UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): July 28, 2015

GILEAD SCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

DELAWARE (State or other jurisdiction of incorporation) | | 0-19731 (Commission File Number) | | 94-3047598 (I.R.S. Employer Identification No.) |

333 LAKESIDE DRIVE, FOSTER CITY, CALIFORNIA (Address of principal executive offices)

94404 (Zip Code) |

(650) 574-3000 (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

[ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 - FINANCIAL INFORMATION

| |

Item 2.02 | Results of Operations and Financial Condition. |

On July 28, 2015, Gilead Sciences, Inc., a Delaware corporation (Gilead), issued a press release announcing its financial results for the quarter ended June 30, 2015. A copy of the press release is filed as Exhibit 99.1 to this report.

Gilead has presented certain financial information in accordance with U.S. generally accepted accounting principles (GAAP) and also on a non-GAAP basis for the three and six months ended June 30, 2015 and 2014. Management believes this non-GAAP information is useful for investors, when considered in conjunction with Gilead's GAAP financial statements, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead's operating results as reported under GAAP. A reconciliation between GAAP and non-GAAP financial information is provided in the table on pages 7 and 8 of the press release filed as Exhibit 99.1 to this report.

The information in this Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Section 9 - FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

| | |

Exhibit Number | | Description |

99.1 | | Press Release, issued by Gilead Sciences, Inc. on July 28, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

GILEAD SCIENCES, INC. |

(Registrant) |

/s/ Robin L. Washington |

Robin L. Washington Executive Vice President and Chief Financial Officer |

Date: July 28, 2015

Exhibit Index

|

| | |

Exhibit Number | | Description |

99.1 | | Press Release, issued by Gilead Sciences, Inc. on July 28, 2015 |

|

| | | | |

CONTACTS: | Investors | | | Media |

| Robin Washington | | | Amy Flood |

| (650) 522-5688 | | | (650) 522-5643 |

| | | | |

| Patrick O'Brien | | | |

| (650) 522-1936 | | | |

| | | | |

For Immediate Release |

GILEAD SCIENCES ANNOUNCES SECOND QUARTER 2015 FINANCIAL RESULTS

- Over 180,000 U.S. and EU Patients Treated Year-to-Date with Sovaldi or Harvoni -

- Product Sales of $8.1 billion -

- Non-GAAP EPS of $3.15 per share -

- Revised 2015 Full Year Guidance -

Foster City, CA, July 28, 2015 - Gilead Sciences, Inc. (Nasdaq: GILD) announced today its results of operations for the second quarter ended June 30, 2015. The financial results that follow represent a year over year comparison of second quarter 2015 to the second quarter 2014. Total revenues were $8.2 billion in 2015 compared to $6.5 billion in 2014. Net income was $4.5 billion or $2.92 per diluted share in 2015 compared to $3.7 billion or $2.20 per diluted share in 2014. Non-GAAP net income, which excludes amounts related to acquisition, restructuring, stock-based compensation and other, was $4.8 billion or $3.15 per diluted share in 2015 compared to $3.9 billion or $2.36 per diluted share in 2014.

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

(In millions, except per share amounts) | | 2015 | | 2014 | | 2015 | | 2014 |

Product sales | | $ | 8,126 |

| | $ | 6,413 |

| | $ | 15,531 |

| | $ | 11,284 |

|

Royalty, contract and other revenues | | 118 |

| | 122 |

| | 307 |

| | 250 |

|

Total revenues | | $ | 8,244 |

| | $ | 6,535 |

| | $ | 15,838 |

| | $ | 11,534 |

|

| | | | | | | | |

Net income attributable to Gilead | | $ | 4,492 |

| | $ | 3,656 |

| | $ | 8,825 |

| | $ | 5,883 |

|

Non-GAAP net income attributable to Gilead | | $ | 4,845 |

| | $ | 3,929 |

| | $ | 9,449 |

| | $ | 6,417 |

|

| | | | | | | | |

Diluted EPS | | $ | 2.92 |

| | $ | 2.20 |

| | $ | 5.68 |

| | $ | 3.52 |

|

Non-GAAP diluted EPS | | $ | 3.15 |

| | $ | 2.36 |

| | $ | 6.08 |

| | $ | 3.84 |

|

Product Sales

Total product sales for the second quarter of 2015 were $8.1 billion compared to $6.4 billion for the second quarter of 2014. Product sales in the U.S. were $5.6 billion compared to $4.8 billion for the second quarter of 2014. In Europe, product sales were $2.0 billion compared to $1.3 billion for the same period in 2014.

