and diluted earnings per share, excluding

non-core items, increased 57.0% and 26.7% during the third quarter

of 2015, respectively. On a year-to-date basis, net income and

diluted earnings per share, excluding non-core items, increased by

30.0% and 17.8%, respectively. Given the persistent low interest

rate environment, loan and fee income growth and the ability to

create operating leverage are critical to combat margin pressure

existing throughout the banking industry.”

Non-GAAP Reconciliation of Net Income and Diluted

Earnings per Share (Dollar in Thousands Except per Share Data,

Unaudited)

Three Months Ended

Nine Months Ended September 30 September 30

Non-GAAP

Reconciliation of Net Income

2015 2014 2015

2014 (Unaudited) (Unaudited)

(Unaudited) (Unaudited) Net income as reported

$ 4,288 $ 4,958

$ 14,374 $ 13,153

Merger expenses

3,648 124

4,364 1,335 Tax effect

(1,219 ) (43 )

(1,402 ) (467 ) Net income excluding

merger expenses

6,717 5,039

17,336 14,021 Gain

on sale of investment securities

- (988 )

(124

) (988 ) Tax effect

- 346

43 346 Net

income excluding gain on sale of investment securities

6,717

4,396

17,255 13,379 Death benefit on bank owned life

insurance ("BOLI")

- -

(145 ) - Tax effect

- -

51 - Net income excluding death

benefit on BOLI

6,717 4,396

17,161 13,379

Acquisition-related PAUs

(402 ) (438 )

(2,282

) (2,027 ) Tax effect

141

153

799 709

Net income excluding PAUs

$ 6,456 $

4,112

$ 15,678 $ 12,061

Non-GAAP

Reconciliation of Diluted Earnings per Share

Diluted earnings per share as reported

$ 0.36 $ 0.51

$ 1.37 $ 1.39 Merger expenses

0.30 0.01

0.42 0.14 Tax effect

(0.10 )

(0.00 )

(0.13 )

(0.05 ) Diluted earnings per share excluding merger expenses

0.56 0.52

1.66 1.48 Gain on sale of investment

securities

- (0.10 )

(0.01 ) (0.11 ) Tax

effect

- 0.03

0.00 0.04 Net income

excluding gain on sale of investment securities

0.56 0.45

1.65 1.41 Death benefit on BOLI

- -

(0.01 ) - Tax effect

-

-

0.00 -

Net income excluding death benefit on BOLI

0.56 0.45

1.64 1.41 Acquisition-related PAUs

(0.03

) (0.05 )

(0.22 ) (0.22 ) Tax effect

0.01 0.02

0.08 0.08 Diluted earnings per

share excluding PAUs

$ 0.54 $ 0.42

$ 1.50 $ 1.27

Dwight commented, “Due to a decline in mortgage refinancing

activity, Horizon’s mortgage warehouse portfolio returned to more

normalized levels during the third quarter of 2015. This decrease

was partially offset by continued organic growth in other loan

types and the addition of loans acquired in the Peoples

transaction. Excluding loans acquired in the Peoples acquisition,

mortgage warehouse loans and loans held for sale, loans increased

by 11.9% on an annualized basis in the third quarter of 2015 and

12.2% on an annualized basis during the first nine months of 2015

compared to the same periods of 2014.”

Dwight continued, “Horizon’s strategy of revenue diversification

through commercial loan growth and non-mortgage related fee income

is evident in our results. At its peak, for the year ended December

31, 2012 mortgage warehouse and mortgage gain on sale revenue

comprised 24.5% of Horizon’s total revenue base (interest income

and non-interest income). For the year ending December 31, 2014 and

the nine months ending September 30, 2015, mortgage warehouse and

mortgage gain on sale revenue as a percentage of total revenue

declined to 12.8% and 14.7%, respectively.”

Loan Growth by Type, Excluding Acquired Loans

Three Months Ended September 30, 2015 (Dollars in Thousands,

Unaudited)

Excluding Acquired

Loans Acquired Annualized

September 30 June 30 Amount Peoples

Amount Percent Percent

2015 2015 Change

Loans Change Change

Change Commercial loans

$ 795,271 $ 709,946 $

85,325 $ (67,435 ) $ 17,890 2.5 % 10.0 % Residential mortgage loans

430,477 277,407 153,070 (136,861 ) 16,209 5.8 % 23.2 %

Consumer loans

361,298 336,006

25,292 (19,593 ) 5,699

1.7 % 6.7 % Subtotal

1,587,046 1,323,359 263,687

(223,889 ) 39,798 3.0 % 11.9 % Held for sale loans

5,583

7,677 (2,094 ) - (2,094 ) -27.3 % -108.2 % Mortgage warehouse loans

138,974 195,924 (56,950 )

