UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

January 26, 2016

Date of Report (Date of earliest event reported)

HUNTINGTON BANCSHARES INCORPORATED

(Exact name of registrant as specified in its charter)

Commission file number : 1-34073

|

Maryland |

|

31-0724920 |

|

(State of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

Huntington Center |

|

|

|

41 South High Street |

|

|

|

Columbus, Ohio |

|

43287 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(614) 480-8300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events

On January 26, 2016, Huntington Bancshares Incorporated (“Huntington”) and FirstMerit Corporation (“FirstMerit”) issued a joint press release announcing the execution of an Agreement and Plan of Merger, dated as of January 25, 2016, by and among Huntington, FirstMerit, and West Subsidiary Corporation, an Ohio corporation and direct wholly-owned subsidiary of Huntington. A copy of the joint press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

On January 26, 2016, Huntington also provided supplemental information regarding the proposed transaction in connection with a presentation to investors. A copy of the investor presentation is attached hereto as Exhibit 99.2 and is incorporated by reference herein.

* * *

Caution regarding Forward-Looking Statements

This communication may contain certain forward-looking statements, including certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, the merger parties’ plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions, uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board, volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and services; success, impact, and timing of Huntington’s and FirstMerit’s respective business strategies, including market acceptance of any new products or services implementing Huntington’s “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB, and the regulatory approval process associated with the merger; the possibility that the proposed transaction does not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two

companies or as a result of the strength of the economy and competitive factors in the areas where Huntington and FirstMerit do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; Huntington’s ability to complete the acquisition and integration of FirstMerit successfully; and other factors that may affect future results of Huntington and FirstMerit. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2014 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended September 30, 2015, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website, http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC, and in FirstMerit’s Annual Report on Form 10-K for the year ended December 31, 2014 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended September 30, 2015, each of which is on file with the SEC and available in the “Investors” section of FirstMerit’s website, http://www.firstmerit.com, under the heading “Publications & Filings” and in other documents FirstMerit files with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Huntington nor FirstMerit assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Important Additional Information

In connection with the proposed transaction, Huntington will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Huntington and FirstMerit and a Prospectus of Huntington, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Huntington and FirstMerit will be submitted to FirstMerit’s stockholders and Huntington’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. STOCKHOLDERS OF HUNTINGTON AND STOCKHOLDERS OF FIRSTMERIT ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain a free copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Huntington and FirstMerit, without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by

2

directing a request to Huntington Investor Relations, Huntington Bancshares Incorporated, Huntington Center, HC0935, 41 South High Street, Columbus, Ohio 43287, (800) 576-5007 or to FirstMerit Corporation, Attention: Thomas P. O’Malley, III Cascade Plaza, Akron, Ohio 44308, (330) 384-7109.

Participants in the Solicitation

Huntington, FirstMerit, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Huntington’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 12, 2015, and certain of its Current Reports on Form 8-K. Information regarding FirstMerit’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on March 6, 2015, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Joint Press Release, dated January 26, 2016 |

|

99.2 |

|

Investor Presentation, dated January 26, 2016 |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HUNTINGTON BANCSHARES INCORPORATED |

|

|

|

|

|

|

By: |

/s/ Howell D. McCullough III |

|

|

|

Howell D. McCullough III |

|

|

|

Senior Executive Vice President and Chief Financial Officer |

Date: January 26, 2016

4

EXHIBIT INDEX

|

Exhibit No. |

|

Description of Exhibit |

|

|

|

|

|

99.1 |

|

Joint Press Release, dated January 26, 2016 |

|

99.2 |

|

Investor Presentation, dated January 26, 2016 |

5

Exhibit 99.1

FOR IMMEDIATE RELEASE

January 26, 2016

Analysts: Mark Muth (mark.muth@huntington.com), 614.480.4720

Media: Brent Wilder (brent.wilder@huntington.com), 614.480.5875

Maureen Brown (maureen.brown@huntington.com), 614.480.5512

HUNTINGTON BANCSHARES TO STRENGTHEN MIDWEST FRANCHISE WITH FINANCIALLY AND STRATEGICALLY ACCRETIVE MERGER WITH FIRSTMERIT CORPORATION

Columbus, Ohio and Akron, Ohio — Huntington Bancshares Incorporated (NASDAQ: HBAN; www.huntington.com) and FirstMerit Corporation (NASDAQ: FMER; www.firstmerit.com) jointly announced today the signing of a definitive merger agreement under which Ohio-based FirstMerit Corporation, the parent company of FirstMerit Bank, will merge into Huntington in a stock and cash transaction. Based on the closing price of Huntington’s common shares on January 25, 2016 of $8.80, the total transaction value is approximately $3.4 billion, including outstanding options and other equity-linked securities.