- more -

|

| | |

Gilead Sciences, Inc. 333 Lakeside Drive Foster City, CA 94404 USA | www.gilead.com |

phone (650) 574-3000 facsimile (650) 578-9264 | |

Antiviral Product Sales

Antiviral product sales increased to $7.6 billion for the second quarter of 2015, up from $6.0 billion for the second quarter of 2014 primarily due to sales of Harvoni® (ledipasvir 90 mg/sofosbuvir 400 mg), which was approved in the U.S. and Europe in the fourth quarter of 2014, partially offset by a decrease in sales of Sovaldi® (sofosbuvir 400 mg) due primarily to the uptake in Harvoni.

Other Product Sales

Other product sales, which include Letairis® (ambrisentan), Ranexa® (ranolazine) and AmBisome® (amphotericin B liposome for injection), were $495 million for the second quarter of 2015 compared to $401 million for the second quarter of 2014.

Operating Expenses

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

(In millions) | | 2015 | | 2014 | | 2015 | | 2014 |

Non-GAAP research and development expenses | | $ | 702 |

| | $ | 542 |

| | $ | 1,353 |

| | $ | 1,100 |

|

Non-GAAP selling, general and administrative expenses | | $ | 761 |

| | $ | 570 |

| | $ | 1,361 |

| | $ | 1,070 |

|

| |

Note: | Non-GAAP R&D and SG&A expenses exclude amounts related to acquisition, restructuring, stock-based compensation and other. |

During the second quarter of 2015, compared to the same period in 2014:

| |

• | Non-GAAP research and development (R&D) expenses increased primarily due to the continued progression and expansion of Gilead's clinical studies, particularly Phase 3 studies in the liver disease and oncology areas. |

| |

• | Non-GAAP selling, general and administrative (SG&A) expenses increased primarily due to an increase in Gilead's portion of the branded prescription drug fee along with growth and the geographic expansion in its business. |

Cash, Cash Equivalents and Marketable Securities

As of June 30, 2015, Gilead had $14.7 billion of cash, cash equivalents and marketable securities compared to $14.5 billion as of March 31, 2015. During the second quarter of 2015, Gilead generated $5.7 billion in operating cash flow, utilized $900 million to repurchase 9 million shares under the $15.0 billion share repurchase plan approved in January 2015 and $3.9 billion to retire 46 million warrants related to the 2016 convertible debt. At June 30, 2015, approximately 9 million warrants remain outstanding. Gilead also paid its first cash dividend of $633 million, or $0.43 per share, during the second quarter of 2015.

Revised 2015 Full Year Guidance

Gilead updated its full year 2015 guidance, which it initially provided on February 3, 2015, updated on April 30, 2015, and further revised on July 28, 2015.

|

| | | | |

(In millions, except percentages and per share amounts) | | Initially Provided February 3, 2015 | Updated April 30, 2015 | Updated July 28, 2015 |

Net Product Sales | | $26,000 - $27,000 | $28,000 - $29,000 | $29,000 - $30,000 |

Non-GAAP* | | | | |

Product Gross Margin | | 87% - 90% | 87% - 90% | 88% - 90% |

R&D expenses | | $3,000 - $3,300 | $3,000 - $3,300 | $2,800 - $3,000 |

SG&A expenses | | $3,000 - $3,300 | $3,000 - $3,300 | $3,000 - $3,200 |

Effective Tax Rate | | 18.0% - 20.0% | 18.0% - 20.0% | 17.0% - 18.0% |

| | | | |

Diluted EPS Impact of Acquisition-Related, Restructuring, Stock-Based Compensation Expenses and Other | | $0.82 - $0.87 | $0.82 - $0.87 | $0.82 - $0.87 |

|

* Non-GAAP product gross margin, R&D and SG&A expenses and effective tax rate exclude amounts related to acquisition, restructuring, stock-based compensation and other. |

Corporate Highlights

| |

• | Announced the signing of a definitive agreement to acquire EpiTherapeutics, a privately-held Danish company. EpiTherapeutics generated a library of first-in-class, selective small molecule inhibitors of epigenetic regulation of gene transcription, in particular histone demethylases. |

| |

• | Announced that the company’s Board of Directors declared a quarterly cash dividend of $633 million or $0.43 per share of common stock and paid on June 29, 2015 to all stockholders of record as of the close of business on the record date of June 16, 2015. This was the first quarterly dividend declared under the Board's dividend program announced on February 3, 2015. |

