SECURITIES AND EXCHANGE COMMISSION

Washington D.C., 20549

FORM 11-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM

TO

.

COMMISSION FILE NO. 1-34073

| A. |

Full Title of the Plan and the address of the Plan, if different from that of the issuer named below: |

Huntington Investment and Tax Savings Plan

| B. |

Name of issuer of the securities held pursuant to the Plan and the address of its principal executive office: |

Huntington Bancshares Incorporated

Huntington Center

41

South High Street

Columbus, Ohio 43287

HUNTINGTON INVESTMENT AND TAX SAVINGS PLAN

REQUIRED INFORMATION

Item 4. Financial

Statements and Supplemental Schedule for the Plan.

The Huntington Investment and Tax Savings Plan (the “Plan”) is subject to the Employee

Retirement Income Security Act of 1974 (“ERISA”). In lieu of the requirements of Items 1-3 of this Form, the Plan is filing financial statements and a supplemental schedule prepared in accordance with the financial reporting requirements

of ERISA. The Plan financial statements and supplemental schedule for the fiscal year ended December 31, 2014, are included as Exhibit 99.1 to this report on Form 11-K and are incorporated herein by reference. The Plan financial statements and

supplemental schedule as of and for the year ended December 31, 2014 have been audited by Ary Roepcke Mulchaey, P.C., Independent Registered Public Accounting Firm, and their report is included therein.

EXHIBITS

| 23.1 |

Consent of Independent Registered Public Accounting Firm, Ary Roepcke Mulchaey, P.C. |

| 99.1 |

Financial statements and supplemental schedule of the Huntington Investment and Tax Savings Plan for the fiscal years ended December 31, 2014 and 2013, prepared in accordance with the financial reporting

requirements of ERISA. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Huntington Bancshares Incorporated has duly caused this annual report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HUNTINGTON INVESTMENT |

|

|

|

|

|

|

|

|

|

|

AND TAX SAVINGS PLAN |

|

|

|

|

| Date: June 29, 2015 |

|

|

|

By: |

|

/s/ Howell D. McCullough |

|

|

|

|

|

|

Howell D. McCullough |

|

|

|

|

|

|

Sr. Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

Huntington Bancshares Incorporated |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement No. 333-153573 of Huntington Bancshares Incorporated on Form S-8 of our report

dated June 29, 2015, appearing in this Annual Report on Form 11-K of the Huntington Investment and Tax Savings Plan for the year ended December 31, 2014.

/s/ Ary Roepcke Mulchaey, P.C.

Columbus, Ohio

June 29, 2015

Exhibit 99.1

Huntington Investment and Tax Savings Plan

Employer ID No.:

31-0724920

Plan Number: 002

Financial Statements as of

and for the Years Ended December 31, 2014 and 2013, Supplemental Schedule as of December 31, 2014, and Report of Independent Registered Public Accounting Firm

HUNTINGTON INVESTMENT AND TAX SAVINGS PLAN

TABLE OF CONTENTS

|

|

|

|

|

| |

|

Page |

|

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM – ARY ROEPCKE MULCHAEY, P.C. |

|

|

1 |

|

|

|

| FINANCIAL STATEMENTS AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013: |

|

|

|

|

|

|

| Statements of Net Assets Available for Benefits |

|

|

2 |

|

|

|

| Statements of Changes in Net Assets Available for Benefits |

|

|

3 |

|

|

|

| Notes to Financial Statements |

|

|

4–12 |

|

|

|

| SUPPLEMENTAL SCHEDULE* — |

|

|

|

|

|

|

| Schedule H, Part IV Line 4i — Schedule of Assets (Held at End of Year) as of December 31, 2014 |

|

|

13 |

|

|

|

| EXHIBITS — |

|

|

|

|

|

|

| Consent of Ary Roepcke Mulchaey, P.C. |

|

|

23.1 |

|

| * |

All other financial schedules required by section 2520.103-10 of the U.S. Department of Labor’s Annual Reporting and Disclosure Requirements under the Employee Retirement Income Security Act of 1974 have been

omitted because they are not applicable. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Compensation Committee of the Board of Directors of

Huntington Bancshares Incorporated and Plan Participants of the

Huntington Investment and Tax Savings Plan

Columbus, Ohio

We have audited the accompanying statements of net assets available for benefits of the Huntington Investment and Tax Savings Plan (the “Plan”) as

of December 31, 2014 and 2013, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to

express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company

Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor

were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence

supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We

believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all

material respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in

the United States of America.

