Current Report Filing (8-k)

January 26 2016 - 4:16PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 26, 2016

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-32335 |

|

88-0488686 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

11388 Sorrento Valley Road, San Diego, California |

|

92121 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 794-8889

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On January 26, 2016, Halozyme Therapeutics, Inc. issued a press release announcing the closing of its previously announced $150 million royalty-back debt financing. The full text of the press release issued in connection with this announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated January 26, 2016 |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Halozyme Therapeutics, Inc. |

|

|

|

|

January 26, 2016 |

By: |

/s/ Harry J. Leonhardt,, Esq. |

|

|

|

Harry J. Leonhardt,, Esq. |

|

|

|

Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary |

3

Exhibit Index

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated January 26, 2016 |

4

Exhibit 99.1

|

|

Contacts: |

|

|

Jim Mazzola |

|

|

858-704-8122 |

|

|

ir@halozyme.com |

|

|

|

|

|

Chris Burton |

|

|

858-704-8352 |

|

|

ir@halozyme.com |

FOR IMMEDIATE RELEASE

HALOZYME ANNOUNCES CLOSING OF $150 MILLION ROYALTY-BACKED DEBT FINANCING

SAN DIEGO, January 26, 2016 — Halozyme Therapeutics, Inc. (NASDAQ: HALO) today announced that it has closed the previously announced $150 million royalty-backed debt transaction with investment funds managed by Pharmakon Advisors and Athyrium Capital Management. The debt is secured by future royalties of ENHANZE™ products, received only from Halozyme’s collaborations with Roche and Baxalta.

“With the completion of this non-dilutive financing, we are well funded to initiate our Phase 3 study in pancreatic cancer patients and continue to execute our two pillar strategy in 2016,” said Dr. Helen Torley, president and chief executive officer.

The company announced details of the financing on Jan. 4, including the formation of a wholly-owned subsidiary, Halozyme Royalty LLC (“Halozyme Royalty”), which borrowed $150 million at a per annum interest rate of 8.75 percent plus the three-month LIBOR rate. Under the terms of the credit agreement, Halozyme Royalty will not be required to apply any of the royalty payments to repay the loan during 2016. 50 percent of royalty payments received in 2017 and 100 percent of royalty payments received in 2018 and thereafter will be used to service the loan, subject to quarterly caps. Royalty payments that are not required to be applied to the loan will be retained by Halozyme Royalty and distributed to Halozyme. Repayment of the loan is the sole obligation of Halozyme Royalty and is intended to be non-recourse to Halozyme Therapeutics, Inc. and its other subsidiaries.

About Halozyme

Halozyme Therapeutics is a biotechnology company focused on developing and commercializing novel oncology therapies that target the tumor microenvironment. Halozyme’s lead proprietary program, investigational drug PEGPH20, applies a unique approach to targeting solid tumors, allowing increased access of co-administered cancer drug therapies to the tumor. PEGPH20 is currently in development for metastatic pancreatic cancer, non-small cell lung cancer, gastric cancer, metastatic breast cancer and has potential across additional cancers in combination with different types of cancer therapies. In addition to its proprietary product portfolio, Halozyme has established value-driving partnerships with leading pharmaceutical companies including Roche, Baxalta, Pfizer, Janssen, AbbVie and Lilly for its drug delivery platform, ENHANZE™, which enables biologics and small molecule compounds that are currently administered intravenously to be delivered subcutaneously. Halozyme is headquartered in San Diego. For more information visit www.halozyme.com.

Safe Harbor Statement

In addition to historical information, the statements set forth above include forward-looking statements including, without limitation, statements concerning the possible activity, benefits and attributes of PEGPH20, the anticipated timing and amount of costs for clinical trials and expectations of the company’s funding levels that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements are typically, but not always, identified through use of the words “believe,” “enable,” “may,” “will,” “could,” “intends,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “potential,” “possible,” “should,” “continue,” and other words of similar meaning. Actual results could differ materially from the expectations contained in forward-looking statements as a result of several factors, including unexpected expenditures and costs, unexpected results or delays in development and regulatory review, regulatory approval requirements, unexpected adverse events and competitive conditions. These and other factors that may result in differences are discussed in greater detail in Halozyme’s most recent Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission. Except as required by law, Halozyme undertakes no duty to update forward-looking statements to reflect events after the date of this release.

# # #

2

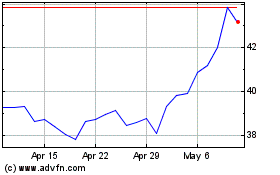

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

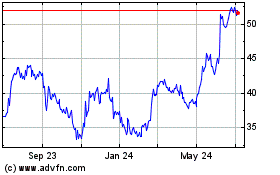

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Apr 2023 to Apr 2024