Current Report Filing (8-k)

June 30 2015 - 10:48AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| |

|

Date of report (Date of earliest event reported): June 30, 2015

|

| |

|

Horizon Bancorp

|

|

(Exact Name of Registrant as Specified in Its Charter)

|

| |

|

|

| |

|

|

| |

|

|

|

Indiana

|

000-10792

|

35-1562417

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

| |

|

|

515 Franklin Square, Michigan City, Indiana

|

46360

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

| |

| |

|

(219) 879-0211

|

|

(Registrant’s Telephone Number, Including Area Code)

|

| |

| |

| |

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 7.01 Regulation FD Disclosure.

Horizon Bancorp (the “Company”) intends to present financial and other information to the Company’s shareholders at the Annual Meeting of Shareholders to be held on June 30, 2015. The slides for the presentation are attached as Exhibit 99.1 to this Current Report and are incorporated by reference into this Item 7.01.

This information is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. The filing of this Current Report shall not been deemed an admission as to the materiality of any information in the Current Report that is required to be disclosed solely by reason of Regulation FD.

A cautionary note about forward-looking statements: This Current Report and the presentation materials may contain forward-looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon. For these statements, Horizon claims the protections of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in the presentation materials should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include risk factors relating to the banking industry and the other factors detailed from time to time in Horizon’s reports filed with the Securities and Exchange Commission, including those described in Horizon’s Annual Report on Form 10-K. Undue reliance should not be placed on the forward-looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Item 8.01 Other Events.

The Company is filing the slide presentation for the Annual Meeting of Shareholders with the SEC pursuant to Rule 425 under the Securities Act of 1933, as amended, in connection with the proposed merger transaction between the Company and Peoples Bancorp.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

Exhibit No.

|

|

Description

|

| |

99.1

|

|

Slide Presentation for Annual Meeting of Shareholders on June 30, 2015

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereto duly authorized.

|

Date: June 30, 2015

|

Horizon Bancorp

|

| |

|

| |

|

|

| |

By:

|

/s/ Mark E. Secor |

| |

|

Mark E. Secor

Executive Vice President & Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

Location

|

| |

|

|

|

|

|

99.1

|

|

Slide Presentation for Annual Meeting of Shareholders on June 30, 2015

|

|

Attached

|

Exhibit 99.1

Filed by Horizon Bancorp

Pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934

Subject Company: Horizon Bancorp

Commission File No. 000-10792

This filing relates to the proposed merger transaction between Horizon Bancorp (“Horizon”) and Peoples Bancorp (“Peoples”) pursuant to the terms of an Agreement and Plan of Merger dated as of February 18, 2015 (the “Merger Agreement”) between Horizon and Peoples. The Merger Agreement is on file with the Securities and Exchange Commission (“SEC”) as an exhibit to the Current Report on Form 8-K filed by Horizon on February 19, 2015.

Forward-Looking Statements

This filing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act giving Horizon’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbs such as “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks, and uncertainties which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. In addition to factors previously disclosed in Horizon’s reports filed with the SEC, the following factors among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by Horizon’s and Peoples’ shareholders, on the expected terms and schedule; delay in closing the merger; difficulties and delays in integrating Horizon’s and Peoples’ businesses or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of Horizon’s products and services; customer borrowing, repayment, investment, and deposit practices; customer disintermediation; the introduction, withdrawal, success, and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; economic conditions; and the impact, extent, and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms, including those associated with the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Additional Information for Shareholders

In connection with the proposed merger, Horizon has filed with the SEC a Registration Statement on Form S-4 that includes a Joint Proxy Statement of Peoples and Horizon as well as a Prospectus of Horizon, and other relevant documents concerning the proposed transaction. SHAREHOLDERS AND INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. The joint proxy statement/prospectus and other relevant materials, and any other documents Horizon has filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents Horizon has filed with the SEC by contacting Dona Lucker, Shareholder Relations Officer, 515 Franklin Square, Michigan City, Indiana 46360, telephone: (219) 874-9272, or on Horizon’s website at www.horizonbank.com, under the tab “About Us” and then under the heading “Investor Relations” and then “SEC Filings”. The information available through Horizon’s website is not and shall not be deemed part of this filing or incorporated by reference into other filings Horizon makes with the SEC. This report does not constitute an offer of any securities for sale.

Participants in the Transaction

Horizon, Peoples and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Horizon’s and Peoples’ shareholders in connection with the proposed merger under the rules of the SEC. Information about the directors and executive officers of Horizon is set forth in the Annual Report on Form 10-K, as filed with the SEC on March 13, 2015. Free copies of this document may be obtained as described in the preceding paragraph. Additional information regarding the interests of these participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger.