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2014, has been subjected to

audit procedures performed in conjunction with the audit of the Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the

information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming

our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement

Income Security Act of 1974. In our opinion, the schedule of assets (held at end of year) is fairly stated, in all material respects, in relation to the financial statements as a whole.

|

| /s/ Ary Roepcke Mulchaey, P.C. |

|

| Columbus, Ohio |

| June 29, 2015 |

1

HUNTINGTON INVESTMENT AND TAX SAVINGS PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

DECEMBER 31, 2014 AND 2013

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Cash, non-interest bearing |

|

$ |

118,379 |

|

|

$ |

1,618,872 |

|

| Investments, at fair value: |

|

|

|

|

|

|

|

|

| Cash, interest bearing |

|

|

31,767,373 |

|

|

|

32,165,127 |

|

| Huntington Bancshares Incorporated common stock |

|

|

135,532,663 |

|

|

|

131,475,740 |

|

| Mutual funds |

|

|

439,077,899 |

|

|

|

387,394,111 |

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

|

606,377,935 |

|

|

|

551,034,978 |

|

| Profit sharing contribution receivable |

|

|

5,716,133 |

|

|

|

— |

|

| Accrued dividends and interest receivable |

|

|

797,975 |

|

|

|

735,104 |

|

| Notes receivable from participants |

|

|

334,018 |

|

|

|

8,546 |

|

| Due from brokers for investment securities sold |

|

|

276,409 |

|

|

|

393,541 |

|

| Employer match true up |

|

|

453,309 |

|

|

|

565,964 |

|

|

|

|

|

|

|

|

|

|

| Total receivables |

|

|

7,577,844 |

|

|

|

1,703,155 |

|

| Total assets |

|

|

614,074,158 |

|

|

|

554,357,005 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| Due to brokers for investment securities purchased |

|

|

572,277 |

|

|

|

1,682,390 |

|

| Dividends payable to Plan participants |

|

|

85,809 |

|

|

|

78,319 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

658,086 |

|

|

|

1,760,709 |

|

|

|

|

|

|

|

|

|

|

| NET ASSETS AVAILABLE FOR BENEFITS |

|

$ |

613,416,072 |

|

|

$ |

552,596,296 |

|

|

|

|

|

|

|

|

|

|

See notes to financial statements.

2

HUNTINGTON INVESTMENT AND TAX SAVINGS PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| ADDITIONS |

|

|

|

|

|

|

|

|

| Investment income: |

|

|

|

|

|

|

|

|

| Net appreciation in fair value of investments |

|

$ |

3,977,623 |

|

|

$ |

103,758,867 |

|

| Dividends from Huntington Bancshares Incorporated common stock |

|

|

2,784,826 |

|

|

|

2,566,941 |

|

| Dividends from mutual funds |

|

|

37,200,732 |

|

|

|

16,769,243 |

|

| Interest |

|

|

20,395 |

|

|

|

20,238 |

|

|

|

|

|

|

|

|

|

|

|

|

|

43,983,576 |

|

|

|

123,115,289 |

|

| Contributions: |

|

|

|

|

|

|

|

|

| Employees |

|

|

44,435,133 |

|

|

|

37,964,324 |

|

| Employer |

|

|

30,060,432 |

|

|

|

17,988,772 |

|

| Rollovers |

|

|

5,495,709 |

|

|

|

2,886,820 |

|

|

|

|

|

|

|

|

|

|

|

|

|

79,991,274 |

|

|

|

58,839,916 |

|

| Total additions |

|

|

123,974,850 |

|

|

|

181,955,205 |

|

|

|

|

|

|

|

|

|

|

| DEDUCTIONS |

|

|

|

|

|

|

|

|

| Benefit distributions and other withdrawals |

|

|

63,155,074 |

|

|

|

52,322,156 |

|

|

|

|

|

|

|

|

|

|

| Net increase in net assets available for benefits |

|

|

60,819,776 |

|

|

|

129,633,049 |

|

|

|

|

|

|

|

|

|

|

| Net assets available for benefits at beginning of year |

|

|

552,596,296 |

|

|

|

422,963,247 |

|

|

|

|

|

|

|

|

|

|

| NET ASSETS AVAILABLE FOR BENEFITS AT END OF YEAR |

|

$ |

613,416,072 |

|

|

$ |

552,596,296 |

|

|

|

|

|

|

|

|

|

|

See notes to financial statements.

3

HUNTINGTON INVESTMENT AND TAX SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS

ENDED DECEMBER 31, 2014 AND 2013

| 1. |

DESCRIPTION OF THE PLAN |

General —The Huntington Investment and Tax

Savings Plan (the “Plan”) is a defined contribution plan that was initially adopted by the Board of Directors (the “Board of Directors”) of Huntington Bancshares Incorporated (“Huntington”) on September 29, 1977,

to be effective January 1, 1978, to provide benefits to eligible employees of Huntington, as defined in the Plan document. Plan participants should refer to the Plan document and summary plan description for a more complete description of the

Plan’s provisions. On December 13, 2000, Huntington’s common stock held in accounts of participants who elected to have all or a portion of their accounts invested in Huntington’s common stock were designated an Employee Stock

Ownership Plan (“ESOP”). The ESOP forms a portion of the Plan.