- (56,950 ) -29.1 % -115.3 %

Total loans

$ 1,731,603 $ 1,526,960 $

204,643 $ (223,889 ) $ (19,246 ) -1.3 % -5.0 %

Loan Growth by Type, Excluding Acquired Loans Nine

Months Ended September 30, 2015 (Dollars in Thousands)

Excluding Acquired Loans Acquired Annualized

September 30 December 31 Amount Peoples

Amount Percent Percent 2015 2014

Change Loans Change Change

Change (Unaudited)

Commercial loans

$ 795,271 $ 674,314 $ 120,957 $

(67,435 ) $ 53,522 7.9 % 10.6 % Residential mortgage loans

430,477 254,625 175,852 (136,861 ) 38,991 15.3 % 20.5 %

Consumer loans

361,298 320,459

40,839 (19,593 ) 21,246

6.6 % 8.9 % Subtotal

1,587,046 1,249,398 337,648

(223,889 ) 113,759 9.1 % 12.2 % Held for sale loans

5,583

6,143 (560 ) - (560 ) -9.1 % -12.2 % Mortgage warehouse loans

138,974 129,156 9,818

- 9,818 7.6 % 10.2

% Total loans

$ 1,731,603 $ 1,384,697 $

346,906 $ (223,889 ) $ 123,017 8.9 %

11.9 %

The following table presents Horizon’s core net interest margin,

which excludes acquisition-related purchase accounting adjustments.

Dwight noted, “The Peoples transaction created a slight reduction

in Horizon’s net interest margin. The reduction was partially

alleviated due to the mix of earning assets as the cash from

Peoples’ liquidated securities portfolio was used to redeem

short-term borrowings at the close of the transaction reducing

interest-earning assets throughout the third quarter. During the

quarter, a portion of the cash from the liquidated securities

portfolio was used to repurchase securities and pay down a matured

long-term FHLB advance.”

To reduce funding costs over the next four years the Company

currently plans to use the securities portfolio to redeem maturing

long-term debt. As of September 30, 2015, $31.6 million of

long-term debt is scheduled to mature in 2016, $47.5 million in

2017, $27.0 million in 2018 and $55.2 million in 2019. This

deleveraging will help reduce the Company’s cost of funds and

provide additional capital for growth.

Non-GAAP Reconciliation of Net Interest Margin

(Dollar Amounts in Thousands, Unaudited)

Three Months

Ended Nine Months Ended September 30

June 30 September 30 September

30

Net Interest

Margin As Reported

2015 2015 2014

2015 2014 Net interest income

$

19,776 $ 17,850 $ 16,400

$ 54,512 $

46,460 Average interest-earning assets

2,304,515 2,008,191

1,877,066

2,072,276 1,770,187 Net interest income as a

percent of average interest- earning assets ("Net Interest Margin")

3.51 % 3.67 % 3.59 %

3.59 % 3.62 %

Impact of

Acquisitions

Interest income from acquisition-related purchase accounting

adjustments ("PAUs")

$ (402 ) $ (797 ) $ (438

)

$ (2,282 ) $ (2,027 )

Excluding Impact

of Acquisitions

Net interest income

$ 19,374 $ 17,053 $ 15,962

$ 52,230 $ 44,433 Average interest-earning assets

2,304,515 2,008,191 1,877,066

2,072,276 1,770,187

Core Net Interest Margin

3.44 % 3.51 % 3.50 %

3.44 % 3.47 %

Horizon’s loan loss reserve ratio, excluding loans with

credit-related purchase accounting adjustments, was 1.13% as of

September 30, 2015.

Allowance for Loan and Lease Loss Detail As of

September 30, 2015 (Dollars in Thousands, Unaudited)

Horizon Legacy

Heartland Summit Peoples

Total Pre-discount loan balance $ 1,409,298 $ 26,496 $

81,421 $ 218,195 $ 1,735,410 Allowance for loan losses

(ALLL) 15,896 264 8 - 16,168 Loan discount N/A

1,576 3,213 4,601

9,390 ALLL+loan discount 15,896 1,840

3,221 4,601 25,558

Loans, net $ 1,393,402 $ 24,656

$ 78,200 $ 213,594 $ 1,709,852

ALLL/ pre-discount loan balance 1.13 % 1.00 % 0.01 %

0.00 % 0.93 % Loan discount/ pre-discount loan balance N/A 5.95 %

3.95 % 2.11 % 0.54 % ALLL+loan discount/ pre-discount loan balance

1.13 % 6.94 % 3.96 % 2.11 % 1.47 %

Income Statement Highlights

Net income for the third quarter of 2015 was $4.3 million or

$.36 diluted earnings per share compared to $4.9 million or $.51

diluted earnings per share in the third quarter of 2014. The

decrease in net income and earnings per share from the previous

year reflects an increase in non-interest expenses of $6.9 million

primarily due to an increase in salaries and employee benefits and

outside services and consultants expense, partially offset by an

increase in net interest income of $3.4 million, a decrease in

provision for loan losses of $1.4 million and an increase in

non-interest income of $1.0 million. The decrease in earnings per

share also reflects an increase in diluted shares due to the

Peoples acquisition. Excluding acquisition-related expenses and

purchase accounting adjustments and gain on sale of investment

securities, net income for the third quarter of 2015 was $6.5

million or $.54 diluted earnings per share compared to $4.1 million

or $.42 diluted earnings per share in the same period of 2014.

