SEC Charges Five With Insider Trading Over 2011 Gilead Deal

September 28 2015 - 1:43PM

Dow Jones News

By Chelsey Dulaney

The Securities and Exchange Commission on Monday charged five

Florida residents, including two lawyers and an accountant, with

insider trading ahead of Gilead Sciences Inc.'s 2011 acquisition of

Pharmasset Inc.

The SEC said attorneys Robert L. Spallina and Donald R. Tescher

and accountant Steven G. Rosen traded on information obtained from

a mutual client who served on the board of Pharmasset. According to

the SEC, the Pharmasset board member and his advisers, including

Messrs. Spallina, Tescher, and Rosen, talked about Pharmasset's

negotiations to sell the company during a meeting about tax and

estate planning on Nov. 8, 2011.

Afterwards, Messrs. Spallina, Tescher, and Rosen allegedly

bought Pharmasset securities.

The SEC said Mr. Spallina also told Thomas J. Palermo, a

financial adviser at a brokerage firm, and Brian H. Markowitz, his

next-door neighbor at the time, about the potential deal with

Gilead, a pharmecuetical company whose drugs include Hepatitis C

treatment Sovaldi. Both then bought shares based on Mr. Spallina's

tips, the SEC said.

After Gilead announced its deal on Nov. 21, 2011, the price of

Pharmasset's stock shot up 84%. The defendants sold off their

holdings, making over $234,000 in illegal profits, the SEC

said.

The defendants have collectively agreed to pay about $489,000 to

settle the charges. The settlements are subject to court

approval.

Mr. Spallina's attorney declined to comment. Attorneys for

Messrs. Tescher, Rosen, Palermo and Markowitz couldn't immediately

be reached for comment.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 28, 2015 13:28 ET (17:28 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

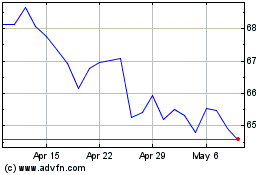

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024