Plan Amendments — From time to time, the

Plan has been amended and restated. The most recent amendments to the Plan include provisions as necessary to conform to various legislation and guidance under the Internal Revenue Code (the “Code”), the provisions of the Employee

Retirement Income Security Act of 1974 (“ERISA”), and employee eligibility requirements as well as matching provisions as further described in the Funding and Vesting section below.

Plan Termination — Pursuant to the Plan document, Huntington may terminate or modify the Plan at any time by resolution of its

Board of Directors and subject to the provisions of ERISA and the Code.

Funding and Vesting — During the 2013 plan year,

eligible employees could enroll on their hire date. Beginning on January 1, 2014, employees must complete one month of service before they are eligible to participate in the Plan. Participants may elect to make pre-tax and/or Roth 401(k)

after tax contributions of up to 75% of their eligible compensation, subject to certain statutory limits.

Beginning in 2013, Huntington

made a matching contribution equal to 100% on the first 4% of participant elective deferrals following six months of employment. Prior to January 1, 2014, participant and employer contributions were fully vested at all times. Employer matching

contributions for employees hired on or after January 1, 2014 are on a two-year cliff-vesting schedule. After two years of service, the employer matching contribution will be 100% vested.

An annual discretionary profit sharing contribution was also established in 2014. The profit sharing contributions are on a three-year

cliff-vesting schedule. After three years of service, these contributions are 100% vested. All prior years of service count toward vesting.

Effective January 1, 2014 the Plan includes an automatic enrollment feature. Eligible employees who do not enroll or opt out of

participation will be enrolled at 4% pre-tax. The deferral amount will automatically increase each January 1 by 1% per year up to a maximum of 10%.

Forfeitures — Any forfeited portion of a participant’s account can be restored to the participant’s account if they are

rehired within five years of termination and the entire amount distributed upon termination is repaid to the Plan. Forfeitures are either used to reduce Company contributions to the Plan or to pay reasonable expenses of the Plan. Forfeitures used to

reduce Company contributions were $48,279 during 2014. At December 31, 2014, forfeited non-vested accounts were $0.

4

Administration — The Plan administrator is Huntington. Portions of Plan

administration have been delegated by the Plan administrator to a committee of employees appointed by the board of directors of Huntington. The Plan administrator believes that the Plan is currently designed and operated in compliance with the

applicable requirements of the Code and the provisions of ERISA, as amended.

Participant Accounts — Each

participant’s account is credited with the participant’s own contribution and an allocation of Huntington’s contribution, as applicable, and Plan earnings. Investment income or loss is allocated to participant accounts based on

proportional account balances in their respective investments. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s individual account.

Fees and Expenses — Certain administrative fees are paid from the general assets of Huntington and are excluded from these

financial statements. Participants are also charged a fixed amount for administration of the Plan. Investment related expenses are included in the net appreciation of fair value of investments. Fees incurred by the Plan for investment management

services or recordkeeping are also included in the net appreciation in fair value of investments because they are paid through a revenue sharing arrangement rather than a direct payment from the Plan.

Investment Options — Plan participants are permitted to direct their deferrals, employer matching contributions, and

discretionary profit sharing contributions to any combination of investment options, including the Huntington Conservative Deposit Account, Huntington common stock and a variety of mutual funds. Huntington has the sole discretion to determine or

change the number and nature of investment options in the Plan. An active participant may change or suspend deferrals pursuant to the terms set forth in the Plan document. If a Plan participant enrolls without making an investment election, all

contributions will be allocated to the Vanguard Wellington Fund.

Plan Investments — Plan investments consist of

interest bearing cash, shares of Huntington common stock, and mutual funds. The investments are held by the trust division of The Huntington National Bank (the “Plan Trustee”), a wholly owned subsidiary of Huntington. The Plan Trustee

purchases and sells shares of Huntington common stock on the open market at market prices. Additionally, the Plan Trustee may directly purchase from, and sell to, Huntington, at market prices, shares of Huntington common stock. The Plan Trustee

purchases and redeems shares of mutual funds in accordance with rules of the mutual funds.

Participant Loans — The

Plan does not permit participant loans. However, as a result of acquisitions, certain participant loans were rolled over into the Plan. Participant loans are recorded at unpaid principal balance plus any accrued but unpaid interest, at rates

commensurate with prevailing rates at the time funds were borrowed. The amount recorded approximates current value. Principal and interest is paid ratably through payroll deductions. Participant loans are listed as notes receivable from participants

in the Plan’s financial statements.

Contributions — Employee, employer, and profit sharing contributions to

participants’ accounts in the Plan are invested pursuant to the participants’ investment direction elections on file.

Benefit Distributions and Other Withdrawals — A participant may request that the portion of his or her account that is

invested in Huntington common stock be distributed in shares of Huntington common stock with cash paid in lieu of any fractional shares. All other distributions from the Plan are paid in cash.

5

Distributions and withdrawals are reported at fair value and recorded by the Plan when payments

are made.