Net income for the nine months ended September 30, 2015 was

$14.4 million or $1.37 diluted earnings per share compared to $13.2

million or $1.39 diluted earnings per share for the nine months

ended September 30, 2014. The increase in net income from the

previous year reflects an increase in net interest income of $8.1

million and an increase in non-interest income of $3.1 million,

partially offset by an increase in the provision for loan losses of

$740,000 and an increase in non-interest expenses of $8.7 million.

The decrease in earnings per share also reflects an increase in

diluted shares due to the Peoples acquisition. Excluding

acquisition-related expenses and purchase accounting adjustments,

gain on sale of investment securities and the death benefit on bank

owned life insurance, net income for the first nine months of 2015

was $15.7 million or $1.50 diluted earnings per share compared to

$12.1 million or $1.27 diluted earnings per share in the same

period of 2014.

Horizon’s net interest margin was 3.51% during the third quarter

of 2015, down from 3.67% for the prior quarter and 3.59% for same

period of 2014. The decrease in net interest margin compared to the

prior quarter and the same period of 2014 was due to lower yields

on new loans and re-pricing earning assets and a decrease in

interest income from acquisition-related purchase accounting

adjustments. Excluding acquisition-related purchase accounting

adjustments, the margin would have been 3.44% for the third quarter

of 2015 compared to 3.51% for the prior quarter and 3.50% for the

same period of 2014. Interest income from acquisition-related

purchase accounting adjustments was $402,000, $797,000, and

$438,000 for the three months ended September 30, 2015, June 30,

2015 and September 30, 2014, respectively.

Horizon’s net interest margin was 3.59% for the nine months

ending September 30, 2015, down from 3.62% for same period of 2014.

Excluding interest income from acquisition-related purchase

accounting adjustments, the margin would have been 3.44% for the

nine months ending September 30, 2015 compared to 3.47% for same

period of 2014. Interest income from acquisition-related purchase

accounting adjustments was $2.3 million and $2.0 million for the

nine months ended September 30, 2015 and September 30, 2014,

respectively.

Residential mortgage lending activity during the third quarter

of 2015 generated $2.8 million in income from the gain on sale of

mortgage loans, an increase of $641,000 from the same period of

2014. Total origination volume in the third quarter of 2015,

including loans placed into portfolio, totaled $127.5 million,

representing an increase of 24.8% from the same period of 2014 of

$102.2 million. Purchase money mortgage originations during the

third quarter of 2015 represented 81.0% of total originations

compared to 71.8% of originations during the previous quarter and

77.6% during the third quarter of 2014.

Lending Activity

Total loans increased $346.9 million from $1.4 billion as of

December 31, 2014 to $1.7 billion as of September 30, 2015 as

mortgage warehouse loans increased by $9.8 million, residential

mortgage loans increased by $175.9 million and consumer loans

increased by $40.8 million. Commercial loans increased $121.0

million or 10.5% on an annualized basis from $674.3 million at

December 31, 2014 to $795.3 million at September 30, 2015.

Total loan balances in the Kalamazoo and Indianapolis markets

continued to grow during the third quarter of 2015 to $166.8

million and $151.2 million, respectively, as of September 30, 2015.

In the third quarter of 2015, Kalamazoo’s aggregate loan balances

increased $12.4 million or 8.0%, and Indianapolis’ aggregate loan

balances increased $5.7 million or 3.9%. Combined, these markets

contributed $18.1 million in loan growth during the third quarter

of 2015 or 6.0%.

The provision for loan losses was $300,000 for the third quarter

of 2015 compared to $1.7 million for the same period of 2014. The

lower provision for loan losses in the third quarter of 2015

compared to the same period of the previous year was predominantly

due a $1.0 million charge-off associated with one commercial credit

during the third quarter of 2014. The provision for loan losses was

$2.8 million the first nine months of 2015 compared to $2.1 million

for the same period of 2014. The higher provision for loan losses

in the first nine months of 2015 compared to the same period of

2014 was due to the charge-off of one commercial credit of $1.3

million in the second quarter of 2015 as well as continued loan

growth. The $1.3 million commercial charge-off was a legacy workout

loan that was determined to be impaired due to the borrower’s

inability to make payments and a decrease in collateral value.