Product & Pipeline Updates Announced by Gilead During the Second Quarter of 2015 Include:

Antiviral Program

| |

• | Announced that Gilead submitted a New Drug Application (NDA) to the U.S. Food and Drug Administration (FDA) for two doses of an investigational fixed-dose combination of emtricitabine and tenofovir alafenamide (F/TAF) (200/10 mg and 200/25 mg) for the treatment of HIV-1 infection in adults and pediatric patients age 12 years and older, in combination with other HIV antiretroviral agents. Under the Prescription Drug User Fee Act, the FDA has set a target action date of April 7, 2016. |

| |

◦ | This was Gilead's second F/TAF-based NDA submitted to the FDA for review. In November 2014, Gilead filed an NDA for an investigational once-daily single tablet regimen containing elvitegravir 150 mg, cobicistat 150 mg, emtricitabine 200 mg and TAF 10 mg (E/C/F/TAF). The FDA has set a target action date of November 5, 2015. |

| |

• | Announced that Gilead’s Marketing Authorization Application (MAA) for two doses of F/TAF (200/10 mg and 200/25 mg) was fully validated and under evaluation by the European Medicines Agency. The data included in the application support the use of F/TAF for the treatment of HIV-1 infection in adults in combination with other HIV antiretroviral agents. |

| |

◦ | Gilead's MAA for E/C/F/TAF was validated on December 23, 2014. |

| |

• | Presented data at the 50th Annual Meeting of the European Association for the Study of the Liver including: |

| |

◦ | Positive results from two studies evaluating the safety and efficacy of investigational uses of sofosbuvir-based regimens in HCV-infected patients with genotypes 2, 3, 4 and 5. Results from the BOSON study of sofosbuvir in combination with ribavirin or with pegylated interferon and ribavirin demonstrated high cure rates across all patients with genotypes 2 and 3. Separately, results from a Phase 2 study demonstrated the safety and efficacy of ledipasvir/sofosbuvir in patients with genotypes 4 or 5 infection. |

| |

◦ | Positive results from several Phase 2 clinical studies evaluating investigational uses of ledipasvir/sofosbuvir and other sofosbuvir-based regimens for the treatment of HCV infection in patients with advanced liver disease, including patients with decompensated cirrhosis, patients with fibrosing cholestatic hepatitis C (a rare and severe form of the disease following liver transplantation) and patients with portal hypertension. |

| |

◦ | Positive pre-clinical data and results from Phase 1 and Phase 2 studies supporting the development of an investigational all-oral, pan-genotypic regimen of sofosbuvir, the investigational NS5A inhibitor velpatasvir (formerly GS-5816) and GS-9857, an investigational NS3/4A protease inhibitor. In pre-clinical studies, GS-9857 demonstrated similarly potent antiviral activity against HCV replicons of all tested genotypes (1-6), as well as an improved resistance profile compared to other HCV protease inhibitors. In a healthy volunteer study, GS-9857 demonstrated a favorable pharmacokinetic profile. Data from a three-day monotherapy study also demonstrated that GS-9857 was well-tolerated for HCV patients with genotypes 1, 2, 3 and 4 at the 100 mg dose. |

Oncology Program

| |

• | Announced positive results from the Phase 3 clinical Study 119 of an investigational use of Zydelig® (idelalisib) in combination with ofatumumab in previously-treated patients with chronic lymphocytic leukemia. In Study 119, there was a 73-percent reduction in the risk of disease progression or death in patients receiving Zydelig in combination with ofatumumab compared to ofatumumab alone. These results were presented at the 51st Annual Meeting of the American Society of Clinical Oncology. |

Conference Call

At 4:30 p.m. Eastern Time today, Gilead's management will host a conference call and a simultaneous webcast to discuss results from its second quarter 2015 as well as provide a general business update. The live webcast of the call can be accessed at the company's Investors page at www.gilead.com/investors. Please connect to the company's website at least 15 minutes prior to the start of the call to ensure adequate time for any software download that may be required to listen to the webcast. Alternatively, please call 1-877-359-9508 (U.S.) or 1-224-357-2393 (international) and dial the conference ID 73361664 to access the call.

A replay of the webcast will be archived on the company's website for one year, and a phone replay will be available approximately two hours following the call through July 30, 2015. To access the phone replay, please call 1-855-859-2056 (U.S.) or 1-404-537-3406 (international) and dial the conference ID 73361664.