Participants are permitted to take distributions and withdrawals from their accounts in the Plan under the circumstances set

forth in the Plan document. Generally, participants may request in-service withdrawal of funds in their account attributable to: (i) rollover contributions; (ii) after-tax contributions; and (iii) pre-April 1, 1998, Employer

contributions. Employee pre-tax elective deferrals and post April 1, 1998 employer matching contributions are subject to special withdrawal rules and generally may not be withdrawn from the Plan prior to a participant’s death, disability,

termination of employment, or attainment of age 59 1/2. Certain distributions of employee deferrals may be made, however, in the event a participant requests a distribution due to financial hardship as defined by the Plan. Participants

should refer to the summary plan description for a complete summary of the Plan provisions. Participants may withdraw up to 100% of their account balances in the Plan for any reason after they have reached age 59 1/2.

Plan participants have the option of reinvesting cash dividends paid on Huntington common stock or having dividends paid in cash.

| 2. |

SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation — The financial

statements of the Plan are presented on the accrual basis and are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

In conjunction with applicable accounting standards, all material subsequent events have been either recognized in the financial statements or

disclosed in the notes to financial statements.

Dividends and Interest Income — Dividends are recorded on their

ex-dividend date. Interest is recorded on an accrual basis when earned. Net appreciation or depreciation includes the Plan’s gains and losses on investments bought and sold, as well as held, during the year.

Fair Value Measurements — Accounting Standards Codification (“ASC”) Topic 820 defines fair value as the

exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date.

ASC 820 also establishes a three-level valuation hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability as of the measurement date. The

three levels are defined as follows:

Level 1 — inputs to the valuation methodology are quoted prices

(unadjusted) for identical assets or liabilities in active markets.

Level 2 — inputs to the valuation

methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument.

Level 3 — inputs to the valuation methodology are unobservable and significant to the fair value measurement.

6

A financial instrument’s categorization within the valuation hierarchy is based upon the

lowest level of input that is significant to the fair value measurement. The Plan’s policy is to recognize significant transfers between levels at the beginning of the reporting period.

Use of Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect amounts of assets and liabilities, and changes therein, reported in the financial statements. Actual results could differ from those estimates.

Risks and Uncertainties — The Plan utilizes various investment instruments, including mutual funds and common stock. In

general, investment securities are exposed to various risks such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of

investment securities will occur in the near term and that such changes will materially affect the amounts in the financial statements.

The following individual investments represent 5% or more of the fair value

of net assets available for benefits as of December 31:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Huntington Bancshares Incorporated common stock |

|

$ |

135,532,663 |

|

|

$ |

131,475,740 |

|

| Vanguard Institutional Index Fund |

|

|

88,077,376 |

|

|

|

70,628,655 |

|

| T. Rowe Price Mid-Cap Growth Fund |

|

|

74,997,526 |

|

|

|

67,666,253 |

|

| Vanguard Wellington Fund |

|

|

74,837,707 |

|

|

|

58,792,346 |

|

| Huntington Situs Fund |

|

|

34,221,301 |

|

|

|

40,422,380 |

|

| T. Rowe Price Small-Cap Stock Fund |

|

|

33,382,718 |

|

|

|

30,459,741 |

|

| Huntington Conservative Deposit Account |

|

|

31,767,373 |

|

|

|

32,165,127 |

|

| Huntington Dividend Capture Fund |

|

|

29,839,433 |

(1) |

|

|

28,060,172 |

|

| American Funds Europacific Growth Fund |

|

|

28,442,603 |

(1) |

|

|

29,885,504 |

|

| (1) |

Investment represents less than 5% in the year indicated, but is shown for comparative purposes. |

The Plan’s investments (including investments purchased, sold, and held during the year) appreciated in carrying value for the years ended

December 31 as follows:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Huntington Bancshares Incorporated common stock |

|

$ |

11,582,632 |

|

|

$ |

46,287,157 |

|

| Mutual funds |

|

|

(7,605,009 |

) |

|

|

57,471,710 |

|

|

|

|

|

|

|

|

|

|

| Net appreciation |

|

$ |

3,977,623 |

|

|

$ |

103,758,867 |

|

|

|

|

|

|

|

|

|

|

| 4. |

PARTY-IN-INTEREST TRANSACTIONS |

Certain plan investments are held with the Huntington

National Bank or are shares of mutual funds managed by Huntington Asset Advisors, Inc., a subsidiary of the Huntington National Bank. These investments are held by the Plan Trustee, and therefore, qualify as party-in-interest investments.