The ratio of the allowance for loan losses to total loans

decreased to 0.93% as of September 30, 2015 from 1.19% as of

December 31, 2014 due to an increase in total loans and a decrease

in the allowance for loan losses from $16.5 million as of December

31, 2014 to $16.2 million as of September 30, 2015. The Peoples

transaction added $223.9 million in loans without a loan loss

reserve due to purchase accounting adjustments. As of September 30,

2015, the ratio of the allowance for loan losses to total loans,

excluding loans with credit-related purchase accounting

adjustments, was 1.13% compared to 1.29% as of December 31,

2015.

Non-performing loans totaled $21.0 million as of September 30,

2015 and $22.4 million as of December 31, 2014. Compared to

December 31, 2014, non-performing commercial loans and consumer

loans decreased by $707,000 and $927,000, respectively, while

non-performing real estate loans increased by $253,000. As a

percentage of total loans, non-performing loans were 1.21% at

September 30, 2015, down 41 basis points from 1.62% at December 31,

2014.

Expense Management

Total non-interest expense was $6.9 million higher in the third

quarter of 2015 compared to the same period of 2014. The increase

was primarily due to an increase in salaries and employee benefits

costs of $2.4 million, outside services and consultants expense of

$2.6 million and other expense of $547,000, reflecting overall

company growth and the Peoples acquisition. One-time non-interest

expense related to the Peoples acquisition totaled $3.6 million in

the third quarter of 2015.

Total non-interest expense was $8.7 million higher in the first

nine months of 2015 compared to the same period of 2014. The

increase was primarily due to an increase in salaries and employee

benefits costs of $3.6 million, outside services and consultants

expense of $2.2 million, other expenses of $817,000, net occupancy

expenses of $461,000, data processing expense of $456,000,

professional fees of $211,000, loan expense of $486,000, FDIC

deposit insurance expense of $245,000 and other losses of $253,000

due to overall company growth and the Peoples acquisition. One-time

non-interest expense related to the Peoples acquisition totaled

$4.4 million in the third quarter of 2015.

Use of Non-GAAP Financial Measures

Certain information set forth in this press release refers to

financial measures determined by methods other than in accordance

with GAAP. Specifically, we have included non-GAAP financial

measures of the net interest margin and the allowance for loan and

lease losses excluding the impact of acquisition-related purchase

accounting adjustments and net income and diluted earnings per

share excluding the impact of one-time costs related to

acquisitions, acquisition-related purchase accounting adjustments

and other events that are considered to be non-recurring. Horizon

believes that these non-GAAP financial measures are helpful to

investors and provide a greater understanding of our business

without giving effect to the purchase accounting impacts and

one-time costs of acquisitions and non-core items, although these

measures are not necessarily comparable to similar measures that

may be presented by other companies and should not be considered in

isolation or as a substitute for the related GAAP measure.

About Horizon

Horizon Bancorp is a locally owned, independent, commercial bank

holding company serving Northern and Central Indiana and Southwest

and Central Michigan through its commercial banking subsidiary

Horizon Bank, NA. Horizon also offers mortgage-banking services

throughout the Midwest. Horizon Bancorp may be reached online at

www.horizonbank.com. Its common stock is traded on the NASDAQ

Global Select Market under the symbol HBNC.

Forward Looking Statements

This press release may contain forward-looking statements

regarding the financial performance, business prospects, growth and

operating strategies of Horizon. For these statements, Horizon

claims the protections of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995. Statements in this press release should be considered

in conjunction with the other information available about Horizon,

including the information in the filings we make with the

Securities and Exchange Commission. Forward-looking statements

provide current expectations or forecasts of future events and are

not guarantees of future performance. The forward-looking

statements are based on management’s expectations and are subject

to a number of risks and uncertainties. We have tried, wherever

possible, to identify such statements by using words such as

“anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,”

“will” and similar expressions in connection with any discussion of

future operating or financial performance. Although management

believes that the expectations reflected in such forward-looking

statements are reasonable, actual results may differ materially

from those expressed or implied in such statements. Risks and

uncertainties that could cause actual results to differ materially

include risk factors relating to the banking industry and the other

factors detailed from time to time in Horizon’s reports filed with

the Securities and Exchange Commission, including those described

in its Form 10-K. Undue reliance should not be placed on the

forward-looking statements, which speak only as of the date hereof.

Horizon does not undertake, and specifically disclaims any

obligation, to publicly release the result of any revisions that

may be made to update any forward-looking statement to reflect the

events or circumstances after the date on which the forward-looking

statement is made, or reflect the occurrence of unanticipated

events, except to the extent required by law.

