Gilead Hepatitis C Drugs Beat Sales Views

February 02 2016 - 5:30PM

Dow Jones News

Gilead Sciences Inc. said its two hepatitis drugs, Sovaldi and

Harvoni, generated combined sales of $4.89 billion world-wide

during the fourth quarter, topping analysts' expectations for

global sales of $4.45 billion.

The Foster City, Calif., biopharmaceutical company also said its

board authorized the repurchase of an additional $12 billion of its

shares and raised the quarterly dividend by 10%.

The latest share-buyback program will begin after the completion

of Gilead's current $15 billion stock repurchase plan, which had

about $8 billion remaining as of Dec. 31. The company intends to

tap $5 billion of the current buyback program in the next three

months. The quarterly dividend will rise to 47 cents a share, an

increase of four cents a share.

Shares rose 1.5% to $83.94 in recent after-hours trading as

per-share earnings, excluding certain one-time items, and revenue

beat expectations.

For 2016, Gilead projected net product sales of between $30

million and $31 million, lower than the net product sales of $32.15

billion the company reported for 2015.

Gilead, which had been known for its HIV/AIDS treatments,

recently has seen its sales driven by its hepatitis C drugs.

Sovaldi and Harvoni are part of the latest generation of hepatitis

C treatments that studies indicate cure most patients in just a few

months. The two drugs, which have faced criticism over their

pricing, also are facing increased competition.

The Food and Drug Administration, as expected, last month

granted approval for Merck's new hepatitis C treatment, Zepatier.

Last week, AbbVie said it expects $2 billion in sales of its

hepatitis C drug Viekira this year, up from $1.64 billion in

2015.

Sovaldi, which initially received FDA approval in December 2013,

generated sales of $1.55 billion for the quarter ended Dec. 31, a

decline of 11% from a year earlier but an increase from $1.47

billion in the third quarter.

Harvoni, which combines Sovaldi with another drug and was

approved in October 2014, generated fourth-quarter sales of $3.35

billion, up 59% from a year earlier and from $3.33 billion in

three-month period ended Sept 30.

Analysts were expecting global sales of $1.32 billion for

Sovaldi and $3.13 billion for Harvoni, according to a note by

Evercore ISI analyst Mark Schoenebaum.

The latest tally brings the sales total for both drugs to $19.14

billion for 2015.

Over all, Gilead reported a profit of $4.68 billion, or $3.18 a

share, up from $3.49 billion, or $2.18 a share, a year earlier.

Excluding stock-based compensation and other items, per-share

earnings rose to $3.32 from $2.43. Revenue increased 16% to $8.51

billion.

Analysts polled by Thomson Reuters expected per-share profit of

$3 and revenue of $8.14 billion.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

February 02, 2016 17:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

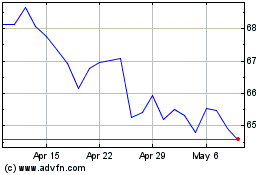

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024