7

The following table lists the fair value of party-in-interest investments at December 31:

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Huntington Bancshares Incorporated common stock (1) |

|

$ |

135,532,663 |

|

|

$ |

131,475,740 |

|

| Huntington Situs Fund |

|

|

34,221,301 |

|

|

|

40,422,380 |

|

| Huntington Conservative Deposit Account |

|

|

31,767,373 |

|

|

|

32,165,127 |

|

| Huntington Dividend Capture Fund |

|

|

29,839,433 |

|

|

|

28,060,172 |

|

| Huntington Treasury Money Market Fund |

|

|

4,806,995 |

|

|

|

4,869,954 |

|

| Huntington Real Strategies Fund |

|

|

2,909,644 |

|

|

|

3,299,183 |

|

| Huntington Money Market Fund |

|

|

1,205,513 |

|

|

|

1,185,515 |

|

| Huntington Fixed Income Securities Fund |

|

|

— |

|

|

|

15,922,615 |

|

| Huntington International Equity Fund |

|

|

— |

|

|

|

11,722,310 |

|

| Huntington Intermediate Government Income Fund |

|

|

— |

|

|

|

7,409,703 |

|

| Huntington Rotating Markets Fund |

|

|

— |

|

|

|

5,888,278 |

|

| (1) |

12,883,333 shares at cost of $77,619,652 in 2014, 13,624,429 shares at cost of $89,330,658 in 2013. |

Costs and expenses paid by the Plan for administration totaled $323,531 and $330,234 for 2014 and 2013, respectively. Amounts are included in

benefit distributions and other withdrawals in the Plan financial statements.

The Plan obtained its latest determination letter dated September 24,

2013, in which the Internal Revenue Service (IRS) stated the Plan, as then designed, was qualified under Section 401(a) of the Code and, therefore, the related trust is exempt from taxation. Subsequent to this determination by the IRS, the Plan

was amended and restated. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. Huntington believes the Plan is being operated in compliance with applicable requirements of the Code and related

state statutes, and that the trust, which forms a part of the Plan, is qualified and exempt from federal income and state franchise taxes.

GAAP requires the evaluation of tax positions taken by the Plan and recognition of a tax liability if the Plan has taken an uncertain tax

position that is not more likely than not to be sustained upon examination by the IRS. Huntington, on behalf of the Plan, has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014 and 2013, there are no

uncertain tax positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits; however, there are currently no audits for any tax periods in

progress. The Plan administrator believes it is no longer subject to income tax examinations for years prior to 2011.

8

| 6. |

FAIR VALUE MEASUREMENTS |

Investments of the Plan are accounted for at cost on the

trade-date and are reported at fair value. Interest bearing cash accounts have a fair value equal to the amount payable on demand. Huntington common stock is valued using the year-end closing price as determined by the National Association of

Securities Dealers Automated Quotations. Mutual funds are valued at quoted market prices that represent the net asset value of shares held by the Plan at year-end. There have been no changes in the valuation methodologies used at December 31,

2014 and 2013. The following tables set forth by level within the fair value hierarchy a summary of the Plan’s investments measured at fair value on a recurring basis at December 31, 2014 and 2013. For the years ended December 31,

2014 and 2013, there were no significant transfers in or out of Levels 1, 2, or 3.

9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fair Value Measurements Using |

