SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2015

Commission File Number: 000-30540

GIGAMEDIA

LIMITED

8F, No. 22, Lane 407, Section 2, Tiding Boulevard

Neihu District

Taipei,

Taiwan (R.O.C.)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form

20-F x Form 40-F ¨

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ¨ No

x

(If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b) :82- .)

GIGAMEDIA LIMITED is submitting under cover of Form 6-K:

| |

1. |

GigaMedia Announces Third-Quarter 2015 Financial Results (attached hereto as Exhibit 99.1) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

GigaMedia Limited |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: November 4, 2015 |

|

|

|

By: |

|

/s/ Collin Hwang |

|

|

|

|

(Signature) |

|

|

|

|

Name: |

|

Collin Hwang |

|

|

|

|

Title: |

|

Chief Executive Officer |

Exhibit 99.1

|

|

|

| FOR IMMEDIATE RELEASE |

|

For further information contact: |

|

|

|

|

Amanda Chang |

|

|

Investor Relations Department |

|

|

Country/City Code 8862 Tel: 2656-8080 |

|

|

amanda.chang@gigamedia.com.tw |

GigaMedia Announces Third-Quarter 2015 Financial Results

TAIPEI, Taiwan, November 4, 2015 – GigaMedia Limited (NASDAQ: GIGM) today announced its third-quarter 2015 unaudited financial results.

Message from Management

For the third quarter of 2015,

the sales revenues were $2.0 million. The contribution made by the mobile games, the social casino games and the cloud computing business accounted for about 52.4%, 30.4% and 17.2% respectively.

In the third quarter, the Company streamlined the mobile gaming business. The Company reviewed all the existing games, halted the ones with weak monetization

and repackaged the ones considered better monetization for re-launch. It is expected to see its margin improve by the end of this year.

In addition to

the social casino games platform, it has started to hold the online qualifying tournaments of the World Series of Mahjong 2015. It is also a good opportunity to testify the quality and loading capacity of this in-house developed platform.

With regard to cloud computing business, for the nine months of 2015 compared with the same period of 2014, the business grew by approximately 128% and the

gross loss narrowed. For the third quarter of 2015 compared with the previous quarter, although the business went down, the Company believes that the cloud computing business will outperform its last year performance.

Last but not least, due to the recent slowdown of global economy and stock market, management decided to terminate the acquisition of Strawberry Cosmetics. In

consequence of the termination of the acquisition, the Company had to pay $2.0 million consideration to Strawberry Cosmetics as stated in the announcement dated October 7th, 2015 and the $2.0

million payment will impact its 4Q 2015 financial results.

Before the market rebounds, management will remain conservative in investment. At the present

stage, management will make more effort to streamline the current operations, continue to maintain a healthy financial structure and meanwhile, look for other potential investment opportunities in Asia.

Consolidated Financial Results

GigaMedia Limited is a diversified provider of online games and cloud computing services. GigaMedia’s online games business FunTown develops and operates

a suite of games in Taiwan and Hong Kong, with focus on browser/mobile games and social casino games. GigaMedia’s cloud computing business GigaCloud was launched in early April 2013 and is focused on providing small and medium-sized enterprises

in Greater China with critical communications services and IT solutions that increase flexibility, efficiency and competitiveness.

Unaudited consolidated

results of GigaMedia are summarized in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GIGAMEDIA 3Q15 UNAUDITED CONSOLIDATED FINANCIAL RESULTS |

