UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 30, 2015

HALOZYME THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-32335 |

|

88-0488686 |

|

|

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

11388 Sorrento Valley Road, San Diego, California |

|

92121 |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (858) 794-8889

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On December 30, 2015, Halozyme, Inc., a California corporation (“Halozyme”) and wholly-owned subsidiary of Halozyme Therapeutics, Inc., a Delaware corporation, Halozyme Royalty LLC, a Delaware limited liability company and wholly-owned subsidiary of Halozyme (“Halozyme Royalty”), BioPharma Credit Investments IV Sub, LP, a Cayman Islands exempted limited partnership managed by Pharmakon Advisors (“BioPharma”), as collateral agent and a lender, and Athyrium Opportunities II Acquisition LP, as a lender (“Athyrium” and together with BioPharma, collectively, the “Lenders”) entered into a credit agreement (the “Credit Agreement”). Upon the closing of the transaction contemplated by the Credit Agreement, which, subject to the satisfaction of specified closing conditions, is expected to occur within 15 business days of the date of the Credit Agreement (the “Closing Date”):

(i) Halozyme will transfer to Halozyme Royalty, pursuant to a purchase and sale agreement between Halozyme and Halozyme Royalty (the “Purchase Agreement”) the right to receive:

a. royalty payments on the commercial sales of rHuPH20, Halozyme’s proprietary recombinant human hyaluronidase, owed by Baxalta US Inc. and Baxalta GmbH (collectively, “Baxalta”) to Halozyme under that certain Enhanze Technology License and Collaboration Agreement (Biologic), dated as of September 7, 2007, by and between Halozyme and Baxalta, as amended (the “Baxalta License Agreement”) as well as certain royalty-related payments, if any, owed by Baxalta with respect to the underpayment of royalties pursuant to the Baxalta License Agreement and any payments made by Baxalta to Halozyme pursuant to Baxalta’s indemnification obligations under the Baxalta License Agreement (collectively, the “Baxalta Royalty Payments”);

b. royalty payments on the commercial sales of rHuPH20 owed by F. Hoffman-La Roche Ltd. and Hoffmann-La Roche Inc. (collectively, “Roche”) to Halozyme under that certain License and Collaboration Agreement, dated as of December 5, 2006, by and between Halozyme and Roche, as amended (the “Roche License Agreement” and together with the Baxalta License Agreement, the “License Agreements”) as well as certain royalty-related payments, if any, owed by Roche with respect to the underpayment of royalties pursuant to the Roche License Agreement and any payments made by Roche to Halozyme pursuant to Roche’s indemnification obligations under the Roche License Agreement (collectively, the “Roche Royalty Payments” and together with the Baxalta Royalty Payments, the “Royalty Payments”);

(ii) the Lenders will loan to Halozyme Royalty $150 million that, together with accrued interest, will be repaid by Halozyme Royalty from time to time from the proceeds of the Royalty Payments (the “Loan”).

Pursuant to the terms of the Credit Agreement, on the Closing Date, and subject to the satisfaction of specified closing conditions, the Lenders will make the Loan to Halozyme Royalty. The Loan will bear interest at a rate per annum of the three-month LIBOR rate plus 8.75% (with the three-month LIBOR rate being subject to a floor of 0.70% and a cap of 1.50%). The Loan and accrued interest will be repaid by Halozyme Royalty from the proceeds of the Royalty Payments that it receives from time to time from Baxalta and Roche.

Quarterly Royalty Payments from Baxalta and Roche will first be applied to pay (i) escrow fees payable by Halozyme, (ii) certain expenses incurred by the Lenders in connection with the Credit Agreement and related transaction documents, including enforcement of their rights under the Credit Agreement and (iii) expenses incurred by Halozyme enforcing the right to indemnification under the License Agreements. The Credit Agreement provides that none of the remaining Royalty Payments are required to be applied to the Loan prior to January 1, 2017, 50% of

2

the remaining Royalty Payments are required to be applied to the Loan between January 1, 2017 and January 1, 2018 and thereafter all remaining Royalty Payments must be applied to the Loan. Additionally, the amounts available to repay the Loan are subject to caps of $13.75 million per quarter in 2017, $18.75 million per quarter in 2018, $21.25 million per quarter in 2019 and $22.50 million per quarter in 2020. Amounts available to repay the Loan will be applied first, to pay interest and second, to repay principal on the Loan. Any accrued interest that is not paid on any applicable quarterly payment date will be capitalized and added to the principal balance of the Loan. Halozyme Royalty will be entitled to receive and distribute to Halozyme any Royalty Payments that are not required to be applied to the Loan or which are in excess of the foregoing caps.