* * * * * * * * * *

A NASDAQ Traded Company - Symbol HBNC

This presentation may contain forward-looking statements regarding the financial performance, business, and future operations of Horizon Bancorp and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future results or performance. As a result, undue reliance should not be placed on these forward-looking statements, which speak only as of the date hereof. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions, and although management believes that the expectations reflected in such forward-looking statements are accurate and reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause our actual results to differ materially include those set forth in Horizon’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Statements in this presentation should be considered in conjunction with such risk factors and the other information publicly available about Horizon, including the information in the filings we make with the Securities and Exchange Commission. Horizon does not undertake, and specifically disclaims any obligation, to publicly release any updates to any forward-looking statement to reflect events or circumstances occurring or arising after the date on which the forward-looking statement is made, or to reflect the occurrence of unanticipated events, except to the extent required by law. Forward-Looking Statements *

Mark E. SecorExecutive Vice President Chief Financial Officer *

Northern Indiana/Southwest Michigan… The Right Side of Chicago

* Horizon at a Glance * Market data as of June 26, 2015; financial data as of March 31, 2015

Retail BankingBusiness BankingMortgage BankingWealth Management Complementary Revenue Streams that are Counter-Cyclical to Varying Economic Cycles * Four Key & Consistent Revenue Streams

Horizon’s Story Steady GrowthSuperior ReturnsFinancial StrengthConsistent Performance *

* Net Income and Diluted Earnings per Share Good Start to 2015 Change LQ YOY Net Inc. 8.3% 56.8% Dil. EPS 7.8% 44.7%

* (In Millions)Loan Type 3/31/14 12/31/14 3/31/15 LQA Δ YOY Δ Commercial $528 $674 $695 13% 32% Residential Mtg. $189 $254 $260 10% 38% Consumer $280 $320 $326 8% 16% Mtg. Warehouse $102 $129 $178 154% 75% Total Loans $1,100 $1,362 $1,461 29% 33% Loan Growth Drives First Quarter Results

* Horizon and Peoples company financials as of Mar. 31, 2015. Pro forma financials exclude merger adjustments. Horizon announced intention to close Peoples’ Middlebury, IN branch. Peoples’ market cap as of Feb. 18, 2015, the day prior to deal announcement. Pro forma market cap based on HBNC’s stock price on Jun. 26, 2015. Map Source: SNL Financial Complementary Footprint and Increased Scale Category Peoples Pro Forma Branches 16 47 Assets $477 Mil. $1.6 Bil. Loans $230 Mil. $1.7 Bil. Deposits $358 Mil. $1.8 Bil. Assets Under Management $230 Mil. $1.2 Bil. NPAs/ Assets 0.27% 0.93% Market Cap. $60.1 Mil. $297 Mil.

* Strategic Financial Operational Good Strategic Fit Aligned with plan to expand in Indiana and MichiganContinued revenue diversificationStrong core deposit franchise EPS accretion of 4.5% in 2016, first full yearInitial TBV dilution of $0.65 with five year earn backInternal rate of return over 20.0% Operating leverage through cost savings estimated at 37.0%Revenue synergies through increased product offeringMinimal credit concerns

* Source: SNL Financial; financial data as of December 31, 2014 and market data as of February 18, 2015Nationwide bank and thrift transactions announced after 12/31/2012 with target’s assets between $200 million and $1 billion, tangible common equity to tangible assets between 10.0% and 15%, LTM return on average assets between 0.25% and 1.00% and NPAs/assets less than 1.50%, excluding transactions where pricing information is unavailable Fair Pricing Metric HBNC/PBNI ComparableTransactions (1) Price/Tangible Book Value 124% 138% Price/LTM Earnings 21x 21x Core Deposit Premium 4.4% 6.9% Market Premium 22% 33%

Thomas H. EdwardsPresident & Chief Credit OfficerHorizon Bank *

Horizon: A Company on the Move OrganicExpans.(7) St. JosephSouth BendElkhart Lake County Kalamazoo Indianapolis Carmel M&A(7) Anchor Mortgage Alliance Bank American Trust Heartland 1st MortgageSummitPeoples * Assets ($ Mil.) $721 $2,631 Loans($ Mil.) $548 $1,691 Deposits($ Mil.) $489 $1,823 Branches 7 47 11% CAGR 10% CAGR 11% CAGR Note: Current financials reflect Peoples, excluding merger adjustments; branch count excludes Peoples Middlebury, IN branch

Growth Opportunities in All Directions * Kalamazoo, Lansing & St. JosephPopulation: 883,000Deposits: $10 billion South Bend, Elkhart & Fort WaynePopulation: 835,000Deposits: $12 billion Indianapolis & Johnson CountyPopulation: 1.4 millionDeposits: $32 billion Lake & Porter CountiesPopulation: 657,000Deposits: $11 billion LEGACYLa Porte CountyPopulation: 111,000Deposits: $1.6 billion N E S W Note: Data by primary counties for each market

In Millions Net Income History * Solid Historical Earnings 10-year CAGR: 10%

* Investing in Commercial LendersCreates Growth Commercial Loan Balances

* Balanced Risk In Commercial Portfolio Commercial Loan Composition as of March 31, 2015