|

| (unaudited, all figures in US$ thousands, except per share amounts) |

|

3Q15 |

|

|

2Q15 |

|

|

Change

(%) |

|

|

3Q15 |

|

|

3Q14 |

|

|

Change

(%) |

|

|

9M15 |

|

|

9M14 |

|

|

Change

(%) |

|

| Revenues |

|

|

2,006 |

|

|

|

2,728 |

|

|

|

-26.5 |

% |

|

|

2,006 |

|

|

|

2,472 |

|

|

|

-18.9 |

% |

|

|

7,895 |

|

|

|

7,119 |

|

|

|

10.9 |

% |

| Gross Profit/ Loss |

|

|

-598 |

|

|

|

217 |

|

|

|

-375.6 |

% |

|

|

-598 |

|

|

|

205 |

|

|

|

-391.7 |

% |

|

|

358 |

|

|

|

2,038 |

|

|

|

-82.4 |

% |

| Loss from Operations |

|

|

-5,240 |

|

|

|

-3,801 |

|

|

|

-37.9 |

% |

|

|

-5,240 |

|

|

|

-3,631 |

|

|

|

-44.3 |

% |

|

|

-12,457 |

|

|

|

-9,143 |

|

|

|

-36.2 |

% |

| Net Income/ Loss Attributable to GigaMedia |

|

|

-301 |

|

|

|

1,377 |

|

|

|

-121.9 |

% |

|

|

-301 |

|

|

|

-4,839 |

|

|

|

93.8 |

% |

|

|

6,315 |

|

|

|

-10,592 |

|

|

|

159.6 |

% |

| Net Income/ Loss Per Share Attributable to GigaMedia, Diluted |

|

|

-0.01 |

|

|

|

0.02 |

|

|

|

-150.0 |

% |

|

|

-0.01 |

|

|

|

-0.09 |

|

|

|

88.9 |

% |

|

|

0.11 |

|

|

|

-0.20 |

|

|

|

155.0 |

% |

| EBITDA (A) |

|

|

-207 |

|

|

|

1,463 |

|

|

|

-114.1 |

% |

|

|

-207 |

|

|

|

-4,589 |

|

|

|

95.5 |

% |

|

|

6,591 |

|

|

|

-9,844 |

|

|

|

167.0 |

% |

| Cash and Marketable Securities-Current |

|

|

74,824 |

|

|

|

68,305 |

|

|

|

9.5 |

% |

|

|

74,824 |

|

|

|

56,940 |

|

|

|

31.4 |

% |

|

|

74,824 |

|

|

|

56,940 |

|

|

|

31.4 |

% |

| (A) |

EBITDA (earnings before interest, taxes, depreciation, and amortization) is provided as a supplement to results provided in accordance with U.S. generally accepted accounting principles (“GAAP”). (See,

“Use of Non-GAAP Measures,” for more details.) |

Financial Highlights

9M2015

| • |

|

Operating revenues reached to $7.9 million, a 10.9% increase compared with the same period of 2014 attributable to the growth of cloud computing business. |

| • |

|

Operating expenses increased resulting from an increase of selling and marketing expenses for more mobile games launched, particularly in the first half of 2015. |

| • |

|

Net income was $6.3 million primarily due to the capital gain on disposal of marketable securities. |

3Q2015

| • |

|

Consolidated revenues were $ 2.0 million, dropped by 26.5% quarter-on-quarter and 18.9% quarter-over-quarter respectively mainly due to a decline of the overall business. |

| • |

|

Gross profit reported a loss of $0.6 million primarily resulting from the expenses associated with licensing fees and outsource. |

| • |

|

Consolidated operating expenses were $4.6 million in 3Q15, up by 15.0% quarter-on-quarter and 21.0% quarter-over-quarter mainly due to an increase on general and administrative expenses, including the expenses

related to Strawberry Cosmetics Acquisition Proposal. |

| • |

|

Consolidated non-operating income was $5.0 million, slightly decreased by 2.8% due to investment loss recognized under equity method and foreign exchange loss. |

| • |

|

Net loss was $0.3 million mainly due to a reduction of operating revenues and an increase of operating expenses. |

| • |

|

Cash and cash equivalents in 3Q15 accounted for $74.8 million, increased by 9.5% from $68.3 million in 2Q15 resulting from a disposal of marketable securities-noncurrent. |

Financial Position

GigaMedia maintained its solid

financial position with cash and cash equivalents, marketable securities-current and restricted cash accounted for $75.8 million as of September 30, 2015, or approximately $1.37 per share. In consideration of short-term borrowings, its net cash

was estimated at $70.0 million as of September 30, 2015, or approximately $1.27 per share.

Business Outlook

The following forward-looking statements reflect GigaMedia’s expectations as of November 4, 2015. Given potential changes in economic conditions

and consumer spending, the evolving nature of online games, and various other risk factors, including those discussed in the Company’s 2014 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission as referenced below,

actual results may differ materially.