The final maturity date of the Loan will be, subject to earlier acceleration as further described below, the earlier of (i) the date when principal and interest is paid in full, (ii) the termination of Halozyme Royalty’s right to receive royalties under the License Agreements and (iii) December 31, 2050. Under the terms of the Credit Agreement, at any time after January 1, 2019, Halozyme Royalty may, subject to certain limitations, prepay the outstanding principal of the Loan in whole or in part, at a price equal to 105% of the outstanding principal on the Loan, plus accrued but unpaid interest.

The obligations of Halozyme Royalty under the Credit Agreement to repay the Loan may be accelerated upon the occurrence of certain events of default under the Credit Agreement, including but not limited to:

· if any payment of principal is not made within three days of when such payment is due and payable or otherwise made in accordance with the terms of the Credit Agreement;

· if any representations or warranties made in the Credit Agreement or any other transaction document proves to be incorrect or misleading in any material respect when made;

· if there occurs a default in the performance of affirmative and negative covenants set forth in the Credit Agreement or any other transaction document;

· the failure by either Baxalta or Roche to pay material amounts owed under the License Agreements because of an actual breach or default by Halozyme under the License Agreements;

· the voluntary or involuntary commencement of bankruptcy proceedings by either Halozyme or Halozyme Royalty and other insolvency related defaults;

· any materially adverse effect on the binding nature of any of the transaction documents or the License Agreements; or

· Halozyme shall at any time cease to own, of record and beneficially, 100% of the equity interests in Halozyme Royalty.

The Credit Agreement contains covenants applicable to Halozyme and Halozyme Royalty, including certain visitation, information and audits rights granted to the collateral agent and the lenders and restrictions on the conduct of business, including as it relates to continued compliance with the License Agreements and specified affirmative actions regarding the escrow account established to facilitate payment of Royalty Payments to the Lenders or other specified parties. The Credit Agreement also contains covenants solely applicable to Halozyme Royalty, including restrictions on incurring indebtedness, creating or granting liens, making acquisitions and making specified restricted payments.

In connection with the Loan, Halozyme Royalty will grant a first priority lien and security interest (subject only to permitted liens) in all of its assets and all real, intangible and personal property, including all of its right, title and interest in and to the Royalty Payments. The Loan constitutes an obligation of Halozyme Royalty, and is intended to be non-recourse to Halozyme and Halozyme Therapeutics, Inc.

The foregoing is a summary of the Credit Agreement, does not purport to be complete and is qualified in its entirety by reference to the full text of the Credit Agreement, which Halozyme Therapeutics, Inc. intends to file as an exhibit to its Annual Report on Form 10-K for the fiscal year ending December 31, 2015.

3

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 8.01. Other Events.

On January 4, 2016, Halozyme Therapeutics, Inc. issued a press release announcing the entry into a $150 million credit agreement. The full text of the press release issued in connection with this announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated January 4, 2016 |

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Halozyme Therapeutics, Inc. |

|

|

|

|

|

January 4, 2016 |

By: |

/s/ Harry J. Leonhardt,, Esq. |

|

|

|

Harry J. Leonhardt,, Esq. |

|

|

|

Senior Vice President, General |

|

|

|

Counsel, Chief Compliance Officer |

|

|

|

and Corporate Secretary |

5

Exhibit Index

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press release dated January 4, 2016 |

6

Exhibit 99.1

|

|

Contacts: |

|

|

Jim Mazzola |

|

|

858-704-8122 |

|

|

ir@halozyme.com |

|

|

|

|

|

Chris Burton |

|

|

858-704-8352 |

|

|

ir@halozyme.com |

FOR IMMEDIATE RELEASE

HALOZYME ENTERS INTO AGREEMENT FOR $150 MILLION

NON-DILUTIVE ROYALTY-BACKED DEBT FINANCING

SAN DIEGO, January 4, 2016 — Halozyme Therapeutics, Inc. (NASDAQ: HALO) today announced that it has entered into a $150 million credit agreement, secured by future royalties of ENHANZE products, received only from Halozyme’s collaborations with Roche and Baxalta.

“This transaction allows us to continue to execute our two pillar strategy supporting the initiation of our phase 3 study in pancreatic cancer, ongoing studies in non-small cell lung and gastric cancers, and start of our planned trial in breast cancer in collaboration with Eisai,” said Dr. Helen Torley, president and chief executive officer of Halozyme. “This opportunity for non-dilutive financing further demonstrates how our ENHANZE platform can drive value, and is additive to the $25 million upfront payment from the recently announced licensing and collaboration agreement with Eli Lilly.”