The partnership brings together two companies who have served their respective communities for 150 years or more, meeting the banking needs of consumers and small and middle market businesses across the Midwest. Huntington recently posted record earnings for 2015, including a 10% increase in net income and a 13% increase in earnings per common share, driven by ongoing growth in revenues, deposits, and lending. FirstMerit today announced their 67th consecutive quarter of profitability, reflecting strong organic loan growth and continued balance sheet strength. The pro forma company is expected to have nearly $100 billion in assets and will operate across an eight-state Midwestern footprint. The combination will create the largest bank in Ohio, based on deposit market share. Huntington will also expand its operations into the attractive new markets of Chicago and Wisconsin.

“We are very pleased to come together with FirstMerit to create a regional bank with added customer convenience, an enhanced portfolio of products for consumers and businesses, as well as strong market share. I believe the strength of this deal is that both organizations already understand the needs and goals of our Midwestern customers and communities. Our combined track records of service excellence and efficient financial management will add value for our collective shareholders, customers, communities, and colleagues,” said Steve Steinour, Huntington chairman, president, and CEO.

“Joining forces with Huntington will give us an opportunity to combine both companies’ commercial, small business, wealth, and consumer expertise while giving all of our customers greater access to services. We will also leverage our strong credit culture and continue our mutual tradition of community involvement to help our Midwest markets grow. We have every confidence that the integration with Huntington will be smooth and seamless for our customers and our communities, and are pleased with the commitments that Huntington has made to our employees and communities,” said Paul Greig, FirstMerit chairman, president, and CEO.

Under the terms of the definitive agreement, FirstMerit will merge with a subsidiary of Huntington Bancshares, and FirstMerit Bank will merge with and into The Huntington National Bank. In conjunction with the closing of the transaction, four independent members of the FirstMerit Board of Directors will join the Huntington Board, which will be expanded accordingly.

1

Shareholders of FirstMerit Corporation will receive 1.72 shares of Huntington common stock, and $5.00 in cash, for each share of FirstMerit Corporation common stock. The per share consideration is valued at $20.14 per share based on the closing price of Huntington common stock on January 25, 2016.

The transaction is expected to be completed in the third quarter of 2016, subject to the satisfaction of customary closing conditions, including regulatory approvals and the approval of the shareholders of Huntington and FirstMerit Corporation.

Huntington expects the acquisition to be accretive to earnings per share in 2017, excluding one-time merger-related expenses, and approximately 10% accretive to earnings per share in 2018, the first full year after all expected synergies are implemented.

Pro forma tangible capital equity to tangible assets (TCE ratio) is projected to be 7.1% at closing, and pro forma regulatory common equity Tier 1 ratio (CET1 ratio) is projected to be 8.7% at closing on a fully phased-in Basel III basis. Huntington will not re-submit its 2015 CCAR capital plan, and intends to forgo the remaining $166 million of share repurchase capacity under its 2015 CCAR capital plan. Huntington will include FirstMerit Corporation in its 2016 CCAR capital plan proposal and expects the plan will include share repurchases.

Goldman, Sachs & Co. served as financial advisor, and Wachtell, Lipton, Rosen, & Katz served as legal advisor to Huntington. Sandler O’Neill + Partners, L.P. served as financial advisor, and Sullivan & Cromwell LLP served as legal advisor to FirstMerit and Jones Day served as legal advisor to FirstMerit’s Board of Directors.

Conference Call / Webcast Information

Huntington’s senior management will host a conference call on January 26, 2016, at 9:00 a.m. (Eastern Standard Time) to discuss the strategic and financial implications of the transaction. The call may be accessed via a live Internet webcast at the Investor Relations section of Huntington’s website, www.huntington.com, or through a dial-in telephone number at (844) 318-8148; Conference ID# 38543166. Slides will be available in the Investor Relations section of Huntington’s website about an hour prior to the call.