The mobile gaming business has been underperforming. In the third quarter, we continued to work on the

integration of the resources of our gaming business in Taiwan and Hong Kong in order to streamline the operations. We hope to see significant effect on the cost reduction and margin improvement in the next two quarters. Besides, the Company

published a new popular game “Yume100” from Japan targeting teenage girls and young single women who really indulge into fanfiction and this game has high monetization in Japan. We expect it to have the same performance in Taiwan and Hong

Kong markets by bringing stable revenues and creating margin. This game has been launched for about one month in Taiwan and Hong Kong and received a huge response from the players; moreover, achieved to break even upon the launch on the market.

In addition to social casino game platform, for the next quarter it will continue to hold the online qualifying tournaments for World Series of Mahjong 2015

until the land-based finals in Macau.

As for cloud computing business, the Company launched a new platform “Tesseratic”

(http://www.tesseratic.com/index.php/en/) for the container cluster management on OpenStack, which is an integration solution with high availability, low cost on building and good scalability. The Company will increase its marketing events in

order to have widespread promotion for this new platform on the market.

Use of Non-GAAP Measures

To supplement GigaMedia’s consolidated financial statements presented in accordance with US GAAP, the company uses the following measure defined as

non-GAAP by the SEC: EBITDA. Management believes that EBITDA (earnings before interest, taxes, depreciation, and amortization) is a useful supplemental measure of performance because it excludes certain non-cash items such as depreciation and

amortization and that EBITDA is a measure of performance used by some investors, equity analysts and others to make informed investment decisions. EBITDA is not a recognized earnings measure under GAAP and does not have a standardized meaning.

Non-GAAP measures such as EBITDA should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, other financial measures prepared in accordance with GAAP. A limitation of

using EBITDA is that it does not include all items that impact the company’s net income for the period. Reconciliations to the GAAP equivalents of the non-GAAP financial measures are provided on the attached unaudited financial statements.

About the Numbers in This Release

Quarterly

results

All quarterly results referred to in the text, tables and attachments to this release are unaudited. The financial statements from which

the financial results reported in this press release are derived have been prepared in accordance with U.S. GAAP, unless otherwise noted as “non-GAAP,” and are presented in U.S. dollars.

Webcast Schedule

For Q&A regarding the third quarter

2015 performance upon the release, investors may send the questions via email to IR@gigamedia.com.tw by November 10, and the responses will be replied in the webcast. Webcast will be available on the company’s official website

www.gigamedia.com on November 20.

About GigaMedia

Headquartered in Taipei, Taiwan, GigaMedia Limited (Singapore registration number: 199905474H) is a diversified provider of online games and cloud computing

services. GigaMedia’s online games business develops and operates a suite of games in Taiwan and Hong Kong, with focus on browser/mobile games and social casino games. The company’s cloud computing business is focused on providing SMEs in

Greater China with critical communications services and IT solutions that increase flexibility, efficiency and competitiveness. More information on GigaMedia can be obtained from www.gigamedia.com.

The statements included above and elsewhere in this press release that are not historical in nature are

“forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding expected financial performance

(as described without limitation in the “Business Outlook” section and in quotations from management in this press release) and GigaMedia’s strategic and operational plans. These statements are based on management’s current

expectations and are subject to risks and uncertainties and changes in circumstances. There are important factors that could cause actual results to differ materially from those anticipated in the forward looking statements, including but not

limited to, our ability to license, develop or acquire additional online games that are appealing to users, our ability to retain existing online game players and attract new players, and our ability to launch online games in a timely manner and

pursuant to our anticipated schedule. Further information on risks or other factors that could cause results to differ is detailed in GigaMedia’s Annual Report on Form 20-F filed in April 2013 and its other filings with the United States

Securities and Exchange Commission.