The debt transaction is expected to close in January 2016. The financing will be facilitated through investment funds managed by Pharmakon Advisors and Athyrium Capital Management. “We are pleased to partner with Halozyme in this transaction,” said Martin Friedman, managing member of Pharmakon Advisors. “We believe Halozyme’s ENHANZE technology adds tremendous value to biologic products as demonstrated by the strength of Halozyme’s collaborations with Roche and Baxalta.” As part of the financing structure, Halozyme formed a wholly-owned subsidiary, Halozyme Royalty LLC (“Halozyme Royalty”), which, subject to satisfaction of certain closing conditions, will borrow $150 million at a per annum interest rate of 8.75 percent plus the three-month LIBOR rate. Under the terms of the loan, the three-month LIBOR rate is subject to a floor of 0.70 percent and a cap of 1.50 percent.

On the closing date, Halozyme will transfer to Halozyme Royalty the right to receive certain royalty payments from the commercial sales of Herceptin SC and MabThera SC under Halozyme’s collaboration agreement with Roche and from the commercial sales of Hyqvia under Halozyme’s collaboration agreement with Baxalta. Halozyme will continue to record and report royalty revenues over the term of the loan, using the payments from the collaboration agreements as the source of funds to repay the principal and interest on the loan. Milestone payments received under any current or future collaboration agreements are excluded from the transaction.

Under the terms of the credit agreement, Halozyme Royalty will not be required to apply any of the royalty payments to repay the loan during 2016. All interest accrued in 2016 will be capitalized and added to the outstanding balance of the loan. Halozyme Royalty will only be required to apply 50% of royalty payments received in 2017 to make principal and interest payments subject to quarterly caps set forth in the credit agreement. Thereafter, subject to quarterly caps set forth in the credit agreement, Halozyme Royalty will apply all of the royalty payments received to repay outstanding principal and interest on the loan. If royalty payments available to repay the loan are insufficient to pay accrued interest due on any quarterly payment date, the unpaid interest will be capitalized and added to the outstanding principal balance of the loan. Royalty payments received in excess of the quarterly caps will be retained by Halozyme Royalty and distributed to Halozyme. Loan-related expenses will be deducted from the royalty payments before such amounts are applied to the loan or distributed to Halozyme Royalty.

The final maturity date of the loan will be the earlier of (i) the date when the principal amount and accrued interest are paid in full, (ii) the termination of Halozyme Royalty’s right to receive royalties under the collaboration agreements with Roche and Baxalta and (iii) December 31, 2050. Repayment of the loan is the sole obligation of Halozyme Royalty and is intended to be non-recourse to Halozyme Therapeutics, Inc. and its other subsidiaries.

About Halozyme

Halozyme Therapeutics is a biotechnology company focused on developing and commercializing novel oncology therapies that target the tumor microenvironment. Halozyme’s lead proprietary program, investigational drug PEGPH20, applies a unique approach to targeting solid tumors, allowing increased access of co-administered cancer drug therapies to the tumor. PEGPH20 is currently in development for metastatic pancreatic cancer, non-small cell lung cancer, gastric cancer, metastatic breast cancer and has potential across additional cancers in combination with different types of cancer therapies. In addition to its proprietary product portfolio, Halozyme has established value-driving partnerships with leading pharmaceutical companies including Roche, Baxalta, Pfizer, Janssen, AbbVie and Lilly for its drug delivery platform, ENHANZE™, which enables biologics and small molecule compounds that are currently administered intravenously to be delivered subcutaneously. Halozyme is headquartered in San Diego. For more information visit www.halozyme.com.

# # #

Safe Harbor Statement

In addition to historical information, the statements set forth above include forward-looking statements including, without limitation, statements concerning the possible activity, benefits and attributes of PEGPH20, the expected timing of consummation of the royalty-based financing transaction, the anticipated timing and amount of costs for clinical trials and expectations of the company’s funding levels that involve risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. The forward-looking statements are typically, but not always, identified through use of the words “believe,” “enable,” “may,” “will,” “could,” “intends,” “estimate,” “anticipate,” “plan,” “predict,” “probable,” “potential,” “possible,” “should,” “continue,” and other words of similar meaning. Actual results could differ materially from the expectations contained in forward-looking statements as a result of several factors, including unexpected problems in satisfying conditions to closing the royalty-based financing transaction, unexpected expenditures and costs, unexpected results or delays in development and regulatory review, regulatory approval requirements, unexpected adverse events and competitive conditions. These and other factors that may result in differences are discussed in greater detail in Halozyme’s most recent Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission. Except as required by law, Halozyme undertakes no duty to update forward-looking statements to reflect events after the date of this release.

2

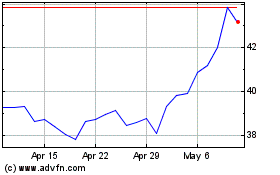

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

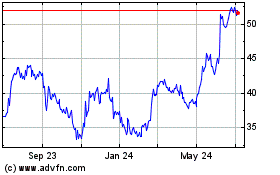

Halozyme Therapeutics (NASDAQ:HALO)

Historical Stock Chart

From Apr 2023 to Apr 2024