Current Report Filing (8-k)

April 25 2016 - 5:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________

FORM 8-K

_______________________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 21, 2016

_______________________________________________________________

HUNTINGTON BANCSHARES INCORPORATED

(Exact name of registrant as specified in its charter)

_______________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

1-34073

|

|

31-0724920

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

Huntington Center

41 South High Street

Columbus, Ohio

|

|

43287

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(614) 480-8300

Not Applicable

(Former name or former address, if changed since last report.)

_______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

April 21, 2016

, at the

2016

Annual Meeting of Shareholders of Huntington Bancshares Incorporated (Huntington), Huntington’s shareholders approved the Management Incentive Plan for Covered Officers, an annual cash incentive compensation plan, as amended and restated effective for plan years beginning on or after January 1,

2016

, subject to approval by the shareholders (MIP). Shareholder approval was obtained in order to qualify certain awards as deductible for federal income tax purposes as “performance-based compensation” under Internal Revenue Code Section 162(m). Participants in the MIP are the chief executive officer and those other officers whose compensation is anticipated by the Compensation Committee of Huntington’s board of directors as potentially exceeding the limit under Code Section 162(m). Awards under the MIP will be based solely upon the achievement of one or more objective performance goals based on qualifying performance criteria selected by the Compensation Committee. The maximum award payable to a participant for any plan year will not exceed $7,500,000. The qualifying performance criteria and details of the MIP are set forth in Huntington’s definitive Proxy Statement filed on

March 10, 2016

(Proxy Statement).

Item 5.07 Submission of Matters to a Vote of Security Holders.

On

April 21, 2016

, the following matters were voted upon and approved by the shareholders of Huntington at its

2016

Annual Meeting of Shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against/

Withheld

|

|

Abstentions

|

|

Broker

Non-Votes

|

|

Uncast

|

|

1.

|

|

Election of eleven directors to serve a one-year term expiring at the 2017 annual meeting:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ann (“Tanny”) B. Crane

|

|

568,242,075

|

|

|

7,880,538

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Steven G. Elliott

|

|

572,774,140

|

|

|

3,348,473

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Michael J. Endres

|

|

569,495,368

|

|

|

6,627,245

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

John B. Gerlach, Jr.

|

|

562,792,941

|

|

|

13,329,672

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Peter J. Kight

|

|

572,604,501

|

|

|

3,518,113

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Jonathan A. Levy

|

|

572,573,984

|

|

|

3,548,629

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Eddie R. Munson

|

|

572,450,071

|

|

|

3,672,542

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Richard W. Neu

|

|

572,444,219

|

|

|

3,678,394

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

David L. Porteous

|

|

507,474,057

|

|

|

68,648,557

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Kathleen H. Ransier

|

|

567,001,644

|

|

|

9,120,969

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Stephen D. Steinour

|

|

551,067,220

|

|

|

25,055,393

|

|

|

—

|

|

|

119,120,481

|

|

|

4,021

|

|

|

|

|

Each of the nominees for director received the favorable vote of at least 88% of the votes cast.

|

|

|

|

|

|

|

|

|

|

|

|

2.

|

|

Approval of the Management Incentive Plan.

|

|

556,804,804

|

|

|

16,615,376

|

|

|

2,706,454

|

|

|

119,120,481

|

|

|

—

|

|

|

|

|

97.1

|

%

|

|

2.9

|

%

|

|

|

|

|

|

|

|

3.

|

|

Ratification of appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year 2016.

|

|

685,144,247

|

|

|

8,467,164

|

|

|

1,631,859

|

|

|

—

|

|

|

3,845

|

|

|

98.8

|

%

|

|

1.2

|

%

|

|

|

|

|

|

|

|

4.

|

|

Advisory resolution to approve, on a non-binding basis, the compensation of executives as disclosed in Huntington’s Proxy Statement.

|

|

549,075,060

|

|

|

23,977,860

|

|

|

3,073,713

|

|

|

119,120,481

|

|

|

—

|

|

|

95.8

|

%

|

|

4.2

|

%

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HUNTINGTON BANCSHARES INCORPORATED

|

|

|

|

|

|

|

Date:

|

April 25, 2016

|

|

By:

|

|

/s/ Richard A. Cheap

|

|

|

|

|

|

|

|

|

|

|

|

Richard A. Cheap

|

|

|

|

|

|

|

Title: Secretary

|

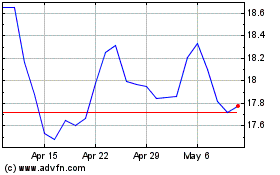

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

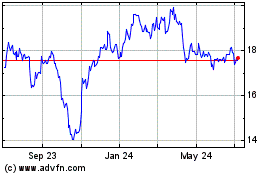

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Apr 2023 to Apr 2024