# # #

(Tables to follow)

GIGAMEDIA LIMITED

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

9/30/2015 |

|

|

6/30/2015 |

|

|

9/30/2014 |

|

|

9/30/2015 |

|

|

9/30/2014 |

|

| |

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

| |

|

USD |

|

|

USD |

|

|

USD |

|

|

USD |

|

|

USD |

|

| Operating revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asian online game and service revenues |

|

|

1,660,013 |

|

|

|

2,014,922 |

|

|

|

2,237,498 |

|

|

|

6,393,327 |

|

|

|

6,459,770 |

|

| Other revenues |

|

|

345,516 |

|

|

|

712,646 |

|

|

|

234,987 |

|

|

|

1,501,854 |

|

|

|

658,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,005,529 |

|

|

|

2,727,568 |

|

|

|

2,472,485 |

|

|

|

7,895,181 |

|

|

|

7,118,589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Asian online game and service revenues |

|

|

2,230,148 |

|

|

|

1,777,811 |

|

|

|

1,972,295 |

|

|

|

5,974,124 |

|

|

|

4,176,186 |

|

| Cost of other revenues |

|

|

373,245 |

|

|

|

732,775 |

|

|

|

294,982 |

|

|

|

1,563,539 |

|

|

|

904,102 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,603,393 |

|

|

|

2,510,586 |

|

|

|

2,267,277 |

|

|

|

7,537,663 |

|

|

|

5,080,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit (loss) |

|

|

(597,864 |

) |

|

|

216,982 |

|

|

|

205,208 |

|

|

|

357,518 |

|

|

|

2,038,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product development and engineering expenses |

|

|

151,621 |

|

|

|

164,085 |

|

|

|

197,745 |

|

|

|

497,413 |

|

|

|

671,583 |

|

| Selling and marketing expenses |

|

|

1,649,356 |

|

|

|

2,262,207 |

|

|

|

1,759,991 |

|

|

|

6,598,679 |

|

|

|

5,009,682 |

|

| General and administrative expenses |

|

|

1,997,787 |

|

|

|

1,265,399 |

|

|

|

1,878,580 |

|

|

|

4,549,022 |

|

|

|

5,500,141 |

|

| Impairment losses |

|

|

805,746 |

|

|

|

0 |

|

|

|

0 |

|

|

|

805,746 |

|

|

|

0 |

|

| Other |

|

|

37,291 |

|

|

|

326,594 |

|

|

|

0 |

|

|

|

363,885 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,641,801 |

|

|

|

4,018,285 |

|

|

|

3,836,316 |

|

|

|

12,814,745 |

|

|

|

11,181,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(5,239,665 |

) |

|

|

(3,801,303 |

) |

|

|

(3,631,108 |

) |

|

|

(12,457,227 |

) |

|

|

(9,143,105 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

62,153 |

|

|

|

106,324 |

|

|

|

187,194 |

|

|

|

271,006 |

|

|

|

535,584 |

|

| Gain on sales of marketable securities |

|

|

5,844,306 |

|

|

|

4,703,500 |

|

|

|

2,447,065 |

|

|

|

20,020,869 |

|

|

|

2,609,357 |

|

| Interest expense |

|

|

(24,142 |

) |

|

|

(48,224 |

) |

|

|

(78,714 |

) |

|

|

(154,479 |

) |

|

|

(162,694 |

) |

| Foreign exchange (loss) gain - net |

|

|

(346,248 |

) |

|

|

(17,655 |

) |

|

|

20,058 |

|

|

|

(380,146 |

) |

|

|

(311,755 |

) |

| Equity in net (loss) earnings on equity method investments |

|

|

(615,990 |

) |

|

|

22,954 |

|

|

|

(3,848,048 |

) |

|

|

(552,936 |

) |

|

|

(4,069,323 |

) |

| Changes in the fair value of an instrument recognized at fair value |

|

|

637 |

|

|

|

879,472 |

|

|

|

0 |

|

|

|

(71,552 |

) |

|

|

0 |

|

| Gain on disposal of investments |

|

|

37,364 |

|

|

|

0 |

|

|

|

0 |

|

|

|

37,364 |

|

|

|

0 |

|

| Other |

|

|

33,477 |

|

|

|

(508,926 |

) |

|

|

22,550 |

|

|

|

(457,074 |

) |

|

|

98,395 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,991,557 |

|

|

|

5,137,445 |

|

|

|

(1,249,895 |

) |

|

|

18,713,052 |

|

|

|

(1,300,436 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Income from continuing operations before income taxes |

