FDA Panel Backs Approval of Liver-Disease Drug

April 07 2016 - 6:40PM

Dow Jones News

A U.S. Food and Drug Administration advisory panel recommended

the agency approve a new drug for the treatment of a rare liver

condition—the latest milestone in a rapidly growing market for

liver-disease drugs.

The FDA's panel of outside advisers voted 17-0 Thursday that

there was substantial evidence to support FDA approval of Intercept

Pharmaceuticals Inc.'s drug, obeticholic acid, to treat a condition

called primary biliary cirrhosis, or PBC. The disease destroys bile

ducts in the liver and can lead to life-threatening complications

requiring liver transplants.

While primary biliary cirrhosis is relatively rare, analysts

believe Intercept's drug has big sales potential because the

company also plans to seek regulatory approval for it to treat a

more common liver disease known as nonalcoholic steatohepatitis, or

NASH. Credit Suisse predicts sales of obeticholic acid could reach

$159 million in 2018 if it is approved for primary biliary

cirrhosis this year, but eventually could rise to annual sales of

$6.5 billion if cleared for NASH.

The drug was the focus of much attention in 2014 when positive

clinical data caused Intercept shares to rally, but then the stock

plunged on concerns that the drug might cause abnormal cholesterol

levels in NASH patients. Those concerns weren't a major part of

Thursday's FDA panel discussion because it focused on the drug's

use to treat primary biliary cirrhosis, and lipid changes in these

patients weren't significant in studies.

The market for liver-disease drugs is booming. Gilead Sciences

Inc. has racked up billions of dollars in sales in recent years for

its new drugs to treat hepatitis C, and Merck & Co. and AbbVie

Inc. have introduced competing hepatitis C drugs. Gilead this week

agreed to pay $400 million, with a potential for $800 million in

future payments, to acquire another company developing a treatment

for NASH.

Last week, the FDA approved a new drug from Jazz Pharmaceuticals

to treat a life-threatening liver condition known as hepatic

veno-occlusive disease.

"These blockbuster markets have attracted drug companies because

these are areas of potential new drug options, huge unmet needs,

and global epidemics," said RBC Capital Markets analyst Michael

Yee.

Intercept is seeking to market its drug to treat primary biliary

cirrhosis patients who don't improve while taking an older drug

called ursodeoxycholic acid, or are unable to tolerate the older

drug. The FDA, which isn't bound by its advisory committees but

often follows their advice, is expected to make a final decision by

May 29.

In a clinical trial, patients who received obeticholic acid had

improved measures of liver function a year after starting

treatment, compared with patients who received a placebo. The most

common side effect was itchy skin, which led some patients to stop

taking the drug.

Intercept was a little-known drug startup until January 2014,

when its share price nearly quadrupled in a single day on news that

obeticholic acid had performed well in a clinical trial of patients

with NASH. The National Institute of Diabetes and Digestive and

Kidney Diseases, which conducted the trial, halted it early because

patients had shown significant improvement.

The NIDDK revealed that it had concerns about abnormal

cholesterol levels in patients taking it in the NASH trial, but

company later said the cholesterol effects appeared to be

manageable.

Intercept shares, which were halted in trading Thursday, closed

Wednesday at $163.83, down more than 60% from their peak in

2014.

The company, which operates out of offices in Manhattan's

Meatpacking District, hasn't turned a profit to date. It was

founded in 2002 by an Italian professor and an American venture

capitalist and had an initial public offering in 2012.

Intercept's clinical study in PBC used a short-term measure of

liver function in patients as a surrogate to predict long-term

benefit, given that the disease progresses slowly over many years.

Members of the advisory panel said Thursday they believed the

surrogate measure was sufficient, but encouraged long-term

follow-up.

"Weighing the risks and benefits in the setting of patients with

PBC, with limited treatment options, I think it's very reasonable

to go forward," Linda A. Feagins, a panelist and associate

professor of medicine at the University of Texas Southwestern

Medical Center, said at the meeting.

Intercept Pharmaceuticals said Thursday it was pleased that the

FDA panel "recognized the unmet need in this population, and the

potential" of its drug to help patients.

Shares of Intercept, up 21% over the past three months, rose

9.6% to $179.50 in after-hours trading.

Write to Peter Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

April 07, 2016 18:25 ET (22:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

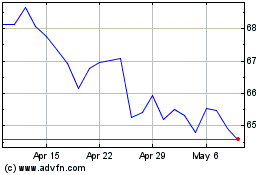

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024