About Huntington

Huntington Bancshares Incorporated is a $71 billion asset regional bank holding company headquartered in Columbus, Ohio, with a network of more than 750 branches and more than 1,500 ATMs across six Midwestern states. Founded in 1866, The Huntington National Bank and its affiliates provide consumer, small business, commercial, treasury management, wealth management, brokerage, trust, and insurance services. Huntington also provides auto dealer, equipment finance, national settlement and capital market services that extend beyond its core states. Visit huntington.com for more information.

About FirstMerit Corporation

FirstMerit Corporation is a diversified financial services company headquartered in Akron, Ohio, with assets of approximately $25.5 billion as of December 31, 2015, and 366 banking offices and 400 ATM locations in Ohio, Michigan, Wisconsin, Illinois and Pennsylvania. FirstMerit provides a complete range of banking and other financial services to consumers and businesses through its core operations. Principal affiliates include: FirstMerit Bank, N.A. and FirstMerit Mortgage Corporation

Caution regarding Forward-Looking Statements

This communication may contain certain forward-looking statements, including certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, the merger parties’ plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or

2

similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions, uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board, volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and services; success, impact, and timing of Huntington’s business strategies, including market acceptance of any new products or services implementing Huntington’s “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB, and the regulatory approval process associated with the merger; the possibility that the proposed transaction does not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington and FirstMerit do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; Huntington’s ability to complete the acquisition and integration of FirstMerit successfully; and other factors that may affect future results of Huntington and FirstMerit. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2014 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended September 30, 2015, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website, http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC, and in FirstMerit’s Annual Report on Form 10-K for the year ended December 31, 2014 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended September 30, 2015, each of which is on file with the SEC and available in the “Investors” section of FirstMerit’s website, http://www.firstmerit.com, under the heading “Publications & Filings” and in other documents FirstMerit files with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Huntington nor FirstMerit assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Important Additional Information

In connection with the proposed transaction, Huntington will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Huntington and FirstMerit and a Prospectus of Huntington, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Huntington and FirstMerit will be submitted to FirstMerit’s stockholders and Huntington’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. STOCKHOLDERS OF HUNTINGTON AND STOCKHOLDERS OF FIRSTMERIT ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT

3

DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain a free copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Huntington and FirstMerit, without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington Investor Relations, Huntington Bancshares Incorporated, Huntington Center, HC0935, 41 South High Street, Columbus, Ohio 43287, (800) 576-5007 or to FirstMerit Corporation, Attention: Thomas P. O’Malley, III Cascade Plaza, Akron, Ohio 44308, (330) 384-7109.

Participants in the Solicitation

Huntington, FirstMerit, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Huntington’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 12, 2015, and certain of its Current Reports on Form 8-K. Information regarding FirstMerit’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on March 6, 2015, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph.

# # #

4

Exhibit 99.2

Merger with FirstMerit Corporation Welcome January 26, 2015

Disclaimer 2 CAUTION REGARDING FORWARD-LOOKING STATEMENTS This presentation may contain certain forward-looking statements, including certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, the merger parties’ plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions, uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board, volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and services; success, impact, and timing of Huntington’s business strategies, including market acceptance of any new products or services implementing Huntington’s “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB, and the regulatory approval process associated with the merger; the possibility that the proposed transaction does not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Huntington and FirstMerit do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; Huntington’s ability to complete the acquisition and integration of FirstMerit successfully; and other factors that may affect future results of Huntington and FirstMerit. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2014 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended September 30, 2015, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s website, http://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC, and in FirstMerit’s Annual Report on Form 10-K for the year ended December 31, 2014 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended September 30, 2015, each of which is on file with the SEC and available in the “Investors” section of FirstMerit’s website, http://www.firstmerit.com, under the heading “Publications & Filings” and in other documents FirstMerit files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Huntington nor FirstMerit assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. IMPORTANT ADDITIONAL INFORMATION In connection with the proposed transaction, Huntington will file with the SEC a Registration Statement on Form S-4 that will include a Joint Proxy Statement of Huntington and FirstMerit and a Prospectus of Huntington, as well as other relevant documents concerning the proposed transaction. The proposed transaction involving Huntington and FirstMerit will be submitted to FirstMerit’s stockholders and Huntington’s stockholders for their consideration. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. STOCKHOLDERS OF HUNTINGTON AND STOCKHOLDERS OF FIRSTMERIT ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders will be able to obtain a free copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Huntington and FirstMerit, without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to Huntington Investor Relations, Huntington Bancshares Incorporated, Huntington Center, HC0935, 41 South High Street, Columbus, Ohio 43287, (800) 576-5007 or to FirstMerit Corporation, Attention: Thomas P. O’Malley, III Cascade Plaza, Akron, Ohio 44308, (330) 384-7109. Participants in THE Solicitation Huntington, FirstMerit, and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Huntington’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 12, 2015, and certain of its Current Reports on Form 8-K. Information regarding FirstMerit’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on March 6, 2015, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph.