HORIZON BANCORP

Financial Highlights (Dollars in thousands except share

and per share data and ratios, Unaudited) September

30 June 30 March 31 December 31

September 30 2015 2015

2015 2014 2014 Balance

sheet: Total assets $ 2,606,833 $ 2,219,307 $ 2,153,965 $

2,076,922 $ 2,037,045 Investment securities 617,860 493,631 495,315

489,531 495,941 Commercial loans 795,271 709,946 695,736 674,314

677,349 Mortgage warehouse loans 138,974 195,924 178,899 129,156

105,133 Residential mortgage loans 430,477 277,407 260,390 254,625

251,739 Consumer loans 361,298 336,006 326,334 320,459 308,800

Earning assets 2,363,286 2,031,671 1,974,251 1,885,576 1,860,041

Non-interest bearing deposit accounts 338,436 307,215 285,181

267,667 278,527 Interest bearing transaction accounts 1,164,787

983,912 905,216 930,582 881,299 Time deposits 409,852 293,596

274,699 284,070 289,837 Borrowings 372,820 385,236 440,415 351,198

350,113 Subordinated debentures 32,758 32,719 32,680 32,642 32,603

Common stockholders' equity 252,238 189,631 186,991 181,914 177,280

Total stockholders’ equity 264,738 202,131 199,491 194,414 189,780

Income statement: Three months ended Net

interest income $ 19,776 $ 17,850 $ 16,886 $ 16,523 $ 16,400

Provision for loan losses 300 1,906 614 978 1,741 Non-interest

income 8,400 7,186 7,066 6,738 7,390 Non-interest expenses 22,235

16,650 16,068 15,671 15,353 Income tax expense 1,353

1,752 1,912

1,664 1,738 Net income 4,288 4,728

5,358 4,948 4,958 Preferred stock dividend (31 )

(31 ) (31 ) (31 )

(40 ) Net income available to common shareholders $ 4,257

$ 4,697 $ 5,327 $ 4,917

$ 4,918

Per share data: Basic earnings

per share $ 0.37 $ 0.51 $ 0.58 $ 0.53 $ 0.53 Diluted earnings per

share 0.36 0.49 0.55 0.51 0.51 Cash dividends declared per common

share 0.15 0.14 0.14 0.14 0.13 Book value per common share 21.14

20.49 20.25 19.75 19.25 Tangible book value per common share 16.37

17.06 16.80 16.26 15.75 Market value - high 26.15 26.03 25.86 26.73

23.67 Market value - low $ 22.60 $ 22.85 $ 22.38 $ 22.83 $ 20.65

Weighted average shares outstanding - Basic 11,605,976 9,240,005

9,216,011 9,212,156 9,208,707 Weighted average shares outstanding -

Diluted 11,893,254 9,637,586 9,609,506 9,628,240 9,588,332

Key ratios: Return on average assets 0.69 % 0.87 % 1.05 %

0.96 % 0.96 % Return on average common stockholders' equity 8.70

9.88 11.66 10.72 10.95 Net interest margin 3.51 3.67 3.70 3.64 3.59

Loan loss reserve to total loans 0.93 1.08 1.13 1.19 1.20

Non-performing loans to loans 1.21 1.51 1.52 1.62 1.47 Average

equity to average assets 8.36 9.32 9.56 9.56 9.33 Bank only capital

ratios: Tier 1 capital to average assets 9.35 8.18 8.75 8.80 8.63

Tier 1 capital to risk weighted assets 12.17 11.04 11.47 11.96

12.13 Total capital to risk weighted assets 13.03 12.08 12.54 13.08

13.26

Loan data: Substandard loans $ 25,898 $ 28,220

$ 27,355 $ 27,661 $ 35,023 30 to 89 days delinquent 4,868 3,326

3,945 5,082 3,310 90 days and greater delinquent - accruing

interest $ 100 $ 207 $ 19 $ 115 $ 62 Trouble debt restructures -

accruing interest 2,948 3,271 4,368 4,372 5,838 Trouble debt

restructures - non-accrual 3,994 4,523 4,711 2,643 3,061

Non-accrual loans 13,956 15,050

13,282 15,312

10,828 Total non-performing loans $ 20,998

$ 23,051 $ 22,380 $ 22,442

$ 19,789

HORIZON BANCORP

Financial Highlights (Dollars in thousands except share

and per share data and ratios, Unaudited) September

30 September 30 2015 2014

Balance sheet: Total assets $ 2,606,833 $ 2,037,045

Investment securities 617,860 495,941 Commercial loans 795,271

677,349 Mortgage warehouse loans 138,974 105,133 Residential

mortgage loans 430,477 251,739 Consumer loans 361,298 308,800

Earning assets 2,363,286 1,860,041 Non-interest bearing deposit

accounts 338,436 278,527 Interest bearing transaction accounts

1,164,787 881,299 Time deposits 409,852 289,837 Borrowings 372,820

350,113 Subordinated debentures 32,758 32,603 Common stockholders'