Kalamazoo and Indianapolis Loan Balances * Growth Markets Thriving 2014 Growth: 43%

March 31, 2015 December 31, 2008 In Millions 2008 1Q15 CAGR Commercial $311 $695 14% Real Estate $291 $439 7% Consumer $280 $326 2% Total $882 $1,461 8% * Shift to Commercial Lending

December 31, 2008 March 31, 2015 Strong Low Cost Deposit Growth * In Millions 2008 1Q15 CAGR NIB $84 $285 22% IB Trans. $429 $905 13% CDs $329 $274 -3% Total $842 $1,465 9%

* NPLs/ Loans Disciplined Credit Culture

Craig M. DwightChairman, President & CEO *

Consistent, Well Executed and Disciplined Business Strategy Horizon is a Growth Story10-year Asset CAGR of 9%Seven Acquisitions and Seven Market Expansions Since 2000Capacity to Take Additional Market ShareHistorical Financial Performance Illustrates Ability to ExecuteHistorical Total Shareholder Return Above Major Indices * Strategic Execution Leads to Strong Stock Performance Total Return HBNC SNL U.S. Bank S&P 500 5-Year Period (1) 195% 83% 117% As of June 26, 2015

Shareholder Value Plan - Since 2001 Steady Growth in Net Book Value & Earnings Per ShareIncreased Liquidity Through Stock Splits and MergersUninterrupted Dividends for More than 25 YearsAdded to Nasdaq Community Bank Index in 2014Russell 2000 Index Since 2012 *

Highly Regarded For Financial Performance *

Highly Regarded In Our Communities * Community Relations Award Urban League of Northwest Indiana, Inc.Nine out of Ten Customers Would Refer a FriendIndependent SurveyBest Bank - Thirteen out of Last Fourteen YearsThe News Dispatch Readers PollBest Bank for Obtaining a Business LoanNorthwest Indiana Business Quarterly Family Friendly Work PoliciesIU Health / Clarian Award

Horizon Outperforms the MarketFor Total Shareholder Return As of June 26, 2015; 2015 estimated EPS of $2.24 is the mean estimate from 3rd party research analystsSNL U.S. Bank: Includes all Major Exchange Banks in SNL's coverage universe. * Horizon Bancorp: 5-Year Total Return Comparison P/2015 Est. EPS 11.6x P/TBV 155% Div. Yield 2.2%

Thank Youfor Your Investment inHorizon Bancorp *

A NASDAQ Traded Company - Symbol HBNC *

* Based on Horizon’s closing price of $23.02 as of February 18, 2015 Merger Summary Horizon Bancorp Acquiring Peoples Bancorp Horizon Bancorp Acquiring Peoples Bancorp Deal Price per Share (1) $31.62 Consideration Structure 0.95 HBNC shares for each outstanding PBNI share; $9.75 in cash for each outstanding PBNI share Aggregate Deal Value (1) $73.1 million Consideration Mix (1) 69% stock, 31% cash Termination Fee $3.5 million Required Approvals Customary regulatory; Horizon and Peoples shareholder approval Anticipated Closing Early third quarter of 2015 Social Issues Maurice Winkler, III, Peoples CEO, to serve on Horizon Bancorp and Horizon Bank’s board of directorsRetention of Jeffrey Gatton, Peoples COO, to lead regional branch operations, training and sales efforts

* Transaction Assumptions Category Assumption Cost saves 37% 1x after-tax charges $4.9 million Loan mark $3.5 million or 1.5% of total loans Core deposit intangibles $2.3 million or 1.0% of core deposits Branches One branch closing identified

A NASDAQ Traded Company - Symbol HBNC

A NASDAQ Traded Company - Symbol HBNC

13 Horizon and Peoples company financials as of Mar. 31, 2015. Pro forma financials exclude merger adjustments. Horizon announced intention to close Peoples’ Middlebury, IN branch. Peoples’ market cap as of Feb. 18, 2015, the day prior to deal announcement. Pro forma market cap based on HBNC’s stock price on Jun. 26, 2015. Map Source: SNL Financial Complementary Footprint and Increased Scale Category Peoples Pro Forma Branches 16 47 Assets $477 Mil. $1.6 Bil. Loans $230 Mil. $1.7 Bil. Deposits $358 Mil. $1.8 Bil. Assets Under Management $230 Mil. $1.2 Bil. NPAs/ Assets 0.27% 0.93% Market Cap. $60.1 Mil. $297 Mil.

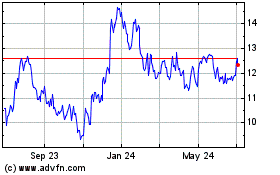

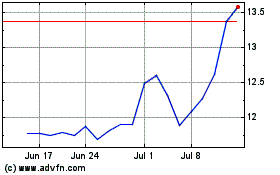

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Apr 2023 to Apr 2024