|

|

(248,108 |

) |

|

|

1,336,142 |

|

|

|

(4,881,003 |

) |

|

|

6,255,825 |

|

|

|

(10,443,541 |

) |

| Income tax (expense) benefit |

|

|

(125 |

) |

|

|

170 |

|

|

|

125 |

|

|

|

13,396 |

|

|

|

60,254 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Income from continuing operations |

|

|

(248,233 |

) |

|

|

1,336,312 |

|

|

|

(4,880,878 |

) |

|

|

6,269,221 |

|

|

|

(10,383,287 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

|

(248,233 |

) |

|

|

1,336,312 |

|

|

|

(4,880,878 |

) |

|

|

6,269,221 |

|

|

|

(10,383,287 |

) |

| Less: Net (income) loss attributable to noncontrolling interest |

|

|

(53,111 |

) |

|

|

40,525 |

|

|

|

41,966 |

|

|

|

45,545 |

|

|

|

(208,419 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable to shareholders of GigaMedia |

|

|

(301,344 |

) |

|

|

1,376,837 |

|

|

|

(4,838,912 |

) |

|

|

6,314,766 |

|

|

|

(10,591,706 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per share attributable to GigaMedia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from continuing operations |

|

|

(0.01 |

) |

|

|

0.02 |

|

|

|

(0.09 |

) |

|

|

0.11 |

|

|

|

(0.20 |

) |

| Loss from discontinued operations |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.01 |

) |

|

|

0.02 |

|

|

|

(0.09 |

) |

|

|

0.11 |

|

|

|

(0.20 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from continuing operations |

|

|

(0.01 |

) |

|

|

0.02 |

|

|

|

(0.09 |

) |

|

|

0.11 |

|

|

|

(0.20 |

) |

| Loss from discontinued operations |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(0.01 |