equity 252,238 177,280 Total stockholders’ equity 264,738 189,780

Income statement: Nine Months Ended Net

interest income $ 54,512 $ 46,460 Provision for loan losses 2,820

2,080 Non-interest income 22,652 19,539 Non-interest expenses

54,953 46,275 Income tax expense 5,017

4,491 Net income 14,374 13,153 Preferred stock dividend

(94 ) (102 ) Net income available to common

shareholders $ 14,280 $ 13,051

Per

share data: Basic earnings per share $ 1.42 $ 1.45 Diluted

earnings per share 1.37 1.39 Cash dividends declared per common

share 0.43 0.37 Book value per common share 21.14 19.25 Tangible

book value per common share 16.37 15.75 Market value - high 26.15

24.91 Market value - low $ 22.38 $ 19.57 Weighted average shares

outstanding - Basic 10,029,419 9,009,663 Weighted average shares

outstanding - Diluted 10,387,113 9,389,359

Key

ratios: Return on average assets 0.86 % 0.92 % Return on

average common stockholders' equity 10.03 10.56 Net interest margin

3.59 3.62 Loan loss reserve to total loans 0.93 1.20 Non-performing

loans to loans 1.21 1.47 Average equity to average assets 9.05 9.25

Bank only capital ratios: Tier 1 capital to average assets 9.35

8.63 Tier 1 capital to risk weighted assets 12.17 12.13 Total

capital to risk weighted assets 13.03 13.26

Loan

data: Substandard loans $ 25,898 $ 35,023 30 to 89 days

delinquent 4,868 3,310 90 days and greater delinquent -

accruing interest $ 100 $ 62 Trouble debt restructures - accruing

interest 2,948 5,838 Trouble debt restructures - non-accrual 3,994

3,061 Non-accrual loans 13,956 10,828

Total non-performing loans $ 20,998 $ 19,789

HORIZON BANCORP

Allocation of the Allowance for Loan and Lease Losses

(Dollars in Thousands, Unaudited)

September 30 June 30 March 31

December 31 September 30 2015

2015 2015 2014

2014 Commercial

$ 8,841 $ 8,386 $ 7,876 $

7,910 $ 7,515 Real estate

2,297 3,044 3,281 2,508 3,304

Mortgage warehousing

1,015 1,319 1,272 1,132 1,300 Consumer

4,015 3,672 4,205

4,951 4,041 Total

$ 16,168

$ 16,421 $ 16,634 $ 16,501 $ 16,160

Net Charge-offs (Recoveries)

(Dollars in Thousands, Unaudited)

Three months ended September 30 June

30 March 31 December 31

September 30 2015 2015

2015 2014 2014 Commercial

$ 77 $ 1,584 $ (11 ) $ 199 $ 1,006 Real estate

96 161 20 101 19 Mortgage warehousing

- - - - -

Consumer

380 375 472

336 217 Total

$

553 $ 2,120 $ 481 $ 636 $

1,242

Total

Non-performing Loans

(Dollars in Thousands, Unaudited)

September 30 June 30 March 31

December 31 September 30 2015

2015 2015 2014

2014 Commercial

$ 10,832 $ 13,384 $ 11,540 $

11,855 $ 9,323 Real estate

6,315 5,819 6,062 5,894 6,312

Mortgage warehousing

- - - - - Consumer

3,851

3,848 4,778 4,693

4,154 Total

$ 20,998 $ 23,051 $

22,380 $ 22,442 $ 19,789

Other Real Estate Owned and Repossessed Assets

(Dollars in Thousands, Unaudited)

September 30 June 30 March 31

December 31 September 30 2015

2015 2015 2014

2014 Commercial

$ 324 $ 376 $ 307 $ 411 $ 376

Real estate

958 58 219 636 875 Mortgage warehousing

-

- - - - Consumer

- 37 223

154 3 Total

$ 1,282

$ 471 $ 749 $ 1,201 $ 1,254

HORIZON BANCORP AND

SUBSIDIARIES Average Balance Sheets

(Dollar Amounts in Thousands,

Unaudited)

Three Months Ended Three Months Ended

September 30, 2015 September 30, 2014 Average

Average Average

Average Balance Interest

Rate Balance Interest

Rate ASSETS Interest-earning assets Federal

funds sold $ 23,086 $ 2 0.03 % $ 4,033 $ 5 0.49 % Interest-earning

deposits 16,340 5 0.12 % 5,941 4 0.27 % Investment securities -

taxable 401,702 2,149 2.12 % 394,954 2,330 2.34 % Investment

securities - non-taxable (1) 154,050 1,125 4.39 % 146,513 1,109

4.48 % Loans receivable (2)(3) 1,709,337

20,297 4.72 % 1,325,625 16,403

4.92 % Total interest-earning assets (1) 2,304,515 23,578 4.17 %

1,877,066 19,851 4.32 % Non-interest-earning assets Cash and

due from banks 31,384 27,188 Allowance for loan losses (16,427 )