About Gilead

Gilead Sciences is a biopharmaceutical company that discovers, develops and commercializes innovative therapeutics in areas of unmet medical need. The company's mission is to advance the care of patients suffering from life-threatening diseases. Gilead has operations in more than 30 countries worldwide, with headquarters in Foster City, California.

Non-GAAP Financial Information

Gilead has presented certain financial information in accordance with U.S. generally accepted accounting principles (GAAP) and also on a non-GAAP basis. Management believes this non-GAAP information is useful for investors, when considered in conjunction with Gilead's GAAP financial statements, because management uses such information internally for its operating, budgeting and financial planning purposes. Non-GAAP information is not prepared under a comprehensive set of accounting rules and should only be used to supplement an understanding of Gilead's operating results as reported under GAAP. A reconciliation between GAAP and non-GAAP financial information is provided in the tables on pages 7 and 8.

Forward-looking Statements

Statements included in this press release that are not historical in nature are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Gilead cautions readers that forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include: Gilead's ability to achieve its anticipated full year 2015 financial results; Gilead's ability to sustain growth in revenues for its antiviral and other programs; availability of funding for state AIDS Drug Assistance Programs (ADAPs); continued fluctuations in ADAP purchases driven by federal and state grant cycles which may not mirror patient demand and may cause fluctuations in Gilead's earnings; the possibility of unfavorable results from clinical trials involving sofosbuvir-containing products, including the pan-genotypic regimen of sofosbuvir, velpatasvir and GS-9857; Gilead's ability to initiate clinical trials in its currently anticipated timeframes; the levels of inventory held by wholesalers and retailers which may cause fluctuations in Gilead's earnings; Gilead's ability to submit new drug applications for new product candidates in the timelines currently anticipated; Gilead's ability to receive regulatory approvals in a timely manner or at all, for new and current products, including F/TAF and E/C/F/TAF; Gilead's ability to successfully commercialize its products; the risk that physicians and patients may not see advantages of these products over other therapies and may therefore be reluctant to prescribe the products; the risk that estimates of patients with HCV or anticipated patient demand may not be accurate; the risk that private and public payers may be reluctant to provide, or continue to provide, coverage or reimbursement for new products, including Sovaldi and Harvoni; Gilead's ability to successfully develop its oncology, inflammation, cardiovascular and respiratory programs, including the compounds purchased from EpiTherapeutics; safety and efficacy data from clinical studies may not warrant further development of Gilead's product candidates, including the pan-genotypic regimen of sofosbuvir, velpatasvir and GS-9857; the potential for additional austerity measures in European countries that may increase the amount of discount required on Gilead's products; Gilead's ability to complete its share repurchase program due to changes in its stock price, corporate or other market conditions; Gilead’s ability to pay dividends under its dividend program and the risk that its Board of Directors may reduce the amount of the dividend; fluctuations in the foreign exchange rate of the U.S. dollar that may cause an unfavorable foreign currency exchange impact on Gilead's future revenues and pre-tax earnings; and other risks identified from time to time in Gilead's reports filed with the U.S. Securities and Exchange Commission (SEC). In addition, Gilead makes estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses and related disclosures. Gilead bases its estimates on historical experience and on various other market specific and other relevant assumptions that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ significantly from these estimates. You are urged to consider statements that include the words may, will, would, could, should, might, believes, estimates, projects, potential, expects, plans, anticipates, intends, continues, forecast, designed, goal, or the negative of those words or other comparable words to be uncertain and forward-looking. Gilead directs readers to its press releases, Quarterly Report on Form 10-Q for the quarter ended March 31, 2015 and other subsequent disclosure documents filed with the SEC. Gilead claims the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements.

All forward-looking statements are based on information currently available to Gilead, and Gilead assumes no obligation to update any such forward-looking statements.

# # #

Gilead owns or has rights to various trademarks, copyrights and trade names used in our business, including the following: GILEAD®, GILEAD SCIENCES®, HARVONI®, SOVALDI®, TRUVADA®, STRIBILD®, COMPLERA®, EVIPLERA®, VIREAD®, LETAIRIS®, RANEXA®, AMBISOME®, ZYDELIG®, EMTRIVA®, TYBOST®, HEPSERA®, VITEKTA®, CAYSTON®, VOLIBRIS®, and RAPISCAN®.

ATRIPLA® is a registered trademark belonging to Bristol-Myers Squibb & Gilead Sciences, LLC. LEXISCAN® is a registered trademark belonging to Astellas U.S. LLC. MACUGEN® is a registered trademark belonging to Eyetech, Inc. SUSTIVA® is a registered trademark of Bristol-Myers Squibb Pharma Company. TAMIFLU® is a registered trademark belonging to Hoffmann-La Roche Inc.