A Compelling Strategic and Financial Combination 3 Creates Leading Midwestern Bank Franchise Strategically important footprint spanning key metropolitan markets across the Midwest Creates leading Ohio bank with #1 market share and adds depth to presence in Michigan Provides growth opportunities via attractive new markets of Chicago and Wisconsin Strong Business and Cultural Fit Highly compatible business models with relationship-driven cultures Similar loan and deposit portfolios with consistent credit cultures and risk profiles Adds management talent and depth across all businesses Provides opportunity to introduce Optimal Customer Relationship (OCR) model and gain market share Substantial Long-Term Value Creation Meaningful enhancement to financial metrics, accelerating achievement of long-term financial goals Attractive use of capital to generate ongoing earnings and increase annual capital generation Identified, achievable cost savings from overlap and operational efficiencies Increased pro forma pre-provision net revenue provides significant risk buffer Lower Risk Transaction Experience and brand visibility in most of FirstMerit’s markets Thorough due diligence and integration planning processes Track record of successful integration and conversion with ability to leverage infrastructure investment FirstMerit is a well-run bank with strong credit performance through cycles

Transaction Terms and Key Assumptions Consideration 1.72 shares of Huntington common stock plus $5.00 cash per FirstMerit share $20.14 per FirstMerit share or $3.4BN aggregate value based on Huntington’s closing price as of January 25 Key Pricing Ratios 1.6x Price / Tangible Book Value¹ 14.3x Price / 2016E EPS, based on consensus estimates; 7.9x assuming fully phased-in cost savings 6.8% Tangible Book Premium¹ / Core Deposits Governance 4 independent FirstMerit board members to join Huntington Board Significant commitment to Akron Transaction Assumptions Expected transaction closing: 3Q 2016 Identifiable cost savings: ~40% Earnings impact: ~$255MM based on run-rate expenses, expected to grow at ~3% per year Phase-in: 75% in 2017 and 100% thereafter Capitalized value of cost savings: ~$2.0BN One-time costs: ~$420MM, pre-tax Gross credit mark-to-market: 1.9% Other fair value marks: ~$(55)MM OCR-related revenue opportunities identified, not included in financial model Share repurchase program suspended through closing; total payout ratio of 50% through 2Q18, 70% thereafter Estimated Pro Forma Impact EPS impact: accretive in 2017 excluding restructuring charges; ~10% accretion in 2018 and growing thereafter ROTCE: >300bp enhancement Efficiency Ratio: >400bp improvement IRR: >20% Manageable dilution to pro forma capital ratios TBV / share dilution: ~12% with ~5 ½ years earnback using crossover method 4 1. Tangible book value excludes DTL related to core deposit intangible.

5 FirstMerit at a Glance MSA Deposits ($BN) Rank Akron, OH $3.9 1 Cleveland, OH 3.8 7 Chicago, IL 2.6 16 Canton, OH 1.5 2 Detroit, MI 1.1 11 Flint, MI 1.1 2 Columbus, OH 0.7 9 Saginaw, MI 0.5 1 Lansing, MI 0.5 6 Wooster, OH 0.3 2 All Markets $19.8 Source: Company Filings and SNL Financial Note: Deposit data as of June 30, 2015. Financial data as of December 31, 2015. Founded: 1845 Headquarters: Akron, OH Total Assets: $25.5BN Banking Offices: 366 ATM Locations: 400 Business Lines: Commercial Retail Wealth Management Attractive markets with loyal, long tenured customers Quality lenders and strong commercial relationships Disciplined and conservative underwriting Established position in profitable niche businesses (e.g., wealth, indirect auto, marine/RV) Results driven culture and substantial management depth 67 consecutive quarters of reported profitability Company Overview Branch Footprint Deposits – Top 10 MSAs Key Franchise Highlights ˜

6 FirstMerit Financial Performance Strong track record across cycles driven by prudent underwriting Source: SNL. Midwest Peers include: ASB, WTFC, TCB, FULT, PVTB, FNB, MBFI, and ONB. Peers shown YTD / 3Q15. 1 FirstMerit credit metrics based on originated loans. FirstMerit NPAs exclude OREO previously covered under loss share. 2 As reported. FirstMerit Midwest Peers

FirstMerit Balance Sheet Composition 7 1. Deposit costs for Midwest Peers as of most recent quarter. 2. Midwest Peers include: ASB, WTFC, TCB, FULT, PVTB, FNB, MBFI, and ONB. ($ in billions) This image cannot currently be displayed.