|

| |

|

Quoted Prices |

|

|

Significant |

|

|

Significant |

|

|

|

|

| |

|

In Active |

|

|

Other |

|

|

Other |

|

|

|

|

| |

|

Markets for |

|

|

Observable |

|

|

Unobservable |

|

|

|

|

| |

|

Identical Assets |

|

|

Inputs |

|

|

Inputs |

|

|

|

|

| December 31, 2014 |

|

(Level 1) |

|

|

(Level 2) |

|

|

(Level 3) |

|

|

Total |

|

| Cash, interest bearing |

|

$ |

31,767,373 |

|

|

|

— |

|

|

|

— |

|

|

$ |

31,767,373 |

|

| Common stock — financial services |

|

|

135,532,663 |

|

|

|

— |

|

|

|

— |

|

|

|

135,532,663 |

|

| Mutual funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Cap Growth |

|

|

109,218,827 |

|

|

|

— |

|

|

|

— |

|

|

|

109,218,827 |

|

| Large Blend |

|

|

88,077,376 |

|

|

|

— |

|

|

|

— |

|

|

|

88,077,376 |

|

| Moderate Allocation |

|

|

74,837,707 |

|

|

|

— |

|

|

|

— |

|

|

|

74,837,707 |

|

| Foreign Large Blend |

|

|

40,530,284 |

|

|

|

— |

|

|

|

— |

|

|

|

40,530,284 |

|

| Small Growth |

|

|

33,382,718 |

|

|

|

— |

|

|

|

— |

|

|

|

33,382,718 |

|

| Large Value |

|

|

29,839,433 |

|

|

|

— |

|

|

|

— |

|

|

|

29,839,433 |

|

| Intermediate-term Bond |

|

|

17,851,246 |

|

|

|

— |

|

|

|

— |

|

|

|

17,851,246 |

|

| Intermediate Government Bond |

|

|

7,176,672 |

|

|

|

— |

|

|

|

— |

|

|

|

7,176,672 |

|

| Large Growth |

|

|

6,591,934 |

|

|

|

— |

|

|

|

— |

|

|

|

6,591,934 |

|

| Taxable Money Market |

|

|

6,012,508 |

|

|

|

— |

|

|

|

— |

|

|

|

6,012,508 |

|

| Target Date 2021-2025 |

|

|

3,176,315 |

|

|

|

— |

|

|

|

— |

|

|

|

3,176,315 |

|

| Natural Resources |

|

|

2,909,644 |

|

|

|

— |

|

|

|

— |

|

|

|

2,909,644 |

|

| Target Date 2026-2030 |

|

|

2,829,544 |

|

|

|

— |

|

|

|

— |

|

|

|

2,829,544 |

|

| Target Date 2016-2020 |

|

|

2,646,455 |

|

|

|

— |

|

|

|

— |

|

|

|

2,646,455 |

|

| Short-term Bond |

|

|

2,544,386 |

|

|

|

— |

|

|

|

— |

|

|

|

2,544,386 |

|

| Target Date 2036-2040 |

|

|

2,472,589 |

|

|

|

— |

|

|

|

— |

|

|

|

2,472,589 |

|

| Target Date 2031-2035 |

|

|

1,901,211 |

|

|

|

— |

|

|

|

— |

|

|

|

1,901,211 |

|

| Diversified Emerging Markets |

|

|

1,607,904 |

|

|

|

— |

|

|

|

— |

|

|

|

1,607,904 |

|

| World Bond |

|

|

1,305,219 |

|

|

|

— |

|

|

|

— |

|

|

|

1,305,219 |

|

| Target Date 2011-2015 |

|

|

1,180,263 |

|

|

|

— |

|

|

|

— |

|

|

|

1,180,263 |

|

| Target Date 2041-2045 |

|

|

843,781 |

|

|

|

— |

|

|

|

— |

|

|

|

843,781 |

|

| Inflation Protected Bond |

|

|

785,220 |

|

|

|

— |

|

|

|

— |

|

|

|

785,220 |

|

| Target Date 2046-2050 |

|

|

735,610 |

|

|

|

— |

|

|

|

— |

|

|

|

735,610 |

|

| Target Date 2051+ |

|

|

621,053 |

|

|

|

— |

|

|

|

— |

|

|

|

621,053 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total mutual funds |

|

|

439,077,899 |

|

|

|

— |

|

|

|

— |

|

|

|

439,077,899 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

$ |

606,377,935 |

|

|

|

— |

|

|

|

— |

|

|

$ |

606,377,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fair Value Measurements Using |

|

| |

|

Quoted Prices |

|

|

Significant |

|

|

Significant |

|

|

|

|

| |

|

In Active |

|

|

Other |

|

|

Other |

|

|

|

|

| |

|

Markets for |

|

|

Observable |

|

|

Unobservable |

|

|

|

|

| |

|

Identical Assets |

|

|

Inputs |

|

|

Inputs |

|

|

|

|

| December 31, 2013 |

|

(Level 1) |

|

|

(Level 2) |

|

|

(Level 3) |

|

|

Total |

|

| Cash, interest bearing |

|

$ |

32,165,127 |

|

|

|

— |

|

|

|

— |

|

|

$ |

32,165,127 |

|

| Common stock — financial services |

|

|

131,475,740 |

|

|

|

— |

|

|

|

— |

|

|

|

131,475,740 |

|

| Mutual funds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mid-Cap Growth |

