Chinese Consortium Makes $1.2 Billion Offer for Opera Software -- Update

February 10 2016 - 10:14AM

Dow Jones News

By Rick Carew in Hong Kong and Kjetil Malkenes Hovland in Oslo

A consortium of Chinese companies has bid $1.2 billion in cash

to buy Opera Software ASA, a Norwegian maker of Internet browsers,

the latest sign of how a weakening currency has left China's

acquisition appetite unperturbed.

The Chinese bidders, including security software firm Qihoo 360

Technology Co. and gaming company Beijing Kunlun Tech Co., on

Wednesday offered to purchase Opera shares at 71 Norwegian kroner

apiece ($8.33), a 46% premium compared with their last trading

level.

Trading in Opera shares was suspended Friday amid takeover

rumors. When trading resumed Wednesday, the stock immediately shot

up more than 40%, later trading 37% higher at 67.00 kroner.

The board of Opera said it supported the bid, adding that

shareholders holding a combined 33% interest in the company

intended to tender their shares.

Opera--whose browsers are far less known than rival products

made by Alphabet Inc. or Microsoft Corp.--could gain the financial

muscle it has lacked to place its software in more electronic

devices, analysts said. The company said it expected revenues of

$690 million to $740 million this year, compared with $616 million

in 2015.

The proposed deal is the latest in a wave of outbound

acquisitions by Chinese companies this year amid China's slowing

economy and falling currency. Chinese firms have made more than $60

billion of takeover offers in 2016, including China National

Chemical Corp., known as ChemChina, which recently agreed to pay

$43 billion to buy Swiss pesticide maker Syngenta AG.

The bid comes as Qihoo 360 is in the process of delisting from

New York after agreeing to a buyout by a consortium including its

chairman for $9 billion in December.

Best known for its mobile and PC antivirus software, Qihoo 360

operates China's second-place search engine behind Baidu Inc. along

with a secure Web browser. The company has struggled to compete

with China's technology giants in shifting its business from

desktop to mobile. In the second quarter of 2015, the most recent

quarter for which data is available, mobile accounted for 24% of

the company's total revenue, compared with about half for

Baidu.

For its part, Kunlun bought a 60% stake in gay dating app Grindr

for $93 million in January.

Members of the Chinese consortium also include private-equity

firm Golden Brick Silk Road Fund Management (Shenzhen) LLP, and

Yonglian (Yinchuan) Investment Co.

Mobile-browser company UCWeb, a unit of U.S.-listed Chinese

e-commerce giant Alibaba Group Holding Ltd., falls second to

Alphabet's Chrome with 20% of the world-wide mobile browser market,

according to Internet analytics firm StatCounter. Opera comes in

fourth behind Apple Inc.'s Safari at roughly 10.8% of the mobile

browser market. Including other platforms, such as tablet, desktop

and console browsing, Opera comes in sixth, with a market share of

about 5.7%.

Opera Software was set up in 1994 as a research project within

Norway's biggest telecom provider, Telenor ASA.

"It is naturally sad for Norway to lose yet another outstanding

technology company," said Havard Nilsson, an analyst with financial

firm Carnegie ASA. "However, the company does not hold any specific

national interest."

Morgan Stanley advised Opera Software and Citigroup Inc. advised

the Chinese consortium.

Josh Chin in Beijing contributed to this article.

Write to Rick Carew at rick.carew@wsj.com and Kjetil Malkenes

Hovland at kjetilmalkenes.hovland@wsj.com

(END) Dow Jones Newswires

February 10, 2016 09:59 ET (14:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

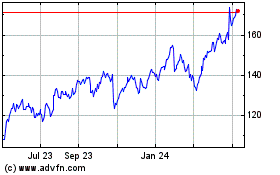

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

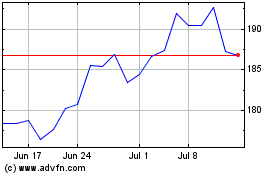

From Mar 2024 to Apr 2024

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Apr 2023 to Apr 2024