Current Report Filing (8-k)

May 05 2016 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

May 5, 2016 (May 3, 2016)

Date of Report (Date of earliest event reported)

HUNTINGTON BANCSHARES INCORPORATED

(Exact name of registrant as specified in its charter)

Commission

file number : 1-34073

|

|

|

|

|

Maryland

|

|

31-0724920

|

|

(State of incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

Huntington Center

41 South High Street

Columbus, Ohio

|

|

43287

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(614) 480-8300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

On March 18, 2016, Huntington

Bancshares Incorporated, a Maryland corporation (the “Corporation”), filed articles supplementary to its charter (the “Original Articles Supplementary”) with the State Department of Assessments and Taxation of Maryland (the

“Maryland Department”), establishing the rights, preferences, privileges, qualifications, restrictions and limitations of a new series of its preferred stock designated as the “6.250% Series D Non-Cumulative Perpetual Preferred

Stock” with par value of $0.01 per share and liquidation preference of $1,000 per share (the “Series D Preferred Stock”). A summary description of the rights, preferences, privileges, qualifications, restrictions and limitations of

the Series D Preferred Stock was included under Item 3.03 to the Corporation’s Current Report on Form 8-K filed on March 21, 2016 and is incorporated herein by reference.

On May 3, 2016, the Corporation filed articles supplementary to its charter (the “Additional Articles Supplementary”) with the

Maryland Department classifying and designating an additional 200,000 shares of the Corporation’s authorized shares of preferred stock as its Series D Preferred Stock. The Additional Articles Supplementary became effective upon the acceptance

of the Additional Articles Supplementary for record by the Maryland Department. The Additional Articles Supplementary were filed in connection with an Underwriting Agreement, dated May 2, 2016 (the “Underwriting Agreement”), with Wells

Fargo Securities, LLC acting as representative of the several underwriters (collectively, “Underwriters”) listed in Schedule I thereto, under which the Corporation agreed to sell to the Underwriters 8,000,000 depositary shares (the

“Depositary Shares”), each representing a 1/40th ownership interest in a share of the Series D Preferred Stock.

The foregoing

description of the Additional Articles Supplementary is qualified in its entirety by reference to the full text of the Additional Articles Supplementary, which is included as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by

reference herein.

Item 5.03. Amendments to Certificate of Incorporation or By-Laws; Change in Fiscal Year.

On May 3, 2016, the Corporation filed the Additional Articles Supplementary with the Maryland Department, which became effective upon the

acceptance of the Additional Articles Supplementary for record by the Maryland Department, supplementing the Corporation’s charter by classifying and designating an additional 200,000 shares of the Corporation’s authorized shares of

preferred stock as its Series D Preferred Stock, which Series D Preferred Stock consists of 602,500 authorized shares after the filing of the Additional Articles Supplementary.

The foregoing description of the Additional Articles Supplementary is qualified in its entirety by reference to the full text of the

Additional Articles Supplementary, which is included as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference herein.

On May 5, 2016, the Corporation closed the public offering of 8,000,000

Depositary Shares pursuant to the Underwriting Agreement. The Depositary Shares and the Series D Preferred Stock have been registered under the Securities Act of 1933, as amended, by a registration statement on Form S-3ASR (File No. 333-190078) (the

“Registration Statement”). The following documents are being filed with this Current Report on Form 8-K and incorporated by reference into the Registration Statement: (i) the Underwriting Agreement; (ii) the Original Articles

Supplementary; (iii) the Additional Articles Supplementary; (iv) the Deposit Agreement dated March 21, 2016 among the Corporation, Computershare Inc. and Computershare Trust Company, N.A. (jointly, the “Depositary”) and the holders from

time to time of the depositary receipts described therein; (v) the form of certificate representing the Series D Preferred Stock; (vi) the form of depositary receipt representing the Depositary Shares; and (vii) the validity opinion letters with

respect to the Depositary Shares and the Series D Preferred Stock.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated May 2, 2016, by and between Huntington Bancshares Incorporated and Wells Fargo Securities, LLC

|

|

|

|

|

3.1

|

|

Articles Supplementary of Huntington Bancshares Incorporated, effective as of March 18, 2016 (incorporated by reference to Exhibit 3.1 to Huntington Bancshares Incorporated’s Current Report on Form 8-K filed on March 21,