(15,706 ) Other assets 151,035 155,021

$ 2,470,507 $ 2,043,569

LIABILITIES

AND SHAREHOLDERS' EQUITY Interest-bearing liabilities

Interest-bearing deposits $ 1,568,777 $ 1,566 0.40 % $ 1,204,122 $

1,352 0.45 % Borrowings 303,521 1,729 2.26 % 320,676 1,593 1.97 %

Subordinated debentures 32,737 507 6.14

% 32,580 506 6.16 % Total

interest-bearing liabilities 1,905,035 3,802 0.79 % 1,557,378 3,451

0.88 % Non-interest-bearing liabilities Demand deposits

343,780 282,494 Accrued interest payable and other liabilities

15,149 12,979 Stockholders' equity 206,543

190,718 $ 2,470,507 $ 2,043,569

Net interest income/spread $ 19,776 3.38 % $ 16,400 3.44 %

Net interest income as a percent of average interest earning assets

(1) 3.51 % 3.59 % (1) Securities balances represent daily

average balances for the fair value of securities. The average rate

is calculated based on the daily average balance for the amortized

cost of securities. The average rate is presented on a tax

equivalent basis. (2) Includes fees on loans. The inclusion of loan

fees does not have a material effect on the average interest rate.

(3) Non-accruing loans for the purpose of the computations above

are included in the daily average loan amounts outstanding. Loan

totals are shown net of unearned income and deferred loan fees.

HORIZON BANCORP AND

SUBSIDIARIES Average Balance Sheets

(Dollar Amounts in Thousands,

Unaudited)

Nine Months Ended Nine Months Ended

September 30, 2015 September 30, 2014 Average

Average Average

Average Balance Interest

Rate Balance Interest

Rate ASSETS Interest-earning assets Federal funds

sold $ 10,563 $ 11 0.14 % $ 6,559 $ 9 0.18 % Interest-earning

deposits 11,927 10 0.11 % 6,547 7 0.14 % Investment securities -

taxable 375,548 6,356 2.26 % 395,255 7,108 2.40 % Investment

securities - non-taxable (1) 145,576 3,281 3.96 % 146,643 3,328

4.33 % Loans receivable (2)(3) 1,528,662

55,140 4.83 % 1,215,183 45,988

5.07 % Total interest-earning assets (1) 2,072,276 64,798 4.25 %

1,770,187 56,440 4.37 % Non-interest-earning assets Cash and

due from banks 30,729 26,736 Allowance for loan losses (16,557 )

(15,892 ) Other assets 155,657 140,698

$ 2,242,105 $ 1,921,729

LIABILITIES

AND SHAREHOLDERS' EQUITY Interest-bearing liabilities

Interest-bearing deposits $ 1,347,882 $ 4,035 0.40 % $ 1,171,343 $

3,984 0.45 % Borrowings 340,593 4,747 1.86 % 274,322 4,493 2.19 %

Subordinated debentures 32,698 1,504

6.15 % 32,541 1,503 6.18 % Total

interest-bearing liabilities 1,721,173 10,286 0.80 % 1,478,206

9,980 0.90 % Non-interest-bearing liabilities Demand

deposits 303,309 253,331 Accrued interest payable and other

liabilities 14,692 12,454 Stockholders' equity 202,931

177,738 $ 2,242,105 $ 1,921,729

Net interest income/spread $ 54,512 3.45 % $ 46,460

3.47 % Net interest income as a percent of average interest

earning assets (1) 3.59 % 3.62 % (1) Securities balances

represent daily average balances for the fair value of securities.

The average rate is calculated based on the daily average balance

for the amortized cost of securities. The average rate is presented

on a tax equivalent basis. (2) Includes fees on loans. The

inclusion of loan fees does not have a material effect on the

average interest rate. (3) Non-accruing loans for the purpose of

the computations above are included in the daily average loan

amounts outstanding. Loan totals are shown net of unearned income

and deferred loan fees.

HORIZON BANCORP AND

SUBSIDIARIES Condensed Consolidated Balance Sheets

(Dollar Amounts in Thousands)

September 30 December 31 2015

2014 (Unaudited) Assets

Cash and due from banks

$ 48,155 $ 43,476 Investment

securities, available for sale

435,673 323,764 Investment

securities, held to maturity (fair value of $188,575 and $169,904)

