Alphabet Reports Rising Profits at Core Google Businesses--Update

February 01 2016 - 5:06PM

Dow Jones News

By Alistair Barr

Alphabet Inc. reported new numbers showing the profitability of

its main Google Internet businesses surged last year.

The new disclosures, reflecting a corporate reorganization late

last year, showed revenue at Google's core Internet

businesses--including search, YouTube and Android--rose 13.5% in

2015 to $74.54 billion. Yearly operating income for these

businesses totaled $23.4 billion, excluding stock-based

compensation, up 23% from $19.01 billion a year earlier.

Alphabet adopted the new structure, and agreed to disclose

additional financial details, in part to respond to investor calls

for more transparency as Google branched into new fields like

health care, transportation and communications. Monday, Alphabet

for the first time reported revenue, operating income and other

metrics for both its main Google businesses and for a group of

moonshots it calls "Other Bets," such as self-driving cars.

For the fourth quarter, the company--as a whole--reported

better-than-expected results.

Alphabet's net income in the December quarter totaled $4.92

billion, or $7.06 a share, up from $4.68 billion, or $6.79 a share,

in the same period a year earlier. Excluding certain expenses,

profit came in at $8.67 a share. On that basis, analysts expected

Alphabet to earn $8.10 per share, according to Thomson Reuters.

Revenue increased 18% to $21.33 billion, which was above the

average analyst estimate of $20.8 billion, according to Thomson

Reuters. Revenue from Google's core businesses gained 18% to $21.18

billion.

Shares of Alphabet rose 5.5% to $813.99 in after-hours

trading.

The new numbers showed that the profitability of Google's core

has increased in recent years, excluding the impact of spending on

the moonshots.

Alphabet's Other Bets generated revenue of $448 million last

year, up 37% from 2014. This moonshot segment lost $3.57 billion

last year, compared with a loss of $1.94 billion in 2014.

Over the past year, Alphabet shares have climbed more than 43%

as its Google business improved mobile search ads and cut costs,

putting it within striking distance of overtaking Apple Inc. to be

the world's most valuable company. Apple shares have fallen roughly

18% in the same period, amid slowing growth in sales of its main

product, the iPhone.

Alphabet Chief Executive and co-founder Larry Page had been

searching for big new businesses that can take over the growth

mantle from its online search money machine. This has produced a

complex company that has struggled to manage so many different

projects.

In contrast, Apple has focused on a few core products, making

the company easier to manage. However, this has left it vulnerable

to fluctuations in demand for iPhones.

During the fourth quarter, Alphabet repurchased 2.4 million

shares at a total price of $1.8 billion.

Write to Alistair Barr at alistair.barr@wsj.com

(END) Dow Jones Newswires

February 01, 2016 16:51 ET (21:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

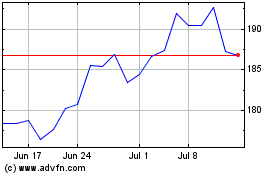

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

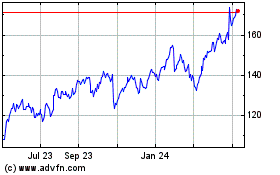

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Apr 2023 to Apr 2024