|

|

108,088,633 |

|

|

|

— |

|

|

|

— |

|

|

|

108,088,633 |

|

| Large Blend |

|

|

76,516,933 |

|

|

|

— |

|

|

|

— |

|

|

|

76,516,933 |

|

| Moderate Allocation |

|

|

58,792,346 |

|

|

|

— |

|

|

|

— |

|

|

|

58,792,346 |

|

| Foreign Large Blend |

|

|

42,846,520 |

|

|

|

— |

|

|

|

— |

|

|

|

42,846,520 |

|

| Small Growth |

|

|

30,459,741 |

|

|

|

— |

|

|

|

— |

|

|

|

30,459,741 |

|

| Large Value |

|

|

28,060,172 |

|

|

|

— |

|

|

|

— |

|

|

|

28,060,172 |

|

| Intermediate-term Bond |

|

|

16,769,569 |

|

|

|

— |

|

|

|

— |

|

|

|

16,769,569 |

|

| Taxable Money Market |

|

|

6,055,469 |

|

|

|

— |

|

|

|

— |

|

|

|

6,055,469 |

|

| Intermediate Government |

|

|

7,409,703 |

|

|

|

— |

|

|

|

— |

|

|

|

7,409,703 |

|

| Natural Resources |

|

|

3,299,183 |

|

|

|

— |

|

|

|

— |

|

|

|

3,299,183 |

|

| Large Growth |

|

|

2,092,643 |

|

|

|

— |

|

|

|

— |

|

|

|

2,092,643 |

|

| Target Date 2026-2030 |

|

|

1,290,533 |

|

|

|

— |

|

|

|

— |

|

|

|

1,290,533 |

|

| Short-term Bond |

|

|

1,114,179 |

|

|

|

— |

|

|

|

— |

|

|

|

1,114,179 |

|

| Target Date 2016-2020 |

|

|

947,127 |

|

|

|

— |

|

|

|

— |

|

|

|

947,127 |

|

| Target Date 2036-2040 |

|

|

741,551 |

|

|

|

— |

|

|

|

— |

|

|

|

741,551 |

|

| Target Date 2031-2035 |

|

|

625,645 |

|

|

|

— |

|

|

|

— |

|

|

|

625,645 |

|

| Target Date 2011-2015 |

|

|

603,212 |

|

|

|

— |

|

|

|

— |

|

|

|

603,212 |

|

| Diversified Emerging Markets |

|

|

519,389 |

|

|

|

— |

|

|

|

— |

|

|

|

519,389 |

|

| Target Date 2021-2025 |

|

|

455,095 |

|

|

|

— |

|

|

|

— |

|

|

|

455,095 |

|

| Inflation Protected Bond |

|

|

239,846 |

|

|

|

— |

|

|

|

— |

|

|

|

239,846 |

|

| World Bond |

|

|

197,769 |

|

|

|

— |

|

|

|

— |

|

|

|

197,769 |

|

| Target Date 2041-2045 |

|

|

152,180 |

|

|

|

— |

|

|

|

— |

|

|

|

152,180 |

|

| Target Date 2046-2050 |

|

|

63,884 |

|

|

|

— |

|

|

|

— |

|

|

|

63,884 |

|

| Target Date 2051+ |

|

|

52,789 |

|

|

|

— |

|

|

|

— |

|

|

|

52,789 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total mutual funds |

|

|

387,394,111 |

|

|

|

— |

|

|

|

— |

|

|

|

387,394,111 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total investments |

|

$ |

551,034,978 |

|

|

|

— |

|

|

|

— |

|

|

$ |

551,034,978 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7. |

TERMINATED PARTICIPANTS |

There were no amounts included in net assets available for

benefits allocated to individuals who have withdrawn from the Plan at December 31, 2014 and 2013.

11

On April 16, 2014, the Compensation Committee of the Board of

Directors of Huntington approved the merger of the Camco Financial & Subsidiaries Salary Savings Plan into the Huntington Investment and Tax Savings Plan as of a date that is administratively practicable. The merger is scheduled to occur on

September 1, 2015.

12

SUPPLEMENTAL SCHEDULE

HUNTINGTON INVESTMENT AND TAX SAVINGS PLAN

EIN: 31-0724920 Plan Number: 002

SCHEDULE H, PART IV,

LINE 4I — SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2014

|

|

|

|

|

|

|

|

|

|

|

| |

|

(b) identity of issuer, borrower, |

|

(c) Description of investment including maturity date, |

|

(d) Cost |

|

(e) Current |

|

| (a) |

|

lessor or similar party |

|

rate of interest, collateral, par, or maturity value |

|

** |

|

value |

|

|

|

CASH, INTEREST BEARING — |

|

|

|

|

|

|

|

|

| * |

|

Huntington National Bank |

|

Huntington Conservative Deposit Account |

|

|

|

$ |

31,767,373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cash, interest bearing |

|

|

|

|

|

|

31,767,373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCK — |

|

|

|

|

|

|

|

|

| * |

|

Huntington Bancshares Incorporated |

|

Huntington Bancshares Incorporated |

|

|

|

|

|

|

|

|

|

|

Common Stock — 12,883,333 shares |

|

|

|

|

135,532,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total common stock |

