Amazon Reports Another Profit

April 28 2016 - 4:50PM

Dow Jones News

Amazon.com Inc. swung to a better-than-expected profit in the

first quarter as it continued its drive to crowd out other

retailers by offering nearly everything in as fast as an hour.

The Seattle online retailer reported a profit of $513 million,

or $1.07 a share, reversing a loss of $57 million, or 12 cents per

share, a year earlier. Analysts were expecting a profit of 58

cents, according to the average estimate compiled by Thomson

Reuters.

Sales of $29.13 billion, up 28% from a year ago, surpassed

Amazon's own forecast of $26.5 billion to $29 billion and analysts'

expectations of $27.98 billion.

The Seattle online retailer was boosted by its Amazon Web

Services cloud computing division, where sales surged 64%. The AWS

unit, which rents computing power to a variety of startups,

government agencies and other corporations, has become a major

driver of sales growth and profits for Amazon.

Shares of Amazon, up 40% over the past year, jumped 11% to $670

in after-hours trading.

Though Amazon has won over Wall Street by consistently bringing

in billions in new sales each quarter, it still suffers from a

reputation as a profit miser as it plows most of its collected

money into product development, hiring and warehouse development.

But the company has delivered profits in four straight quarters,

including its largest profit ever last year, while demonstrating

some spending restraint.

Amazon continues to build new warehouses and streamline shipping

and logistics operations, including making more of its own

deliveries by truck and plane as it challenges United Parcel

Service Inc. and FedEx Corp. Amazon also is working to bring in new

members to its Prime unlimited shipping service with proprietary

television content and monthly-plan offers released just earlier in

April.

AWS sales were $2.57 billion, up from $1.57 billion a year ago

and above the average analyst estimate of $2.54 billion on FactSet.

Operating profit, before stock-based compensation, increased to

$716 million from $265 million.

Chief Executive Jeff Bezos has said he expects AWS to reach $10

billion in sales this year, even as Microsoft Corp., Alphabet Inc.

and others ramp up pressure.

Amazon still spends heavily to get its inventory to customers.

It reported shipping costs rose 42% to $3.28 billion.

Rival eBay Inc. on Tuesday posted its first uptick in sales in

five quarters, though the company said its profits slipped, partly

because of unfavorable exchange rates abroad.

Write to Greg Bensinger at greg.bensinger@wsj.com

(END) Dow Jones Newswires

April 28, 2016 16:35 ET (20:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

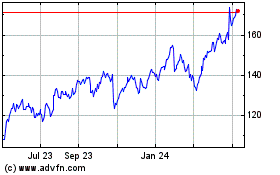

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

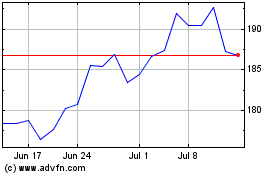

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Apr 2023 to Apr 2024