) |

|

|

0.02 |

|

|

|

(0.09 |

) |

|

|

0.11 |

|

|

|

(0.20 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

55,261,661 |

|

|

|

55,261,661 |

|

|

|

55,261,661 |

|

|

|

55,261,661 |

|

|

|

53,477,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

55,261,661 |

|

|

|

55,262,036 |

|

|

|

55,261,661 |

|

|

|

55,261,873 |

|

|

|

53,477,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GIGAMEDIA LIMITED

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

9/30/2015 |

|

|

6/30/2015 |

|

|

9/30/2014 |

|

| |

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

| |

|

USD |

|

|

USD |

|

|

USD |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

74,818,341 |

|

|

|

68,299,828 |

|

|

|

38,899,281 |

|

| Marketable securities - current |

|

|

5,307 |

|

|

|

5,307 |

|

|

|

18,041,022 |

|

| Accounts receivable - net |

|

|

982,186 |

|

|

|

1,675,561 |

|

|

|

1,327,883 |

|

| Prepaid expenses |

|

|

420,918 |

|

|

|

1,019,249 |

|

|

|

534,534 |

|

| Restricted cash |

|

|

1,000,000 |

|

|

|

1,000,000 |

|

|

|

9,006,571 |

|

| Other receivables |

|

|

74,327 |

|

|

|

186,994 |

|

|

|

2,739,712 |

|

| Other current assets |

|

|

258,117 |

|

|

|

273,500 |

|

|

|

166,917 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

77,559,196 |

|

|

|

72,460,439 |

|

|

|

70,715,920 |

|

|

|

|

|

| Marketable securities - noncurrent |

|

|

0 |

|

|

|

4,744,000 |

|

|

|

9,073,630 |

|

| Investments |

|

|

5,798,904 |

|

|

|

6,740,252 |

|

|

|

20,775,344 |

|

| Property, plant & equipment - net |

|

|

1,502,697 |

|

|

|

1,675,312 |

|

|

|

1,753,309 |

|

| Intangible assets - net |

|

|

137,532 |

|

|

|

206,780 |

|

|

|

592,482 |

|

| Prepaid licensing and royalty fees |

|

|

3,150,519 |

|

|

|

5,026,779 |

|

|

|

5,061,593 |

|

| Other assets |

|

|

333,006 |

|

|

|

369,685 |

|

|

|

309,549 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

88,481,854 |

|

|

|

91,223,247 |

|

|

|

108,281,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

|

5,780,347 |

|

|

|

4,536,617 |

|

|

|

19,395,135 |

|

| Accounts payable |

|

|

280,738 |

|

|

|

557,599 |

|

|

|

453,885 |

|

| Accrued compensation |

|

|

672,966 |

|

|

|

464,384 |

|

|

|

1,144,451 |

|

| Accrued expenses |

|

|

2,233,313 |

|

|

|

3,739,583 |

|

|

|

2,508,376 |

|

| Unearned revenue |

|

|

1,591,386 |

|

|

|

1,673,170 |

|

|

|

2,172,611 |

|

| Other current liabilities |

|

|

1,632,963 |

|

|

|

1,800,582 |

|

|

|

3,781,432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

12,191,713 |

|

|

|

12,771,935 |

|

|

|

29,455,890 |

|

| Other liabilities |

|

|

1,937,864 |

|

|

|

1,933,173 |

|

|

|

181,193 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

14,129,577 |

|

|

|

14,705,108 |

|

|

|

29,637,083 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GigaMedia’s shareholders’ equity |

|

|

74,352,277 |

|

|

|

76,607,057 |

|

|

|

78,589,516 |

|

| Noncontrolling interest |

|

|

0 |

|

|

|

(88,918 |

) |

|

|

55,228 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

74,352,277 |

|

|

|

76,518,139 |

|

|

|

78,644,744 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

|

88,481,854 |

|

|

|

91,223,247 |

|

|

|

108,281,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GIGAMEDIA LIMITED

Reconciliations of Non-GAAP Results of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

9/30/2015 |

|

|

6/30/2015 |

|

|

9/30/2014 |

|

|

9/30/2015 |

|

|

9/30/2014 |

|

| |

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

|

unaudited |

|

| |

|

USD |

|

|

USD |

|

|

USD |

|

|

USD |

|

|

USD |

|

| Reconciliation of Net Income (Loss) to EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to GigaMedia |

|

|

(301,344 |

) |

|

|

1,376,837 |

|

|

|

(4,838,912 |

) |

|

|

6,314,766 |

|

|

|

(10,591,706 |

) |

| Depreciation |

|

|

73,079 |

|

|

|

80,296 |

|

|

|

76,182 |

|

|

|

227,587 |

|

|

|

229,470 |

|

| Amortization |

|

|

59,838 |

|

|

|

64,129 |

|

|

|

282,115 |

|

|

|

179,283 |

|

|

|

951,569 |

|

| Interest income |

|

|

(62,153 |

) |

|

|

(106,302 |

) |

|

|

(187,194 |

) |

|

|

(270,985 |

) |

|

|

(535,383 |

) |

| Interest expense |

|

|

23,934 |

|

|

|

47,975 |

|

|

|

78,714 |

|

|

|

154,011 |

|

|

|

162,694 |

|

| Income tax (benefit) expense |

|

|

125 |

|

|

|

(170 |

) |

|

|

(125 |

) |

|

|

(13,396 |

) |

|

|

(60,254 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

(206,521 |

) |

|

|

1,462,765 |

|

|

|

(4,589,220 |

) |

|

|

6,591,266 |

|

|

|

(9,843,610 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

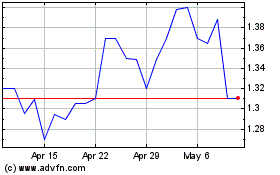

GigaMedia (NASDAQ:GIGM)

Historical Stock Chart

From Mar 2024 to Apr 2024

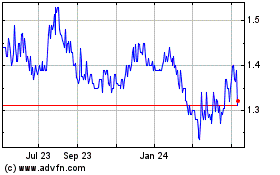

GigaMedia (NASDAQ:GIGM)

Historical Stock Chart

From Apr 2023 to Apr 2024