|

|

|

|

|

|

135,532,663 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MUTUAL FUNDS: |

|

|

|

|

|

|

|

|

|

|

Vanguard Institutional Index Funds |

|

Vanguard Institutional Index Fund — 466,833 shares |

|

|

|

|

88,077,376 |

|

|

|

T. Rowe Price Mid-Cap Growth Fund |

|

T. Rowe Price Mid-Cap Growth Fund — 994,135 shares |

|

|

|

|

74,997,526 |

|

|

|

Vanguard Wellington Fund |

|

Vanguard Wellington Fund — 1,106,903 shares |

|

|

|

|

74,837,707 |

|

| * |

|

The Huntington Funds |

|

Huntington Situs Fund — 1,649,219 shares |

|

|

|

|

34,221,301 |

|

|

|

T. Rowe Price Small Cap Stock Fund |

|

T. Rowe Price Small Cap Stock Fund — 753,220 shares |

|

|

|

|

33,382,718 |

|

| * |

|

The Huntington Funds |

|

Huntington Dividend Capture Fund — 2,980,962 shares |

|

|

|

|

29,839,433 |

|

|

|

Europacific Growth Fund |

|

American Funds Europacific Growth Fund — 604,005 shares |

|

|

|

|

28,442,603 |

|

|

|

Federated Bond Fund |

|

Federated Bond Fund — 1,742,943 shares |

|

|

|

|

16,383,667 |

|

|

|

Harbor International Fund |

|

Harbor International Fund—150,187 shares |

|

|

|

|

9,729,141 |

|

|

|

Federated Total Return Gov’t Bond Fund |

|

Federated Total Return Gov’t Bond Fund —644,225 shares |

|

|

|

|

7,176,672 |

|

|

|

Fidelity Contra Fund |

|

Fidelity Contra Fund — 67,285 shares |

|

|

|

|

6,591,934 |

|

| * |

|

The Huntington Funds |

|

Huntington Treasury Money Market Fund — 4,806,995 shares |

|

|

|

|

4,806,995 |

|

|

|

Vanguard Target Retirement 2025 Fund |

|

Vanguard Target Retirement 2025 Fund — 192,155 shares |

|

|

|

|

3,176,315 |

|

| * |

|

The Huntington Funds |

|

Huntington Real Strategies Fund — 433,628 shares |

|

|

|

|

2,909,644 |

|

|

|

Vanguard Target Retirement 2030 Fund |

|

Vanguard Target Retirement 2030 Fund — 97,436 shares |

|

|

|

|

2,829,544 |

|

|

|

Vanguard Target Retirement 2020 Fund |

|

Vanguard Target Retirement 2020 Fund — 92,989 shares |

|

|

|

|

2,646,455 |

|

|

|

PIMCO Low Duration Institutional Fund |

|

PIMCO Low Duration Institutional Fund — 253,425 shares |

|

|

|

|

2,544,386 |

|

|

|

Vanguard Target Retirement 2040 Fund |

|

Vanguard Target Retirement 2040 Fund — 83,084 shares |

|

|

|

|

2,472,589 |

|

|

|

Vanguard Total International Index Fund |

|

Vanguard Total International Index Fund — 22,683 shares |

|

|

|

|

2,358,540 |

|

|

|

Vanguard Target Retirement 2035 Fund |

|

Vanguard Target Retirement 2035 Fund — 106,570 shares |

|

|

|

|

1,901,211 |

|

|

|

Franklin Templeton Institutional Emerging Markets Fund |

|

Franklin Templeton Institutional Emerging Markets Fund — 350,306 shares |

|

|

|

|

1,607,904 |

|

|

|

Vanguard Total Bond Market Index Fund |

|

Vanguard Total Bond Market Index Fund — 135,012 shares |

|

|

|

|

1,467,579 |

|

|

|

PIMCO Foreign Bond Fund |

|

PIMCO Foreign Bond Fund — 121,190 shares |

|

|

|

|

1,305,219 |

|

| * |

|

The Huntington Funds |

|

Huntington Money Market Fund — 1,205,513 shares |

|

|

|

|

1,205,513 |

|

|

|

Vanguard Target Retirement 2015 Fund |

|

Vanguard Target Retirement 2015 Fund — 77,192 shares |

|

|

|

|

1,180,263 |

|

|

|

Vanguard Target Retirement 2045 Fund |

|

Vanguard Target Retirement 2045 Fund — 45,243 shares |

|

|

|

|

843,781 |

|

|

|

Vanguard Inflation Protected Securities Fund |

|

Vanguard Inflation Protected Securities Fund — 74,499 shares |

|

|

|

|

785,220 |

|

|

|

Vanguard Target Retirement 2050 Fund |

|

Vanguard Target Retirement 2050 Fund — 24,835 shares |

|

|

|

|

735,610 |

|

|

|

Vanguard Target Retirement 2055 Fund |

|

Vanguard Target Retirement 2055 Fund — 10,972 shares |

|

|

|

|

350,869 |

|

|

|

Vanguard Target Retirement 2060 Fund |

|

Vanguard Target Retirement 2060 Fund — 9,581 shares |

|

|

|

|

270,184 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total mutual funds |

|

|

|

|

|

|

439,077,899 |

|

|

|

|

|

|

|

|

|

|

|

|

| * |

|

NOTES RECEIVABLE FROM PARTICIPANTS |

|

$322,063 principal amount, interest rates of 4.25%—6.25%; maturing between 2015—2026 |

|

|

|

|

334,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

$ |

606,711,953 |

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Indicates party-in-interest to the Plan. |

| ** |

Cost information is not required for participant-directed investments and therefore not included. |

See notes

to financial statements.

13

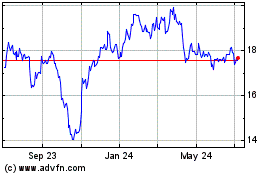

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Mar 2024 to Apr 2024

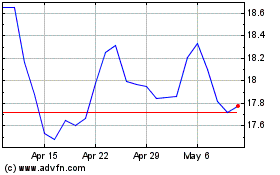

Huntington Bancshares (NASDAQ:HBANP)

Historical Stock Chart

From Apr 2023 to Apr 2024