Gilead Knew Hepatitis Drug Price Was High, Senate Says

December 01 2015 - 5:00PM

Dow Jones News

Concluding an 18-month investigation into how drug maker Gilead

Sciences Inc. set the price for its expensive new hepatitis C drug,

the U.S. Senate Finance Committee said the company knew its

$1,000-a-pill launch price would put the treatment out of reach of

many patients and cause "extraordinary problems" for government

health programs.

The 144-page committee report released Tuesday adds to a chorus

of criticism of escalating drug prices from patients, doctors,

insurers and some presidential candidates. U.S. congressional

committees also have opened inquiries into drug-pricing practices

by other companies including Valeant Pharmaceuticals International

Inc., and House Democrats have formed a drug-pricing task force to

explore ways to reduce costs.

The Senate committee reviewed about 20,000 pages of internal

Gilead documents and a trove of data from state Medicaid health

programs, the committee said. The probe primarily focused on

Sovaldi, which was introduced in late 2013, but also included

information about pricing of a second expensive hepatitis C drug

Gilead introduced in October 2014, Harvoni.

Gilead said in a statement that it disagreed with the

committee's conclusions and that the company "responsibly and

thoughtfully priced Sovaldi and Harvoni."

Among the documents cited in the Senate report is an internal

Gilead slide presentation from July 2013, before Sovaldi was

introduced, predicting that 24% of insurers and other U.S. payers

would restrict patient access to Sovaldi if it were priced at

$75,000 per patient, rising to 47% if priced at $90,000. The

presentation also anticipated that patient-advocacy groups and some

doctors would be critical of a price around $80,000.

Another document released by the committee is an email that

Kevin Young, Gilead's executive vice president for commercial

operations, wrote to colleagues in November 2013, shortly before

Sovaldi was cleared for sale by U.S. regulators: "Two sincere

requests…Let's not fold to advocacy pressure in 2014. Let's hold

our position whatever competitors do or whatever the

headlines."

The company ultimately set the price of Sovaldi at about $84,000

per patient for a standard 12-week treatment.

Gilead was "fully aware that as the prices kicked up, the number

of Americans treated and cured would go down," Sen. Ron Wyden, a

Democrat from Oregon and ranking member of the committee, said at a

news conference in Washington Tuesday. "Yet based on our

investigation, the company chose to put revenue ahead of

affordability, of accessibility for millions of patients."

Gilead said Tuesday that the drugs' prices were initially in

line with those for older hepatitis C treatments, and now cost less

because Gilead pays rebates and offers discounts to payers. The

company said it provides financial assistance to help uninsured

patients receive the drugs.

The committee also concluded that Gilead underestimated the

degree of restrictions that health insurers would impose as a

result of the price. State Medicaid programs paid $1.3 billion

before rebates on Sovaldi in 2014, yet less than 2.4% of the

roughly 700,000 Medicaid patients with hepatitis C were treated,

according to the report.

The committee report said Gilead set the price of Sovaldi as a

benchmark to "raise the price floor" for future hepatitis C drugs

including Harvoni, which costs about $94,500 per patient for a

12-week treatment. In clinical trials, both drugs had high rates of

curing patients infected with hepatitis C, a liver-damaging virus

that is spread by contact with the blood of an infected person.

Sen. Charles Grassley, a longtime industry watchdog and member

of the finance committee, and Sen. Wyden had sent a letter to

Gilead Chief Executive John Martin in July 2014 requesting a wide

range of documents about the company's pricing decisions. They said

in the letter that while Sovaldi had potential to help patients

with hepatitis C, its price was straining health-care budgets

including the federal Medicare and Medicaid programs.

Together, Sovaldi and Harvoni generated $14.2 billion in global

sales for the first nine months of 2015.

Gilead acquired an active ingredient shared by both drugs via

its $11 billion purchase in 2011 of Pharmasset, which developed the

drug.

Write to Peter Loftus at peter.loftus@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 16:45 ET (21:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

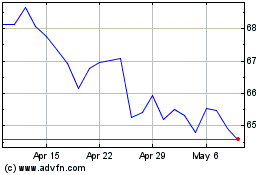

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024