8 Pro Forma Deposit Footprint Meaningful Scale ~$100BN platform Market leader in Ohio and #6 in Michigan Top-5 combined rank in 17 of the top 20 pro forma MSAs Improved Customer Reach Increased density of branch network improves customer access Allows Huntington to increase investment in digital channels Complementary Distribution 82% of FirstMerit’s deposits in current Huntington footprint ~65% 2.5-mile branch overlap within shared footprint Significantly bolsters branch network in Northeast Ohio Deepens presence in Michigan and provides complement to in-store driven strategy in selected markets Broader Opportunity Set Entry to Chicago and Wisconsin provides new avenues for growth Opportunity to extend Huntington’s OCR and Fair Play models to broader customer base Yellow: 255, 204, 0 Grey: 89,89,89 Green: 48,173,52 Blue: 153, 204,255 Milwaukee Chicago Detroit Indianapolis Cincinnati Columbus Cleveland Pittsburgh FirstMerit Huntington

Huntington Deposits / Rank $35.6 / #3 $9.5 / #6 - FirstMerit Deposits / Rank $10.9 / #7 $5.1 / #9 $3.6 / #17 Pro Forma Deposits / Rank $46.5 / #1 $14.6 / #6 $3.6 / #17 Top 3 Pro Forma Markets Columbus (#1) Cleveland (#2) Akron (#1) Detroit (#5) Grand Rapids (#2) Flint (#2) Chicago (#16) Green Bay (#7) Appleton (#12) Market Highlights Strong industrial economy with attractive banking markets and ample credit demand Robust deposit-gathering opportunity and growing, dynamic business climate Commercial credit opportunity in Chicago MSA and Wisconsin 9 Review of FirstMerit Contributed Markets ($ in billions) A Leading Presence in Ohio Complementary Footprint in Michigan New Opportunities in Chicago MSA & Wisconsin FirstMerit Huntington Source: Company Filings and SNL Financial Note: Deposit data as of June 30, 2015. ˜

10 Our Markets Share Similar Fundamentals Source: SNL, Bureau of Labor Statistics (November 2015), U.S. Bureau of Economic Analysis (2014), American Bankers Association (June 2015). Ohio Michigan PA IN WV KY Chicago MSA WI Huntington Presence FirstMerit Presence Projected Population Growth (2016E-2021E) Median Household Income (2016E) Unemployment Rate (November 2015) 4.5% 5.1% 5.0% 4.4% 6.5% 4.9% 5.4% 4.2% Total Market Deposits (2015, $BN) $ 294 $ 191 $ 356 $ 112 $ 32 $ 75 $ 385 $ 139 Number of Businesses 416,077 379,911 496,809 231,202 68,161 159,657 354,351 238,531 Overlapping Markets Other Huntington Markets New Markets New Markets Demographically Attractive, Accelerating Growth Profile $ 50,829 $ 50,458 $ 55,392 $ 49,708 $ 43,561 $ 45,528 $ 63,377 $ 54,626 0.84 % 0.57 % 0.77 % 2.18 % (0.10)% 1.99 % 1.02 % 1.55 %

11 Similar Loan and Deposit Profiles Compatible Credit Cultures Funded by Granular, Low Cost Deposits Note: Based on balances as of December 31, 2015.