182,187 165,767 Loans held for sale

5,583 6,143

Loans, net of allowance for loan losses of $16,168 and $16,501

1,709,852 1,362,053 Premises and equipment, net

60,700 52,461 Federal Reserve and Federal Home Loan Bank

stock

13,823 11,348 Goodwill

49,214 28,176 Other

intangible assets

7,648 3,965 Interest receivable

10,862 8,246 Cash value of life insurance

54,148

39,382 Other assets

28,988 32,141 Total

assets

$ 2,606,833 $ 2,076,922

Liabilities Deposits Non-interest bearing

$

338,436 $ 267,667 Interest bearing

1,574,639

1,214,652 Total deposits

1,913,075 1,482,319

Borrowings

372,820 351,198 Subordinated debentures

32,758 32,642 Interest payable

490 497 Other

liabilities

22,952 15,852 Total

liabilities

2,342,095 1,882,508

Commitments and contingent liabilities Stockholders’

Equity Preferred stock, Authorized, 1,000,000 shares Series B

shares $.01 par value, $1,000 liquidation value Issued 12,500

shares

12,500 12,500 Common stock, no par value Authorized,

22,500,000 shares Issued, 11,987,424 and 9,278,916 shares

Outstanding, 11,931,987 and 9,213,036 shares

- - Additional

paid-in capital

106,083 45,916 Retained earnings

144,344 134,477 Accumulated other comprehensive income

1,811 1,521 Total stockholders’ equity

264,738 194,414 Total liabilities and

stockholders’ equity

$ 2,606,833 $ 2,076,922

HORIZON BANCORP AND SUBSIDIARIES Condensed

Consolidated Statements of Income

(Dollar Amounts in Thousands, Except Per

Share Data, Unaudited)

Three Months Ended Nine Months Ended

September 30 September 30 2015

2014 2015 2014

(Unaudited) (Unaudited)

(Unaudited) (Unaudited) Interest Income

Loans receivable

$ 20,297 $ 16,403

$ 55,140 $ 45,988 Investment securities Taxable

2,156 2,339

6,377 7,124 Tax exempt

1,125 1,109

3,281 3,328 Total interest

income

23,578 19,851

64,798 56,440

Interest Expense Deposits

1,566 1,352

4,035

3,984 Borrowed funds

1,729 1,593

4,747 4,493

Subordinated debentures

507 506

1,504 1,503

Total interest expense

3,802

3,451

10,286 9,980

Net Interest Income 19,776 16,400

54,512 46,460 Provision for loan losses

300

1,741

2,820

2,080

Net Interest Income after Provision

for Loan Losses 19,476

14,659

51,692

44,380

Non-interest Income Service charges on deposit

accounts

1,359 1,076

3,443 3,037 Wire transfer fees

160 151

493 408 Interchange fees

1,625 1,223

4,093 3,436 Fiduciary activities

1,520 1,131

4,033 3,378 Gain on sale of investment securities (includes

$0 for the three months ended and $124 for the nine months ended

September 30, 2015 and $988 for the three and nine months ended

September 30, 2014, related to accumulated other comprehensive

earnings reclassifications)

- 988

124 988 Gain on

sale of mortgage loans

2,794 2,153

7,815 6,101

Mortgage servicing income net of impairment

246 116

725 556 Increase in cash value of bank owned life insurance

374 296

889 781 Death benefit on bank owned life

insurance

- -

145 - Other income

322

256

892

854 Total non-interest income

8,400 7,390

22,652 19,539

Non-interest

Expense Salaries and employee benefits

10,652 8,215

27,541 23,991 Net occupancy expenses

1,723 1,404

4,649 4,188 Data processing

1,281 907

3,170

2,714 Professional fees

409 358

1,596 1,385 Outside

services and consultants

3,209 595

4,753 2,554 Loan

expense

1,351 1,202

3,975 3,489 FDIC insurance

expense

423 313

1,099 854 Other losses

246 (35

)

351 98 Other expense

2,941

2,394

7,819

7,002 Total non-interest expense

22,235

15,353

54,953

46,275

Income Before Income Tax

5,641 6,696

19,391 17,644 Income tax expense

(includes $0 for the three months ended and $43 for the nine months

ended September 30, 2015 and $346 for the three and nine months

ended September 30, 2014, related to income tax expense from

reclassification items)

1,353

1,738

5,017 4,491

Net Income 4,288 4,958

14,374 13,153

Preferred stock dividend

(31 )

(40 )

(94 ) (102 )

Net

Income Available to Common Shareholders $ 4,257

$ 4,918

$ 14,280

$ 13,051

Basic Earnings Per Share $

0.37 $ 0.53

$ 1.42 $ 1.45

Diluted Earnings

Per Share 0.36 0.51

1.37 1.39

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151022006688/en/

Horizon BancorpMark E. SecorChief Financial Officer(219)

873-2611Fax: (219) 874-9280

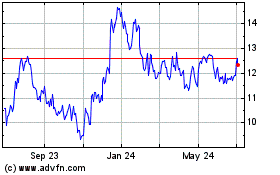

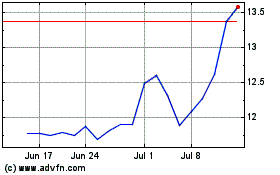

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024