For more information on Gilead Sciences, Inc., please visit www.gilead.com or

call the Gilead Public Affairs Department at 1-800-GILEAD-5 (1-800-445-3235).

GILEAD SCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(in millions, except per share amounts)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | | |

Product sales | | $ | 8,126 |

| | $ | 6,413 |

| | $ | 15,531 |

| | $ | 11,284 |

|

Royalty, contract and other revenues | | 118 |

| | 122 |

| | 307 |

| | 250 |

|

Total revenues | | 8,244 |

| | 6,535 |

| | 15,838 |

| | 11,534 |

|

Costs and expenses: | | | | | | | | |

Cost of goods sold | | 998 |

| | 925 |

| | 1,880 |

| | 1,738 |

|

Research and development expenses | | 818 |

| | 584 |

| | 1,514 |

| | 1,179 |

|

Selling, general and administrative expenses | | 812 |

| | 614 |

| | 1,457 |

| | 1,162 |

|

Total costs and expenses | | 2,628 |

| | 2,123 |

| | 4,851 |

| | 4,079 |

|

Income from operations | | 5,616 |

| | 4,412 |

| | 10,987 |

| | 7,455 |

|

Interest expense | | (140 | ) | | (102 | ) | | (293 | ) | | (178 | ) |

Other income (expense), net | | 35 |

| | (4 | ) | | 56 |

| | (22 | ) |

Income before provision for income taxes | | 5,511 |

| | 4,306 |

| | 10,750 |

| | 7,255 |

|

Provision for income taxes | | 1,014 |

| | 656 |

| | 1,921 |

| | 1,382 |

|

Net income | | 4,497 |

| | 3,650 |

| | 8,829 |

| | 5,873 |

|

Net income (loss) attributable to noncontrolling interest | | 5 |

| | (6 | ) | | 4 |

| | (10 | ) |

Net income attributable to Gilead | | $ | 4,492 |

| | $ | 3,656 |

| | $ | 8,825 |

| | $ | 5,883 |

|

Net income per share attributable to Gilead common stockholders - basic | | $ | 3.05 |

| | $ | 2.39 |

| | $ | 5.96 |

| | $ | 3.83 |

|

Net income per share attributable to Gilead common stockholders - diluted | | $ | 2.92 |

| | $ | 2.20 |

| | $ | 5.68 |

| | $ | 3.52 |

|

Shares used in per share calculation - basic | | 1,472 |

| | 1,533 |

| | 1,480 |

| | 1,535 |

|

Shares used in per share calculation - diluted | | 1,540 |

| | 1,664 |

| | 1,555 |

| | 1,672 |

|

Cash dividends declared per share | | $ | 0.43 |

| | $ | — |

| | $ | 0.43 |

| | $ | — |

|

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION

(unaudited)

(in millions, except percentages and per share amounts)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Cost of goods sold reconciliation: | | | | | | | | |

GAAP cost of goods sold | | $ | 998 |

| | $ | 925 |

| | $ | 1,880 |

| | $ | 1,738 |

|

Stock-based compensation expenses | | (3 | ) | | (2 | ) | | (6 | ) | | (5 | ) |

Acquisition related-amortization of purchased intangibles | | (207 | ) | | (200 | ) | | (413 | ) | | (399 | ) |

Variable interest entity consolidated costs(1) | | — |

| | — |

| | 1 |

| | — |

|

Non-GAAP cost of goods sold | | $ | 788 |

| | $ | 723 |

| | $ | 1,462 |

| | $ | 1,334 |

|

| | | | | | | | |

Product gross margin reconciliation: | | | | | | | | |

GAAP product gross margin | | 87.7 | % | | 85.6 | % | | 87.9 | % | | 84.6 | % |

Acquisition related-amortization of purchased intangibles | | 2.5 | % | | 3.1 | % | | 2.7 | % | | 3.5 | % |

Non-GAAP product gross margin(2) | | 90.3 | % | | 88.7 | % | | 90.6 | % | | 88.2 | % |

| | | | | | | | |

Research and development expenses reconciliation: | | | | | | | | |

GAAP research and development expenses | | $ | 818 |

| | $ | 584 |

| | $ | 1,514 |

| | $ | 1,179 |

|

Stock-based compensation expenses | | (42 | ) | | (37 | ) | | (84 | ) | | (71 | ) |