Notes: Expected improvement in Efficiency Ratio, ROA, and ROATCE shown for 2018E 1. Fully phased-in Basel III metrics. Estimated Pro Forma Financial Metrics 12

Accelerates Achievement of Long-Term Financial Goals 13 2015 LT Target Transaction Impact Revenue Growth 6.2% 4%-6% Operating Leverage 0.5% >0% Efficiency Ratio 64.5% 56%-59% Net Charge-Offs as % of Average Loans 0.18% 35bp-55bp ROTCE 12.4% 13%-15%

Lower-Risk Transaction Due Diligence Findings Consistent with Huntington’s aggregate moderate-to-low risk appetite Full review of impact on LCR, CCAR, and ALM position Sound BSA / AML systems, internal audit function, and operational risk management Culture of discipline and prudent risk management among employee base Low Complexity All prior acquisitions have been fully integrated on common platform Similar business lines and business models Majority of systems are hosted and managed internally FirstMerit expertise in integration and conversion Prepared to be a $100BN Bank Since 2009 Built out robust risk management and compliance functions with scalability Significant investment in back office technology and processes Deep bench of talent with large bank experience Board-level and management expertise in large bank integration Significant Integration Experience Rebranded 597 branches in 2009-2010 Converted 1.5MM ATM and debit cards to new processor in 2011 Converted teller platform in over 700 branches during 2014-2015 Converted over 850 ATMs to image-enabled during 2013-2014 Closed or consolidated 159 branches since 2009, plus six announced and pending Opened 178 new in-store branches since 2010 14

Summary Observations 15 Attractive financial proposition for both companies’ shareholders Significant pro forma EPS accretion with enhanced return profile Identified and committed cost savings Attractive capital deployment opportunity with manageable TBV dilution Accelerates achievement of long-term financial goals Compelling strategic fit Greatly enhances density and customer convenience within footprint Opportunity to enter new markets with unique growth opportunities Similar cultures with compatible business models Lower-risk integration Strong familiarity with markets and franchise Consistent credit and risk profiles Demonstrated track record of successful conversions and integrations at both companies

16 For More Information Visit Our Website huntington-ir.com E-mail Request to huntington.investor.relations@huntington.com Call Investor Relations at (800) 576-5007 Write to Huntington Investor Relations Huntington Center, HC0935 41 South High Street Columbus, OH 43287

Appendix 17

Core Integration Tenets “Best of Breed” technology selection process Strong risk oversight Well-informed but quick decisions Integration Management Office with dedicated Enterprise Integration and Technology Integration Coordinators Board level oversight committee Executive level steering committees Dedicated project teams Augmented with business segment, technology, credit, risk, finance, and other support teams Supported by third-party experts and resources Three-step retail branch conversion planned by geography Optimize distribution network at each conversion Implement Huntington branch staff model at all FirstMerit locations Thoughtful, Five-Stage Integration Plan 18 Regulatory approval process Pre-closing preparation Colleague and Customer Communications Colleague Training Back office and corporate integration (e.g., HR, Finance, and credit systems) Commercial / Business & Specialty businesses (e.g., Auto Finance, Wealth, and Mortgage) 1st Conversion Geography #1 Retail branch conversion Retail branch consolidations 2nd Conversion Geography #2 Retail branch conversion Retail branch consolidations 3rd Conversion Geography #3 Retail branch conversion Retail branch consolidations 1st 60 Days Pre- Close

Illustrative Transaction Assumptions 19 Balance Sheet Items Income Statement Items Fair Value Marks 1.9% credit mark ~$(55)MM other marks Core deposit intangible equal to 1.5% of non-time deposits at close Anticipated issuance of $1.3BN of senior notes ~$1.1BN estimated deposit divestiture Suspend share repurchase through close 4Q16 – 2Q18: 50% total payout 3Q18 onward: 70% total payout Huntington based on street estimates FirstMerit earnings based on detailed zero-base forecast led by line of business executives Results in core earnings (ex. synergies) consistent with street forecasts Effective tax rate on FirstMerit earnings and merger adjustments of 26% Cost synergies of 40% Phase-in 75% 2017 / 100% 2018+ Total restructuring charges of $420MM, with ~$135MM recognized at close and the remainder over the first year CDI amortized sum-of-the-years digits over 8 years ~$(3)MM annual pre-tax revenue impact from Fair Play policies ~10% initial incremental deposit disruption, recovered by 2018 ~50bp lost earnings on assets related to deposit divestiture

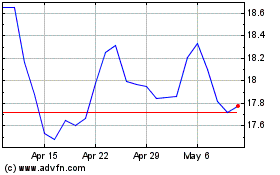

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

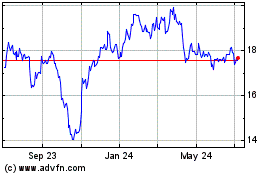

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Apr 2023 to Apr 2024