2016)

|

|

|

|

|

3.2

|

|

Articles Supplementary of Huntington Bancshares Incorporated, effective as of May 3, 2016

|

|

|

|

|

4.1

|

|

Form of Certificate Representing the 6.250% Series D Non-Cumulative Perpetual Preferred Stock (incorporated by reference to Exhibit 4.1 to Huntington Bancshares Incorporated’s Current Report on Form 8-K filed on March 21,

2016)

|

|

|

|

|

4.2

|

|

Deposit Agreement, dated March 21, 2016, between Huntington Bancshares Incorporated and Computershare Inc. and Computershare Trust Company, N.A. (incorporated by reference to Exhibit 4.2 to Huntington Bancshares Incorporated’s

Current Report on Form 8-K filed on March 21, 2016)

|

|

|

|

|

4.3

|

|

Form of Depositary Receipt Representing the Depositary Shares (included as part of Exhibit 4.2)

|

|

|

|

|

5.1

|

|

Opinion of Venable LLP

|

|

|

|

|

5.2

|

|

Opinion of Wachtell, Lipton, Rosen & Katz

|

|

|

|

|

23.1

|

|

Consent of Venable LLP (included in Exhibit 5.1)

|

|

|

|

|

23.2

|

|

Consent of Wachtell, Lipton, Rosen & Katz (included in Exhibit 5.2)

|

- 2 -

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

HUNTINGTON BANCSHARES INCORPORATED

|

|

|

|

|

By:

|

|

/s/ Richard A. Cheap

|

|

|

|

Richard A. Cheap, Secretary

|

Date: May 5, 2016

- 3 -

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated May 2, 2016, by and between Huntington Bancshares Incorporated and Wells Fargo Securities, LLC

|

|

|

|

|

3.1

|

|

Articles Supplementary of Huntington Bancshares Incorporated, effective as of March 18, 2016 (incorporated by reference to Exhibit 3.1 to Huntington Bancshares Incorporated’s Current Report on Form 8-K filed on March 21,

2016)

|

|

|

|

|

3.2

|

|

Articles Supplementary of Huntington Bancshares Incorporated, effective as of May 3, 2016

|

|

|

|

|

4.1

|

|

Form of Certificate Representing the 6.250% Series D Non-Cumulative Perpetual Preferred Stock (incorporated by reference to Exhibit 4.1 to Huntington Bancshares Incorporated’s Current Report on Form 8-K filed on March 21,

2016)

|

|

|

|

|

4.2

|

|

Deposit Agreement, dated March 21, 2016, between Huntington Bancshares Incorporated and Computershare Inc. and Computershare Trust Company, N.A. (incorporated by reference to Exhibit 4.1 to Huntington Bancshares Incorporated’s

Current Report on Form 8-K filed on March 21, 2016)

|

|

|

|

|

4.3

|

|

Form of Depositary Receipt Representing the Depositary Shares (included as part of Exhibit 4.2)

|

|

|

|

|

5.1

|

|

Opinion of Venable LLP

|

|

|

|

|

5.2

|

|

Opinion of Wachtell, Lipton, Rosen & Katz

|

|

|

|

|

23.1

|

|

Consent of Venable LLP (included in Exhibit 5.1)

|

|

|

|

|

23.2

|

|

Consent of Wachtell, Lipton, Rosen & Katz (included in Exhibit 5.2)

|

- 4 -

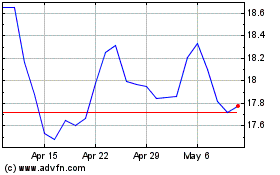

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

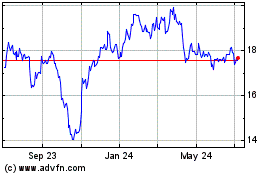

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Apr 2023 to Apr 2024