Acquisition related expenses | | (67 | ) | | — |

| | (67 | ) | | — |

|

Acquisition related-contingent consideration remeasurement | | (7 | ) | | (5 | ) | | (10 | ) | | (8 | ) |

Non-GAAP research and development expenses | | $ | 702 |

| | $ | 542 |

| | $ | 1,353 |

| | $ | 1,100 |

|

| | | | | | | | |

Selling, general and administrative expenses reconciliation: | | | | | | | | |

GAAP selling, general and administrative expenses | | $ | 812 |

| | $ | 614 |

| | $ | 1,457 |

| | $ | 1,162 |

|

Stock-based compensation expenses | | (51 | ) | | (44 | ) | | (98 | ) | | (90 | ) |

Restructuring expenses | | — |

| | — |

| | 2 |

| | — |

|

Acquisition related-amortization of purchased intangibles | | — |

| | — |

| | — |

| | (2 | ) |

Non-GAAP selling, general and administrative expenses | | $ | 761 |

| | $ | 570 |

| | $ | 1,361 |

| | $ | 1,070 |

|

| | | | | | | | |

Operating margin reconciliation: | | | | | | | | |

GAAP operating margin | | 68.1 | % | | 67.5 | % | | 69.4 | % | | 64.6 | % |

Stock-based compensation expenses | | 1.2 | % | | 1.3 | % | | 1.2 | % | | 1.4 | % |

Acquisition related expenses | | 0.8 | % | | — | % | | 0.4 | % | | — | % |

Acquisition related-amortization of purchased intangibles | | 2.5 | % | | 3.1 | % | | 2.6 | % | | 3.5 | % |

Acquisition related-contingent consideration remeasurement | | 0.1 | % | | 0.1 | % | | 0.1 | % | | 0.1 | % |

Non-GAAP operating margin(2) | | 72.7 | % | | 71.9 | % | | 73.6 | % | | 69.6 | % |

| | | | | | | | |

Other income (expense) reconciliation: | | | | | | | | |

GAAP other income (expense), net | | $ | 35 |

| | $ | (4 | ) | | $ | 56 |

| | $ | (22 | ) |

Acquisition related-transaction costs | | — |

| | — |

| | — |

| | (2 | ) |

Non-GAAP other income (expense), net | | $ | 35 |

| | $ | (4 | ) | | $ | 56 |

| | $ | (24 | ) |

| | | | | | | | |

Notes: | | | | | | | | |

Immaterial amounts are not presented in the tables above | | | | | | | | |

(1) Consolidation of a contract manufacturer | | | | | | | | |

(2) Amounts may not sum due to rounding | | | | | | | | |

GILEAD SCIENCES, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL INFORMATION - (Continued)

(unaudited)

(in millions, except percentages and per share amounts)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Effective tax rate reconciliation: | | | | | | | | |

GAAP effective tax rate | | 18.4 | % | | 15.2 | % | | 17.9 | % | | 19.1 | % |

Acquisition related expenses/transaction costs | | (0.2 | )% | | — | % | | (0.1 | )% | | — | % |

Acquisition related-amortization of purchased intangibles | | (0.5 | )% | | (0.6 | )% | | (0.5 | )% | | (0.9 | )% |

Non-GAAP effective tax rate(1) | | 17.7 | % | | 14.6 | % | | 17.3 | % | | 18.2 | % |

