Gilead Reports Drop in Hepatitis C Drug Revenue

April 28 2016 - 5:00PM

Dow Jones News

Gilead Sciences Inc. said revenue from its hepatitis C drugs

fell 5.6% in the first quarter as sales of Harvoni and Sovaldi fell

short of expectations.

Shares in the company slid 5.3% in after-hours trading.

The Foster City, Calif., biopharmaceutical company dominates the

market for treating hepatitis C, inflammation of the liver that

doesn't always show symptoms. The contagious disease affects about

3.5 million people in the U.S., according to the Centers for

Disease Control and Prevention.

In the first quarter, Gilead said sales of Harvoni, its newer

treatment, fell 16% to $3.02 billion. Analysts were looking for

$3.15 billion, according to FactSet. Meanwhile, Sovaldi sales

jumped 31%, to $1.27 billion, but the increase fell short of

expectations amid soft European markets. Analysts had projected a

34% rise in Sovaldi sales to $1.30 billion.

Gilead is facing growing competition in the booming hepatitis

space. During the quarter, pharmaceutical giant Merck & Co.

launched a new treatment that costs 30% less than rival drugs and

comes in the form of a once-daily pill. Meanwhile, AbbVie Inc.

markets Viekira Pak, a competing and similarly costly treatment it

launched in late 2014.

Gilead has managed to protect its market share, but analysts

have cautioned that pressure is heating up. "People are worried

about the hepatitis C market," said RBC analyst Michael Yoon.

"Prices have gone down [and] there's increased competition," he

said.

The two Hepatitis C drugs make up about two-thirds of Gilead's

business. A chunk of the rest is from the company's HIV treatment,

what it was originally known for.

In all for the quarter, Gilead reported a profit of $3.57

billion, or $2.53 a share, down from $4.33 billion, or $2.76 a

share, a year earlier. Excluding acquisition-related expenses,

stock-based compensation and other items, per-share profit rose to

$3.03 from $2.94.

Total product sales rose 3.7% to $7.68 billion. Analysts

projected $3.15 in adjusted earnings per share on $8.12 billion in

sales, according to Thomson Reuters.

The company backed its guidance for the year, still projecting

$30 billion to $31 billion in total sales.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

April 28, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

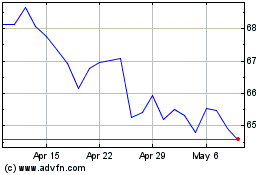

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024