| | | | | | | | |

Net income attributable to Gilead reconciliation: | | | | | | | | |

GAAP net income attributable to Gilead | | $ | 4,492 |

| | $ | 3,656 |

| | $ | 8,825 |

| | $ | 5,883 |

|

Stock-based compensation expenses | | 71 |

| | 72 |

| | 140 |

| | 136 |

|

Restructuring expenses | | — |

| | — |

| | (2 | ) | | — |

|

Acquisition related expenses/transaction costs | | 67 |

| | — |

| | 67 |

| | (1 | ) |

Acquisition related-amortization of purchased intangibles | | 202 |

| | 196 |

| | 403 |

| | 391 |

|

Acquisition related-contingent consideration remeasurement | | 7 |

| | 5 |

| | 10 |

| | 8 |

|

Variable interest entity consolidated costs(2) | | 6 |

| | — |

| | 6 |

| | — |

|

Non-GAAP net income attributable to Gilead | | $ | 4,845 |

| | $ | 3,929 |

| | $ | 9,449 |

| | $ | 6,417 |

|

| | | | | | | | |

Diluted earnings per share reconciliation: | | | | | | | | |

GAAP diluted earnings per share | | $ | 2.92 |

| | $ | 2.20 |

| | $ | 5.68 |

| | $ | 3.52 |

|

Stock-based compensation expenses | | 0.05 |

| | 0.04 |

| | 0.09 |

| | 0.08 |

|

Acquisition related expenses/transaction costs | | 0.04 |

| | — |

| | 0.04 |

| | — |

|

Acquisition related-amortization of purchased intangibles | | 0.13 |

| | 0.12 |

| | 0.26 |

| | 0.23 |

|

Acquisition related-contingent consideration remeasurement | | — |

| | — |

| | 0.01 |

| | — |

|

Non-GAAP diluted earnings per share(1) | | $ | 3.15 |

| | $ | 2.36 |

| | $ | 6.08 |

| | $ | 3.84 |

|

| | | | | | | | |

Shares used in per share calculation (diluted) reconciliation: | | | | | | | | |

GAAP shares used in per share calculation (diluted) | | 1,540 |

| | 1,664 |

| | 1,555 |

| | 1,672 |

|

Share impact of current stock-based compensation rules | | — |

| | (1 | ) | | — |

| | (1 | ) |

Non-GAAP shares used in per share calculation (diluted) | | 1,540 |

| | 1,663 |

| | 1,555 |

| | 1,671 |

|

| | | | | | | | |

Non-GAAP adjustment summary: | | | | | | | | |

Cost of goods sold adjustments | | $ | 210 |

| | $ | 202 |

| | $ | 418 |

| | $ | 404 |

|

Research and development expenses adjustments | | 116 |

| | 42 |

| | 161 |

| | 79 |

|

Selling, general and administrative expenses adjustments | | 51 |

| | 44 |

| | 96 |

| | 92 |

|

Other income (expense) adjustments | | — |

| | — |

| | — |

| | (2 | ) |

Total non-GAAP adjustments before tax | | 377 |

| | 288 |

| | 675 |

| | 573 |

|

Income tax effect | | (30 | ) | | (14 | ) | | (58 | ) | | (38 | ) |

Variable interest entity consolidated costs(2) | | 6 |

| | — |

| | 7 |

| | — |

|

Total non-GAAP adjustments after tax attributable to Gilead | | $ | 353 |

| | $ | 274 |

| | $ | 624 |

| | $ | 535 |

|

| | | | | | | | |

Notes: | | | | | | | | |

Immaterial amounts are not presented in the tables above | | | | | | | | |

(1) Amounts may not sum due to rounding | | | | | | | | |

(2) Consolidation of a contract manufacturer | | | | | | | | |

GILEAD SCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

(in millions)

|

| | | | | | | | |

| | June 30, | | December 31, |

| | 2015 | | 2014(1) |

| | | | |

Cash, cash equivalents and marketable securities | | $ | 14,667 |

| | $ | 11,726 |

|

Accounts receivable, net | | 5,331 |

| | 4,635 |

|

Inventories | | 2,039 |

| | 1,386 |

|

Property, plant and equipment, net | | 1,899 |

| | 1,674 |

|

Intangible assets, net | | 10,660 |

| | 11,073 |

|

Goodwill | | 1,172 |

| | 1,172 |

|

Other assets | | 3,399 |

| | 2,998 |

|

Total assets | | $ | 39,167 |

| | $ | 34,664 |

|

| | | | |

Current liabilities | | $ | 8,925 |

| | $ | 5,761 |

|

Long-term liabilities | | 13,601 |

| | 13,069 |

|

Equity component of currently redeemable convertible notes | | 7 |

| | 15 |

|

Stockholders’ equity(2) | | 16,634 |

| | 15,819 |

|

Total liabilities and stockholders’ equity | | $ | 39,167 |

| | $ | 34,664 |

|

| | | | |

Notes: | | | | |

(1) Derived from the audited consolidated financial statements as of December 31, 2014. |

(2) As of June 30, 2015, there were 1,473 million shares of common stock issued and outstanding. |

GILEAD SCIENCES, INC.

PRODUCT SALES SUMMARY

(unaudited)

(in millions)

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 30, | | June 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Antiviral products: | | | | | | | | |

Harvoni – U.S. | | $ | 2,826 |

| | $ | — |

| | $ | 5,842 |

| | $ | — |

|

Harvoni – Europe | | 623 |

| | — |

| | 1,100 |

| | — |

|

Harvoni – Other International | | 159 |

| | — |

| | 245 |

| | — |

|

| | 3,608 |

| | — |

| | 7,187 |

| | — |

|

| | | | | | | | |

Sovaldi – U.S. | | 615 |

| | 3,031 |

| | 1,036 |

| | 5,129 |

|

Sovaldi – Europe | | 522 |

| | 401 |

| | 1,005 |

| | 564 |

|

Sovaldi – Other International | | 154 |

| | 49 |

| | 222 |

| | 62 |

|

| | 1,291 |

| | 3,481 |

| | 2,263 |

| | 5,755 |

|

| | | | | | | | |

Truvada – U.S. | | 500 |

| | 399 |

| | 909 |

| | 767 |

|

Truvada – Europe | | 277 |

| | 338 |

| | 578 |

| | 661 |

|

Truvada – Other International | | 72 |

| | 69 |

| | 133 |

| | 138 |

|

| | 849 |

| | 806 |

| | 1,620 |

| | 1,566 |

|

| | | | | | | | |

Atripla – U.S. | | 549 |

| | 578 |

| | 1,043 |

| | 1,068 |

|

Atripla – Europe | | 178 |

| | 234 |

| | 372 |

| | 471 |

|

Atripla – Other International | | 55 |

| | 58 |

| | 101 |

| | 111 |

|

| | 782 |

| | 870 |

| | 1,516 |

| | 1,650 |

|

| | | | | | | | |

Stribild – U.S. | | 364 |

| | 230 |

| | 646 |

| | 417 |

|

Stribild – Europe | | 65 |

| | 31 |

| | 126 |

| | 55 |

|

Stribild – Other International | | 18 |

| | 9 |

| | 31 |

| | 13 |

|

| | 447 |

| | 270 |

| | 803 |

| | 485 |

|

| | | | | | | | |

Complera / Eviplera – U.S. | | 207 |

| | 153 |

| | 370 |

| | 284 |

|

Complera / Eviplera – Europe | | 145 |

| | 132 |

| | 290 |

| | 241 |

|

Complera / Eviplera – Other International | | 15 |

| | 14 |

| | 27 |

| | 25 |

|

| | 367 |

| | 299 |

| | 687 |

| | 550 |

|

| | | | | | | | |

Viread – U.S. | | 134 |

| | 117 |

| | 234 |

| | 198 |

|

Viread – Europe | | 77 |

| | 88 |

| | 157 |

| | 172 |

|

Viread – Other International | | 60 |

| | 56 |

| | 114 |

| | 102 |

|

| | 271 |

| | 261 |

| | 505 |

| | 472 |

|

| | | | | | | | |

Other Antiviral – U.S. | | 8 |

| | 13 |

| | 22 |

| | 20 |

|

Other Antiviral – Europe | | 7 |

| | 10 |

| | 14 |

| | 19 |

|

Other Antiviral – Other International | | 1 |

| | 2 |

| | 2 |

| | 4 |

|

| | 16 |

| | 25 |

| | 38 |

| | 43 |

|

| | | | | | | | |

Total antiviral products – U.S. | | 5,203 |

| | 4,521 |

| | 10,102 |

| | 7,883 |

|

Total antiviral products – Europe | | 1,894 |

| | 1,234 |

| | 3,642 |

| | 2,183 |

|

Total antiviral products – Other International | | 534 |

| | 257 |

| | 875 |

| | 455 |

|

| | 7,631 |

| | 6,012 |

| | 14,619 |

| | 10,521 |

|

Other products: | | | | | | | | |

Letairis | | 176 |

| | 145 |

| | 327 |

| | 268 |

|

Ranexa | | 141 |

| | 123 |

| | 258 |

| | 234 |

|

AmBisome | | 103 |

| | 94 |

| | 188 |

| | 186 |

|

Zydelig | | 30 |

| | — |

| | 56 |

| | — |

|

Other | | 45 |

| | 39 |

| | 83 |

| | 75 |

|

| | 495 |

| | 401 |

| | 912 |

| | 763 |

|

| | | | | | | | |

Total product sales | | $ | 8,126 |

| | $ | 6,413 |

| | $ | 15,531 |

| | $ | 11,284 |

|

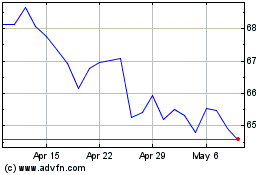

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gilead Sciences (NASDAQ:GILD)

Historical Stock Chart

From Apr 2023 to Apr 2024